Bitpanda Gains FCA Approval—What It Means for Crypto in the UK?

Hey Payments Fanatic!

Regulation just met innovation! 🚀 Bitpanda has secured FCA approval to expand into the UK, solidifying its position as one of Europe’s most regulated crypto platforms. With this milestone—alongside its MiCAR license—Bitpanda is setting a new standard for secure and compliant digital asset investing.

This isn’t just another market entry; it’s a statement. By bringing staking, savings plans, and crypto indices to UK investors, Bitpanda is proving that trust and regulation are the future of crypto.

What’s next for crypto in the UK? Stay tuned for more updates 👇 and I’ll be back tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

INSIGHTS

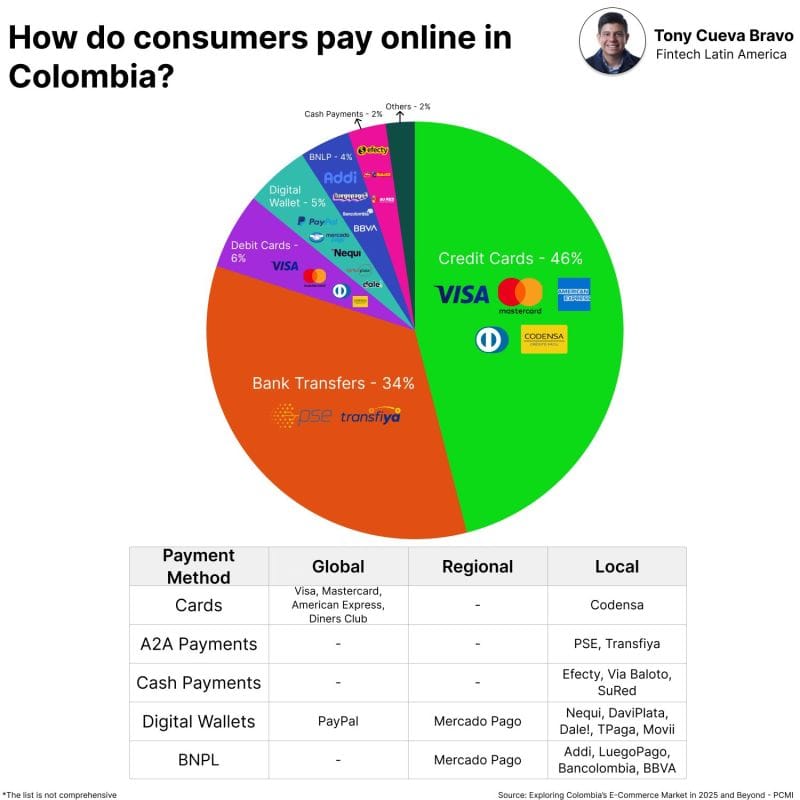

How do consumers pay online in Colombia 🇨🇴?

Let's break it down:

PAYMENTS NEWS

🇧🇷 Brazil projects the biggest growth in fraud in the world. As a result, losses from Pix scams, a term adopted in the country, could reach US$ 1.937 billion (about R$ 11 billion) by 2028. These data come from the latest Scamscope report, developed by ACI Worldwide in partnership with GlobalData.

🇪🇪 How subscription fraud is killing your payment performance—And how to stop it, by Solidgate. Around 2-3%—that’s the average rate of payment fraud in subscription services. In some cases, this number climbs to 4%—a staggering four times higher than the 0.9% threshold set by the card schemes. Learn more here

🇸🇦 Tabby doubles valuation to $3.3 billion ahead of IPO. The company has raised $160 million in a Series E round, doubling its valuation. It now targets 20 million users by year-end and plans to go public within 18 months, with Saudi Arabia as a potential listing venue.

🇸🇬 MAS and ABS to establish new payment entity to position national payment schemes for the next stage of growth. The entity will also collaborate with MAS on the development of Singapore’s national payments strategy, ensuring a safe, efficient, and innovative payment infrastructure.

🇪🇸 BBVA drives innovation in its wholesale banking through the integration of BBVA Spark and the group’s Digital Assets & Blockchain strategy. This restructuring strengthens its leadership in advanced financial solutions and the digital transformation of the industry.

