BNPL Meets Pix in Brazil

Hey Payments Fanatic!

In Brazil, if it exists, one can probably pay for it in installments. Now, a new payment trend is taking shape—even though the Central Bank hasn’t officially launched “Pix parcelado” (Pix in installments), the market isn’t exactly waiting.

Without regulatory restrictions, banks and fintechs are already testing installment payments through Pix, effectively bringing buy now, pay later (BNPL) to the country’s instant payment system.

Pix in installments functions like a credit purchase, allowing users to split payments over time. Some transactions come with fees, while others remain interest-free, depending on the institution and the borrower’s risk profile.

Some providers, like Koin, offer interest-free plans, while others charge up to 2.99% monthly for 12-month installments.

E-commerce platforms are also embracing the model. AliExpress, through a partnership with Pagaleve, allows customers to pay in four interest-free fortnightly installments or up to 12 monthly installments.

A recent Matera survey found that over 30% of Brazilians have used Pix in installments in the past 2 months, placing it on par with revolving credit cards and ahead of consigned credit and informal lending.

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

INSIGHTS

📊 How do consumers pay in Latin America?

Here's a breakdown of the latest 2024 stats:

PAYMENTS NEWS

🇮🇱 Mesh announced it closed a $82 million series B funding round, bringing its total amount raised to over $𝟭𝟮𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻. Now, the company can further accelerate product development and the expansion of its APIs to power hundreds of crypto and payments platforms.

🇺🇸 The sibling founders of Stax Payments are back with a $20M seed raise for their new FinTech, Worth. The company plans to use its new capital primarily to scale its organization, particularly across sales and marketing. Read more

🇳🇱 Adyen publishes 2024 annual report, providing stakeholders with an insight into its business performance, strategy, and key milestones from the past year. The report includes its Annual Report and Consolidated Annual Accounts. More on that here

🇦🇺 Reece partners with Adyen to optimise customer experience. Adyen's payment collaboration upgrades Reece's online and physical stores by improving customer experiences, ensuring secure transactions, and modernising operational processes.

🇬🇭 Flutterwave strengthens Ghana operations. This development further solidifies its commitment to simplifying payments for endless possibilities across Africa. Flutterwave’s latest approval aligns with these developments, ensuring that Ghanaians can benefit from fast, secure, and cost-effective remittance services.

🌍 Klarna launches Gift Card Store in Europe. This launch will give customers the ability to buy gift cards from an extensive selection of national and global brands and pay for them using Klarna’s range of Buy Now, Pay Later products and instant debit option, Pay in Full.

🇺🇸 Affirm launches BNPL partnership with resale marketplace StockX. The partnership lets shoppers choose Affirm’s biweekly or monthly payment plans at checkout, choosing custom payment plans that meet their needs. Discover more

🇺🇸 Conotoxia files complaint against Poland in the US. The firm has notified US law about alleged criminal offenses committed by employees of the Polish financial regulator KNF and various local prosecutor's offices. It claims they abused their power and deliberately acted to harm the international Conotoxia Holding group, causing estimated losses of “at least several billion Polish zlotys.”

🇬🇧 iplicit to bring instant payments to customers with GoCardless. The partnership will bring faster, in-app payment methods to iplicit’s growing customer-base, which spans verticals such as non-profit, recruitment, education, FinTech, SaaS, and multi-academy trusts.

🌍 Eurosystem rolls out Verification of Payee service across SEPA. This initiative, leveraging existing solutions developed by Banco de Portugal and Latvijas Banka, aims to support payment service providers in meeting new regulatory requirements under the EU Instant Payments Regulation.

🇳🇴 Coeo Inkasso selects Neonomics to simplify debt collection payments with Nello Pay. Through its partnership with Neonomics, Coeo’s customers can make instant, secure payments directly from their bank accounts, reducing manual entry errors and improving overall payment compliance.

🇺🇸 Papaya Global adds Citi as sponsor bank. This relationship will enable Papaya Global to expand to new geographic regions. It will also keep enhancing its cross-border payments capabilities, encompassing 160 countries and 130 currencies, and serving clients in the U.S., Europe, Latin America and Asia.

