Citi and Mastercard Join Forces on Cross-Border Debit Payments

Hey Payments Fanatic!

Big news in the world of payments! Citi and Mastercard are teaming up to simplify cross-border debit card payments, making it easier than ever for consumers and businesses to send money worldwide, 24/7.

Citi is the first global bank to roll out Mastercard's Move platform, allowing for fast transactions like insurance payouts, airline refunds, and e-commerce payments. Debopama Sen, Citi’s head of payments, says the partnership will make cross-border payments feel seamless—no borders, no currency issues, just smooth transfers.

With global commerce on the rise, this partnership is a major win for both Mastercard and Visa, who are racing to make international payments faster and easier. Mastercard also recently expanded its partnership with China’s Alipay, while Visa works with Western Union to offer similar cross-border services.

The best part? These payments happen almost in real-time, often within seconds. Citi customers in 65 countries will be able to use this debit card solution to send money across borders.

Exciting stuff! What do you think about this new payment innovation? Drop your thoughts in the comments!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

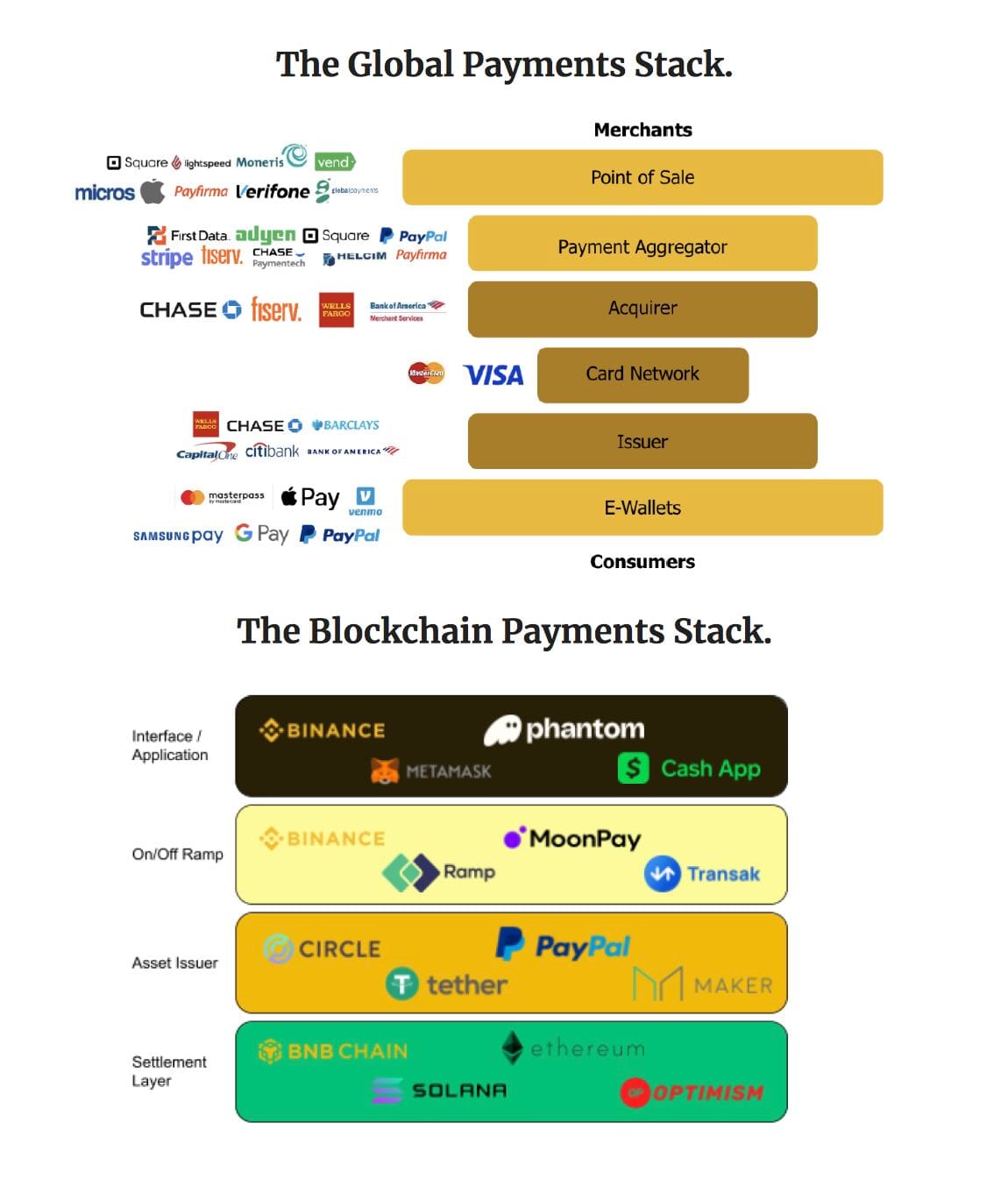

📊 Global Payments Stack 🆚 Blockchain Payments Stack

Let’s dive in:

PAYMENTS NEWS

🇮🇹 Italy’s Fabrick partners with TerraPay to expand global payment services. This partnership marks a significant milestone in Fabrick’s international growth strategy, building upon its presence in Italy, Spain, and the United Kingdom, according to the announcement.

🇮🇳 Amazon-backed payments startup ToneTag is in early talks with Mumbai-based Iron Pillar to raise at least $50 Mn through a mix of primary and secondary share sales, with new investors also joining the cap table. The startup offers audio-based authentication and proximity payment solutions for online and offline commerce.

