Checkout.com Reports 45% Growth in a Record-Breaking 2024

Hey Payments Fanatic!

Checkout.com achieved 45% year-over-year net revenue growth in its core commerce and FinTech business in 2024, with its US operations growing by over 80%. Over 300 new merchants joined their network, including major brands like Ticketmaster, Bumble, and Heineken.

Guillaume Pousaz, CEO, outlined ambitious targets: "We are relentless in solving our merchants' toughest challenges, delivering payment performance and global access to help them thrive."

The company plans 30% growth, sustained profitability, and a 15% headcount increase for 2025 accroding to a New Year letter sent today to its network of merchants, partners, and employees,

The company expanded significantly in 2024, becoming the first global player to directly integrate with Visa and Mastercard in Japan, enhancing domestic processing in Saudi Arabia, and preparing for launches in Canada and Brazil. Their Intelligent Acceptance solution generated $9 billion in additional merchant revenue, while over 40 merchants processed more than $1 billion annually.

Check out more global Payments updates below👇, and I’ll see you again on Monday!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

💰 How do consumers pay in Latin America?

Here's a breakdown of the latest 2024 stats👇

PAYMENTS NEWS

🇳🇱 Mollie announced a partnership with Originem.io. As an expert in e-commerce integrations, Originem empowers businesses with the Sylius e-commerce framework and Mollie’s advanced payment solutions. This collaboration sets the stage for future developments like Bankaccounts, Sales Invoice API, and innovative B2B KYC solutions.

🌍 Yuno announces the appointment of Miguel Duarte Fernandes, as its SVP, Head of Growth and Commercial for Europe, further expanding its geographic footprint. This strategic hire marks a significant step in strengthening Yuno’s global presence and accelerating the company’s expansion into Europe.

🇸🇬 Pomelo Group acquires Singaporean Arrow Checkout. The acquisition is expected to bring the technology and payment expertise of the company to the Pomelo team, as well as accelerate the shared commitment of building an optimised payments infrastructure platform for emerging markets.

🇳🇬 Moniepoint gets Visa backing, plans to work on contactless payments. The business banking and payments platform received a “strategic investment” from the global payments giant as both companies look to drive financial inclusion and support the growth of small and medium-sized enterprises (SMEs) across Africa.

🇬🇧 PayDo releases physical and virtual cards. The PayDo Card is available for both businesses and individuals, offering secure online and in-store shopping, payments via Apple Pay and Google Pay, easy ATM withdrawals worldwide, and more, making it a practical and versatile tool for everyday financial management.

🇸🇪 Open Payments secures €3M. The funding will support the company’s continued growth, enable product development, and enable it to expand further across Europe. The platform combines Open Banking API connections with ISO-based payment integrations, enabling the management of domestic and cross-border payments.

🌏 Thunes and Hyperwallet expand payout access for merchants across Asia-Pacific. With this alliance, Hyperwallet can help its expansive global merchant base, including some of the world’s well known ride-hailing super apps, marketplaces, and social media platforms, offer customers their preferred method of access to funds.

🇺🇸 Mesta launches hybrid fiat-stablecoin payment rails for cross-border payments. It combines real-time fiat payment rails with blockchain-powered stablecoin rails, addressing inefficiencies in global payments and trade. The platform has already processed $12 million in Total Payment Volume, demonstrating rapid market adoption.

