Apple Presses Tencent to Close Payment Loopholes

Hey Payments Fanatic!

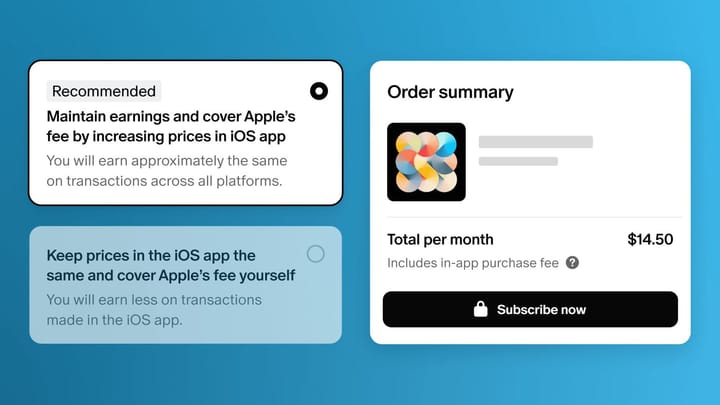

Apple has demanded that WeChat parent Tencent and Douyin parent ByteDance stop allowing in-app creators to direct users to external payment systems. According to Bloomberg, Apple has threatened to reject updates for WeChat and Douyin if these loopholes remain.

An Apple spokesperson stated that their guidelines require all digital goods to be sold through Apple's system, and violations may lead to app rejections.

Tencent agreed to remove links that let mini-game developers bypass Apple’s payment system but resisted disabling an in-game messaging feature, citing its importance for user experience. ByteDance complied with Apple’s request to close similar loopholes on Douyin.

Apple's enforcement aims to maintain app quality and security but also comes as it faces regulatory scrutiny globally and challenges in the Chinese market. A standoff with Tencent, a key player in China, could add to Apple’s conflicts.

In July, Apple sought to amend a Chinese court ruling that referenced its "dominant position" and "unfair pricing," highlighting its delicate situation in the Chinese smartphone market.

Additionally, the European Union announced on July 11 that Apple would open its mobile wallet technology to competitors to avoid fines.

In India, Apple was accused of abusing its dominant position in the app store market in July, further illustrating its global regulatory challenges.

To be continued...

Cheers,

SPONSORED CONTENT

INSIGHTS

📊 Checkout.com, a leading global digital payments provider, announced the results of its commissioned 2024 Total Economic Impact™ (TEI) study conducted by Forrester Consulting. Access the full report

PAYMENTS NEWS

🇨🇳 Apple tells WeChat parent Tencent to eliminate loopholes. Apple is reportedly pressing the makers of China’s most popular apps — WeChat and Douyin — to stop allowing in-app creators to steer users to payment systems outside the Apple platform.

🇺🇸 Zumigo, Inc., a mobile identity authentication company, announced the launch of new authentication and onboarding capabilities in Zumigo DeRiskify, the company’s anti-fraud solution for e-commerce. The enhancements improve customer sign-up/sign-in by eliminating passwords and offer merchants deeper transaction insights to understand fraud impacts.

🇶🇦 Tess Payments gains PSP licence from Qatar Central Bank in partnership with Akurateco. This achievement confirms the reliability and compliance of Akurateco's technology under Qatar's regulatory framework. Keep reading

🇺🇸 Salesforce to acquire PoS startup PredictSpring. Customer relationship management (CRM) software provider Salesforce has signed a definitive agreement to acquire cloud-based point-of-sale (PoS) software vendor PredictSpring to augment its existing Customer 360 capabilities in an attempt to get a stronger hold in the retail industry.

🇵🇭 BSP enhances settlement of digital payments. The BSP said the revised guidelines provide operational flexibility to automated clearing houses (ACHs) organized under the NRPS Framework. These include InstaPay and PESONet.

🇺🇸 FinTech Emburse and Finexio to streamline B2B payments. The partnership offers Emburse customers a solution “to long-standing AP challenges in the $125+ trillion B2B payments market.” Read more

🇸🇪 Swedbank AB has announced its investment in a new position in shares in Global Payments, valued at approximately USD 4.58 million. Following this announcement, Swedbank AB has bought a new position in shares of Global Payments during the first quarter.