🇹🇭 UnionPay ties up with NITMX to integrate PromptPay. In the initial phase, the partnership will introduce QR code payment solutions tailored for Chinese tourists visiting Thailand. Subsequent phases will enable Thai tourists to utilise the QR codes while in China, with specific launch dates to be announced.

🇮🇹 myPOS partners with Satispay to deliver a versatile and user-friendly payment solution for Italian businesses. By integrating Satispay, merchants gain access to a larger customer base, enabling faster and more secure transactions as well as enhancing customer satisfaction by reducing missed sales opportunities.

🇺🇸 Dwolla partners with Plaid to future-proof pay by bank payments. The payments solution will integrate Plaid's instant account verification into Dwolla's pay by bank platform. This will enable customers to onboard with Plaid through Dwolla’s Open Banking Services, creating a modern A2A payment offering for mid- to enterprise-sized businesses.

🇺🇸 Intuit QuickBooks enables Tap to Pay on iPhone for small and mid-market businesses to accept contactless payments. With this added functionality, QuickBooks customers can access even more ways to seamlessly manage their business finances, get paid faster, and unlock their growth path.

🇨🇴 Yuno introduces Pre-Chargeback Alerts. The feature provides early notifications about potential disputes before they escalate into chargebacks. It also allows merchants to take immediate action, addressing customer concerns, issuing refunds, or disputing invalid claims, before financial losses accumulate.