🇬🇧 GoCardless selects Form3 for Bacs payment connectivity. Form3’s technology solution provides GoCardless with improved operational and technical resilience to ensure that service continuity is maintained as its UK business grows. Read more

🇸🇦 Ant International opens first middle east office in Saudi Arabia in drive to expand regional partnership. The company aims to introduce cutting-edge financial and digitisation technology to support digital transformation for the business community in the region and beyond.

🇳🇿 FMA clarifies licensing for E-Money services. Providers will have a range of obligations under New Zealand's financial services regulatory regimen. The level of regulation will largely depend on whether providers are issuing debt securities as part of their service offering.

🌍 Worldline and FreedomPay announce strategic Travel & Hospitality partnership. This collaboration will deliver innovative acquiring services and gateway capabilities to businesses across Europe and can be extended to Retail and other industries in the future.

🇬🇧 Cashflows rolls out Sumni Android terminals. The terminal rental model allows ISVs to generate additional revenue streams with minimal administrative lift, as ISVs can offer high-performance SUNMI devices to their customers while Cashflows manages all hardware maintenance and compliance.

🇬🇧 Paysafe announces agreement to sell direct marketing payment processing business line to KORT Payments. The transaction includes reseller and merchant contracts, as well as dedicated technology and employees related to the business. The transaction is expected to close in 30 days subject to finalizing certain transition services-related items.

🇬🇧 Jazari selects Bud Financial to enhance revolutionary remittance platform. Jazari aims to make remittances faster, more cost-effective, and easier for migrant communities, ensuring both senders and receivers have the tools to achieve long-term financial stability and growth.

GOLDEN NUGGET

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com 👋 — a series of educational posts breaking down the key concepts of payments

Topic #1: 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫?

► A 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫 (#PSP) is a technology company that provides merchants with the ability to accept payments (Card-Present and Card-Not-Present). PSPs typically work with multiple acquirers and offer a variety of services, such as providing a payment gateway, processing transactions, and offering merchant services, such as fraud prevention and data security.

𝐇𝐨𝐰 𝐝𝐨 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫𝐬 𝐰𝐨𝐫𝐤?

