Bizum Is Introducing Bizum Pay to Rival Apple Pay and Google Pay

Hey Payments Fanatic!

Bizum is stepping up to the plate, ready to take on Apple Pay and Google Pay with its very own NFC payment system, aptly named Bizum Pay.

You can send money instantly to a contact using Bizum without fees.

Bizum is already a go-to option for in-store payments, working just like a debit card—and yes, even Amazon now accepts it.

By 2025, Bizum plans to level up with Bizum Pay, which will allow you to make mobile payments like with Apple Pay or Google Wallet.

This new contactless system, backed by most Spanish banks, will bring NFC technology to smartphones. It will enable quick transactions at any standard payment terminal and directly link to your Bizum account.

Bizum Pay will connect with Bizum accounts and support cards from other partner banks, offering flexibility. When paying, users will have the choice to select the account or card for the transaction, making it easier than ever to manage their payments.

Are we going to see NFC P2P payments similar to Apple Tap To Cash in Spain in 2025 as well? Tell me what you think in the comments.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 New whitepaper explores the concept of “Digital Twins” to help financial institutions modernize payments. This free report from Matera and Javelin explores a new approach to help financial institutions update legacy core banking systems while delivering seamless, always-on payment experiences customers now expect.

PAYMENTS NEWS

🇦🇺 ACI Worldwide appoints Trent Gunthorpe as General Manager, Head of Pacific. In this role, Trent will lead ACI‘s growth across the Pacific region, including Australia, New Zealand, PNG, Fiji and 12 other Pacific island nations, supporting banks and merchants in achieving their critical business and growth objectives.

🇶🇦 Ooredoo and QIB introduce AutoPay service for mobile app users. This new solution allows customers to set up automatic payments for their Ooredoo services via the AutoPay feature, ensuring hassle-free bill payments. Keep reading

🇿🇦 Peach Payments partners with Sukhiba. The goal of this integration is to simplify the process of conducting sales through the WhatsApp messaging app. The partnership leverages Peach Payments' infrastructure to provide an additional sales channel for merchants, particularly ahead of Black Friday.

🇺🇸 OwlTing, Visa Direct ink payment partnership. This agreement allows OwlTing to potentially reach more than 8.5 billion endpoints in Visa’s global payment network. With Visa Direct, OwlTing enables U.S. customers to transfer money across regions via OwlPay, its Web2 and Web3 hybrid payment solution.

🇺🇸 Plaid introduces Pay-by-Bank solution for recurring payments. 𝗣𝗹𝗮𝗶𝗱 𝗣𝗮𝘆 𝗯𝘆 𝗕𝗮𝗻𝗸 𝗳𝗼𝗿 𝗕𝗶𝗹𝗹 𝗣𝗮𝘆 is designed to provide consumers with a more seamless, cost-effective and secure way to pay bills, and to help businesses benefit from lower processing costs and fewer returns for all types of recurring payments.

🇸🇬 MAS seeks feedback to close regulatory gaps for crypto service providers. The regulator has released a consultation paper inviting public input on its proposed framework for Digital Token Service Providers (DTSPs) to ensure compliance with international standards.

🇫🇷 Paysafe joins the MyBank ecosystem. Under this agreement, Paysafe will offer their Skrill and NETELLER digital wallets users access to MyBank’s trusted interbank network for a swift, secure, and convenient wallet recharge, using an immediate, irrevocable, pre-filled wire transfer form.

🇭🇰 JCB and Nuvei expand global partnership in APAC. Through this partnership, businesses in Singapore and Hong Kong can now accept JCB credit and debit card payments via their existing Nuvei integration, allowing over 158 million JCB cardmembers to make online payments.

🇬🇧 Cashflows brings Mastercard Click to Pay to UK businesses. The addition of Click to Pay to Cashflows’ diverse payment stack further enables its customers to eliminate checkout friction, thereby maximising every sales opportunity. Read on

🇬🇧 Trustly appoints Adam Miller as group CFO to drive ambitious growth. Adam’s expertise will further strengthen Trustly’s leadership as the company continues to scale and expand its market presence. Continue reading

🇺🇸 71% of Merchants Expect Software to Replace Traditional Point-of-Sale Terminals. A PYMNTS Intelligence report examines SoftPOS implications across business sectors and projected growth. The number of merchants using SoftPOS is expected to rise from six million in 2022 to 34.5 million by 2027—a 475% increase.

