Bolt's Founder Comeback: High Costs and Investor Backlash

Hey Payments Fanatic!

Investors in Bolt are expressing concerns over the costly terms of Ryan Breslow's potential return as CEO. Breslow, who co-founded Bolt and left in 2022, would receive a $2 million bonus and $1 million in back pay, along with $750,000 in reimbursed expenses.

The proposed deal also involves Bolt investing in Breslow's other ventures, including $5.5 million for his startup, Love.com, with additional investments tied to performance milestones.

The return deal, negotiated by Breslow and current CEO Justin Grooms, requires investors to inject more capital into Bolt or face having their stakes bought out for minimal returns. Investors are particularly troubled by the unusually aggressive "pay-to-play" provision, which is seen as harsh even by Silicon Valley standards.

Bolt would also commit to funding legal fees related to Breslow’s past disputes, including an ongoing lawsuit with investor Activant Capital. Additionally, the deal would obligate Bolt to invest $15 million in a UK venture fund associated with Breslow.

Grooms justifies the high valuation of $14 billion for Bolt by citing the company’s 55 million marketable users and upcoming product launches, including a "super app." However, this valuation starkly contrasts with a recent offer to buy back shares at a price suggesting a $300 million valuation.

Investors must decide quickly whether to approve the deal, which could significantly impact the future of the company and their own investments.

To be continued...

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇺🇸 Datos names ACI Worldwide Best in Class in Payments Orchestration. The report used four categories to analyze payments vendors: provider stability, client strength, client service and product features. ACI Worldwide achieved the highest ranking and average score across categories and was the only vendor to earn the “Best in Class” accreditation.

🎙️ Tune into this interesting podcast episode where Robin Amlôt interviews Pav Gill, the lawyer who played a crucial role in uncovering the irregularities at Wirecard. Now the Founder & CEO of Confide Platform, Pav Gill discusses his transition from a legal expert in a major corporate scandal to spearheading a company dedicated to improving corporate governance.

🇹🇭 Mastercard appoints Winnie Wong as country manager for Thailand and Myanmar. Winnie will oversee all Mastercard activities in the two markets, including business development, implementation of innovative, safe, and smart payments solutions, as well as the growth and delivery of commercial solutions to corporations and SMEs.

🇨🇭 Swiss banks dive into instant payments, capturing 95% of retail transactions. The country has moved closer to a cashless society with its new instant payment scheme. The Swiss National Bank (SNB) and financial infrastructure operator SIX made the announcement on Wednesday.

🇺🇸 Hotels. com partners with Affirm to bring guests a flexible way to book trips. By selecting Affirm at checkout, approved Hotels. com guests can split the total cost of their purchase into budget-friendly payments.

🇺🇾 Topper by Uphold and dLocal join forces to expand payment flexibility in emerging markets. The alliance will drive economic growth in emerging markets by offering local payment options. Read on

🇲🇽 Shiji and FreedomPay announce partnership to transform Mexican hospitality payment solutions. This partnership underscores the companies’ commitment to enhancing staff and guest experiences in Latin America's hospitality business, in line with the industry's move toward streamlined payments and payment management.

🇬🇧 Trustly appoints payments industry veteran Adam D’arcy as CPO. Trustly looks to reinforce its product team by bringing on D’arcy to lead several upcoming product expansions for Open Banking Payments.

🇳🇴 Neonomics tapped by supporter's platform Støtte to simplify micro-donations through open banking. "This partnership will greatly enhance the user experience for both donors and organisations, fostering a stronger community of support within Norwegian sports and humanitarian aid," said Christoffer Andvig, CEO of Neonomics.

🇳🇿 Klarna has acquired Laybuy’s assets in New Zealand, the birthplace of the payments provider, and plans to relaunch the service in the coming weeks. Laybuy, which ceased operations in June, is set to make a reenergized return in New Zealand under Klarna.