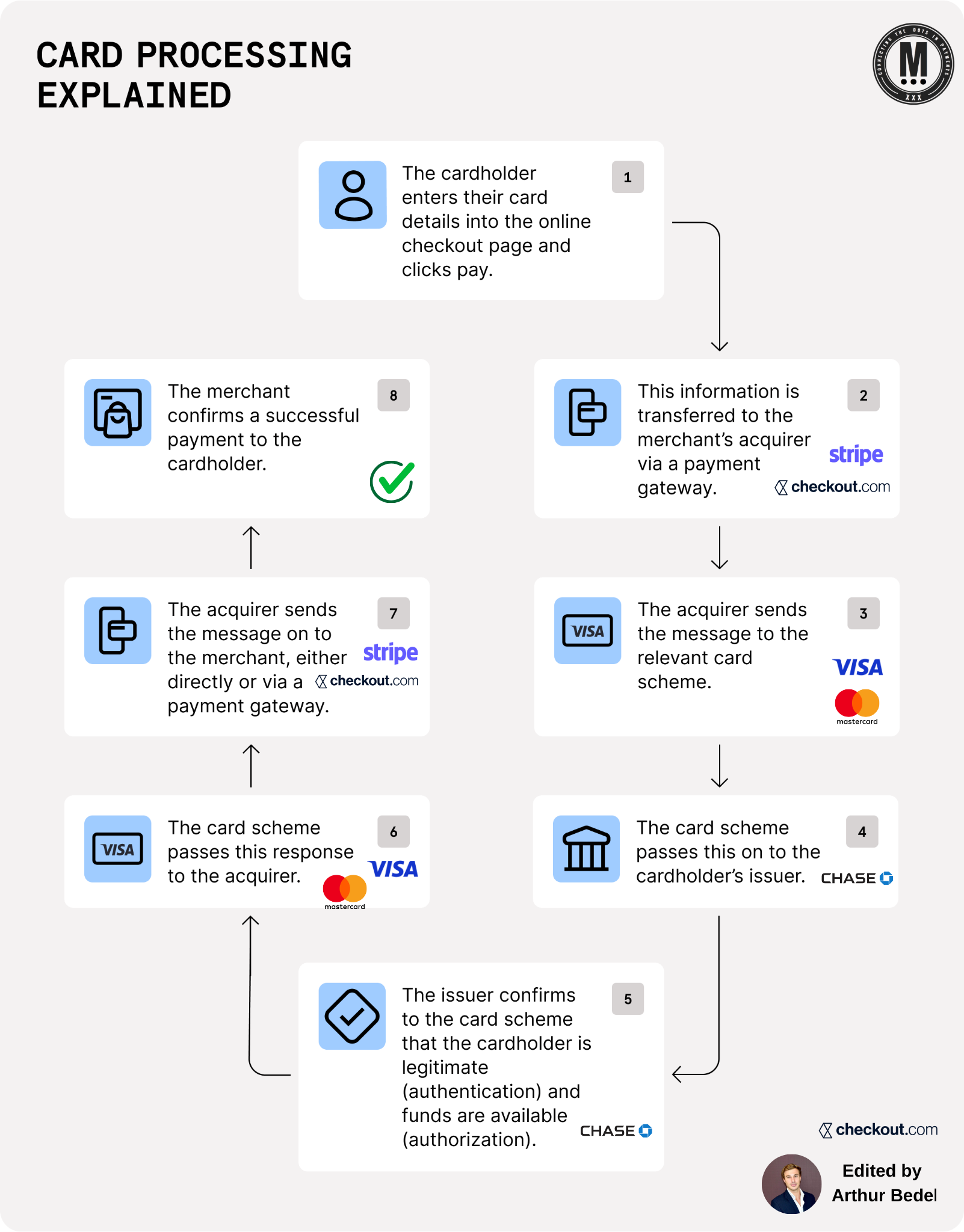

► To understand the role of a 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫 (PSP), it is essential to grasp how an online payment is processed. When a customer enters their payment details and confirms a transaction, the payment data is sent to an 𝐚𝐜𝐪𝐮𝐢𝐫𝐞𝐫 through a 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐠𝐚𝐭𝐞𝐰𝐚𝐲. The acquirer then forwards this information to the relevant 𝐜𝐚𝐫𝐝 𝐬𝐜𝐡𝐞𝐦𝐞 (Visa, Mastercard, etc.), which passes it to the 𝐜𝐚𝐫𝐝 𝐢𝐬𝐬𝐮𝐞𝐫 (the customer's bank).

► At this stage, the 𝐢𝐬𝐬𝐮𝐞𝐫 𝐚𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐞𝐬 the cardholder and determines whether the transaction is legitimate and if sufficient funds are available. The payment is then either 𝐚𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐞𝐝 𝐨𝐫 𝐝𝐞𝐜𝐥𝐢𝐧𝐞𝐝. The response is sent back through the 𝐜𝐚𝐫𝐝 𝐬𝐜𝐡𝐞𝐦𝐞, reaching the acquirer, which then relays the result back to the merchant.

► For a transaction to be successfully processed, multiple entities must work together, including the 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐠𝐚𝐭𝐞𝐰𝐚𝐲, 𝐚𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐛𝐚𝐧𝐤, 𝐜𝐚𝐫𝐝 𝐬𝐜𝐡𝐞𝐦𝐞𝐬, 𝐚𝐧𝐝 𝐢𝐬𝐬𝐮𝐢𝐧𝐠 𝐛𝐚𝐧𝐤. As payment ecosystems grow more complex, the technology supporting these steps becomes increasingly critical, ensuring 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲, 𝐞𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲, 𝐚𝐧𝐝 𝐬𝐞𝐚𝐦𝐥𝐞𝐬𝐬 𝐩𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠. PSPs help simplify this entire process for merchants and consumers alike

𝐇𝐨𝐰 𝐂𝐚𝐫𝐝 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 𝐖𝐨𝐫𝐤𝐬:

1️⃣ Customer enters card details & initiates payment

2️⃣ PSP routes transaction to the acquiring bank

3️⃣ Acquirer forwards it to the card network (Visa, Mastercard, etc.)

4️⃣ Card network sends it to the issuer for authentication & authorization

5️⃣ Issuer verifies the cardholder & approves/declines the payment

6️⃣ Card network relays the response back to the acquirer

7️⃣ Acquirer informs the PSP, and the merchant gets the result

8️⃣ Merchant confirms the successful payment to the customer

𝐓𝐡𝐞 𝐛𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐮𝐬𝐢𝐧𝐠 𝐚 𝐏𝐒𝐏:

► Cost-effective

► Easier setup

► Flexible underwriting requirements

► More features offered

► Accept more payments

Source: Checkout.com x Connecting the dots in payments

I highly recommend following my partner Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()