Brazil’s Central Bank Tightens Rules for Pix Access in 2025

Hey Payment Fanatic!

The Central Bank of Brazil (BC) shook up the Pix landscape with a fresh resolution designed to raise the standards for institutions in the popular instant payment system.

Published this Monday (11), Resolution BCB nº 429 will require only authorized institutions to join Pix starting January 1, 2025. This shift means that those currently participating without BC authorization will need to meet new compliance standards to stay in the game.

From July 1, 2025, Pix participants in the process of obtaining authorization will need to adhere to strict regulations, including:

- Accounting and auditing aligned with BC’s Cosif standards, including filing financial statements.

- Customer data reporting to the National Financial System Customer Registry (CCS).

- Daily balance and credit transaction reports to BC.

Then, by January 1, 2026, all Pix players must demonstrate full compliance, including maintaining minimum net equity of R$5 million.

As the BC noted, "These measures aim to ensure Pix participants meet the operational demands of instant payments while enhancing BC’s supervisory effectiveness."

I'm curious to see how this impacts Brazil's payments ecosystem!

Enjoy more Payments industry news below👇 and I'll be back in your inbox tomorrow.

P.s. Want to boost your brand's visibility in the digital banking, FinTech, and payments sectors? Join us as a partner and connect with a highly engaged audience eager for industry-leading insights. This is a unique opportunity. to showcase your brand directly to decision-makers and innovators in the space.

Ready to make an impact? Sign up here, and let's take your brand to the next level!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

