B2B BNPL Provider Hokodo Closes €10 Million Round

Hey Payments Fanatic!

Hokodo has secured a new €10 million equity round, co-led by Korelya Capital and Opera Tech Ventures, the venture arm of BNP Paribas. Existing Series B investors Mundi Ventures and Notion Capital also participated in the raise.

Founded in 2018, Hokodo offers real-time digital trade credit to B2B merchants and marketplaces. To date, Hokodo has raised more than €50 million in equity and €100 million in debt, with operations spanning major European markets such as France, Germany, Spain, Belgium, and the UK. Hokodo was also the first B2B BNPL fintech to secure regulation as an electronic money institution.

The funding is expected to fuel product development and boost operational capacity ahead of Hokodo’s Series C. With growing interest from offline and omnichannel merchants, the company plans to expand its reach and build out a new in-store solution for professional suppliers, starting in France.

“As we onboard an ever-growing list of larger and larger B2B merchants and marketplaces from all over Europe, we are really happy to have the support of partners and investors that have a full understanding of the problem Hokodo solves,” said Richard Thornton, Co-founder and President of Hokodo.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

PAYMENTS NEWS

🎙️ In this episode of Payments Nerds, Tom Warsop, President and CEO of ACI Worldwide, and David Watson, President and CEO of The Clearing House, dive into the current state – and future – of instant payments in the U.S. From scalable tech to adoption hurdles and cross-border potential, this conversation unpacks why instant payments are just getting started in the U.S. Listen to the full episode here.

🇺🇸 Argentex weighs sale to IFX Payments after margin call chaos. The company is taking steps to preserve cash and increase collateral from counterparties due to a cash squeeze caused by margin calls linked to its foreign exchange derivatives book.

🇬🇧 PayPal to open major office in London landmark. The firm has signed up to become the first occupier of a redeveloped office building on London’s Southbank. It has also agreed a lease for 40,000 sqft on the top floor of the building, a newly revamped Grade II-listed structure next to the National Theatre.

🇺🇸 PayPal unlocks rewards for Holding PayPal USD. PayPal and Venmo users will be able to earn rewards on their PYUSD balances, which they can use to pay at millions of merchants, fund remittances on Xoom without transaction fees, convert 1:1 to their fiat balance and other cryptocurrencies, and send on-chain to supported wallets on the Ethereum and Solana blockchains.

🇨🇦 Trulioo teams up with cross-border embedded payment solutions provider PingPong. By deploying Trulioo’s advanced Business Verification and Watchlist Screening technology, PingPong will improve its ability to quickly verify individuals and companies worldwide while shortening onboarding time and reducing other operational challenges.

🇺🇸 Salsa raises $20M to expand embedded payroll services across US and Canada. The new funding will support Salsa’s efforts to help software platform developers in all 50 U.S. states and Canada embed payroll features in their products that they didn’t previously have.

🇵🇭 GCash partners with Mastercard for contactless payments via app. This collaboration further solidifies GCash's commitment to offering Filipinos convenient and secure cashless payment solutions, making everyday transactions easier and more seamless.

🇺🇸 Expensify launches simplified $5 pricing plan for SMBs. This move is designed to make Expensify more accessible to small and medium-sized businesses (SMBs), a market traditionally underserved by the financial tech industry. Read more

🇦🇺 Australian Open Banking FinTech WeMoney secures $12 million in Series A, backed by Lance East Office and Mastercard. This investment will allow WeMoney not only to maintain leadership in Australia but also to assess prospects on a global stage.

🇬🇧 fumopay selects Cashflows as an acquiring partner to enhance payment processing capabilities. Through this collaboration, businesses using fumopay’s single integrated checkout solution can now accept both traditional card payments and instant bank payments, all through a unified interface.

🇺🇸 Papaya Global and AKT partner to deliver end-to-end workforce payments for SAP customers. This collaboration empowers customers to streamline global workforce management and payment processes across a wide range of business sectors.

🇬🇧 Nationwide Building Society extends partnership with Visa to advance account-to-account payments. The new agreement will help drive growth in current account and credit card issuing, to bring the value of Nationwide to a greater number of consumers across the UK.

🇲🇾 Curlec by Razorpay names Kevin Lee as new Country Head and CEO. Lee confirmed his appointment this week, marking a new chapter after his recent departure from GHL Systems. He previously served as the CEO for GHL Systems Malaysia from June 2009 until recently, a tenure spanning nearly 16 years.

