Apple’s Fee Forces Patreon to Revamp iOS Billing Models

Hey Payments Fanatic!

Big changes are coming for Patreon creators on iOS as the platform will discontinue certain billing models by 2025 to comply with Apple's subscription requirements.

Patreon announced it must switch to Apple’s in-app purchase system for all iOS transactions or risk removal from the App Store. Over the next 16 months, all creators will be moved to this system, with full implementation by November 2025.

The new system includes a 30% Apple fee on new memberships and shop purchases made in the iOS app. Creators using first-of-the-month or per-creation billing must transition to subscription billing, as it’s the only type Apple supports.

While the complete changes take effect in 2025, some impacts will begin in November 2024. Creators can delay the switch to subscription billing until November 2025 but will face restrictions.

Patreon also offers an optional tool for creators to increase prices in the iOS app to offset Apple’s fee, though prices on the web and Android app remain unaffected.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

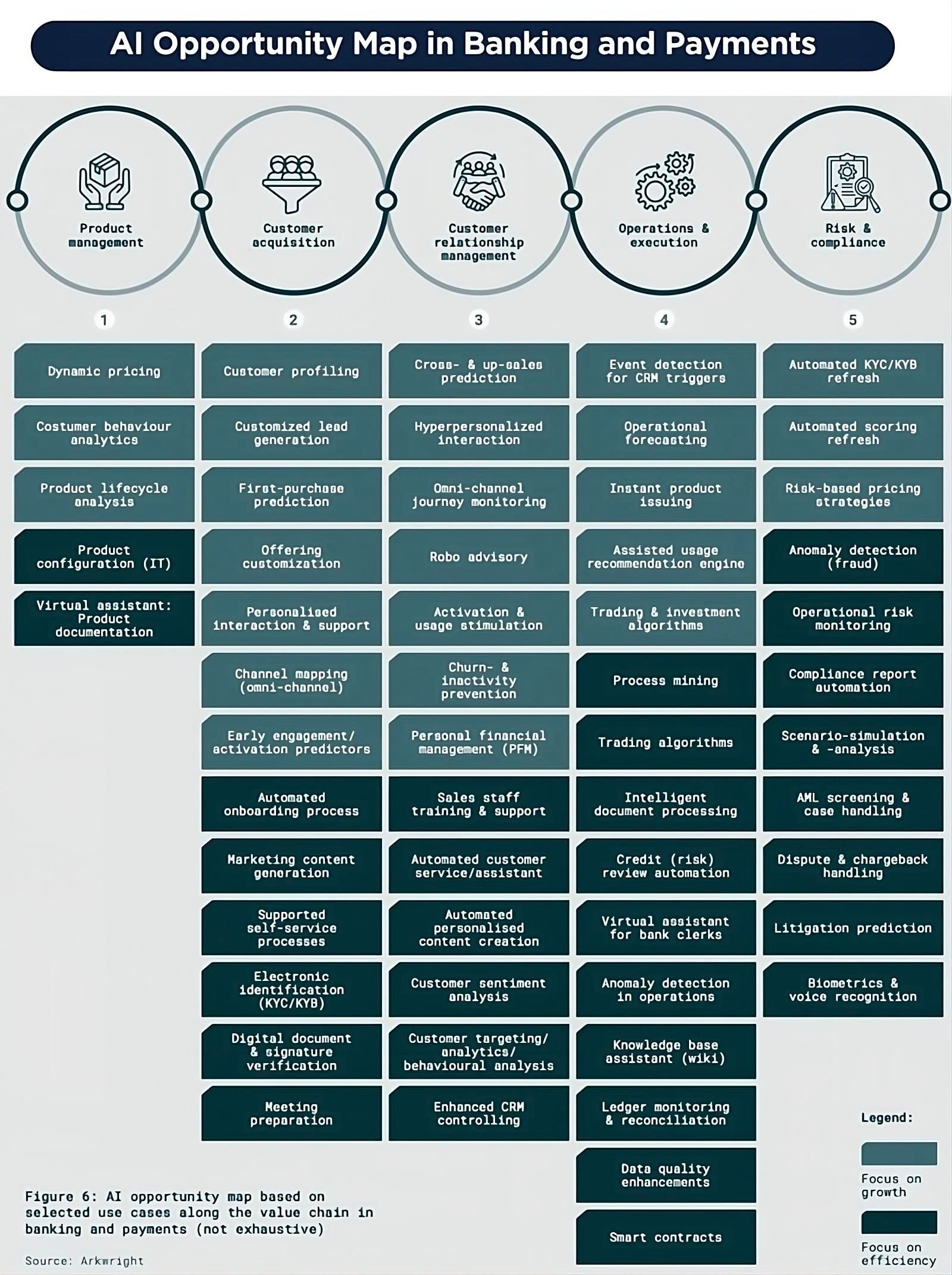

💡AI is revolutionizing the financial services industry.

Let's dive into AI Opportunities in Banking and Payments:

PAYMENTS NEWS

🇺🇸 ACI Worldwide, Inc., reports financial results for the quarter ended June 30, 2024. Here are the highlights: Click here for full details

🇮🇳 The National Payments Corporation of India discussed partnerships with startups to introduce biometric authentication for UPI transactions. This would enable users to verify payments using fingerprints on Android devices and face ID on iPhones, replacing the current UPI PIN. The move followed the RBI's proposal for alternative authentication methods to enhance security and user experience.

🇮🇳 Cross-border payments FinTech Skydo raises $5 mn from Elevation Capital. The company will use the funds to expand its operations and invest in its risk monitoring and compliance systems. The company said it has applied for the Cross-Border Payment Aggregator (PA-CB) licence from the Reserve Bank of India.

🇮🇳 Innoviti raises $8.3m in Series E round led by Random Walk Solutions. Innoviti Technologies, India’s payments-centric retail SaaS platform for enterprise brands, has announced that it closed its Series E round, raising a total of $8.3 million (INR 70 crore.) as a combination of equity and debt.

