BLIK's Record-Breaking H1 2024: 1.1 Billion Transactions and 46% Surge in Value

Hey Payments Fanatic!

BLIK saw impressive growth in the first half of the year, with over 1.1 billion transactions—up 40% from last year. The most significant increase was in POS payments, which rose 58% to 258 million, with over 100 million being contactless. However, online payments dominated, making up nearly 49% of all BLIK transactions.

On its busiest day, BLIK processed nearly 10 million transactions, averaging 71 transactions per second. The total value of transactions in the first half of 2024 was EUR 36.6 billion, a 46% increase from the previous year.

E-commerce remains BLIK’s stronghold, with 544.5 million online transactions in the first half of 2024, up 28% from the same period in 2023. The total value of these transactions reached EUR 18.9 billion.

POS transactions also gained traction, with 258 million payments made, a 58% increase year-on-year. Contactless payments accounted for 40% of these transactions, growing nearly 90% compared to last year. BLIK’s contactless feature is now used in 154 countries.

BLIK phone transfers surged as well, with 282.7 million transactions in the first half of 2024, up 50% from the previous year. These P2P payments now represent over a quarter of all BLIK transactions.

The system also saw nearly 3 million new users, bringing the total number of active BLIK users to 17 million by the end of June 2024.

Cheers,

Marcel

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇵🇱 H1 2024: Over one billion BLIK transactions in six months. From January to June this year, the highest percentage growth in transaction volume occurred in the POS segment, where BLIK payments increased by 58% compared to the first half of 2023.

🇬🇧 Manchester City strikes deal with Corpay for FX solutions and payment handling. Under this agreement, Corpay’s Cross-Border business will become Manchester City’s Official Foreign Exchange (FX) Partner. The partnership also includes Corpay being named an Official Partner of Manchester City Women.

🇺🇸 Checkbook expands payment operations amid shift from paper checks. The company announced this expansion in an Aug. 22 news release, saying it marked a milestone in “streamlining check and payment operations for a variety of business use cases in the U.S.”

🇬🇧 Tribe Payments has been chosen by SetldPay to provide their issuer processing, with the company also benefiting from Tribe’s Risk Monitor and 3D Secure solutions. SetldPay provides solutions for any kind of prepaid card program including gift cards, fuel cards, travel & FX, B2B and commercial cards.

🇺🇸 Thera scores $4M seed to make it easier to hire and pay international employees. Thera’s new, built-from-scratch system replaces multiple financial tools, offering an ecosystem of native apps for payroll, treasury, and accounts payable/receivable (AP/AR) services.

🇳🇬 Stripe to soon allow US retailers to sell directly to Nigerians. Stripe is set to allow its customers (merchants) to seamlessly collect payments in Nigeria using local payment methods in naira. For its merchants, Stripe will settle them in their home currency.

🇺🇸 US Bank purchases healthcare payments firm Salucro. According to a press release, the acquisition is part of U.S. Bank’s long history of healthcare-focused client services, working with hospital systems, insurers, medical equipment manufacturers and medical, dental and veterinary practices.

🇺🇸 US FinTech start-up Received to close down. The company co-founder and CEO Roi Ben Daniel said the team came to the decision “after realising we’re not on the right growth trajectory”. In a LinkedIn post announcing the news, Roi wrote: “We are sorry to update that after 2 intensive years we will be unwinding Received.”

🇺🇸 Stripe, now gushing money, plans new employee tender. Stripe is planning a new tender offer (at $𝟳𝟬 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 valuation) to buy back shares held by employees, but unlike in previous employee tenders, it will finance this one entirely with its own cash.

🇬🇧 Revolut alumni raises $𝟭𝟴𝗠 for real-time shopping app Tilt. The round, led by Revolut and Depop-backer Balderton Capital, also saw participation from TQ Ventures, Earlybird, and Seedcamp. This funding will enable Tilt to build on the success of its live-shopping app.