🇷🇺 Russia pitches BRICS payment system aiming to break US dominance. The country is proposing changes to cross-border payments conducted among BRICS countries aimed at circumventing the global financial system, as the heavily penalized country seeks to sanctions-proof its own economy.

🇺🇸 Stripe says stablecoins payments made in more than 70 countries after relaunch. The company said individuals from more than 70 countries have used stablecoins for online transactions during the first 24 hours after allowing merchants using its platform to accept crypto payments again.

🇰🇪 Network International launches new payments services in Kenya. Network International launched POS with QR code payment tools to improve accessibility for merchants seeking digital transactions. This ensures no client is excluded, creating more business opportunities and boosting revenue for traders.

🇮🇳 UPI transactions jump 52% fuelling India’s digital payment boom. This growth underscores UPI’s dominance in the digital payment ecosystem as it continues to expand beyond India, according to a Worldline report that also suggests that its growing presence could lead to larger transactions, reinforcing its role in India’s payment landscape.

🇺🇸 Zeal secures $15M series B funding to revolutionize payroll for modern work. This latest investment marks a significant milestone in Zeal’s mission to redefine payroll for innovative staffing companies, gig-work platforms, and HR service providers.

🇧🇷 Pix by approach: BB comes out ahead and launches service in Brazil. Banco do Brasil (BB) and payment terminal operator Cielo are ahead of the game, starting on Friday (11/10), by offering “Pix por aproximação” to a select group of the bank’s customers enabling them to make purchases by simply bringing their phone close to the payment terminal at participating retailers.