🇨🇦 Payroc launches Card-Present Payments in Canada with Moneris Go. By partnering with Moneris, Payroc offers a comprehensive solution for processing card-present payments, helping its partners streamline operations and simplifying vendor relationships.

🇨🇦 Canada-based payment service provider Moneris has announced that it expanded its partnership with Wix to launch Moneris Total Commerce and support Canadian businesses. Moneris and Wix now aim to bridge the gap between online and in-store transactions via an integrated and unified commerce experience for merchants and their customers.

🇸🇬 Alchemy Pay partners with Mesh to enable direct crypto payments from exchange accounts and wallets. Alchemy Pay has integrated the Mesh API into its crypto payment solution, enabling users to purchase goods and services at online and offline merchants using crypto funds from exchanges and wallets.

🇬🇧 Trustly UK surpasses £13bn in first half of 2024, outpacing 2023’s total and marking rapid growth in Open Banking adoption, with Trustly enabling organisations to enhance services for the country’s consumers. Read more

🇫🇷 BLIK Code Payments on Worldline Tap on Mobile. The launch of BLIK code payments on Tap on Mobile is another step in the development of the app, which offers its users ever more options. This partnership brings Worldline one more step closer toward creating a universal solution for mobile payments.

🇬🇧 Paymentology achieves Mastercard’s Cloud Edge certification. The new certification aligns with Paymentology’s cloud-first approach. Mastercard’s Cloud Edge allows customers to connect to Mastercard from cloud providers of their choice and supports multiple hybrid connectivity patterns.

🇮🇪 GoCardless and Future Ticketing join forces to enhance ticket affordability in the UK and Ireland. The collaboration aims to simplify and reduce the cost of purchasing tickets and memberships for consumers across the two countries. The core of this partnership revolves around making event attendance more affordable.

🇳🇱 Revolut and Tikkie simplify payments in the Netherlands. Revolut’s new feature makes it easier for its users in the Netherlands to split bills and manage payments seamlessly. By linking their Revolut accounts with Tikkie, users can enjoy enhanced financial versatility and convenience.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()