🇲🇾 Google Pay rolls out integration of eWallets, ShopeePay and TNG eWallet in Malaysia. This new feature will enable Android users to checkout seamlessly with their preferred eWallets when shopping on mobile sites via Google Chrome, starting with selected online merchants.

GOLDEN NUGGET

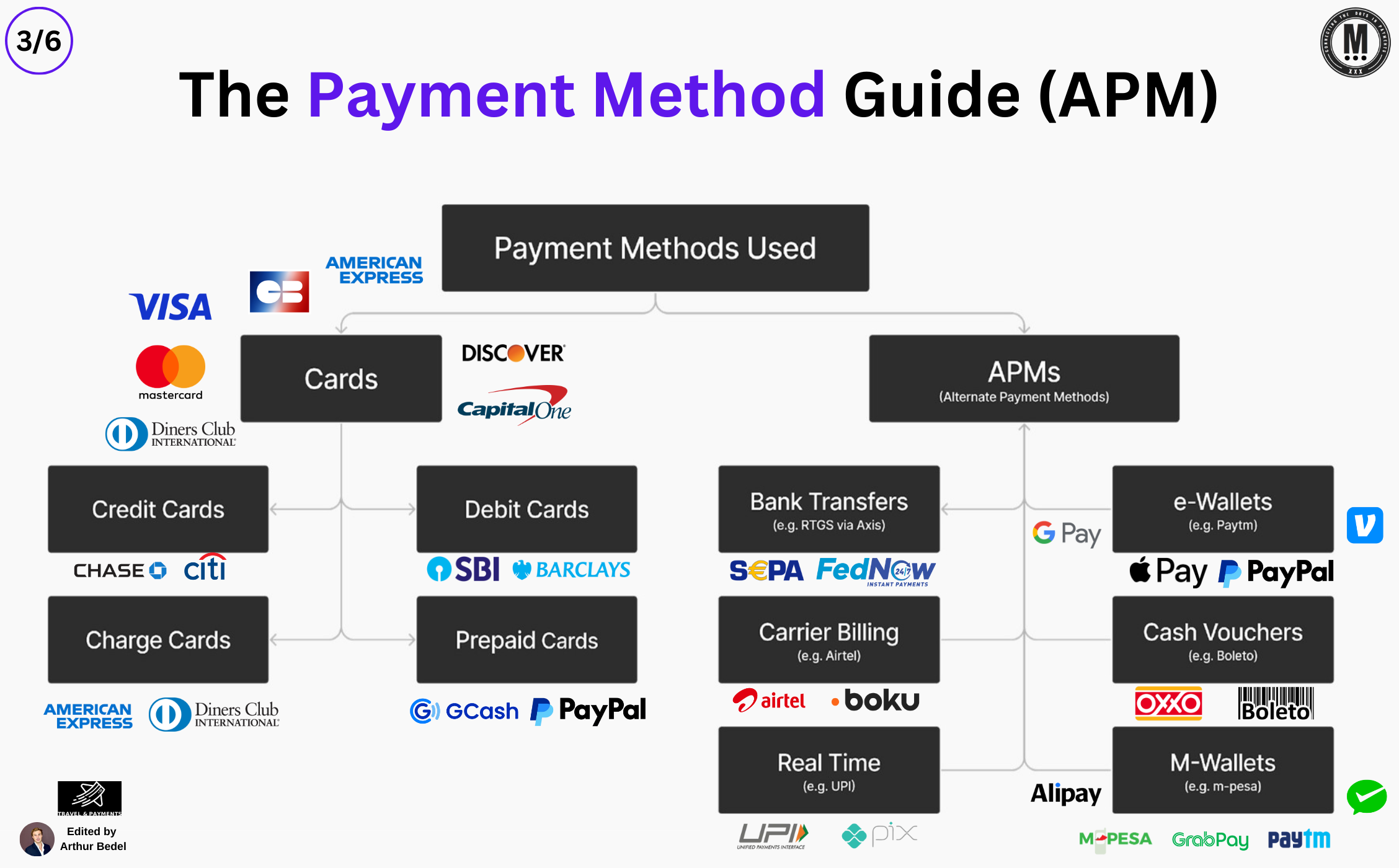

𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝 𝐆𝐮𝐢𝐝𝐞 (𝐀𝐏𝐌) — by Travel & Payments 👇

𝐂𝐚𝐫𝐝𝐬 𝐯𝐬. 𝐀𝐥𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐯𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 (𝐀𝐏𝐌𝐬)

Globally, payment methods are evolving beyond plastic. Card networks still dominate many markets, but Alternative Payment Methods (#APMs) — like real-time payments, e-wallets, & carrier billing — are surging in popularity.