GOLDEN NUGGET

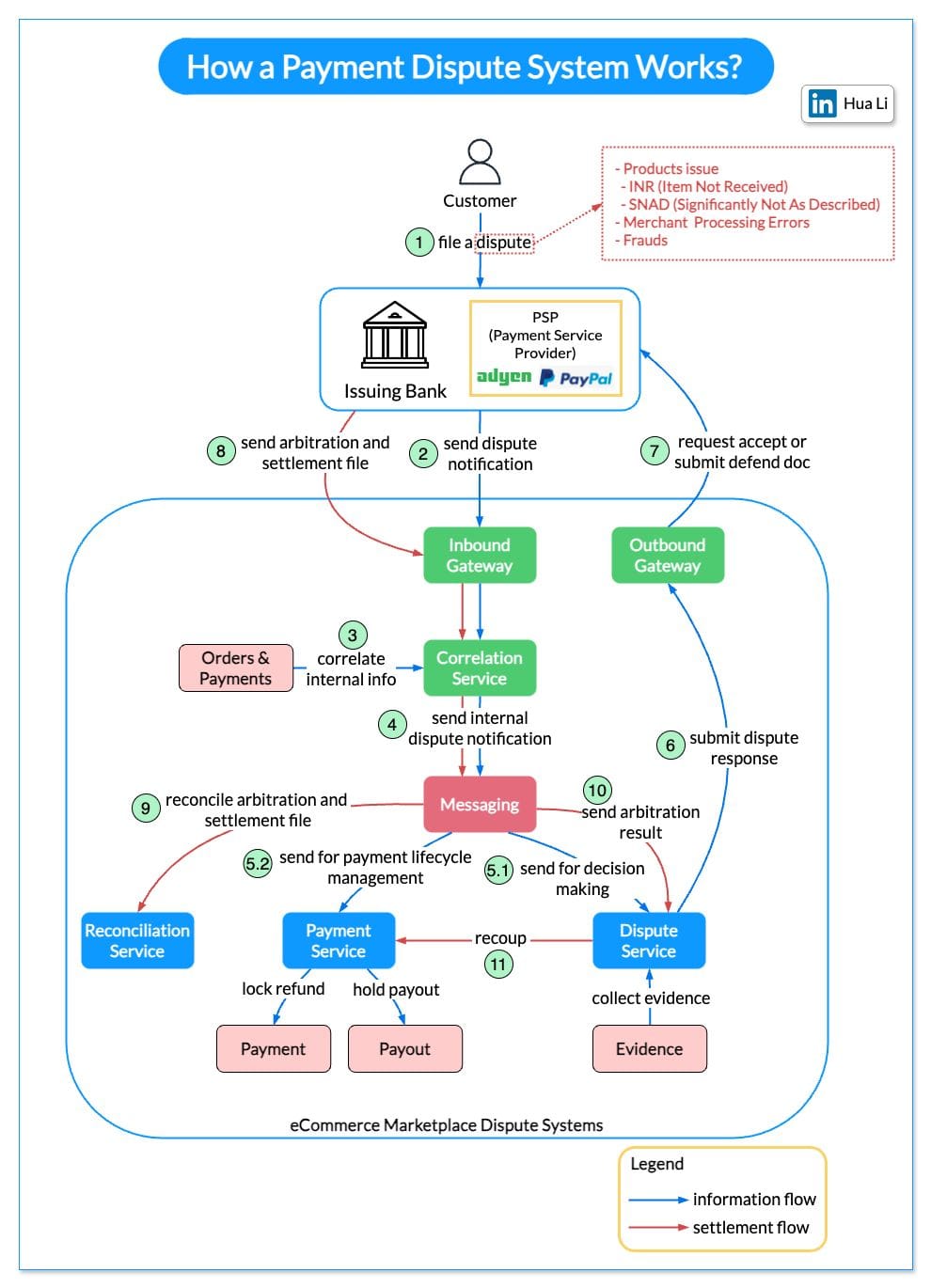

How is a credit card 𝐝𝐢𝐬𝐩𝐮𝐭𝐞 processed in the system?

Hua Li breaks it down for us:

Dispute happens when a cardholder disagrees with a merchant’s charge.

A dispute is 𝐞𝐱𝐩𝐞𝐧𝐬𝐢𝐯𝐞: for every dollar in disputed transactions, an additional $1.50 is spent on fees and expenses [1]. The process/system complexity leads to the cost.

The diagram below shows how a dispute is processed in an eCommerce marketplace.

🔸 Steps 1-2: A customer files a dispute with the issuer or PSP (Payment Service Provider). The issuer or PSP sends the 𝐝𝐢𝐬𝐩𝐮𝐭𝐞 𝐧𝐨𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 to the eCommerce marketplace’s inbound gateway.

🔸 Steps 3-4: The inbound gateway sends the dispute notification to the correlation service, which correlates internal orders and payments with external bank information. Then the enriched notification gets sent to a messaging component.

🔸 Steps 5.1-5.2: The dispute notification is sent to the dispute service for the 𝐝𝐞𝐜𝐢𝐬𝐢𝐨𝐧-𝐦𝐚𝐤𝐢𝐧𝐠 process. It collects evidence from various internal systems to help make the decision. Meanwhile, the dispute notification is sent to the payment service to lock the refund and hold payment.

🔸 Steps 6-7: The decision (accept or defend) is sent to the outbound gateway, then sent to the issuer or PSP for 𝐚𝐫𝐛𝐢𝐭𝐫𝐚𝐭𝐢𝐨𝐧.

🔸 Steps 8-11: After arbitration, the bank or PSP sends the arbitration notification (win or lose) back, together with the settlement files. The reconciliation service reconciles arbitration result and settlement files. The arbitration result is sent to the dispute service. If there is a cost due to merchandise reasons for arbitration loss, the dispute service calls the payment service to 𝐫𝐞𝐜𝐨𝐮𝐩 the cost from the seller.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()