GOLDEN NUGGET

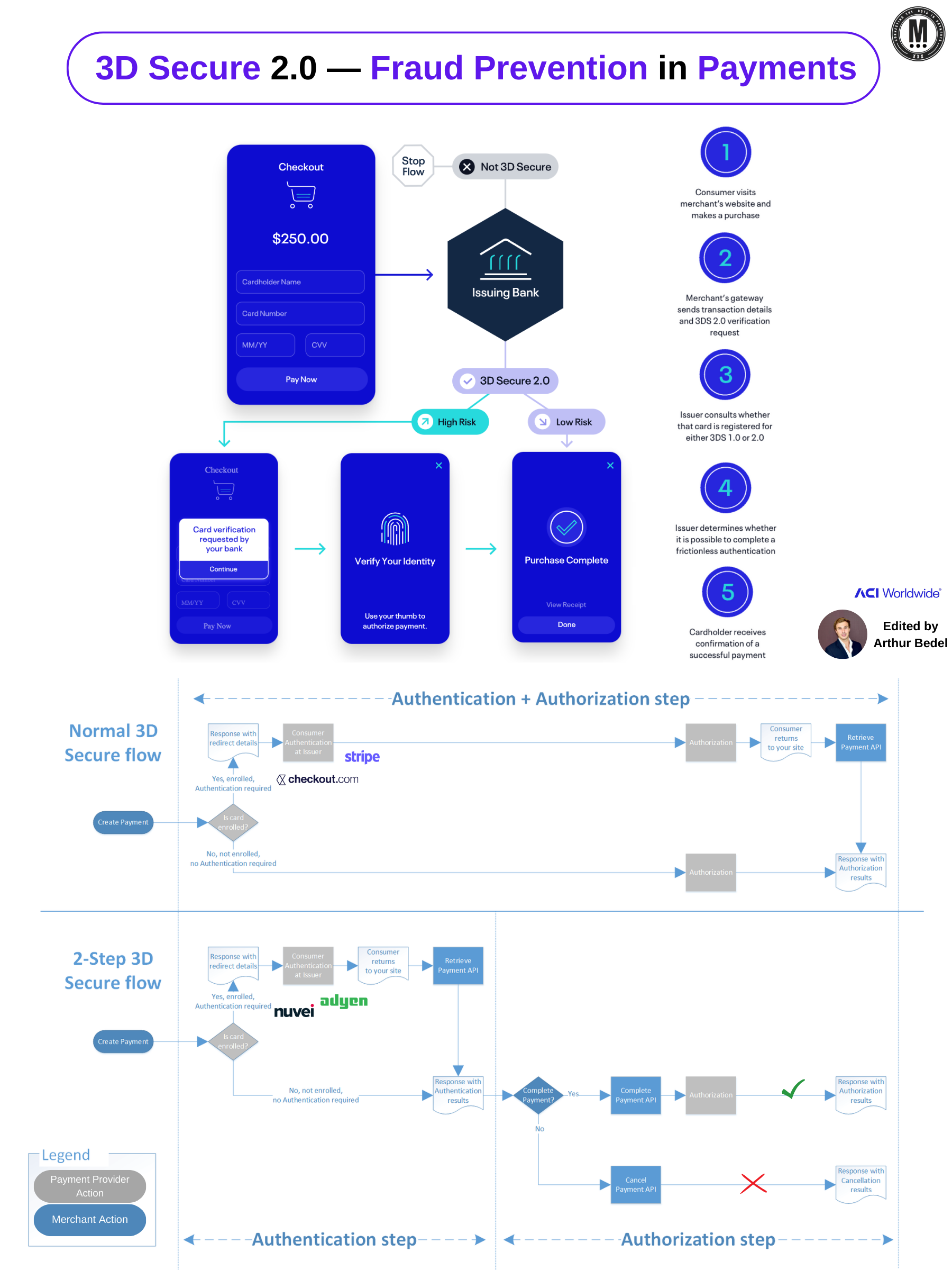

3𝐃-𝐒𝐞𝐜𝐮𝐫𝐞 2.0 — Everything you need to know about it 👇

3𝐃-𝐒𝐞𝐜𝐮𝐫𝐞 2.0 (Three-Domain Secure 2.0) is an advanced version of the 3D Secure authentication protocol, designed to 𝐞𝐧𝐡𝐚𝐧𝐜𝐞 the 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 of 𝐨𝐧𝐥𝐢𝐧𝐞 𝐜𝐚𝐫𝐝 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 while improving the customer experience. It enables real-time, data-rich communication between merchants, card issuers, and payment networks to assess the risk of a transaction more accurately.

Unlike its predecessor, 3DS 2.0 supports frictionless authentication, allowing low-risk transactions to proceed without additional customer intervention. It also introduces mobile optimization for in-app purchases and modern authentication methods like biometrics (e.g., fingerprint or facial recognition) and one-time passwords (OTP), ensuring a seamless payment experience across devices.

Additionally, 3DS 2.0 is compliant with regulatory requirements like PSD2's Strong Customer Authentication (SCA), offering better fraud prevention while minimizing checkout disruptions.

𝐓𝐡𝐞 𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐜𝐞 𝐨𝐟 3𝐃-𝐒𝐞𝐜𝐮𝐫𝐞, especially in Europe:

► Reduce Fraud by verifying cardholder's identity

► Increase Revenue through higher acceptance

► Merchant is covered by Liability Shift (on the card issuer)

Over the years, 3DS became much more thorough, yet frictionless. Payment Providers - i.e. Checkout.com, Adyen - have helped merchants leverage this required process to increase in conversion & decrease fraud

3𝐃𝐒 1.0 𝐯𝐬 3𝐃𝐒 2.0 — Key Benefits:

1. 𝐅𝐫𝐢𝐜𝐭𝐢𝐨𝐧𝐥𝐞𝐬𝐬 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧: 3DS 2.0 can authenticate transactions without interrupting the customer's payment flow. If the transaction is deemed low-risk, it may not require the customer to take any action.

2. 𝐃𝐚𝐭𝐚-𝐑𝐢𝐜𝐡 𝐄𝐱𝐜𝐡𝐚𝐧𝐠𝐞𝐬: 3DS 2.0 exchanges more information between the merchant, issuer, and payment processor. This includes device information, transaction history, and behavioral data.

3. 𝐌𝐨𝐛𝐢𝐥𝐞-𝐅𝐨𝐜𝐮𝐬𝐞𝐝: 3DS 2.0 is optimized for mobile devices, which is critical as more users shop via mobile apps or browsers. It supports in-app purchases, biometric authentication, and other modern mobile security features.

4. 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞: 3DS 2.0 helps merchants and financial institutions comply with new regulations like PSD2 and its Strong Customer Authentication (SCA).

5. 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧: It allows for more flexible authentication methods like facial recognition, fingerprint scanning, or other biometrics.

6. 𝐈𝐦𝐩𝐫𝐨𝐯𝐞𝐝 𝐔𝐗: By minimizing disruptions in the payment process, 3DS 2.0 reduces cart abandonment and provides a better checkout experience

More improvements in security & processes are coming!

𝐖𝐡𝐚𝐭'𝐬 𝐧𝐞𝐱𝐭? 👀

Source: ACI Worldwide & Ingenico

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()