Checkout.com Reports 40% Revenue Growth and Unveils New Product Innovations

Hey Payments Fanatic!

I’m currently in Barcelona, where I was invited by our sponsor, Checkout.com, for the Thrive event, supporting our newly announced FinTech Running Club.

We had a fantastic run yesterday morning, and I’m excited to log a few more miles today.

If you’re interested in organizing a run in your town or at an event, sign up here, and we’ll be in touch soon!

Now, onto today’s news update, coming straight from the event in Barcelona, where Checkout.com announced new product launches at its annual Thrive event.

Including solutions to improve payment performance and unlock $5.5bn in lost revenue. The company’s Intelligent Acceptance service leverages AI and vast transaction data to optimize payment processing, delivering significant improvements for enterprise businesses.

In 2024, Checkout.com expanded its global reach, adding direct acquiring services in Japan, with plans to enter Brazil and Canada in 2025. Additionally, new product features like Flow and Remember Me enhance checkout experiences, boosting conversion rates by presenting relevant payment options and reducing friction.

Further innovations include Standalone Vault, which allows businesses to store and manage payment data securely, and the Checkout Business Account, which optimizes cash flow by offering same-day access to funds and simplified global fund management.

Founder and CEO Guillaume Pousaz also revealed on stage a continued 40% year-over-year revenue growth.

Have a great day, and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇲🇽 DEUNA and Hands In partner to revolutionize the online checkout experience. DEUNA, a payment orchestration platform from Latin America, is teaming up with Hands In to offer split payment solutions to their merchants. This partnership will enable DEUNA to integrate Hands In’s Multi Card Payments and Group Payments into their checkout services.

🇯🇵 NETSTARS partners with ACI Worldwide to power the world’s payment ecosystem. Both companies will collaborate to provide an all-in-one payment solution for service providers and merchant acquirers, ensuring a smooth and secure ecosystem for processing both domestic and cross-border payments.

🇳🇱 MKX Network partners with PayQuicker to inspire global financial freedom and inclusion. MKX sought an efficient solution to overcome their global commission payout challenges and partnered with PayQuicker to achieve this. The collaboration now enables MKX to provide faster and more seamless commission payouts worldwide.

🇳🇬 Mastercard and KaiOS partner to simplify acceptance for millions of SMEs in emerging markets. Beginning in Cote d’Ivoire and Nigeria, Mastercard and KaiOS will deliver affordable payment acceptance devices and stimulate the growth of a more inclusive, connected global economy.

🇮🇩 GoPay introduces AI Voice Assistant ‘Dira’ powered by Google Cloud. Dira understands and responds to commands in Bahasa Indonesia, leveraging Google Cloud’s generative AI technologies, including Vertex AI, speech-to-text AI, and the Gemini 1.5 Flash large language model.

🇺🇸 Flutterwave’s Send App & MainStreet Bank extend payments in 49 US States. Send App by Flutterwave facilitates faster, easier, and more affordable money transfers from Africans in the diaspora to their families and friends back home. Read on

🇺🇸 Cross River and Forward team on embedded payments for SaaS firms. The collaboration is designed to use embedded payments to address payment challenges the companies say are stunting the growth of Software-as-a-Service (SaaS) providers.

🇨🇦 Nuvei adds split payments to its platforms offering. “Nuvei for Platforms is designed to accelerate growth and drive revenue for various business models, including marketplaces, commerce platforms, the gig economy, payment facilitators, and independent software vendors (ISVs),” the Canadian FinTech said in a news release.

🇺🇸 Early Warning Services has gained some traction in the months since it has launched Paze — the bank wallet it hopes will someday take hold as widely as Zelle and serve as an alternative to mobile wallets from Apple and Google. But payment experts say attracting merchants will be key, and that will take time.