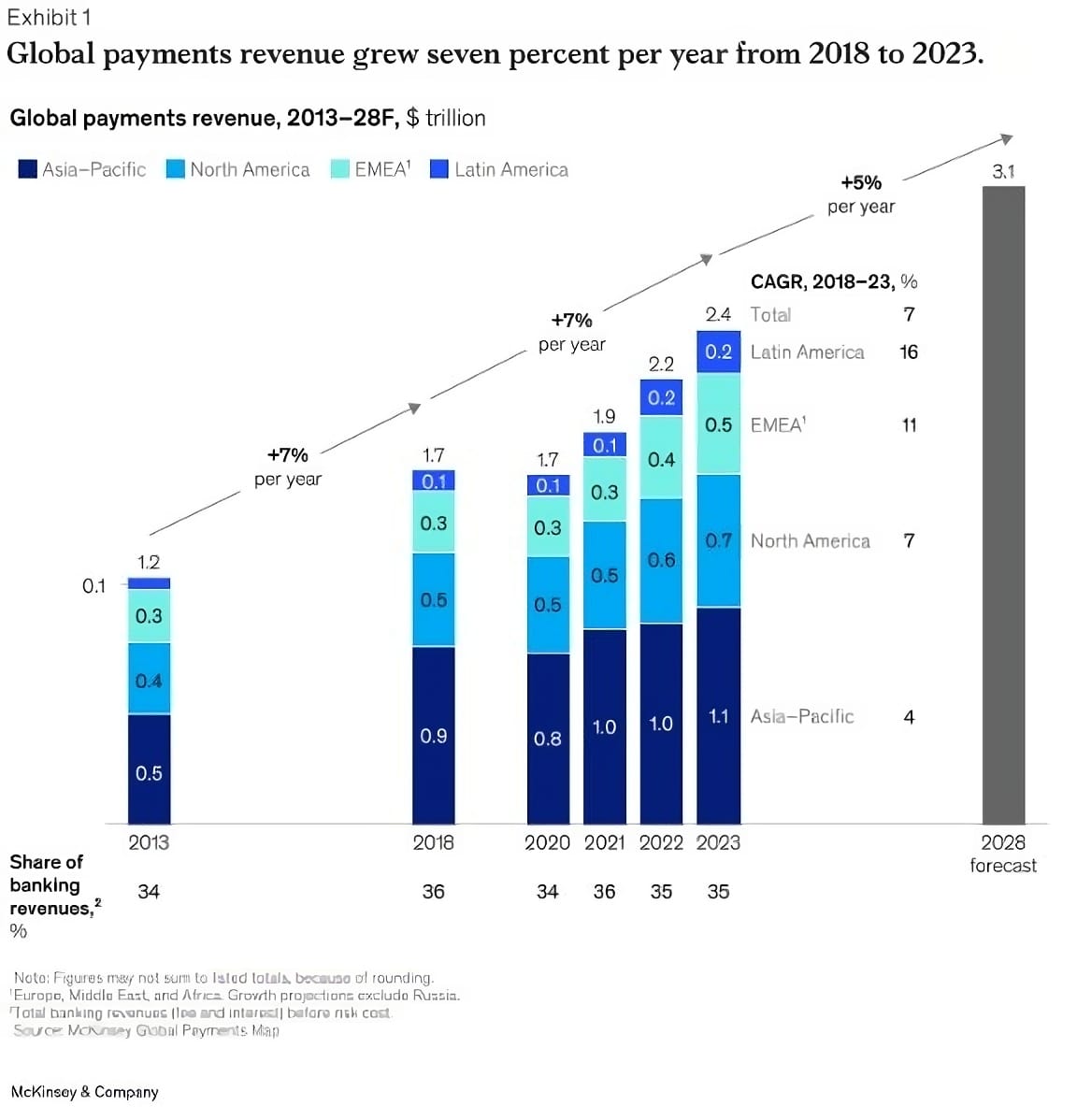

Check out the Global Payments in 2024: Simpler interfaces, complex reality by by McKinsey & Company. This report examines the evolving global payments ecosystem and highlights were players can capitalize on new dynamics. Link here

PAYMENTS NEWS

🇸🇬 Airwallex joins the Pledge 1% Movement, setting aside equity (US$56M) to support the next generation of entrepreneurs. "As Airwallex enters our 10th year as a business, the time is right to build on our community initiatives to date and commit to an enduring impact program," said Airwallex CEO and Co-founder Jack Zhang.

🇹🇷 Thunes and Papara establish a bilateral partnership to enable cross-border transfers to and from Türkiye. This alliance allows Papara users in Türkiye to send money to over 3 billion wallets, 4 billion bank accounts, and 15 billion cards across 130 countries—making fast, affordable international transfers to Papara accounts possible for the first time.

🇪🇸 PayRetailers appoints Patrick Lemay as Head of Corporate Development. With over 16 years of experience across FinTech, financial services, and payments, Patrick brings valuable expertise to PayRetailers’ corporate development team. Throughout his career, Patrick has managed high-profile projects in both the private and public sectors.

🇨🇴 Yuno launches Smart Routing, a revolutionary payment solution leveraging proprietary data and intelligent algorithms, reinforcing its leadership in payment orchestration and commitment to empowering merchants with seamless, intelligent tech.

🇱🇻 How to own a payment gateway? Learn how Spell's mixed model helps businesses that are unsure whether to build an in-house payment gateway or use a white-label SaaS solution to pick the optimal economic route without making any sacrifices. Explore more

🇮🇳 Careem Pay introduces instant transfers to Europe and business payments to India. Careem Pay, the digital wallet and FinTech platform within the Careem Everything App, has introduced a new remittance feature enabling secure transfers to businesses abroad, starting with India.

🇮🇩 Yup aims to be the ‘Nubank from SEA,’ but the road ahead is long. Just like Nubank, whose first product was a no-fee credit card, Yup offered only a physical credit card when it started in 2021. The platform began expanding its product portfolio in 2022 when it launched an e-wallet feature after getting an e-money license in Indonesia.

