Barclays Struggles to Sell Stake in UK Payments Unit

Hey Payment Fanatic,

Barclays is hitting roadblocks in selling a stake in its UK merchant payments business, mainly due to disagreements over valuation, according to sources. Brookfield Asset Management recently withdrew from bidding, largely due to Barclays’ pricing.

Complicating matters is the takeover of Takepayments, a Barclays partner, which may impact revenues. Some offers fell short because of the business’s shrinking market share and needed investment to revive growth.

Despite these hurdles, Barclays is still open to selling a stake. The process is tricky due to the technology and financial complexities involved, as noted by Barclays CEO C.S. Venkatakrishnan in June.

The bank is exploring options, including strategic partnerships, for its merchant acquiring business, and had previously written down its value by £300 million. This sale is part of a broader review of Barclays’ global payment activities, following the sale of its German consumer finance unit to BAWAG in July.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

🎙 Moving beyond payments to solve the evolving needs of SMBs with PayPal’s Michelle Gill. In this episode, Michelle Gill, EVP and General Manager, Small Business and Financial Services Group of PayPal, delves into the strategies that have positioned PayPal at the forefront of supporting small businesses. Tune in now!

PAYMENTS NEWS

🇦🇪 Dubai-listed Mashreq Bank has agreed to sell a 65% stake ($𝟯𝟴𝟱𝗺𝗹𝗻) in NeoPay, the brand name for its subsidiary IDFAA Payments Services, to Arcapita and Turkish FinTech firm Dgpays. The bank said that it was entering into a long-term shareholder arrangement with the purchasers for the future growth of the business.

🇫🇷 Worldline CEO exits, shares plunge as payments firm issues another profit warning. The French payments group said last Friday that long-time CEO Gilles Grapinet would leave the company as it issued its third profit warning within a year, sending its shares to a record low.

🇨🇳 Beijing metro enables "Tap-and-Go" fare payment for foreign MasterCard and Visa card holders. Beijing becomes the first city on the Chinese mainland supporting contactless fare payments in rail transit for foreign MasterCard and Visa card holders. More here

🇺🇸 Citi has launched its BNPL offering, Citi Flex Pay, on its travel booking platform, Citi Travel. The combination of these offerings allows Citi cardmembers to book a getaway and pay for it, without having to pay fees or interest for 12 months. Read more

🇺🇸 Bolt has quietly settled its lawsuit with Fanatics amid ongoing boardroom drama. Online sports apparel retailer Fanatics has agreed to settle and drop a lawsuit that it filed against troubled one-click payments provider Bolt in March, according to court documents obtained by TechCrunch.

🇧🇷 Brazil’s Pix could take over from cards earlier than expected. Global payments technology company EBANX predicts that Pix will account for 44% of all value transacted in online purchases in Brazil next year, more so than debit and credit cards which are expected to have a 41% share.

🇿🇲 Lupiya partners with Network International to launch their card product. The solution introduces an e-commerce enabled debit card with 3D Secure and tokenization, enhancing Lupiya’s value proposition by expanding from simplified lending to also include digital payments for its existing and new customers.

🇬🇧 UK’s Pay Later FinTech Kriya Solution now supported on Stripe. Starting this month, Stripe users can offer flexible payment terms “to their business buyers through Kriya.” Continue reading

🇺🇸 U.S. Faster Payments Council publishes operational considerations for receiving instant payments guideline. This guideline offers essential insights and best practices for financial institutions to improve their readiness for real-time payments like RTP® and FedNow®, with contributions from industry experts.

🇺🇸 Kort Payments announces acquisition of Barnet Technologies. The acquisition of Barnet aligns with KORT's aggressive growth strategy and commitment to providing innovative solutions to businesses across North America. Learn more

🇺🇸 JP Morgan Payments has announced new and enhanced product integrations connecting to the Oracle ecosystem, making it easier for clients to streamline their payments across treasury, trade and commerce. Keep reading

🇨🇦 Chimoney and The Interledger Foundation to power cross-border payments between more than 130 countries. The companies will eliminate up to 12% in international payment fees while enabling individuals to convert between traditional and emerging payment options.

🇩🇪 Lendorse secures €10M for ‘Study Now, Pay Later’ student financing model. The capital will enable the company to provide access to higher education in Europe for over 1,000 talented students from developing and emerging countries. Read on

GOLDEN NUGGET

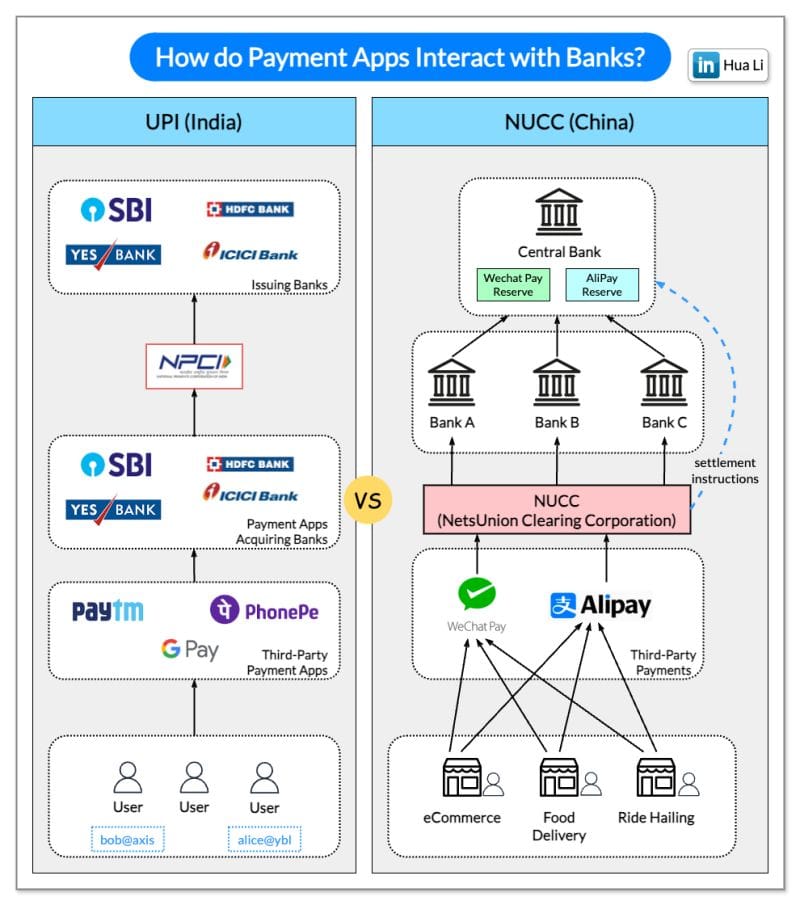

How do Payment Apps interact with Banks in India and China?

🇮🇳 UPI 🆚 NUCC 🇨🇳

The diagram below 👇 shows a comparison between UPI (Unified Payments Interface) in India and NUCC (NetsUnion Clearing Corporation) in China.

Both are nationwide efforts to streamline third-party payments, which means payment apps don’t need to handle the complexity of connecting to banks.

Some differences are:

► UPI = payment markup language + standard for interoperable payments, while NUCC (NetsUnion Clearing Corporation) is a clearing system among banks. So UPI covers the whole workflow, but NUCC handles transaction clearing and settlements.

► UPI builds a digital payments ecosystem with payment apps, banks, and NPCI (National Payments Corporation of India). NUCC saves each payment app the effort of connecting to each bank separately.

► UPI adopts a mobile-first design, each account is given a VPA (Virtual Payment Address), while NUCC doesn’t have such a setup.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()