Checkout.com Lands Major Payments Deal with eBay, Aiming for Profitability in 2025

Hey Payments Fanatic!

Checkout.com, a London-based fintech firm, has announced a significant partnership to provide payment services for eBay. This deal is a strategic move as Checkout.com targets profitability within the year.

By collaborating with eBay, one of the world's leading e-commerce platforms, Checkout.com is set to enhance its global footprint in the digital payments sector. The partnership is expected to streamline eBay's payment processing capabilities, offering improved efficiency and user experience for its vast customer base.

"Our customers value speed, convenience, and safety while shopping on our marketplace," said Avritti Khandurie Mittal, eBay's GM of Global Payments and Financial Services. "Our strategic partnership with Checkout.com enables us to continue delivering fast, reliable, and frictionless payments experiences globally."

The deal gives eBay access to Checkout.com's full-stack payments technology and global acquiring network—an edge in today's competitive commerce landscape.

Guillaume Pousaz, CEO of Checkout.com, added, "Our technology, data, and global acquiring expertise will help eBay maximize acceptance in all markets and drive efficiency across its platform."

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

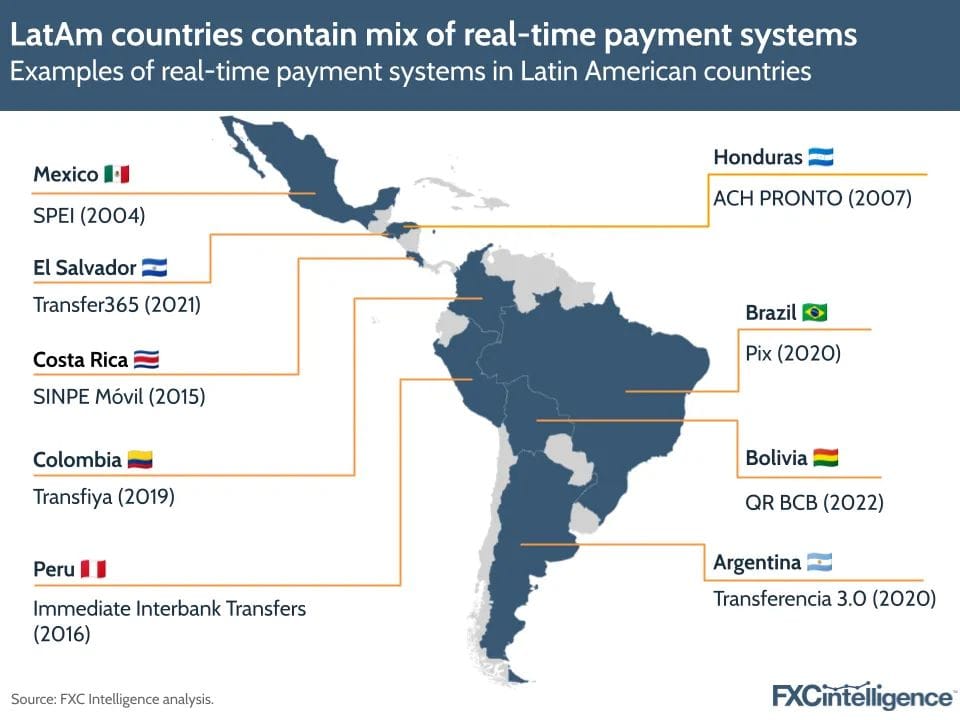

📊 The future of cross-border payments in Latin America: Trends, challenges and opportunities. Over the last decade, most countries across Latin America have built out their real-time payments (RTP) infrastructure with the aim of speeding up domestic payments.

PAYMENTS NEWS

🇬🇧 Ecommpay urges merchants to adopt modern mindsets as ticket fraud soars. The company is working closely with merchants to help them understand and tackle fraud to help protect customers. Ticket fraud involves scammers selling fake or non-existent tickets for concerts, sports events, or festivals, often through unofficial platforms, social media, or phishing emails.

🌎 Real-time payments are accelerating through key partnerships and tech upgrades. Orum (with Visa Direct), ACI Worldwide + Ingo, Jack Henry + Mastercard, and Nium (with Interac) are driving faster, broader access to instant transfers in the U.S., Canada, and beyond.

🇬🇧 Blockchain bank account platform Bleap partners with Mastercard in latest push to take stablecoins mainstream. The collaboration aims to accelerate this growth by leveraging Bleap's proprietary technology to enable other wallet providers to integrate directly with Mastercard's payments network to facilitate more seamless, stablecoin payments.

🇸🇬 Revolut rolls out five new currencies, including Chinese Yuan. With this, Singaporean users can now hold and exchange 39 different currencies directly in-app, according to a press release. Apart from exchanging currencies, users can also set stop and limit orders for automatic exchanges.

