Checkout.com First in UAE to Launch Visa Direct Push-to-Card

Hey Payments Fanatic!

Checkout.com has become the first acquirer in the UAE to launch Visa Direct Push-to-Card solution, enabling near real-time fund disbursements to eligible Visa cards. The platform connects over 190 markets with access to more than 8.5 billion card, account, and wallet endpoints through a single-entry point.

Shahebaz Khan, Visa Senior Vice President and Head of Commercial and Money Movement Solutions, CEMEA, stated: "Visa Direct is transforming the way money moves globally, and we are excited to see Checkout.com leverage this technology to meet the evolving demands of businesses and individuals alike by offering them a faster, more convenient, and secure way to send and receive funds."

Remo Giovanni Abbondandolo, General Manager for MENA at Checkout.com, added: "The UAE has rapidly emerged as a leader in digital payments, fueled by a clear vision to create a cashless, interconnected ecosystem." The company has reached a milestone of processing over one million Account Funding Transactions from the UAE with Visa.

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

PAYMENTS NEWS

🇦🇺 Airwallex CEO and Co-Founder Jack Zhang reflects on 2024 and what’s next. The company’s annualized transaction volume rose from US$100 billion in August to US$130 billion just three months later, following its ARR surpassing US$500 million. This marks a 73% year-over-year increase in transaction volume.

🇺🇸 How Stripe’s billing experiment propelled a $500 million AI-fueled business. In 2010, Patrick and John Collison were experimenting. Fifteen years later, one of those early ideas is stepping into the spotlight, providing what Stripe has come to see as a new pillar to its business.

🇩🇰 Market Pay completes its fourth acquisition with the purchase of Altapay. The acquisition of Altapay represents an incredible opportunity to enhance its online payment offerings. Their team has developed a cutting-edge, robust, and reliable platform that will seamlessly complement its current solutions.

💳 Mastercard has announced plans to phase out traditional 16-digit card numbers by 2030. This shift aims to reduce fraud, improve user experience, and align with the trend of tokenization and biometric authentication in payments. This marks a significant evolution in how consumers pay, shaping a more secure, seamless, and digital-first future.

🇧🇪 Bancontact Payconiq Company will introduce Wero. Customers can scan QR codes in stores to pay via Wero, while users from other banks can still process payments via Bancontact within the app. Wero will be integrated into the banking apps of BNP Paribas Fortis, KBC, ING Belgium, and Belfius.

🇳🇱 Dutch Payments company CM.com announced that it has raised €20M. The company will use the proceeds to strengthen its balance sheet and provide greater operational and tactical flexibility during the next phase of the Company’s growth plan. Read more

🇿🇦 Visa launches ‘Tap to Add Card’ in South Africa. Called Tap to Add Card, it allows cardholders to add Visa contactless cards to digital wallets with a tap on their mobile device. The feature will help drive further adoption of digital wallets by addressing key security concerns and simplifying the user experience.

🇺🇸 ISO 20022 implementation for Fedwire Funds Service postponed to July. Originally scheduled for 10 March, the implementation has been postponed to 14 July 2025, to allow additional time for industry participants to prepare. The decision to delay was made after evaluating customer readiness and responding to industry requests.

🇩🇪 UniCredit’s Commerzbank bid sapped by Berlin pushback. UniCredit’s attempt to build a stake in Commerzbank has faced political backlash in Berlin. With upcoming elections, the potential new government under Friedrich Merz is expected to maintain its stance. As a result, Commerzbank's outlook remains uncertain.

🇮🇳 PhonePe launches device tokenization solution for secure card transactions. With this launch, users will be able to tokenize their cards on the PhonePe App and use the card tokens seamlessly across all use cases such as bill payments, recharges, booking travel tickets, and making payments on Pincode.

🇸🇬 EBANX moves closer to full payment license. The company has received in-principle approval for a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS). This license will allow it to offer cross-border money transfers and merchant acquisition services in Singapore.

🇬🇧 Payrails supports Flix with scalable payment solutions to fuel global growth. The collaboration optimizes checkout experiences, streamlines transactions, and strengthens fraud prevention, enabling Flix to scale efficiently across global markets while advancing its mission to make sustainable travel more accessible.

