Apple Pay's Game Changing New Feature

Hey Payments Fanatic!

ApplePay is set to revolutionize online payments with support across all browsers, dramatically boosting the volume of transactions flowing through Apple Wallet.

This shift isn’t just about expanding reach; it’s about enhancing security and redefining the payment process.

With the new browser functionality, ApplePay on your phone will act as a second factor of authentication, leveraging the secure token issued by your bank along with your biometrics—wrapped in Apple’s signature platform security.

This will eliminate the need to rely on stored card details in browsers, shifting the payment process directly to the phone’s secure provisioning.

Previously, many users faced issues synchronizing cards between iOS and macOS, a limitation imposed by banks that preferred to provision cards only on phones, not laptops. This new flow resolves that problem, benefiting both users and Apple, as Apple only earns wallet fees for cards provisioned on phones.

Additionally, Apple’s system offers a streamlined alternative to network-based 3DS. In Europe, where Strong Customer Authentication (SCA) regulations require a second factor, about 50% of merchants have opted out of using bank 3DS.

Apple now provides a secure, SCA-compliant option, whether merchants rely on 3DS or their own risk management systems. This not only improves security but also strengthens Apple’s case for charging their wallet fees.It’s important to note that both merchants and banks can choose whether to accept ApplePay and its authentication flow.

However, since Apple controls the consumer’s initial experience, having two separate authentication steps in one checkout process would result in a poor user experience.

As a result, many will likely adopt Apple’s flow to avoid disrupting the payment process.

With these enhancements, ApplePay is not just facilitating payments—it’s shaping the future of secure, frictionless transactions online.One limitation is that this feature only works on iOS 18 and later.

While this won't be an issue in the long term, in the short term, there will be many unsupported devices.

What’s your take on this innovation by Apple? Do you think it’s a game-changer?

Let me know in the comments below👇

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇿🇦 PayRetailers expands in Africa, boosting financial inclusion across eight new markets. This expansion enhances PayRetailers' ability to unlock growth for clients by providing access to emerging markets. With many underbanked populations in Africa, PayRetailers fosters financial inclusion and supports business growth in a connected market.

🇺🇸 Checkout.com announces partnership with Slope to enhance payment performance for US enterprise merchants. The partnership is driven by a shared mission of empowering merchants with superior payment solutions that streamline operations and improve cash flow management.

🇺🇸 Amazon adds PayPal as a payment option to Buy with Prime. Amazon announced that Prime customers can use PayPal to check out on websites that have integrated the Buy with Prime API. Starting next year, Prime members can link their Amazon and PayPal accounts for automatic access to Prime benefits when using PayPal.

🇮🇳 Airtel Payments Bank names Amar Kumar as Chief Compliance Officer. Amar will be responsible for enhancing the Bank’s compliance framework and ensuring that regulatory and statutory requirements are met seamlessly.

🇸🇬 Triple-A partners with DCS Card Centre. This collaboration enables DCS cardmembers to top up their virtual accounts with digital assets via the DCS Cards App. The live service allows users to increase their D-Vault balance, which can be converted into SGD for card transactions, including bill payments

🇫🇷 MarketPay introduces dual-purpose terminal and SoftPOS checkout app. The solution stands out by its ability to offer a single app available both for terminal and smartphone payments. It therefore can be used for all point of sale purchases.

🇺🇾 dLocal partners with Ontop to streamline payroll payments in high-growth markets. This strategic alliance will streamline currency conversion and improve payment efficiency in emerging markets. Continue reading

🇺🇸 Treasury4 joins J.P. Morgan Payments Partner Network. Treasury4’s participation in the J.P. Morgan Payments Partner Network builds on the company’s relationship with J.P. Morgan’s Seattle-based Commercial Banking team, which has supported Treasury4 since its early days.

🇺🇸 Brex launches embedded payments solutions for B2B software vendors. The new Brex Embedded payments solution complements the company’s corporate card and spend management platform for startups and enterprises, the company said in a press release.