🌎 Belvo secures $15 million in new round of funding to expand Open Finance access and innovation across Latin America. The new funds will accelerate the expansion of Belvo’s Open Finance product suite across data and payments and advance its AI capabilities to foster the development of more inclusive and personalized financial tools for millions of individuals and businesses.

🇬🇧 Barclays close to selling stake in payments unit to Brookfield. Brookfield could initially buy a minority holding with an option to raise its stake depending on business performance within a window of three to seven years after the deal goes through.

🌍 Stripe to make Tencent's Weixen Pay (WeChat Pay) available on terminals in 20 countries. Stripe is working to expand Weixin Pay’s reach to more countries and plans to introduce recurring payments for eligible merchants as an add-on feature soon. Continue reading

🌍 Solayer launches crypto rewards Visa debit card. The card, called the Emerald Card, will use the Solayer Infini Solana Virtual Machine (SVM) L1 chain. It will be available in over 100 countries, including the US, and it has Apple Pay and Android Pay integration.

🇬🇧 Thinslices and Salt Edge partner to simplify financial data aggregation and open banking payments. The partnership will be especially impactful in industries like automotive finance and lending, where seamless access to financial data and real-time payments are essential for smarter, faster decision-making.

🇬🇧 Thales offers Prime Factors' bank card security system. This collaboration aims to enhance the security and efficiency of payment systems, providing a scalable solution for financial institutions. The partnership underscores a commitment to advancing payment security infrastructure.

🇬🇧 GoCardless appoints Shaun Puckrin as new CPO. Puckrin will lead the product teams for the product development and innovation agenda, including new payment flows, Open Banking capabilities, and continuous product improvements to help merchants collect and send payments from GoCardless’ bank payment platform.

🇬🇧 Ant International’s WorldFirst launches World Card to simplify payment for global commerce. Having empowered over one million SMEs to scale their businesses internationally, WorldFirst has partnered with Mastercard to develop customised features to enhance global operational efficiency for customers.

🇺🇿 Uzum Bank issues 1.5 million cards and launches nationwide access to plastic cards. Anyone in Uzbekistan can easily order both plastic and virtual cards, making secure and convenient banking more accessible and contributing to financial inclusion by bringing modern financial tools to every corner of the country.

🇬🇧 Wise launches ‘Spend With Others’: a new feature for spending with family and friends. The feature allows customers to set up a group of family and friends to spend together straight from Wise, splitting everything from everyday costs to once-in-a-lifetime trips abroad.

🌍 PayPal, TerraPay partner to boost real-time digital transfers across Middle East and Africa. The partnership aims to drive economic growth by making cross-border transactions faster, easier to use, and more accessible by connecting banks, mobile wallets, and financial institutions.

🇲🇦 Visa and Chari announce strategic partnership. By leveraging Chari’s deep market insights and innovative solutions, both companies will work together to broaden their customer base and unlock new revenue streams, positioning themselves at the forefront of the country’s digital financial evolution.

