Aspire Secures MAS Approval for Payments License

Hey Payment Fanatic!

Aspire has just received in-principle approval for a Major Payment Institution license from the Monetary Authority of Singapore (MAS). This is a key milestone in Aspire’s mission to streamline financial services, offering everything from international payments to corporate cards and payables management—all through one seamless platform.

Having recently acquired a Money Service Operator license in Hong Kong, Aspire is clearly on a fast track to regional expansion. With a strong team of over 600 employees across nine countries, they count brands like AirAsia, Love Bonito, Pizza Hut, and Endowus among their clients.

Last year’s $100 million Series C funding round and the launch of the Financial Technology Excellence Hub in Singapore underscore Aspire's impressive growth.

Andrea Baronchelli, Aspire’s CEO, remarked that this new approval from MAS validates their commitment to creating a secure financial ecosystem for businesses across Asia and beyond.

More industry news is listed for you below!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇬🇧 Metro Bank to offer business customers invoice software from BankiFi. Invoice It is a user-friendly app and web-based service that helps SMEs send and receive payments. Available to Metro Bank Business and Commercial Current Account customers via iOS, Android, or the web-based version.

🇬🇧 Acquired.com secures GBP 4 mln to boost digital payments growth. The new financing will allow the company to invest in its workforce and enhance its core payment offerings—card processing, direct debit, Pay by Bank, and real-time payments—driving growth and innovation in the payments sector.

🇨🇳 China’s UnionPay International teams up with NAPAS. Both parties have agreed to deepen the collaboration on cross-border QR code interoperability and enable QR payments by UnionPay and Vietnamese local bank applications/e-wallets on each other's networks, to enhance the experience of users from both countries.

🇮🇳 Cashfree receives NPCI certification for its own UPI switch. This will allow Cashfree to directly integrate with any bank's core banking software and offer a higher transaction success rate for its merchants. Read the full piece

🇰🇭 Cambodia now accepts QR Payments from international travellers via Alipay+. Cambodia has integrated Alipay+ with its national QR code system, KHQR for seamless international payments. This launch enables users of 12 international payment apps to pay at over one million merchants in Cambodia using KHQR.

🇬🇧 Sunshine+Kittens partners with Mastercard, The PayFirm and SaaScada to launch disruptive new kids money account. Sunshine+Kittens aims to disrupt the young person’s finance industry with cool designs and gamified experiences that make learning fun.

🇳🇴 Neonomics introduces Nello, a Personal Finance Manager app. The app aims to elevate Open Banking through AI-driven solutions and simplified payment experiences. The firm is authorised by the Norwegian FSA and provides payment initiation and account information services to various businesses.

🇪🇨 PXP Financial partners with Kushki in LATAM expansion plan. The strategic partnership aims to provide end-to-end payment solutions for merchants and consumers in the region. PXP Financial is now able to leverage Kushki’s technology and expertise to create tailored payment solutions for the Latin American market.

🇳🇿 Cross-border payments FinTech Ebury wants to fill a business banking gap. The firm has opened a New Zealand office and targets medium-sized firms, particularly importers and exporters, offering cross-border payment services, including foreign currency hedging and lending.

🇬🇧 RTGS.global launches unique solution for PSPs to drive ‘exponential growth’ with frictionless foreign exchange money transfers. This solution will enable them to offer cheaper and faster international payments to their retail and corporate customers.