🇪🇺 EPI’s roll-out begins but scheme compliance and dispute resolution questions remain. The success of EPI hinges on consumer adoption. As the project expands, key issues include scheme compliance and fraud and dispute management.

🇨🇦 Canadian FinTech Nuvei has entered into a definitive agreement to acquire Pay2All Instituição de Pagamento Ltda., a licensed Payment Institution authorized by the Central Bank of Brazil. This strategic milestone is expected to enhance Nuvei's capabilities in the Brazilian market and reinforces its commitment to the Latin American (LATAM) region.

🇬🇧 Thredd hires Brian Kieley as chief client officer. Kieley will lead the client success function globally, including teams across the UK, Europe, APAC and U.S. regions. Kieley has led client-facing teams at well-known organisations throughout the payments ecosystem globally for more than 25 years.

🇺🇸 JPMorgan Chase is considering taking legal action against the Consumer Financial Protection Bureau (CFPB) over an ongoing probe into the abuse of Zelle payments by scammers. In its recently released financial statements, JPMorgan notes the ongoing inquiries by the CFPB into the issues raised.

🇧🇷 BC regulates the environment that makes Pix feasible by approximation. The Central Bank issued Resolutions BCB Nos. 406 and 407, establishing rules for non-redirected payments, participation, and responsibilities. These include new minimum capital and net worth requirements for institutions offering this service.

GOLDEN NUGGET

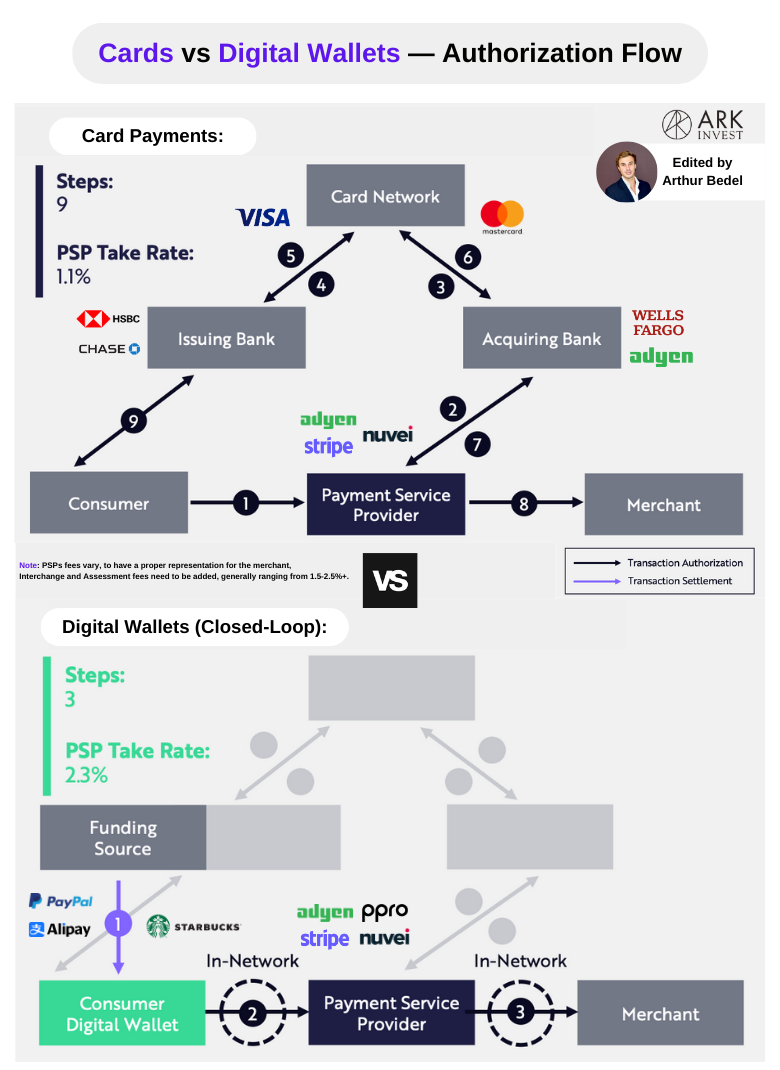

𝐂𝐚𝐫𝐝 𝐯𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — how Digital Wallets bypass banks and card networks saving interchange fees for merchants and consumers 👇

Digital Wallets are challenging the Consumer-To-Business (C2B) payment ecosystems, including cards with their on-us approach.