GOLDEN NUGGET

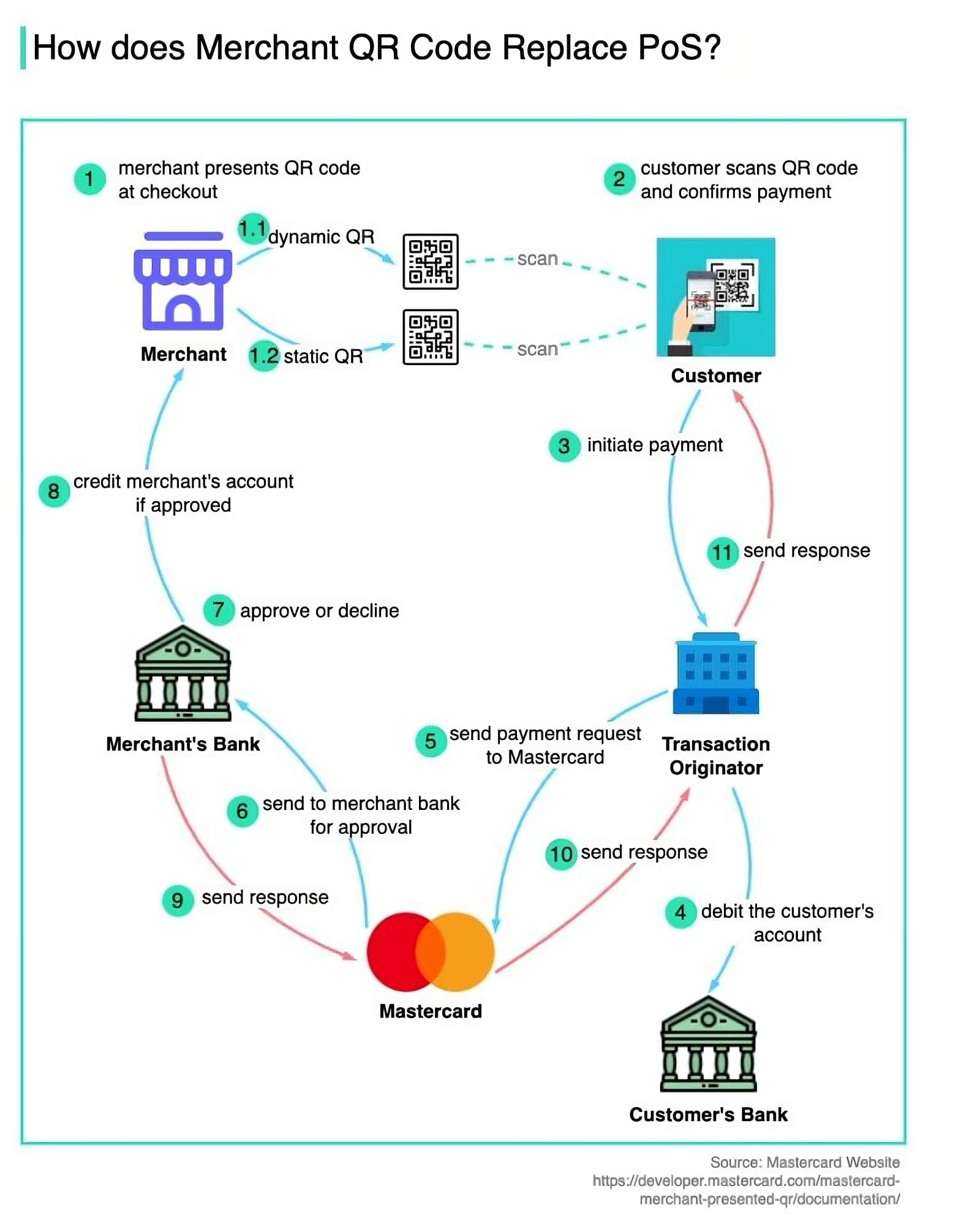

How does Mastercard 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐐𝐑 𝐜𝐨𝐝𝐞 replace PoS (Point of Sale)?

Let's dive in:

The diagram below by Hua Li shows how Mastercard MPQR (Merchant Presented QR) works.

There is 𝐧𝐨 𝐏𝐨𝐒 𝐭𝐞𝐫𝐦𝐢𝐧𝐚𝐥 𝐨𝐫 𝐩𝐡𝐲𝐬𝐢𝐜𝐚𝐥 𝐜𝐚𝐫𝐝 involved.

Step 1️⃣ The merchant presents its QR code at checkout.

There are 𝐭𝐰𝐨 𝐭𝐲𝐩𝐞𝐬 of QR codes:

- 𝐃𝐲𝐧𝐚𝐦𝐢𝐜: the code is generated for each transaction and includes the payment amount

- 𝐒𝐭𝐚𝐭𝐢𝐜: the code is used for all transactions

Step 2️⃣ The customer scans the QR code using a mobile app and confirms the payment.

Step 3️⃣ The payment app sends transaction data to the transaction originator to initiate MPQR payment.

Step 4️⃣ The transaction originator debits the customer’s account in the customer’s bank.

Steps 5️⃣ and 6️⃣ The transaction originator sends a payment request to the Mastercard network. Mastercard routes the payment request to the merchant’s bank.

Steps 7️⃣ and 8️⃣ The merchant’s bank approves or declines the request. If it is approved, the merchant’s bank credits the merchant’s account.

Steps 9️⃣ - 1️⃣1️⃣ The payment response is sent back all the way to the mobile app.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()