Circle Launches Global Payments Network to Take On Visa and Mastercard

Hey Payments Fanatic!

Circle is stepping out of the crypto lane and into the payments fast lane. The company behind USDC—the $60 billion stablecoin—is launching a bold new payments and remittance network aimed squarely at legacy giants like Visa and Mastercard.

Set to be unveiled at Circle’s headquarters in NYC’s One World Trade Center, featuring Circle CEO Jeremy Allaire's sharing vision for the stablecoin giant’s next move within the payments space: the network will target banks, FinTechs, and remittance firms looking for faster, cheaper, and more transparent cross-border payment solutions. It's a big play to bring stablecoins deeper into mainstream finance.

“Circle is launching a payments network that is initially targeting remittances but is ultimately aiming to rival Mastercard and Visa,” said a source familiar with the initiative.

The timing couldn’t be better. With global regulators warming up to stablecoins and demand for modern cross-border rails rising, Circle is betting blockchain tech can finally overhaul how money moves globally.

There is a much larger play here: It is not just a crypto story but a power move in payments. Circle wants USDC to be more than just a digital dollar; it wants to be the infrastructure behind the next-gen global payments system.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

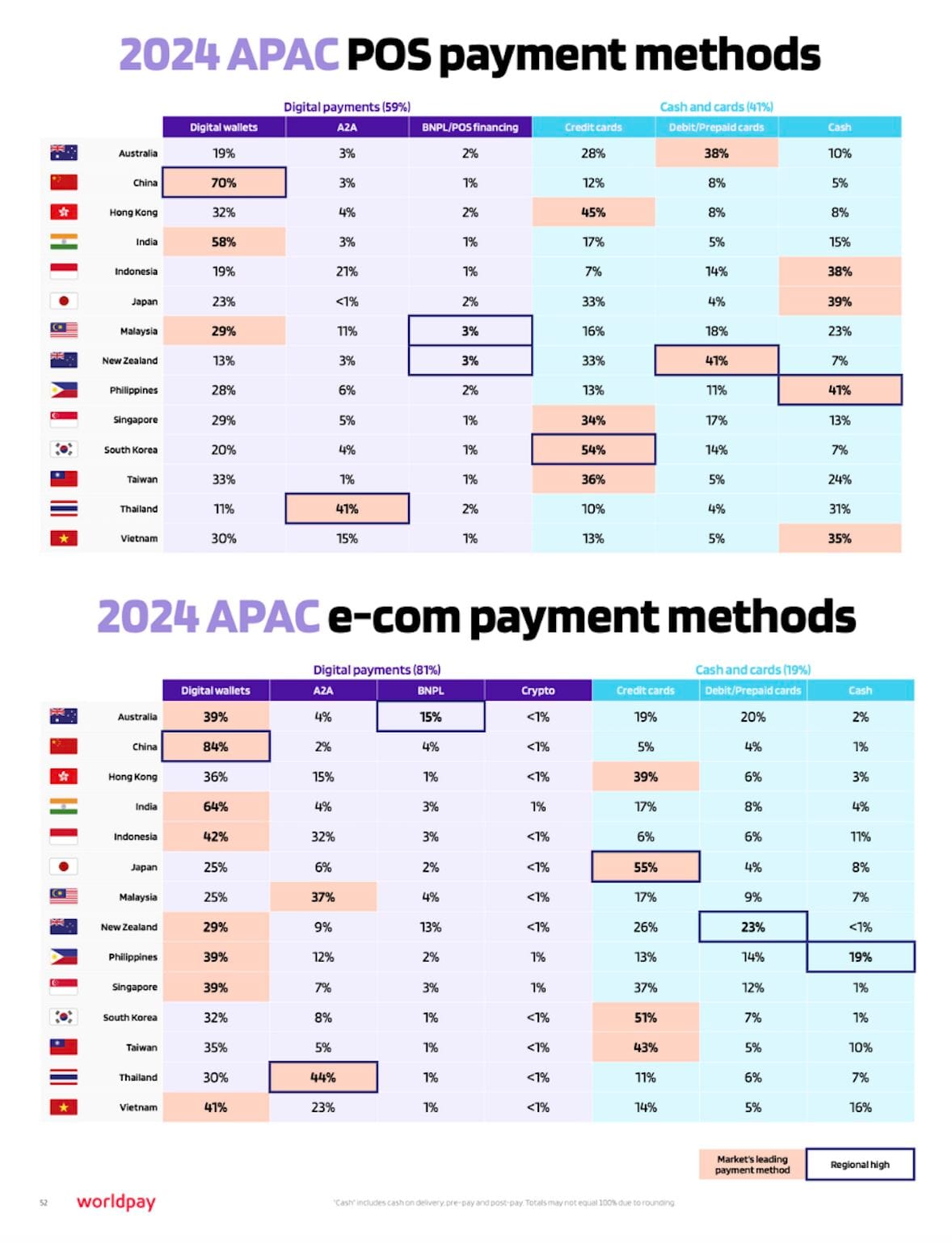

APAC consumers have long been leaders in digital payment adoption. In 2014 digital payments already accounted for 42% of e-com and 6% of POS value, largely skewed by China’s high adoption.

PAYMENTS NEWS

🇺🇸 Big shift in U.S. banking: Federal payments go 100% digital by September 2025. The initiative aims to improve efficiency, lower costs, and reduce check-related fraud. Industry experts view the executive order as a significant policy shift. Phil Bruno, Chief Strategy and Growth Officer at ACI Worldwide, noted that its true significance lies in Washington’s expanding role in shaping the movement of money across the economy.

🇳🇱 Bunq introduced a new way to protect users from Apple Pay and Google Pay scams. Whenever a bunq card is added outside of the app, two layers of security are in place. First, users receive the standard SMS containing a one-time verification code. In addition they are required to give their explicit approval within the bunq app.

