CellPoint Digital & Checkout.com Partner to Simplify Travel Merchants’ Payments

Hey Payments Fanatic!

Payments in travel have always carried a certain complexity—across borders, currencies, payment methods, and more. CellPoint Digital and Checkout.com are joining forces in a strategic partnership designed to streamline payment flows for travel merchants.

Set to go live in June 2025, the integration will combine Checkout.com’s global acquiring network and AI-driven optimisation with CellPoint Digital’s orchestration platform. The result is a single point of access for travel businesses managing online payments, including 168+ alternative payment methods, local acquiring routes, and Buy Now, Pay Later solutions.

The collaboration is framed as a response to rising complexity and shifting customer demands. “As payment complexity continues to grow, travel brands need solutions that reduce friction, optimise performance, and unlock new revenue opportunities,” said Andy Sale, Head of Partnerships at CellPoint Digital.

From Checkout.com’s side, the emphasis is on expanding reach and driving operational efficiency through automation. “By integrating Checkout.com’s acquiring and optimisation capabilities into CellPoint Digital’s platform, travel brands can now leverage AI-powered transaction routing, increase acceptance rates, expand their global reach, deliver top-tier customer service, and streamline operations – all through a single integration,” said Matthieu Barral, VP Global Partnerships.

In a sector shaped by changing demands and global reach, the role of payment orchestration continues to evolve. The addition of AI-driven optimization and broader acquiring capabilities will simplify the way travel merchants approach digital transactions.

Enjoy more Payments industry updates I listed for you below, and I'll be back in your inbox tomorrow!

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

INSIGHTS

🇮🇳 Payments via mobile phones clocked a 41% jump in July- Dec 2024. India's digital payments ecosystem witnessed a significant surge in the second half of 2024, driven by Unified Payments Interface (UPI), mobile payments, and cards. Continue reading

PAYMENTS NEWS

🇿🇦 South African FinTech company Stitch has successfully secured an additional $55 million in funding, aimed at enhancing its comprehensive payment solutions for businesses throughout Africa. This strategic investment is poised to strengthen Stitch’s position within the continent’s rapidly evolving payments ecosystem, reflecting the growing demand for innovative financial technologies.

🇳🇬 OPay’s valuation climbs to $2.75B despite slowdown in venture funding. While the valuation increase is notable, the filings also reveal a sharp slowdown in unrealised fair value gains. Opera Limited’s 9.4% stake in OPay rose slightly to $258.3M in 2024, while unrealised gains dropped sharply from $89.8M to $5M, reflecting slower growth.

🇰🇵 North Korea expands foreign currency payments through smartphone apps. North Korean smartphones are processing more payments in foreign currencies, and an increasing number of businesses are now required to offer electronic payment systems, Daily NK has learned.

🇪🇺 Paysend partners with Tink to enhance open banking payments for faster, seamless transfers. This means more customers can fund their international transfers with minimal friction, greater security, and improved speed. Continue reading

🇺🇸 Blackbird secures $50m Series B for US expansion. The company has used the funding to launch a new tiered loyalty programme called Blackbird Club. The raise brings Blackbird's total funding to $85 million. Keep reading

🇵🇭 Visa and USSC Money Services enable Visa Direct for cross-border B2B payments. With Visa Direct, UMSI’s business clients can reportedly make faster cross-border outbound payments. It facilitates the transfer of funds directly to eligible Visa Direct cards, bank accounts, and wallets in many jurisdictions around the world.

🇳🇵 QR code drives Nepal’s digital payment boom. The number of QR codes issued by banks and financial institutions to merchants increased from 282,000 in mid-July 2021 to 2.34 million in mid-January 2024. Read more

🇦🇷 Ualá, the Argentine FinTech company, has joined Google Wallet, allowing users of its prepaid card to make contactless payments using their Android devices. The integration offers a faster and more secure payment experience, thanks to Google Pay’s multiple layers of security.