Each method offers different experiences based on geography, infrastructure, user behavior, and regulatory preferences.

𝐂𝐚𝐫𝐝𝐬 — The Traditional Backbone

1️⃣ 𝐂𝐫𝐞𝐝𝐢𝐭 𝐂𝐚𝐫𝐝𝐬

Pay Later in Full or Partial — Powered by networks like Visa, Mastercard, and American Express

Examples: Chase Sapphire, Citi Rewards, Capital One Venture

2️⃣ 𝐃𝐞𝐛𝐢𝐭 𝐂𝐚𝐫𝐝𝐬

Pay Now — Directly debited from linked accounts

Examples: SBI Card Debit, Barclays, Visa Debit

3️⃣ 𝐏𝐫𝐞𝐩𝐚𝐢𝐝 𝐂𝐚𝐫𝐝𝐬

Pay Before — Preloaded cards for spending control

Examples: GCash Mastercard, PayPal Prepaid

4️⃣ 𝐂𝐡𝐚𝐫𝐠𝐞 𝐂𝐚𝐫𝐝𝐬

Pay Later in Full (monthly balance due)

Examples: American Express Green, Diners Club International

𝐀𝐏𝐌𝐬 — The Rise of Localized Innovation

1️⃣ 𝐁𝐚𝐧𝐤 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫𝐬 (incl. RTP)

Examples: 𝐅𝐞𝐝𝐍𝐨𝐰 (US), 𝐒𝐄𝐏𝐀 (EU), 𝐔𝐏𝐈 (India), 𝐏𝐈𝐗 (Brazil)

2️⃣ 𝐄-𝐖𝐚𝐥𝐥𝐞𝐭𝐬

Store digital credentials for quick checkout

Examples: Apple Pay, Google Pay, PayPal, Paytm, Venmo

3️⃣ 𝐂𝐚𝐫𝐫𝐢𝐞𝐫 𝐁𝐢𝐥𝐥𝐢𝐧𝐠

Enables digital purchases via mobile operator

Examples: airtel, Boku

4️⃣ 𝐂𝐚𝐬𝐡 𝐕𝐨𝐮𝐜𝐡𝐞𝐫𝐬

Prepaid cash-based systems used in LATAM & Africa

Examples: 𝐁𝐨𝐥𝐞𝐭𝐨 (Brazil), OXXO (Mexico)

5️⃣ 𝐌-𝐖𝐚𝐥𝐥𝐞𝐭𝐬 / 𝐌𝐨𝐛𝐢𝐥𝐞 𝐌𝐨𝐧𝐞𝐲

Designed for mobile-first, cash-reliant economies

Examples: M-PESA Africa, GrabPay, Paytm

𝐆𝐥𝐨𝐛𝐚𝐥 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 — 𝐓𝐨𝐩 𝟑 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 𝐛𝐲 𝐑𝐞𝐠𝐢𝐨𝐧

🔹 𝐍𝐨𝐫𝐭𝐡 𝐀𝐦𝐞𝐫𝐢𝐜𝐚:

Credit & Debit Cards

Digital Wallets (Apple Pay, PayPal)

Buy Now Pay Later (Affirm, Klarna)

🔹 𝐄𝐮𝐫𝐨𝐩𝐞:

Bank Transfers (SEPA)

Credit & Debit Cards

E-wallets (PayPal, Klarna, 𝐢𝐃𝐄𝐀𝐋 in Netherlands)

🔹 LATAM:

Cash Vouchers (Boleto, OXXO)

Cards (especially local scheme cards)

E-wallets (Mercado Pago, PicPay ,Yape)

RTP (Pix)

🔹 APAC:

QR Code & Mobile Wallets (Alipay, WeChat Pay)

Bank Transfers (UPI, Promtpay)

Cards (especially in Japan, South Korea)

🔹 MENA:

Cash on Delivery (still prevalent)

Cards

Mobile wallets (STC Pay, M-PESA Africa, Fawry in Egypt)

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

The payment landscape is no longer “card-first” — it’s becoming experience-first.

The future lies in blended infrastructure: supporting traditional rails & local preferences like e-wallets, RTP, and tokenized credentials.

𝐍𝐞𝐱𝐭 𝐔𝐩 -- 𝐓𝐡𝐞 𝐂𝐚𝐫𝐝 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐅𝐥𝐨𝐰 𝐚𝐧𝐝 𝐅𝐞𝐞𝐬

Source: Travel & Payments

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()