🇺🇸 Corpay Vehicle payments business helps drive profit. The business payments firm’s most recent quarterly earnings, reported Thursday, showed a 6% increase in adjusted profit, driven by growth in those segments. Keep reading

🇬🇧 Travelex launches complete ATM technology refresh with NCR Atleos. The new ATMs feature enhanced capabilities including touch screens, barcode readers, and contactless withdrawal options in select European locations. Continue reading

The Payments Group partners with HubPeople to bring cash payments to 100m daters. TPG will initially accept 17 currencies in cash payments. Users can also pay for their dating services/subscriptions with TPG's evoucher solution, a fast, secure service that closely resembles using an Amazon voucher or gift card.

🇬🇧 USI Money to implement Visa Direct to enable fast, seamless payments. The integration of USI Money's technology with Visa Direct enables customers to send money directly to bank accounts and digital wallets worldwide, solidifying USI Money's position as a leading payment provider with diverse payout options.

🇲🇾 SEA payment platform Tranglo expands to three Gulf states. This move addresses the demand for efficient remittance services, as the Gulf Cooperation Council region is home to over 31 million migrant workers, primarily from South and Southeast Asia, who depend on remittances.

🇸🇦 BuzzAR launches BuzzPay, an AI-powered FinTech. The platform is designed to fully digitalise the payment processes for one million travelers, particularly from Asia, with a projected economic impact of USD 3.2 billion in Saudi Arabia by 2026.

🇬🇧 Paytently hires veteran salesperson and FinTech exec to senior role. Paul Marcantonio has been appointed General Manager of Paytently, bringing 20 years of FinTech experience to support the company’s growth amid rapid technological advancements transforming the industry.