GOLDEN NUGGET

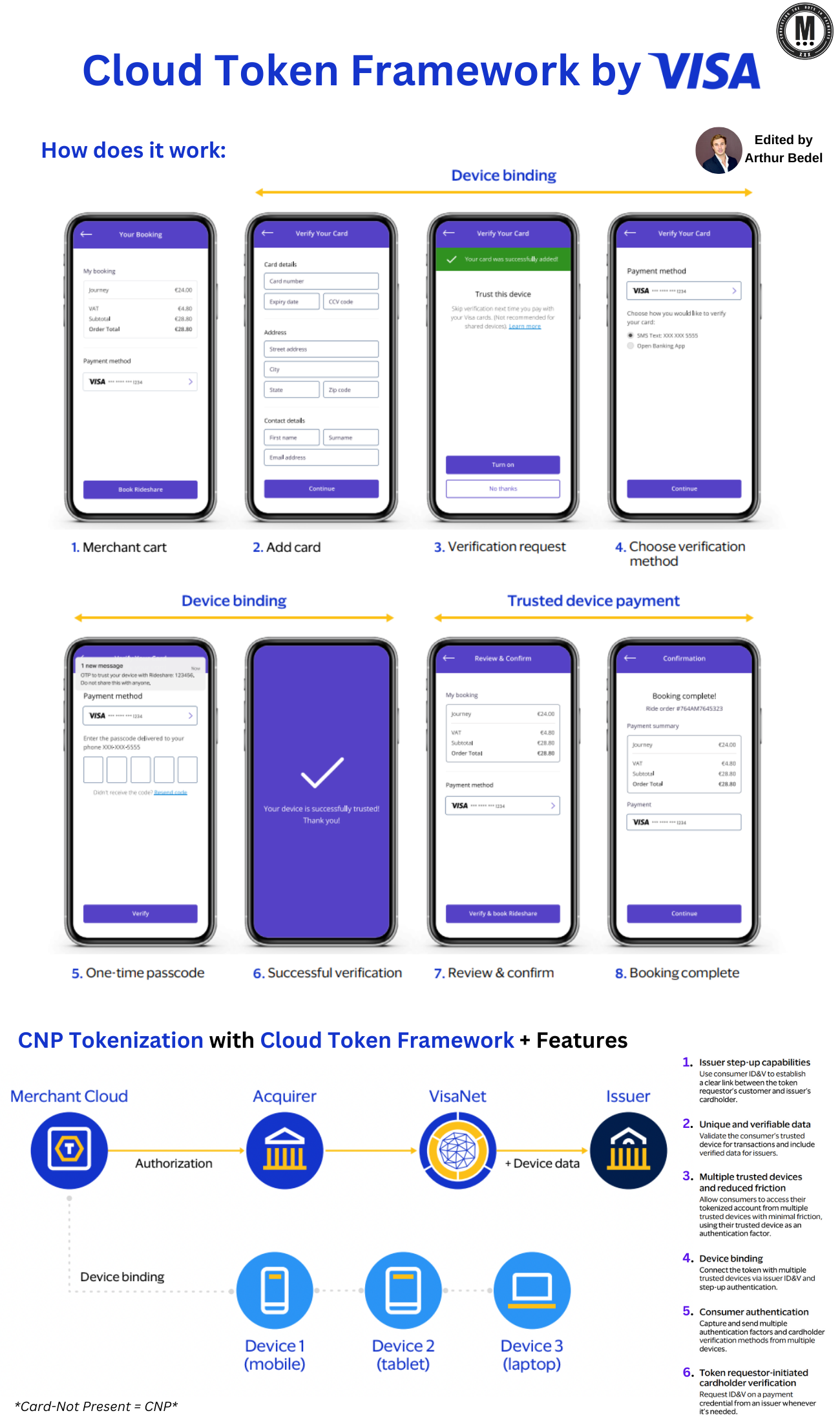

𝐂𝐥𝐨𝐮𝐝 𝐓𝐨𝐤𝐞𝐧 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤 — the newest solution by Visa to bring the ApplePay experience to all 👇

The rise of digital commerce brings immense opportunities — but also a need for enhanced security, particularly for Card-Not-Present (#CNP) transactions. This is where the Cloud Token Framework (#CTF) steps in, transforming how payments are secured across multiple devices, bringing an ApplePay-like enhanced customer experience.

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 𝐨𝐟 𝐂𝐥𝐨𝐮𝐝 𝐓𝐨𝐤𝐞𝐧 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤:

The Cloud Token Framework (CTF) by Visa allows any connected device to become a secure channel for digital commerce, minimizing risks associated with handling sensitive payment data. It enables the tokenization of CNP transactions, ensuring a seamless, secure payment experience across devices, combining consumer identity verification (ID&V) with device intelligence.

In essence, CTF creates an online payment experience binding a network token to a device and leveraging biometrics on that same device for the transaction to be initiated. An experience more secure than an in-person experience (in my opinion).

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐰𝐨𝐫𝐤:

- The cardholder reviews the items in their booking and proceeds to checkout

- The cardholder enters their card details and contact information

- The app prompts the cardholder with a verification request to designate the device as trusted for future purchases

- The merchant or other token requestor displays a list of consumer ID&V methods available from the issuer and the cardholder selects their preferred ID&V method

- The cardholder completes verification via the ID&V method

- Once confirmed, the cardholder receives a message to confirm that their device is trusted for subsequent transactions

- On the trusted device, the cardholder is prompted to verify and confirm their booking

- Once confirmed, the cardholder’s transaction is complete. The issuer receives the required device information to perform further checks

𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬:

𝐄𝐥𝐞𝐯𝐚𝐭𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐚𝐜𝐫𝐨𝐬𝐬 𝐝𝐞𝐯𝐢𝐜𝐞𝐬

Use consumer ID&V and device intelligence to link the consumer, cardholder and their associated devices to help prevent account takeover fraud

𝐓𝐫𝐮𝐬𝐭𝐞𝐝 𝐝𝐞𝐯𝐢𝐜𝐞𝐬 𝐢𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐜𝐨𝐧𝐟𝐢𝐝𝐞𝐧𝐜𝐞

Enable a trusted device to minimize friction and improve authorization rates for CNP transactions

𝐅𝐮𝐭𝐮𝐫𝐞-𝐏𝐫𝐨𝐨𝐟 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Expand digital commerce use cases with an end-to-end, secure and scalable token solution

The ApplePay experience was a revolution. Visa with Cloud Token Framework and Mastercard with TAS are bringing those to us all via tokenization!

Source: Visa ’s report

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()