There are 3 main types of digital wallets:

🔸 𝐏𝐚𝐬𝐬 𝐓𝐡𝐫𝐨𝐮𝐠𝐡 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — (ApplePay, Google Pay) — commonly mobile device-oriented solutions that enable customers to make payments both in physical stores, using tap-to-pay functionality, and online. These wallets typically use tokenization to create a secure, digital representation of the customer's physical Visa card.

🔸 𝐒𝐭𝐨𝐫𝐞𝐝 𝐕𝐚𝐥𝐮𝐞 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — (Cash App, Venmo) — similar to prepaid cards, as they allocate a separate "account" to each customer. Users can load funds onto this account, then, once the account is funded, customers can engage in transactions with sellers who are part of the digital wallet's platform. It operates as the Merchant Of Record (MOR) in its own ecosystem.

🔸 𝐒𝐭𝐚𝐠𝐞𝐝 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — (PayPal, Alipay, Amazon Pay) — operates by using multiple "stages" to complete a transaction, consisting of a "funding" stage and a "payment" stage. Essentially, the wallet acts like an intermediary in the transaction process. With a staged wallet, the card issuer or card network may not have access to specific card details or other pertinent information. It is the MOR in all transactions.

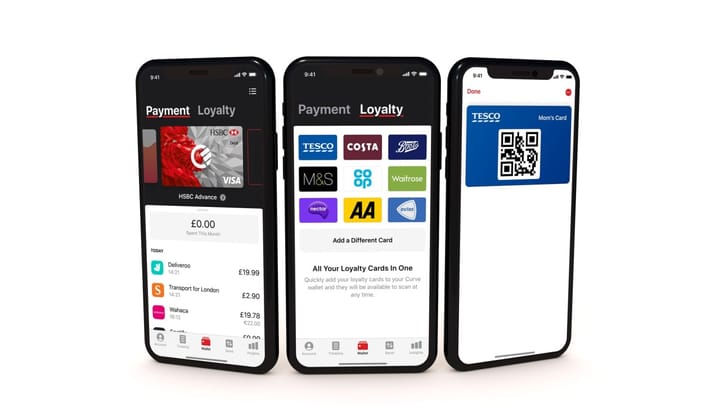

𝐂𝐥𝐨𝐬𝐞𝐝-𝐋𝐨𝐨𝐩 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

🔸Definition: Digital payment systems restricted to a specific network of merchants or services.

🔸Usage: Only usable within a specific ecosystem (e.g., Starbucks app).

🔸Benefits: Enhances customer loyalty, integrates rewards and promotions.

🔸i.e.: Starbucks Mobile App, Walmart Pay

𝐎𝐩𝐞𝐧-𝐋𝐨𝐨𝐩 𝐖𝐚𝐥𝐥𝐞𝐭𝐬:

🔸Definition: Digital payment systems usable across a wide range of merchants and platforms.

🔸Usage: Can be used at any merchant that supports the payment method (e.g., Apple Pay).

🔸Benefits: Broad acceptance, versatile, links various credit/debit cards.

🔸i.e: ApplePay, Google Pay

Note: A closed-loop wallet can become open and vice versa, an open-loop wallet can also adopt a closed-loop model.

The card payment authorization flow involves a minimum of 9 steps, at times more & is subject to interchange, assessment & PSP fees. A closed-loop wallet bypasses the issuer (interchange) and card networks (assessment) fees, making this an attractive solution for merchants and giving them more bandwidth to create advantageous loyalty programs.

If you could move forward with 1 initiative, create a digital wallet, or launch a co-branded card, what would you choose & why?

Source: Ark Investment Management Ltd, Checkout.com & Howard Xiao

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()