GOLDEN NUGGET

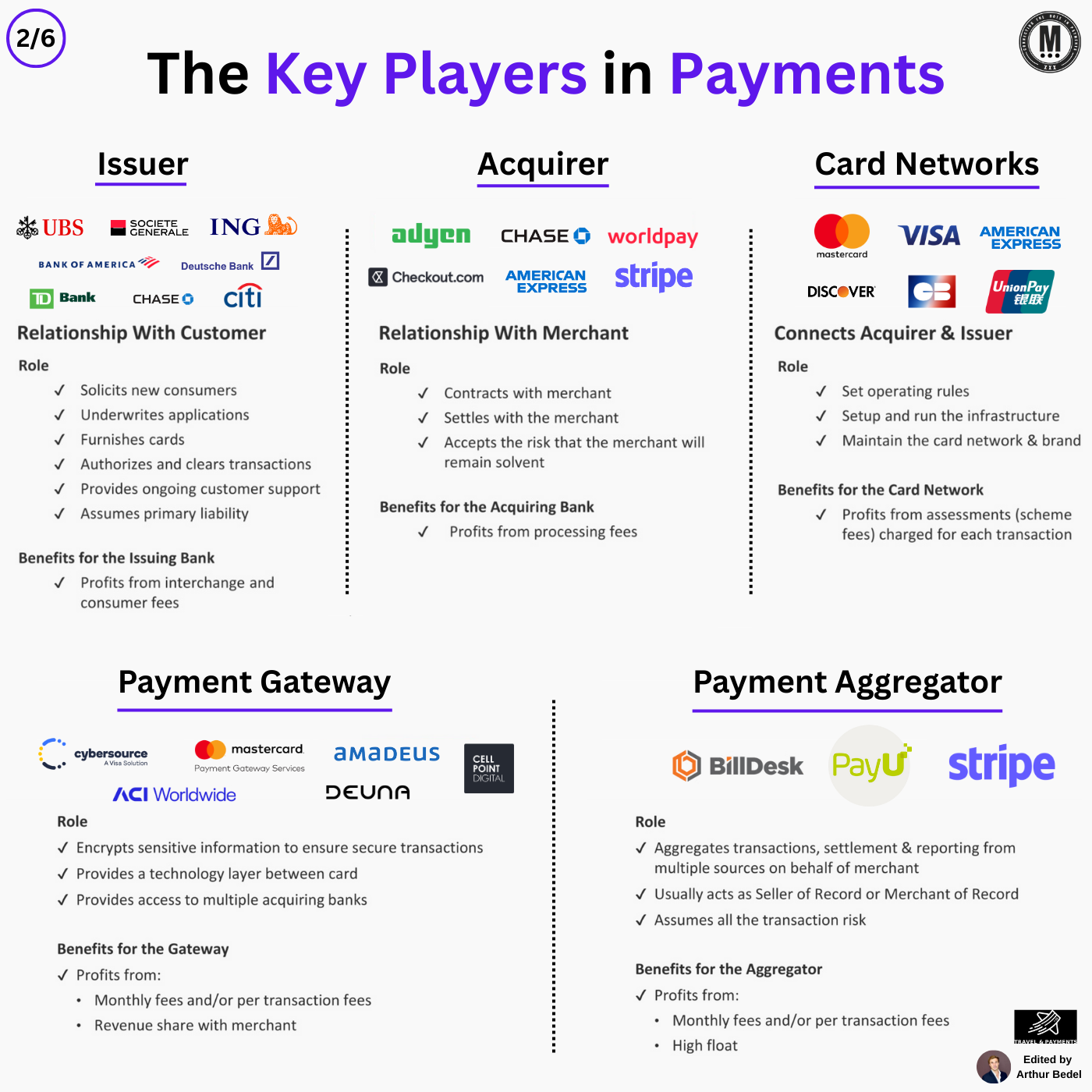

𝐓𝐡𝐞 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐭𝐨 𝐂𝐚𝐫𝐝𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by Travel & Payments 👇

𝐓𝐡𝐞 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — Edition #2

Behind every card transaction is a coordinated set of players — each with a unique role in enabling seamless, secure, and scalable payments.

𝐈𝐬𝐬𝐮𝐞𝐫𝐬:

Issuers are banks or financial institutions that provide cards directly to consumers.

► Key Functions:

→ Underwrite and approve new cardholders

→ Furnish credit, debit, or prepaid cards

→ Authorize and clear transactions in real-time

► How They Make Money:

From interchange fees, annual card fees, interest on revolving credit, and FX markups.

► Examples:

Citi, UBS, ING, TD, Deutsche Bank, Chase

𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫𝐬

Acquirers are responsible for enabling businesses to accept card payments.

► Key Functions:

→ Set up and manage merchant accounts

→ Process card transactions and settle funds to merchants

→ Manage chargebacks and fraud risk

► How They Make Money:

Through processing fees, gateway charges, and often value-added services (fraud protection, analytics)

► Examples:

Checkout.com, Worldpay, Nuvei

𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬

Card networks serve as the central infrastructure layer between issuers and acquirers.

► Key Functions:

→ Route transaction requests between issuer and acquirer

→ Establish dispute resolution protocols

→ Set interchange and assessment fees

→ Manage card branding and acceptance standards

► How They Make Money:

Card networks earn scheme fees, cross-border fees, and fraud assessment charges

► Examples:

Visa, Mastercard, American Express, GIE Cartes Bancaires

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲𝐬

Gateways act as the secure portal through which card data travels from the consumer to the acquiring bank.

► Key Functions:

→ Route transactions to the appropriate processor

→ Offer tools for fraud prevention, 3DS, and retry logic

→ Provide dashboard and reconciliation interfaces to merchants

𝐍𝐨𝐭𝐞: The tokenization process may be performed by 3rd Party vault VGS, Acquirer Checkout.com, Gateway DEUNA, and Merchant...

► How They Make Money:

Gateways charge monthly platform fees, per-transaction fees, and revenue-sharing arrangements

► Examples:

DEUNA, CellPoint Digital, Amadeus

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐨𝐫𝐬

Aggregators combine payment services into a single offering, especially for smaller merchants

► Key Functions:

→ Act as Merchant of Record (MoR), processing under their own MID

→ Aggregate transactions across merchants

→ Handle onboarding, settlement, and risk management

► How They Make Money:

Profit from higher per-transaction fees and managing float

► Examples:

Paddle, Stripe, PayU, BillDesk

𝐍𝐞𝐱𝐭 𝐔𝐩 #3: 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝 𝐆𝐮𝐢𝐝𝐞

Source: Travel & Payments

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()