🇬🇧 CurrencyFair selects tell.money to enhance open banking capabilities for seamless global money transfers. The company continues to develop solutions in the international payments space, ensuring its customers enjoy greater speed, security, and transparency when sending money abroad.

🇺🇸 Branch adds ‘Full-Service Paycard’ to workforce payments platform. The paycard is delivered through the Branch App and Card, enables payments to a dedicated bank account, and allows employers to provide workers with a path to a complete banking experience.

🇲🇦 PayTic raises USD 4 million to expand across African markets. The funding will be used not only to scale the business in new African markets but also to strengthen the company’s technical capabilities in response to increasing demand for efficient payment systems.

🇦🇺 Xero offers Tap to Pay on iPhone for Australian SMBs with a Stripe account. This enables businesses to accept all forms of contactless payments, including contactless credit and debit cards, Apple Pay, and other digital wallets. The payment will be securely completed using Near Field Communication (NFC) technology.

🇺🇸 Ozone API launches industry-first tool for US banks to calculate the cost of building API infrastructure. The tool helps financial institutions understand the complexity and cost involved in building APIs and the hidden maintenance costs.

🇳🇴 Neonomics and Ovoro partner to enhance crypto investor payments with Nello Pay. This collaboration is set to redefine how users across the Nordics buy and sell crypto, making transactions faster, safer, and more cost-effective for investors. Users will connect their bank accounts directly, bypassing unnecessary intermediaries and reducing transaction costs.