🇺🇸 SoftBank Chain (SBC) launches Interstellar: powering the future of web3 payments and open finance. Interstellar aims to bridge traditional financial systems with decentralized networks, delivering seamless, secure, and scalable payment experiences for users and developers alike.

🇸🇦 Mastercard and McLaren Racing bring partnership to life at Saudi Arabian Grand Prix. The new partnership marks the coming together of two preeminent brands known for their focus on innovation and setting the standard in offering incredible experiences for fans.

🇶🇦 PayLater’s impact on Qatar’s digital finance market. Qatar’s first licensed Shari’a-compliant Buy Now, Pay Later (BNPL) provider by Qatar Central Bank has skyrocketed to the #1 position in the Finance category and Top 3 overall ranking across Qatar.

🇺🇸 US businesses face cross-border payments paradox amid digital wallet surge. A recent report digs deep into the evolving landscape of cross-border payments. One particularly unexpected insight is that digital wallet usage is not just a trend for younger or wealthier U.S. consumers.

🇦🇪 Fuze secures UAE central bank license to power next-gen payments. The new license will enable businesses to benefit from faster, more secure payment options, reduced transaction times, and end-to-end compliance. Keep reading

🇱🇾 AFS and Al-Etihad Al-Dawli advance Libyan payments. Together, they aim to redefine Libya's ecosystem by introducing a dynamic suite of advanced digital and electronic payment services. This alliance promises to equip businesses, consumers, and financial institutions with seamless, secure, and disruptive digital payment solutions.

🇺🇸 Axxess and Texas Capital enter strategic partnership to enable faster payer remittance for care at home providers. The integration optimizes the back-office payer reconciliation workflow using sophisticated automation that matches payments and remittances, eliminating the need for manual tracking of payments.

🇳🇬 Readen Holding Corporation signs Memorandum of Understanding to acquire 80% stake in Morrich Loterry Limited. The acquisition will enable RHCO to oversee the expansion of Morrich Lottery's services to include Keno and scratch lottery games, with a future roadmap to potentially incorporate casino offerings, subject to regulatory approval.