GOLDEN NUGGET

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 5 👋

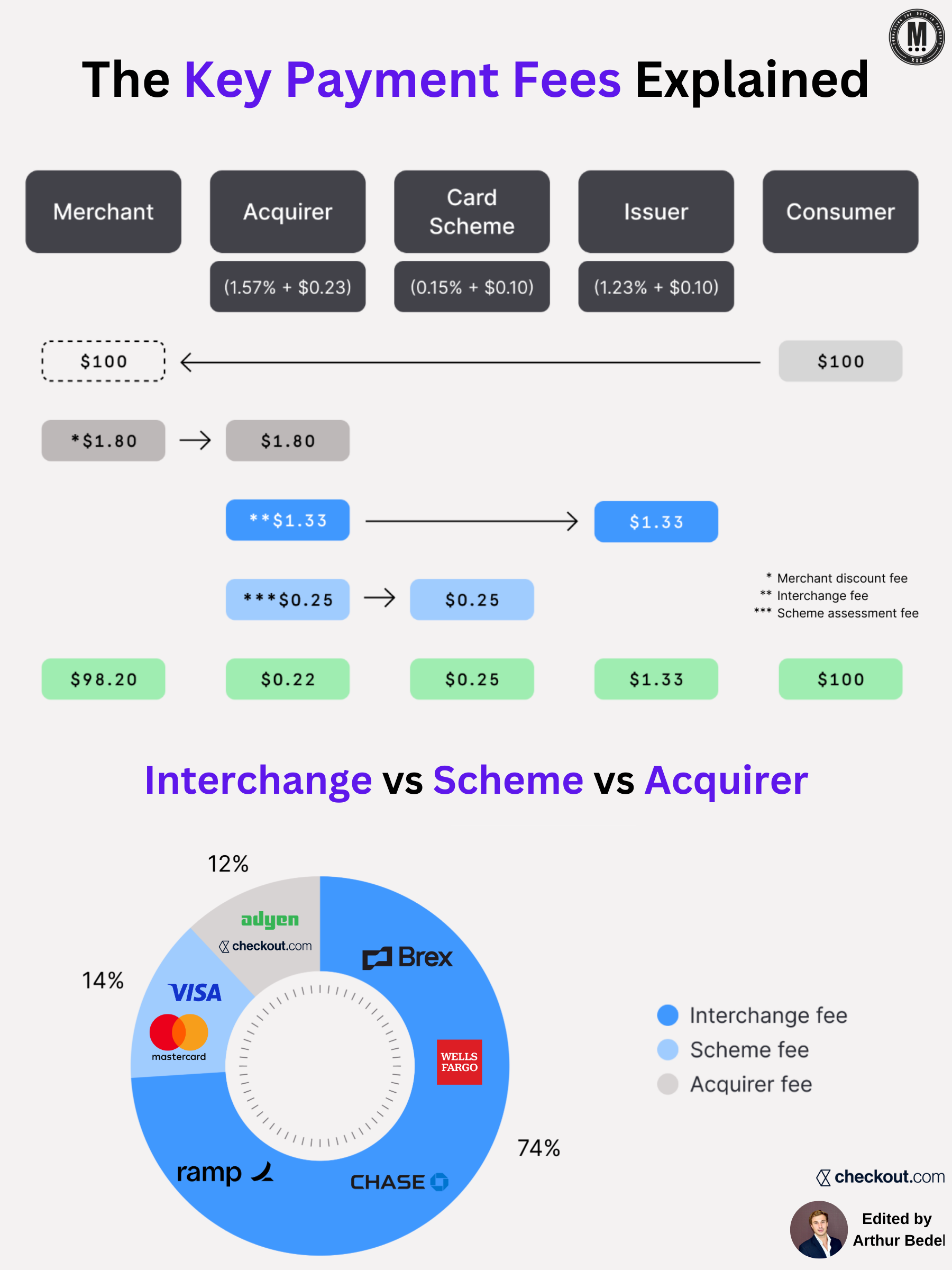

𝟒-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 & 𝐊𝐞𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐞𝐞𝐬 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝

► Interchange fees are a critical part of card payments, representing the fee paid by the acquiring bank to the issuing bank for processing a transaction. They are set by card schemes (Visa, Mastercard, etc.) and vary based on factors like card type, transaction method, and region.

Merchants indirectly pay interchange fees as part of their total Merchant Discount Rate (#MDR), which includes:

✔ Interchange Fees → Paid to the issuing bank (Chase, Wells Fargo).

✔ Card Scheme Fees → Paid to the card networks (Visa, Mastercard).

✔ Acquirer Fees → Paid to the acquiring bank or PSP (Checkout.com, Adyen).

𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝:

► $100 transaction

1️⃣ The customer pays $100.

2️⃣ The acquirer (Checkout.com, Adyen) deducts fees before settling the funds with the merchant. #MDR 1.57% + $0.23 → $1.80 goes to the Acquirer to be distributed across all parties.

3️⃣ Interchange fees (paid to the issuing bank, Chase, Wells Fargo) are deducted:

1.23% + $0.10 → $1.33 goes to the Issuer (deducted from $1,80)

4️⃣ Card scheme fees (paid to Visa, Mastercard, etc.) are deducted:

0.15% + $0.10 → $0.25 goes to the card scheme (deducted from $1,80)

5️⃣ The merchant receives the remaining amount: $98.20.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐭𝐡𝐞 𝟒-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 & 𝐡𝐨𝐰 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐢𝐦𝐩𝐚𝐜𝐭 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

The 4-party model is the foundation of card payments, involving the Cardholder and:

1️⃣ Merchant

2️⃣ Acquirer (Merchant’s Bank)

3️⃣ Issuer (Cardholder’s Bank)

4️⃣ Scheme (Card Network)

𝐖𝐡𝐚𝐭 𝐀𝐟𝐟𝐞𝐜𝐭𝐬 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

► Card Network — Visa, Mastercard, American Express have different rates

► Card Type — Debit, credit, premium, commercial cards have varying fees.

► Transaction Type: Card Present or Card Not Present

► Merchant Category Code (MCC) — Different Industry Types

► Geography — Fees vary by region due to regulation (EU has capped interchange fees)

𝐇𝐨𝐰 𝐝𝐨 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐏𝐚𝐲 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

► 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐏𝐥𝐮𝐬 (IC+) → A transparent pricing structure, where merchants pay, here is an concrete example for $100:

👉 Interchange fee (Chase) → $1.33

👉 Scheme fee (Visa, Mastercard) → $0.25

👉 Acquirer fee (Checkout.com, Adyen) → $0.22

👉 Total Fees for Merchant: $1.80

👉 Merchant receives: $98.20

► 𝐁𝐥𝐞𝐧𝐝𝐞𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 → A simpler, fixed-rate model where the merchant pays one flat percentage per transaction, covering everything: ~ 2.6% + $0.15

While easier to manage, blended pricing can be more expensive than Interchange Plus, as it bundles all costs into a higher flat rate.

Source: Checkout.com x Connecting the dots in payments...

I highly recommend following my partner Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()