GOLDEN NUGGET

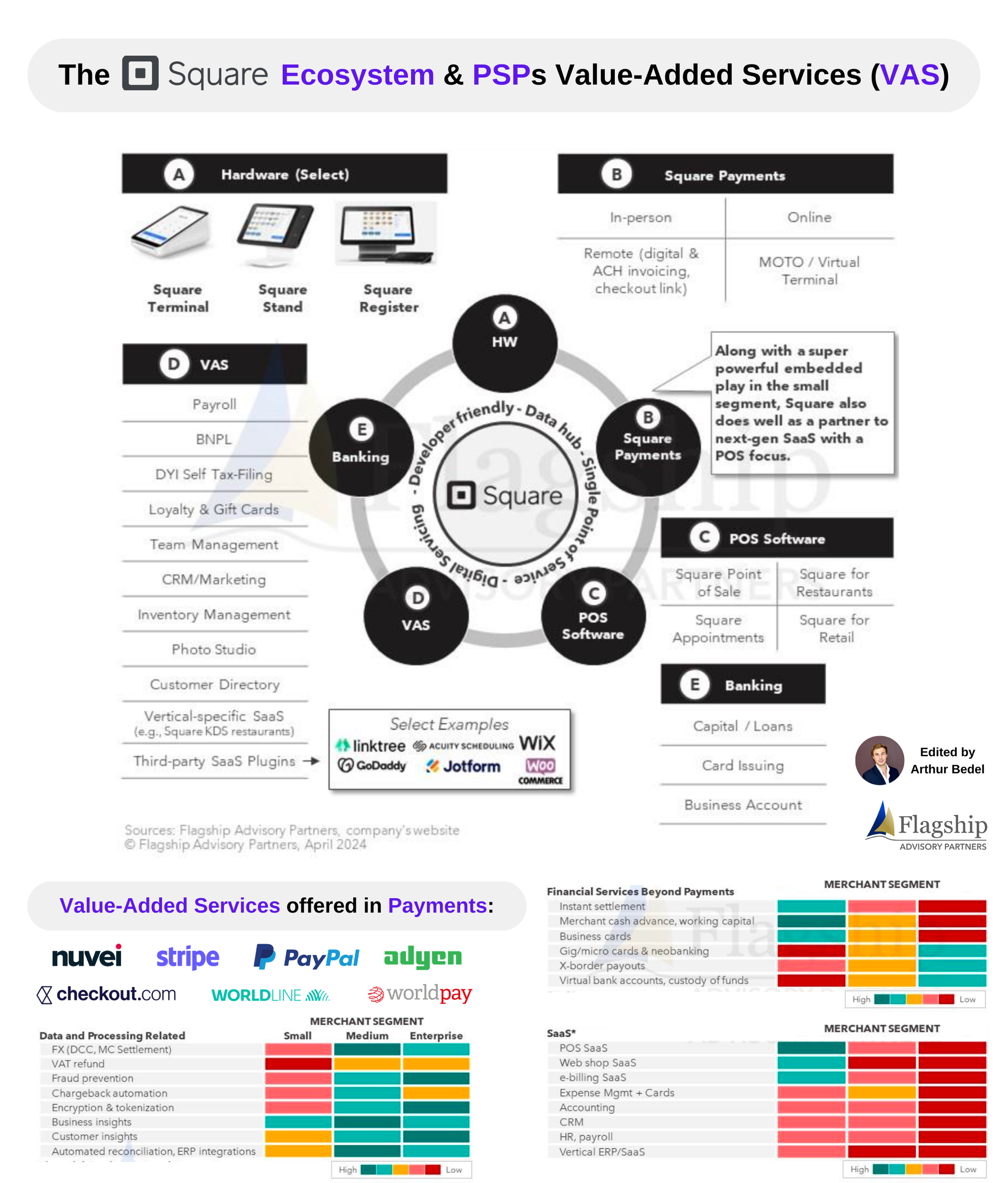

How Value-Added Services in payments became the key differentiator in today's world for PSPs👇

Value-Added Services (VAS) for merchant Payment Service Providers (PSPs) have evolved from aspirational concepts to essential revenue drivers, contributing significantly to PSPs' profitability, including, lending, multi-currency processing, SaaS & fraud services, for merchants with different needs across segments & geographies.

In Flagship Advisory Partners's whitepaper, Square's ecosystem serves as a prime example of a successful VAS integration, showcasing how PSPs (i.e. Nuvei, Adyen, Checkout.com...) can leverage these services to enhance their offerings and secure a competitive edge in the FinTech industry.

Let's dive deeper into the different VAS merchants are interested in based on their maturity 👇

🔸Multi-Currency Settlement (MCC): Allows merchants to accept payments in multiple currencies, simplifying the process for businesses that operate internationally

🔸Fraud Management: Tools & services designed to help merchants detect and prevent fraudulent transactions, reducing the risk of chargebacks and financial loss.

👉 Specialized fraud providers — Forter, Signifyd, Riskified, Kount, an Equifax Company... — also partner with PSPs

🔸Tokenization/Vaulting: Security measures that protect sensitive payment information by replacing it with unique identification symbols (tokens) stored securely

👉 2 type of companies specialize in tokenization enabling a multi-processor strategy (Token Vaults - VGS, TokenX, Nexio, Basis Theory & Orchestration Layers - Gr4vy, Inc, Spreedly, IXOPAY...)

🔸Chargeback Services: Assistance and tools for merchants to manage and dispute chargebacks, aiming to reduce their occurrence and impact on the business

🔸Software Subscriptions: Merchants gain access to specialized software for managing various aspects of their business, such as inventory, CRM, payments

👉 Platforms like Chargebee, Zuora and Recurly specialize in Subscription & Billing

🔸Lending: Short-term loans or cash advances based on sales history, helping to manage cash flow and fund business growth

👉 PurePlay Lenders - YouLend, Pipe, Liberis

🔸Dynamic Currency Conversion (DCC): Service that allows international customers to see prices and pay in their home currency at the point of sale or online, enhancing the customer experience

🔸Tax-Free Shopping: Solutions that enable international shoppers to receive refunds on sales taxes for purchases made while visiting a foreign country

Value-Added Services enable PSPs to become FinTech aggregators, diversifying their core offering and either competing or partnering with specialized companies to increase their value prop beyond basic payments 🚀

Source: Flagship Advisory Partners

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()