GOLDEN NUGGET

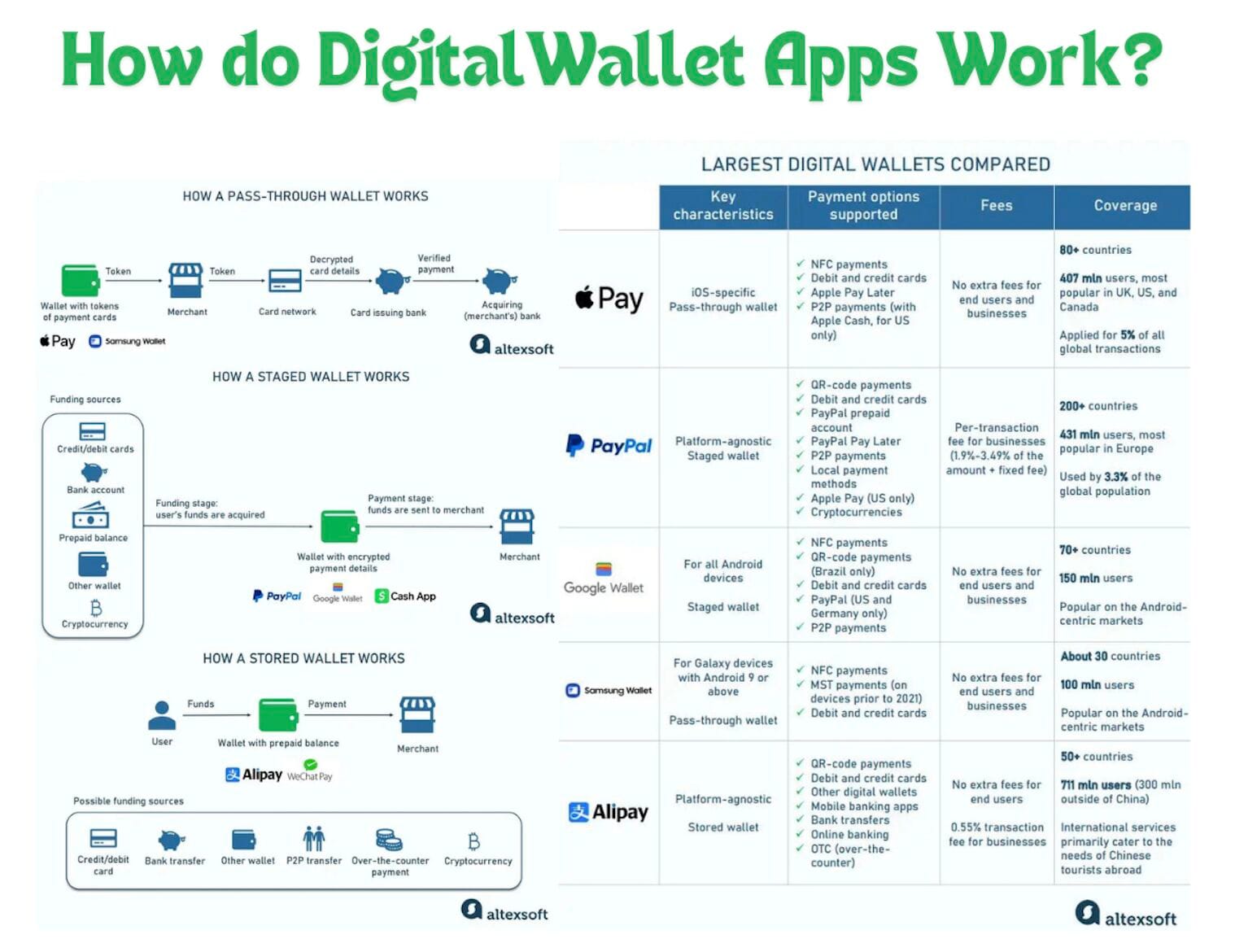

Digital Wallet Apps: how do they work?

Basically, there are 3 distinct groups of B2C wallet apps:

1️⃣ 𝗣𝗮𝘀𝘀-𝘁𝗵𝗿𝗼𝘂𝗴𝗵 𝘄𝗮𝗹𝗹𝗲𝘁𝘀; commonly designed as mobile-first, keep tokens that link to your credit and debit cards instead of storing sensitive data or money directly.

They don’t take part in moving funds. Once a transaction is initiated, such apps just pass encrypted information to a merchant — hence, the name.

In the course of further payment processing, the token travels to a payment network to be decrypted and checked against the actual card or account information in the issuing bank. After verification, the payment gets approved and sent to a merchant’s acquiring bank.

So, only the network and an issuing bank will know the actual card or account details.

Known for high security, pass-through wallets act essentially as extensions of credit and debit cards, so they are more widespread in regions with high card adoption, such as Europe and North America.

Major examples: Apple Pay, Samsung Wallet, Chase Mobile app

2️⃣ 𝗦𝘁𝗮𝗴𝗲𝗱 𝘄𝗮𝗹𝗹𝗲𝘁𝘀; also house tokenized payment details but don’t transmit them anywhere. Instead, they perform transactions in two stages.

At the funding stage, the wallet acquires money from a customer’s bank account, credit line, or other source. Then, at the payment stage, it sends funds to a merchant.

In this scenario, a wallet provider can make additional fraud assessments. At the same time, a payment network or card issuer may know nothing about details of a particular transaction that are disclosed during operations with pass-through solutions.

Staged options often support peer-to-peer transfers and cryptocurrencies and allow for storing funds right in the wallet’s account.

Major examples: PayPal, Google Wallet (former Google Pay), Cash App (the US and UK only)

3️⃣ 𝗦𝘁𝗼𝗿𝗲𝗱 𝗱𝗶𝗴𝗶𝘁𝗮𝗹 𝘄𝗮𝗹𝗹𝗲𝘁𝘀; work as prepaid cards. Before making a transaction, a user must load money to a wallet’s balance from a bank account, debit or credit card, via peer-to-peer transfer, etc.

The availability of funding sources differs across providers, depending on the location and targeted users. A merchant withdraws money directly from the wallet.

Stored wallets are especially popular in unbanked and underbanked countries since they enable people to deposit money without having a bank account.

Major examples: Apple Cash (US only), Alipay (China’s most popular), WeChat Pay, Paytm Wallet (India’s largest platform for instant payments).

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: AltexSoft

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()