🇸🇬 Visa Partners with dtcpay to expand its crypto payments network. This integration not only simplifies the payment process for users but also opens new avenues for businesses and individuals seeking to engage with cryptocurrencies.

🇺🇸 Alviere launches Loyalty Wallets with pay-by-bank funding capabilities. Consumers can fund these wallets via ACH or direct deposit and merchants can save 80% on payment acceptance costs by bypassing network interchange fees typically associated with card-only options.

🇳🇬 CashAfrica aims to simplify payments by changing customer behavior. While digital payments have blown up in Nigeria in the last decade, contactless payments are still unpopular. CashAfrica, a Nigerian FinTech startup that builds payment infrastructure for banks and FinTechs, believes there’s a business opportunity in contactless payments.

🇺🇸 Block promotes several long-time executives to senior leadership roles and will hire a new CRO focused on “trust and safety.” Brian Grassadonia is now the eco-system lead, Owen Jennings oversees business functions, Thomas Templeton heads hardware, and Brian Boates is in charge of science functions.

GOLDEN NUGGET

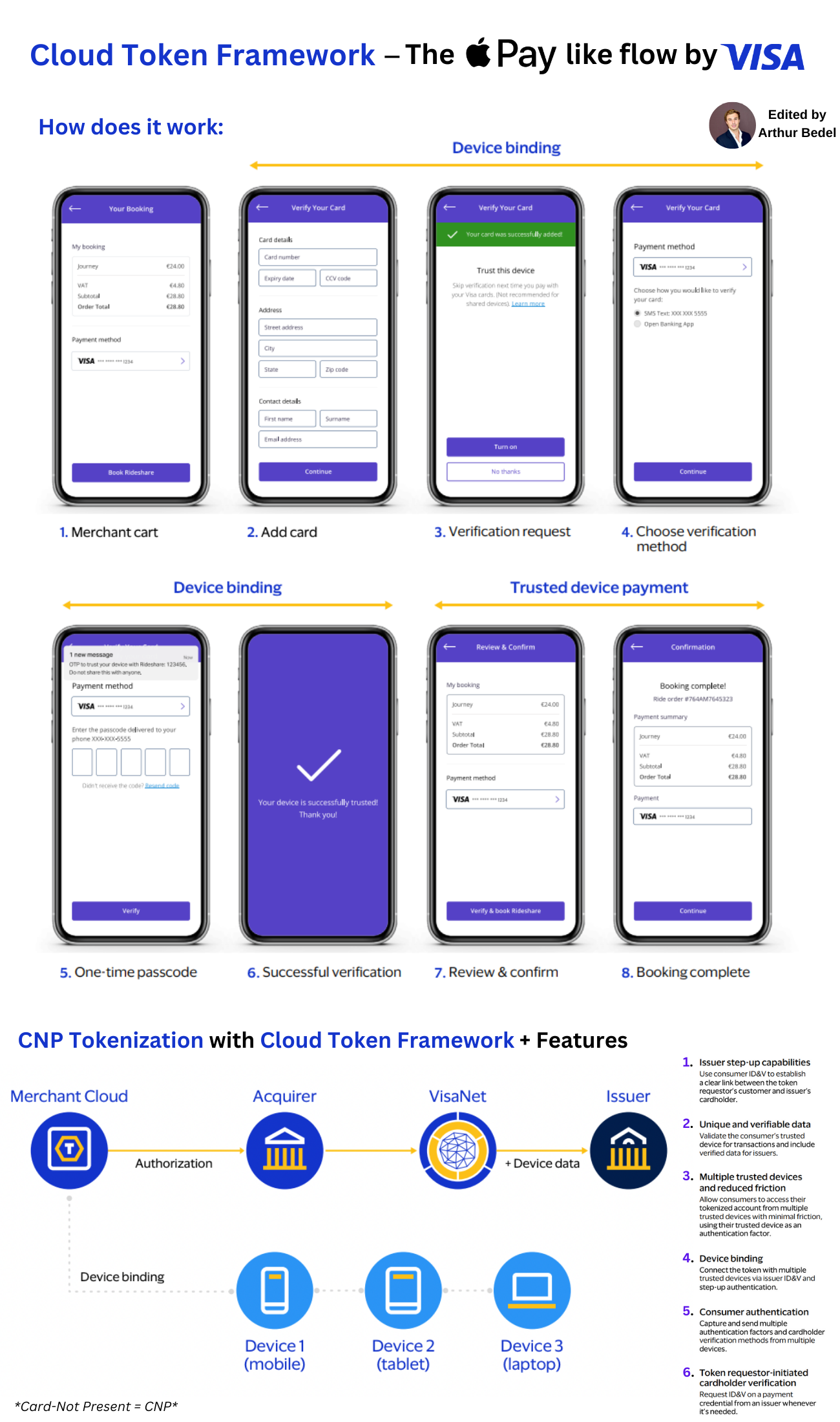

𝐂𝐥𝐨𝐮𝐝 𝐓𝐨𝐤𝐞𝐧 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤 — the Visa newest solution to bring the ApplePay experience to all 👇

The rise of digital commerce brings immense opportunities — but also a need for enhanced security, particularly for Card-Not-Present (CNP) transactions. This is where the Cloud Token Framework (CTF) steps in, transforming how payments are secured across multiple devices, bringing an ApplePay-like enhanced customer experience.

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 𝐨𝐟 𝐂𝐥𝐨𝐮𝐝 𝐓𝐨𝐤𝐞𝐧 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤:

The Cloud Token Framework (CTF) by Visa allows any connected device to become a secure channel for digital commerce, minimizing risks associated with handling sensitive payment data. It enables the tokenization of CNP transactions, ensuring a seamless, secure payment experience across devices, combining consumer identity verification (ID&V) with device intelligence.