GOLDEN NUGGET

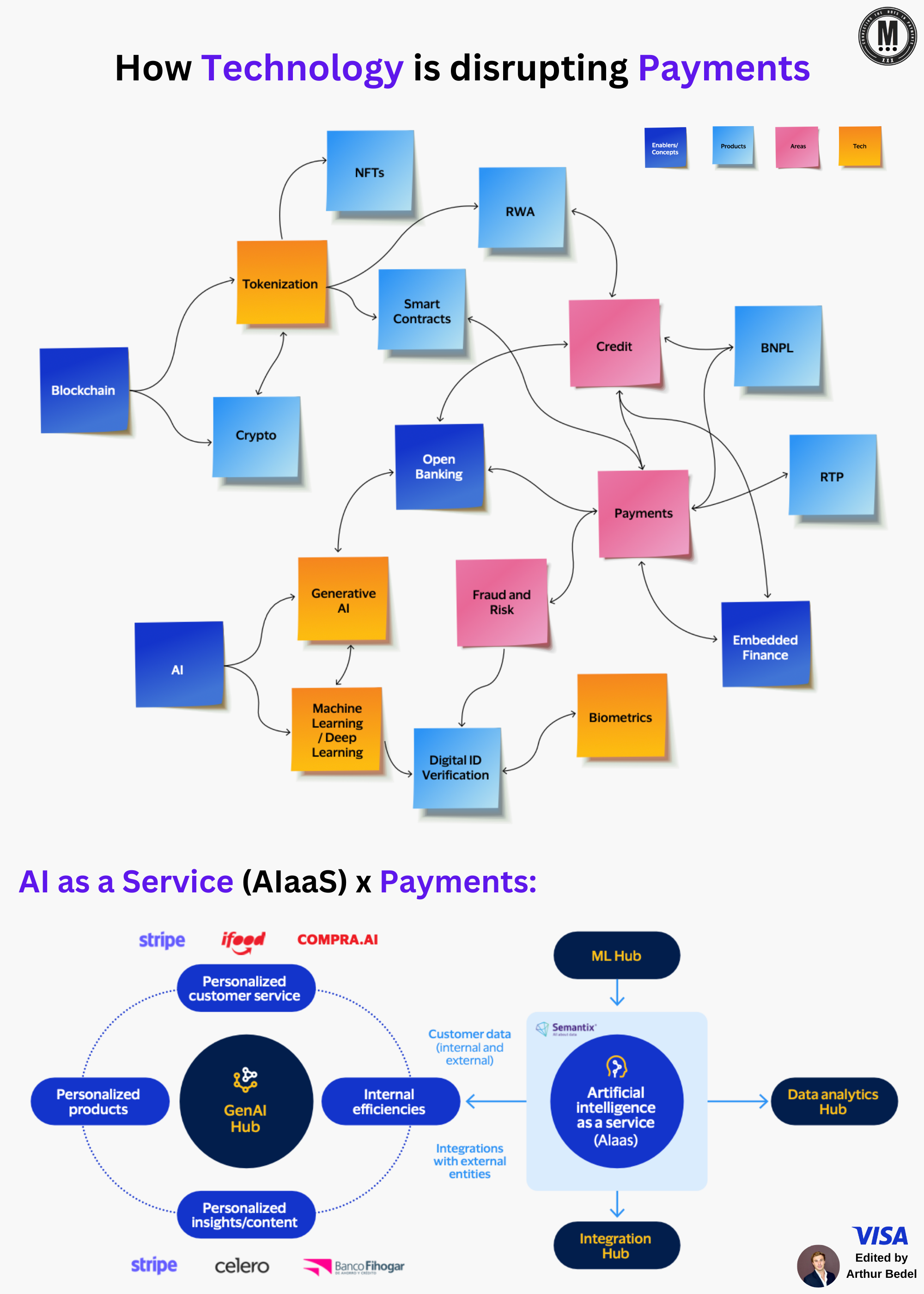

How Technology is disrupting Payments — Artificial Intelligence + Open Finance + Blockchain👇

New Technologies are transforming payments by enabling real-time transactions, personalized financial services, and secure, interoperable digital value networks, driveing innovation in fraud prevention, customer personalization, and seamless cross-platform payments.

1. 𝐎𝐩𝐞𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐚𝐧𝐝 𝐀𝐏𝐈𝐬: Data Sharing & Personalization

► Enables secure data sharing across banks, fintechs, and other financial institutions, allowing for deeply personalized financial products.

👉 Banco do Brasil uses open banking to provide customers with customized credit limits and loan offerings.

2. 𝐀𝐈 & 𝐌𝐋 𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬: Fraud Prevention and Enhanced Security

► AI models improve fraud prevention by analyzing transaction patterns and identifying suspicious activity in real-time. Predictive AI proactively monitors for potential risks as well.

👉 Mercado Pago applies AI-based risk analysis to dynamically detect and prevent fraud.

3. 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 & 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐕𝐚𝐥𝐮𝐞 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬

► 𝐈𝐧𝐭𝐞𝐫𝐨𝐩𝐞𝐫𝐚𝐛𝐥𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬: Real-time payment networks facilitate instant transfers of different asset types, from fiat currency to loyalty points, across multiple platforms.

👉 Brazil's PIX system enables instant, cross-platform transactions (i.e. enabler Matera)

► 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Payments integrated directly within apps, allowing users to complete transactions without needing to switch platforms.

👉 Nupay on iFood allows customers to pay using their Nubank balance or credit card within the app.

► 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬: Multi-asset digital wallets can store not just cash but also crypto, loyalty points, and tokenized assets, allowing customers to manage various financial assets in one convenient place.

👉 Mercado Pago enables users to store and transact in multiple currencies, access micro-loans, and receive remittances.

4. 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 & 𝐂𝐁𝐃𝐂𝐬: Blockchain-Based Payment Settlements

► Blockchain enables near-instant settlement of payments without intermediaries, automated through smart contracts.

𝐊𝐞𝐲 𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐭𝐨 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧:

► Privacy and Security: Ensuring secure data practices in an open finance environment.

► Regulation and Ethics: Addressing cross-border compliance and ethical AI use.

► Infrastructure Costs: Balancing advanced tech adoption with budget constraints.

These technologies are driving the payments and banking sectors toward a more connected, real-time, and personalized ecosystem, despite challenges in privacy, regulation, and infrastructure.

Source: Visa

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()