GOLDEN NUGGET

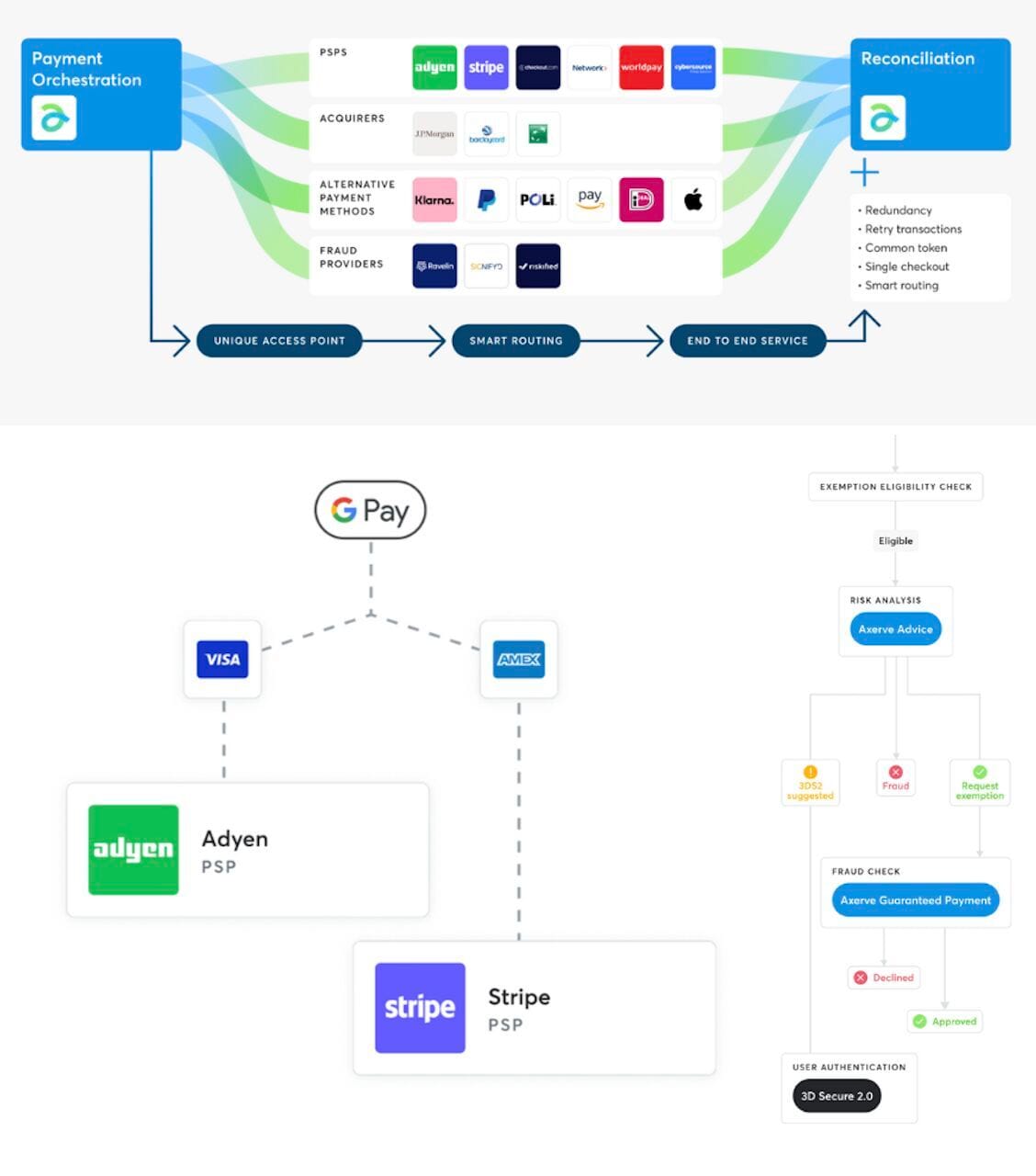

Understanding 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻

Let me break it down for you:

In the 𝟭𝟵𝟵𝟬𝘀, with the rise of Ecommerce, the first payment gateways came into existence. However, they lacked today's advanced collection and reconciliation tools.

The 𝟮𝟬𝟬𝟬𝘀 saw integrations between developers and gateways due to limitations in serving all customers through one gateway.

By the 𝟮𝟬𝟭𝟬𝘀, PSPs transformed, introducing alternative payment methods, fraud prevention, and global payments in local currencies.

The 𝟮𝟬𝟮𝟬𝘀 witnessed a shift, with over 60% of retailers using multiple payment providers and payment orchestration becoming essential for businesses.

What is 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻?

Drawing from the world of music, payment orchestration functions similarly to a maestro harmonizing an orchestra🎼

This system blends multiple payment processes, offering an efficient and streamlined transaction route.

It centralizes various gateways, ensuring a smooth consumer checkout.

Integrated reporting provides a unified data view, and "smart routing" auto-directs transactions through the best route.

Europe's e-commerce data shows that roughly a quarter of Mastercard's payment authentications in early 2021 failed. Smart routing in payment orchestration aims to combat such issues.

Business Research Insights predicts that by 2027, the payment orchestration market will be valued at nearly $5 billion.

Key advantages of payment orchestration include:

1️⃣ Cost and Time Efficiency: Merchants can choose lower transaction fees from a range of providers.

2️⃣ Increased Conversion: Improved customer experience boosts conversion rates. Factors like smart routing, diverse payment methods, and local currency support play significant roles.

3️⃣ Transaction Success: With the rise in digital payments, ensuring transaction success becomes vital. Payment orchestration can notably reduce decline rates.

4️⃣ Customer Loyalty: Offering preferred payment methods enhances the buying experience, fostering customer loyalty.

5️⃣ Global Expansion: For businesses aiming globally, understanding regional payment preferences is crucial.

6️⃣ Rapid Scaling: Merchants can swiftly integrate solutions supporting business growth.

7️⃣ Fraud Reduction: A consolidated platform with multiple payment methods aids in fraud prevention.

8️⃣ Automatic Reconciliation: This feature minimizes errors, saving internal resources and enhancing efficiency.

9️⃣ Real-time Ledgers (RTLs): RTLs provide almost instant financial data visibility, ensuring transactional integrity.

Source: Axerve

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()