Brazil’s Pix Unleashes New Feature, Driving $30B in E-Commerce Payments

Hey Payments Fanatic!

Brazil’s instant payment system, Pix, is gearing up for a major expansion with the upcoming launch of Pix Automático, a recurring payments feature set to debut in June. This innovation is expected to drive $30 billion in eCommerce payments over the next two years, making seamless, automated transactions accessible to millions of Brazilians—especially those without credit cards.

For businesses, Pix Automático simplifies recurring billing by eliminating the need to partner with multiple banks, and streamlining subscription payments for services like utilities and streaming platforms.

“Pix Automático should be really relevant,” said Eduardo de Abreu, VP of Product at Ebanx, one of the early adopters of the feature. The system is expected to revolutionize B2B payments as well, offering global SaaS companies a powerful way to digitize their payment infrastructure.

Ebanx has already begun preparing merchants for the transition, providing technical documentation and backend integration tools to ensure a smooth rollout. “This solution streamlines billing processes and enhances payment efficiency for users and businesses,” noted Fabio Scopeta, Chief Product and Technology Officer at Ebanx.

With Pix already handling over $338 billion in transactions per month, this new addition could further solidify Brazil’s position as a global leader in digital payments.

If you’re interested in reading more about what’s been happening in Payments, keep scrolling!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

𝐅𝐫𝐨𝐦 𝐁𝐍𝐏𝐋 𝐭𝐨 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧—𝐖𝐡𝐚𝐭 🔟 𝐂𝐨𝐥𝐥𝐚𝐛𝐨𝐫𝐚𝐭𝐢𝐨𝐧𝐬 𝐀𝐫𝐞 𝐓𝐞𝐥𝐥𝐢𝐧𝐠 𝐔𝐬 𝐀𝐛𝐨𝐮𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓

The latest FinTech partnerships reveal three powerful shifts shaping the future of payments.

PAYMENTS NEWS

🌍 DEUNA’s Aware AI: transforming data chaos into commerce growth. The platform enables merchants to automate data preparation, systematize insight discovery, and deliver proactive, actionable strategies that boost customer lifetime value, streamline operations, and optimize payment performance in real time.

🇵🇹 Ecommpay adds MB Way to payment platform for seamless pay-ins and refunds. Merchant clients based in any geography can offer MB Way as a payment option for Portuguese customers, simplifying and accelerating expansion into Portugal, also, customers can make EUR payments, send or request money, and manage funds using their mobile application.

🇺🇸 Skipify teams up with Retail Realm. With this merger, Retail Realm’s merchants can implement a pay-by-link feature, allowing shoppers to finalise their purchases with a single click via SMS or email. Skipify automatically recognizes shoppers and displays their payment cards and financing options at checkout.

🇬🇧 Y-Combinator Alumni Grey to partner with Clear Junction on global payments. The FinTech aims to provide banking services in emerging markets. Current products include multi-currency accounts, real-time money transfers, and virtual cards.

🇦🇪 Arab Financial Services expands into UAE. This move follows the successful acquisition of a Retail Payment Services License, category II from the Central Bank of the UAE, allowing it to introduce a comprehensive suite of innovative and secure payment solutions tailored to the country's dynamic financial landscape, the company said.

🇪🇺 Sumsub joins Payments Association EU, to help stop ID fraud in digital transactions. It will have the opportunity to speak to policymakers and senior industry leaders to advocate for more effective protections against the growing threat of identity fraud.

🌍 Cauridor has a fix for the biggest cross-border payments issues. Its platform supports mobile wallets, bank transfers, and cash pickups through a network of more than 25,000 agents across Guinea, Senegal, Ivory Coast, Sierra Leone and Liberia. Also, is adopting a hybrid approach to solving the money transfer problem.

🇪🇬 Paymob and Woo partner to revolutionize e-commerce in MENA. As a result of this collaboration, Paymob’s checkout experience is now seamlessly embedded into the WooCommerce Marketplace, providing merchants with streamlined access to its comprehensive suite of digital payment solutions.