GOLDEN NUGGET

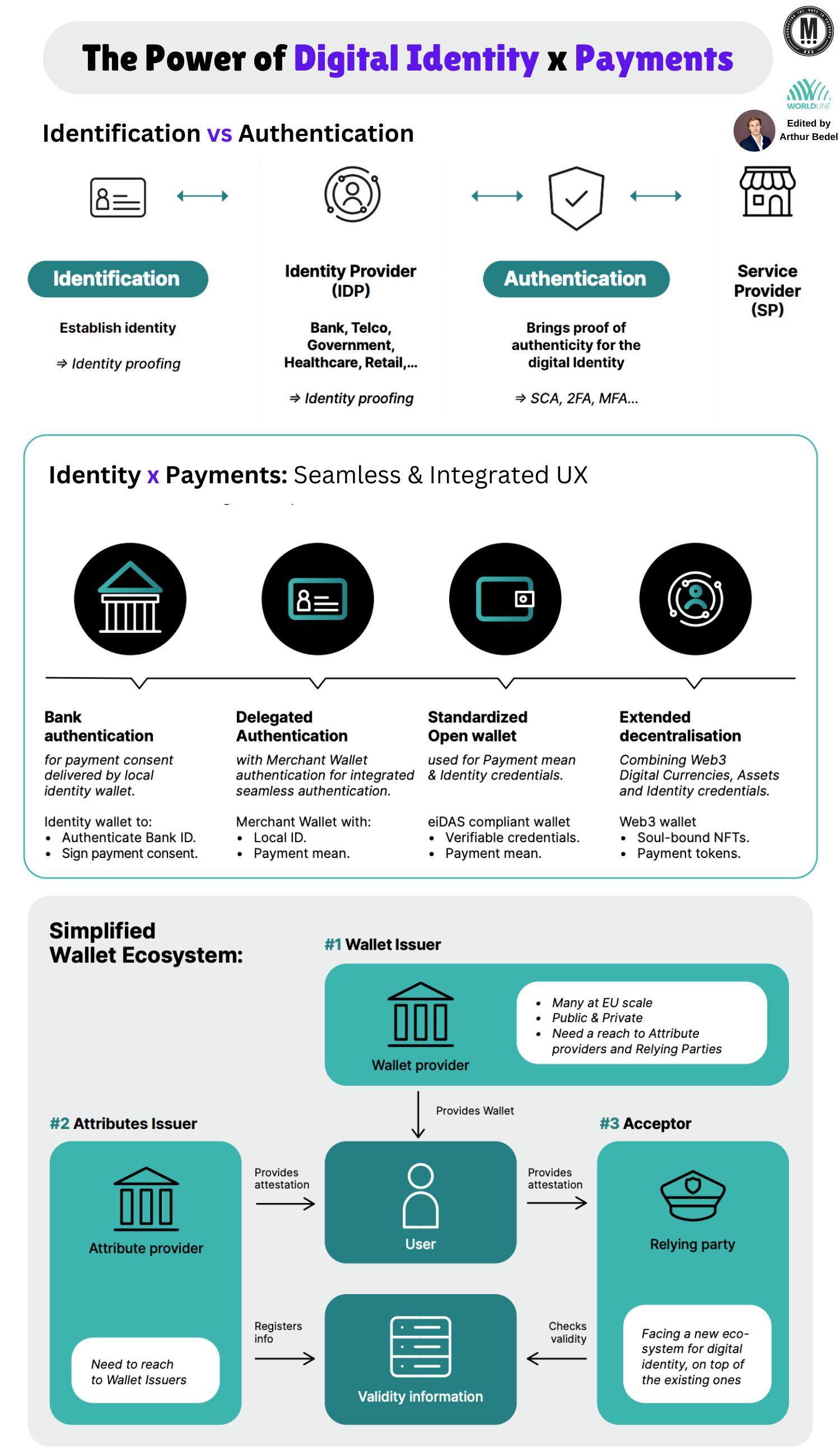

The European Digital Identity Framework (EIDF) aims to unify and secure digital identity verification across all EU by introducing the European Digital Identity Wallet. This wallet will integrate identify verification with services like banking, healthcare and payments.

𝐈𝐝𝐞𝐧𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 vs 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧:

𝐈𝐝𝐞𝐧𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — The process of establishing who a user is by collecting identity details (e.g., name, address, date of birth) from the user)

𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — The process of verifying the legitimacy of the identity during an interaction. It confirms that the user is who they claim to be, using tools like Strong Customer Authentication (#SCA), Two-Factor Authentication (#2FA), or Multi-Factor Authentication (#MFA)

Identification is about "Who are you?" — Authentication is "Prove it's really you."

𝐓𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞 — 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 linked to 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐬 𝐔𝐬𝐞𝐫 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞 — Digital identity, when integrated with payments, reduces friction in the payment process by eliminating the need for repeated identity verification

𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐬 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 — The EUDIW includes mechanisms like multi-factor authentication and biometric data, ensuring secure payment processes

𝐒𝐭𝐫𝐞𝐚𝐦𝐥𝐢𝐧𝐞𝐬 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐞𝐬:

🔸 Financial institutions benefit from (KYC) processes

🔸 Loan applications and account opening are simplified

𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐳𝐞𝐝 & 𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

🔸 Merchants can use digital identity to offer personalized services

🔸 Zero Knowledge Proofs allow for age verification without revealing more personal information

🔸 Cross-border payments between EU member are simplified

How 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 and 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 are creating a 𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐝 𝐖𝐚𝐥𝐥𝐞𝐭 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦

𝐔𝐧𝐢𝐟𝐢𝐞𝐝 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 — The European Digital Identity Wallet serves as a single, unified digital wallet that can store both identity credentials (e.g., ID cards, passports) and payment methods (e.g., bank account details, payment tokens) — One-stop solution for both online and in-store

𝐊𝐞𝐲 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐏𝐚𝐫𝐭𝐢𝐜𝐢𝐩𝐚𝐧𝐭𝐬:

🔸 Wallet Issuers

🔸 Attribute Providers

🔸 Relying Parties: Businesses (e.g., e-commerce platforms, financial institutions)

𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 — Payments and identity verification happen within the same workflow

𝐔𝐬𝐞𝐫 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 & 𝐏𝐫𝐢𝐯𝐚𝐜𝐲 — Users maintain control over which attributes are shared with which service providers

Let's see how the major actors create adoption now!

Source: Worldline

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()