GOLDEN NUGGET

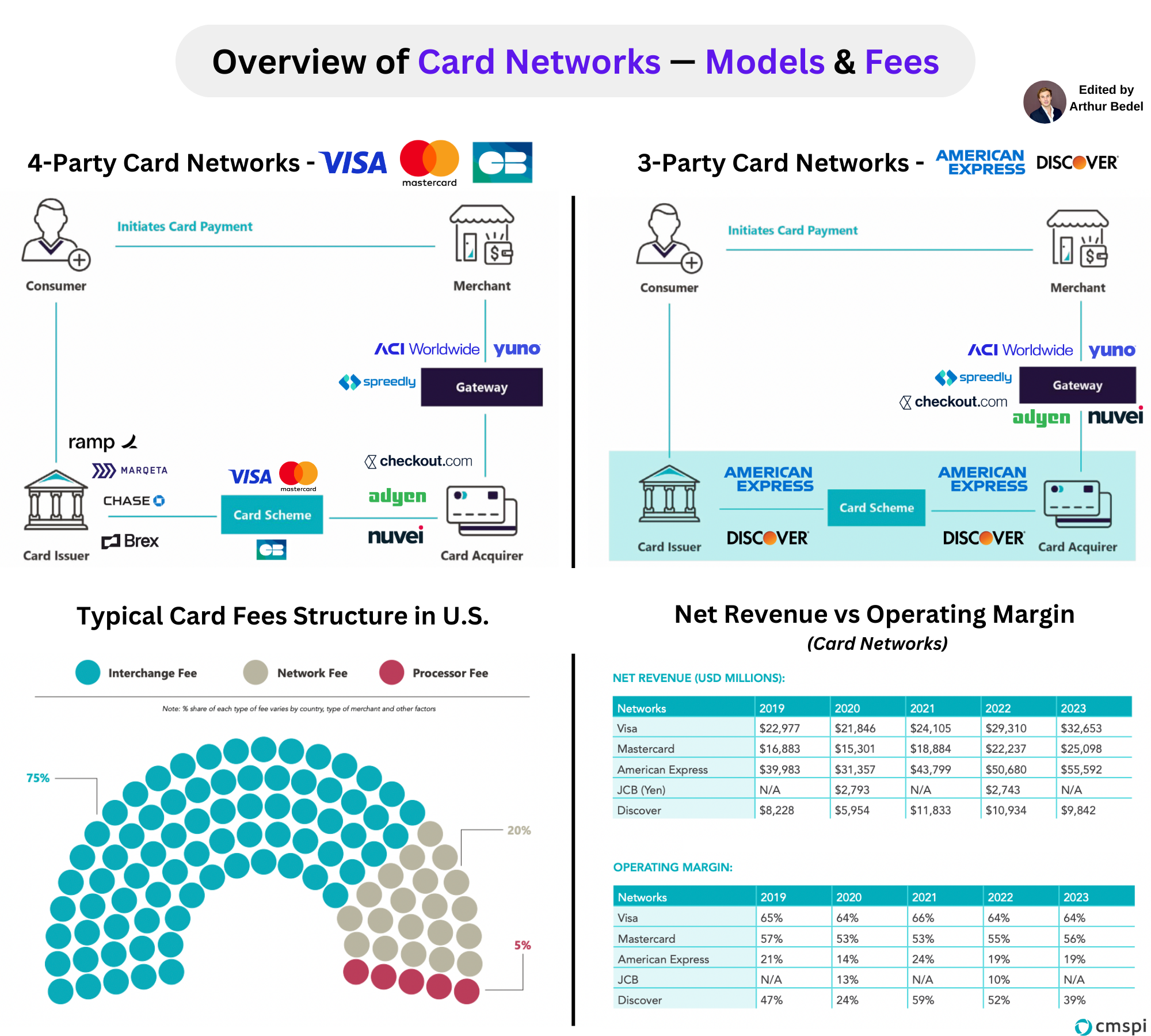

𝐓𝐡𝐞 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰 𝐨𝐟 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — 3-Party vs 4-Party Models, Key Players, Fees, and the Journey Explained 👇

The payments industry has evolved significantly since the first charge card in 1950. Today, 𝐜𝐚𝐫𝐝 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 are responsible for the majority of global transactions, with 687 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐜𝐚𝐫𝐝 𝐧𝐞𝐭𝐰𝐨𝐫𝐤 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 𝐫𝐞𝐜𝐨𝐫𝐝𝐞𝐝 𝐢𝐧 2023. However, behind each transaction lies a complex infrastructure involving several parties and significant costs.

𝐊𝐞𝐲 𝐍𝐮𝐦𝐛𝐞𝐫𝐬:

- In 2023, U.S. merchants paid ~$224 billion in fees for accepting card payments (interchange, network, and processor fees combined).

- U.S. merchants would have saved $49 billion in 2023 if fees had remained at 2009 levels.

- In Europe, 45% of the Merchant Discount Rates (MDR) are attributable to interchange fees.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐢𝐧 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬:

- 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫𝐬: Banks or financial institutions that manage the acceptance of payment cards for merchants and ensure that funds from cardholders are transferred to the merchants.

- 𝐈𝐬𝐬𝐮𝐞𝐫𝐬: Banks, Neobanks or credit unions that provide consumers with payment cards to facilitate transactions.

- 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬: Entities like Visa and Mastercard that act as intermediaries, facilitating communication and transaction processing between issuers and acquirers.

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞𝐥𝐬:

🔸 4-𝐏𝐚𝐫𝐭𝐲 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (Visa, Mastercard)

- This model involves consumers, issuers, merchants, and acquirers. Merchants interact with their customers and acquirers, while card networks (like Visa and Mastercard) serve as intermediaries.

🔸 3-𝐏𝐚𝐫𝐭𝐲 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (American Express, Discover Financial Services)👇

- In this model, one entity acts as the issuer, acquirer, and network. This simplifies the process for merchants, who pay a single fee, but can result in higher fees compared to the 4-party model.

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐞𝐞𝐬 💲

- 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬: The largest fee, paid by merchants to the card-issuing bank. These fees are usually set by the card network.

- 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐅𝐞𝐞𝐬: Charged by the card networks to the acquiring bank.

- 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 𝐅𝐞𝐞𝐬: Paid by merchants to the acquirer. Together with interchange and network fees, these costs form the Merchant Discount Rate (MDR) that merchants pay to accept card transactions.

Note - watch out for Foreign Exchange (FX).

Despite the critical role card payments play in global commerce, these costs continue to rise, impacting merchants significantly. Staying informed about fee structures and potential regulatory changes is essential for merchants to manage these growing expenses.

Source: CMSPI

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()