GOLDEN NUGGET

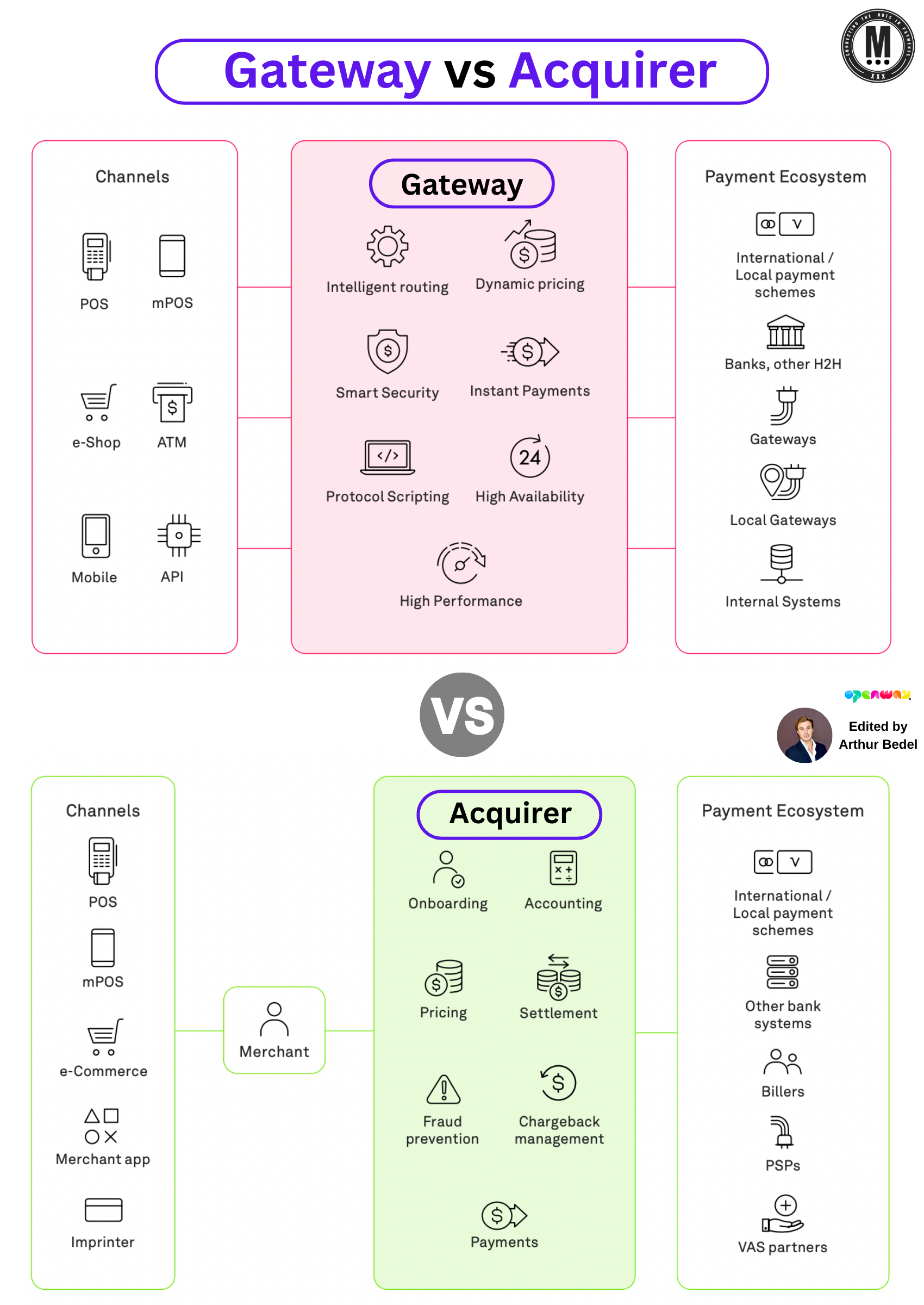

𝐆𝐚𝐭𝐞𝐰𝐚𝐲 vs 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫, the payment essentials👇

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦?

A payment platform ensures the financial exchanges between consumers, merchants, and financial institutions, efficiently, seamlessly and securely. These platforms support multiple services, from card issuing to merchant acquiring and payment gateways.

𝐌𝐚𝐢𝐧 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬:

► Payment Gateway (ACI Worldwide, Cybersource, DEUNA, Solidgate...)

► Merchant Acquiring Platforms (Stripe, Checkout.com, Getnet, Adyen...)

► Card Issuing Platforms (Marqeta, Galileo Financial Technologies, Bilt Rewards...)

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲?

A payment gateway enables merchants to securely process electronic payments, typically online, by connecting their website or POS system with the Network, Acquirer (if not consolidated into one). It acts as an intermediary between the Merchant and the Financial institutions.

Key Features:

► 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 — The payment gateway verifies that the customer's payment method (card, or other payment methods) is valid with sufficient funds or credit to complete the transaction.

► 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 — Securely tokenizes sensitive payment information to protect it from being intercepted during the transaction process.

► 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 — Routes the transaction request to the appropriate payment processor or acquiring bank for authorization and processing.

► 𝐑𝐞𝐬𝐩𝐨𝐧𝐬𝐞 𝐇𝐚𝐧𝐝𝐥𝐢𝐧𝐠 — After processing, the gateway returns a response to the merchant's system (approved or declined).

► 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 — Helps facilitate the transfer of funds from the customer's account to the merchant's account.

This is the Portal or Entrance.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫?

A Merchant Acquirer enables businesses to accept payments through various methods, such as cards, digital wallets, or other payment methods. These platforms act as intermediaries between the Gateway and the Financial institutions or networks (like Visa, Mastercard...).

Key Features:

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 — Handling the technical aspects of transaction processing, including authorization, settlement, and funding.

► 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 —Ensuring secure transaction processing, often through tokenization and compliance.

► 𝐑𝐢𝐬𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 —Offering tools to manage fraud prevention, chargebacks, and other risks.

► 𝐑𝐞𝐩𝐨𝐫𝐭𝐢𝐧𝐠 & 𝐀𝐧𝐚𝐥𝐲𝐭𝐢𝐜𝐬 — Providing merchants with insights into transaction data, sales trends, and other metrics for business management.

This is the Chef d'Orchestre or Conductor.

𝐍𝐨𝐭𝐞: Today, most Merchant Acquiring Platforms have built their own Gateway to consolidate both services. By adding card issuing, they have created an all-in-one platform.

Source: OpenWay

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()