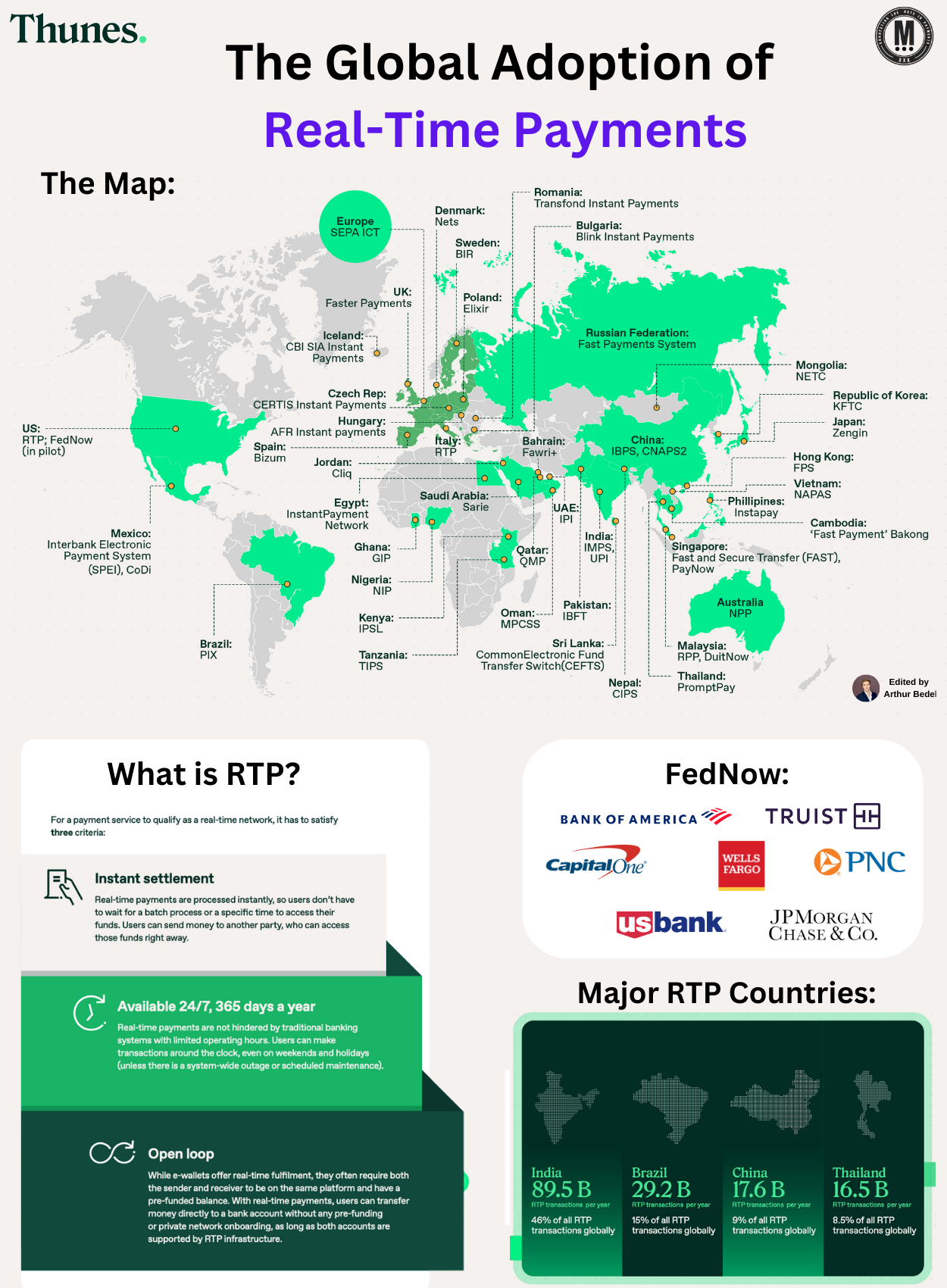

GOLDEN NUGGET

𝐓𝐡𝐞 𝐆𝐥𝐨𝐛𝐚𝐥 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐨𝐟 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 (#RTP) — by Thunes👇

𝐖𝐡𝐚𝐭 𝐚𝐫𝐞 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

► Real-Time Payments (RTPs) enable funds to be sent and received instantly, eliminating delays associated with traditional banking systems.

𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐬𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 → Transactions are processed in real-time, ensuring recipients can access funds immediately.

24/7 𝐚𝐯𝐚𝐢𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲 → Unlike traditional banking, RTPs operate every day of the year, including weekends and holidays.

𝐎𝐩𝐞𝐧-𝐥𝐨𝐨𝐩 𝐧𝐞𝐭𝐰𝐨𝐫𝐤𝐬 → Unlike closed e-wallet systems, RTPs enable direct bank-to-bank transfers across different financial institutions.

📈 195 billion RTP transactions were recorded in 2022, with a 63.2% YoY growth. By 2027, this figure is expected to reach 511.7 billion transactions.

𝐇𝐨𝐰 𝐝𝐨 𝐑𝐓𝐏 𝐒𝐲𝐬𝐭𝐞𝐦𝐬 𝐖𝐨𝐫𝐤?

► RTPs operate through instant bank-to-bank transfers, ensuring that the sender and receiver experience an immediate update of their financial position.

► Transactions are triggered via mobile numbers, QR codes, or account details, and final settlement occurs in seconds.

► Unlike Automated Clearing House (ACH) or wire transfers, which take days, RTPs are near-instant.

𝐓𝐡𝐞 𝐈𝐦𝐩𝐚𝐜𝐭 𝐨𝐟 𝐑𝐓𝐏 𝐨𝐧 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬

► 𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐜𝐫𝐨𝐬𝐬-𝐛𝐨𝐫𝐝𝐞𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 relied on Swift or correspondent banking, leading to high costs and delays (3-5 days).

► 𝐑𝐓𝐏 lowers remittance fees, improves liquidity, and enhances financial inclusion by offering instant global transfers.

𝐍𝐨𝐭𝐚𝐛𝐥𝐞 𝐄𝐱𝐚𝐦𝐩𝐥𝐞 → India’s 𝐔𝐏𝐈 & Singapore’s PayNow integration allows users to send cross-border transactions instantly using a mobile number.

𝐓𝐨𝐩 𝐂𝐨𝐮𝐧𝐭𝐫𝐢𝐞𝐬 𝐢𝐧 𝐑𝐓𝐏 𝐯𝐨𝐥𝐮𝐦𝐞𝐬:

► India 🇮🇳: 89.5B RTP transactions annually (46% of global RTP transactions).

► Brazil 🇧🇷: 29.2B transactions (15% share).

► China 🇨🇳: 17.6B transactions (9% share).

► Thailand 🇹🇭: 16.5B transactions (8.5% share).

𝐅𝐞𝐝𝐍𝐨𝐰: 𝐓𝐡𝐞 𝐔.𝐒. 𝐄𝐧𝐭𝐞𝐫𝐬 𝐭𝐡𝐞 𝐑𝐓𝐏 𝐑𝐚𝐜𝐞

► FedNow, launched in July 2023 by the Federal Reserve, enables instant bank transfers in the U.S.

► 100+ banks (JPMorganChase, Wells Fargo, U.S. Bank) have joined, with plans to expand nationwide.

► Unlike private networks like 𝐙𝐞𝐥𝐥𝐞, FedNow operates as an open-loop RTP system for both businesses and individuals.

Note:

𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐋𝐢𝐦𝐢𝐭: $500,000 (default: $100,000, but banks can adjust limits).

RTPs are transforming digital payments, offering instant, secure, and cost-effective transactions. Adoption is accelerating globally with Cross-border RTP interoperability soon-to-be a game changer.

Source: Thunes

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()