In essence, CTF creates an online payment experience binding a network token to a device and leveraging biometrics on that same device for the transaction to be initiated. An experience more secure than an in-person experience (in my opinion).

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐰𝐨𝐫𝐤:

1. The cardholder reviews the items in their booking and proceeds to checkout

2. The cardholder enters their card details and contact information

3. The app prompts the cardholder with a verification request to designate the device as trusted for future purchases

4. The merchant or other token requestor displays a list of consumer ID&V methods available from the issuer and the cardholder selects their preferred ID&V method

5. The cardholder completes verification via the ID&V method

6. Once confirmed, the cardholder receives a message to confirm that their device is trusted for subsequent transactions

7. On the trusted device, the cardholder is prompted to verify and confirm their booking

8. Once confirmed, the cardholder's transaction is complete. The issuer receives the required device information to perform further checks

𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬:

𝐄𝐥𝐞𝐯𝐚𝐭𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐚𝐜𝐫𝐨𝐬𝐬 𝐝𝐞𝐯𝐢𝐜𝐞𝐬

Use consumer ID&V and device intelligence to link the consumer, cardholder and their associated devices to help prevent account takeover fraud

𝐓𝐫𝐮𝐬𝐭𝐞𝐝 𝐝𝐞𝐯𝐢𝐜𝐞𝐬 𝐢𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐜𝐨𝐧𝐟𝐢𝐝𝐞𝐧𝐜𝐞

Enable a trusted device to minimize friction and improve authorization rates for CNP transactions

𝐅𝐮𝐭𝐮𝐫𝐞-𝐏𝐫𝐨𝐨𝐟 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Expand digital commerce use cases with an end-to-end, secure and scalable token solution

The ApplePay experience was a revolution. Visa with Cloud Token Framework and Mastercard with TAS are bringing those to us all via tokenization!

Source: Visa's report

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()