Apple is in talks with two new partners to take over Apple Card

Hey Payments Fanatic!

Apple is in discussions with Barclays and Synchrony Financial to potentially replace Goldman Sachs as its credit card partner. The talks come as Goldman Sachs CEO David Solomon indicated their partnership, originally set to run until 2030, might end earlier than planned.

Several financial institutions are competing for the Apple Card partnership, though some view the original deal terms as challenging for profitability. Barclays has been in negotiations for months, having recently acquired Goldman's General Motors credit card business in 2024.

The potential shift follows Goldman Sachs's strategic retreat from consumer finance after setting aside billions for potential losses, marking a significant change from its decade-ago expansion into retail banking.

The Wall Street Journal previously reported that Apple is in discussions with JPMorgan Chase and Capital One to take over the partnership.

Stay tuned for the latest updates. In the ever-evolving world of Payments, being informed is your best asset 😉

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

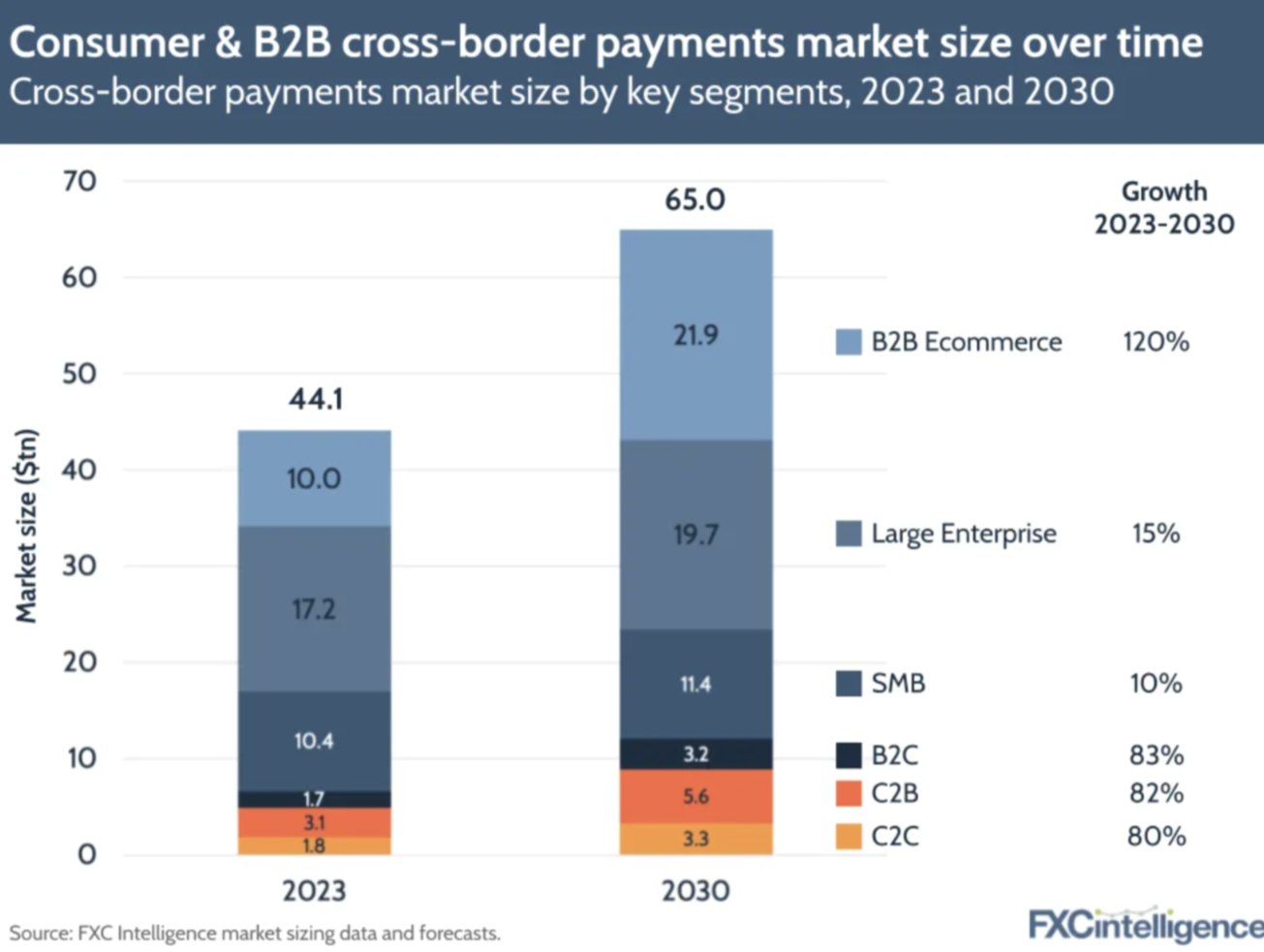

📊 How big is the cross-border payments market? 2032’s $65tn TAM. In this report, FXC Intelligence outlines the overall size of the market and how growth in key sectors is driving a significant upswing in cross-border payments between now and 2032. Download and read the full report

PAYMENTS NEWS

🇬🇧 Ecommpay empowers merchants to tailor payments pages with market-leading design tool. The new functionality allows for customisation of any part of a payment page layout as well as providing CSS and A/B testing for optimised performance. Moshe Winegarten, CRO at Ecommpay, commented: “The demand for greater customisation options within the market has been undeniable, and we’re proud to be at the forefront with this innovative tool." Read more

🇮🇳 Amazon to buy Indian BNPL startup Axio for over $150M. The e-commerce group signed the acquisition agreement in December after completing due diligence. The transaction requires approval from the Indian central bank. Continue reading

🇨🇿 Changelly announced the addition of Revolut's payment infrastructure. The technical integration allows users to purchase cryptocurrencies using Revolut Ramp, expanding the payment options available on Changelly's platform. Users can access 30 cryptocurrencies using 20 fiat currencies through various payment methods.

🇺🇸 Block (SQ) was fined $80M for anti-money laundering violations. Block agreed to pay a fine to 48 state financial regulators after the agencies determined the company had insufficient policies for policing money laundering through its mobile payment service, Cash App.

🇬🇧 UK’s BNPL market booms ahead of Crunch Year. Britons are using BNPL like never before to fund their lifestyles. This model, allowing customers to spread out payments without interest or credit checks, has become the darling of retailers and is drawing a growing menagerie of FinTech companies.

🌎 Bluefin integrates with Visa Platform Connect. This integration facilitates a ‘single’ connection for merchants using Visa Platform Connect, allowing for payment processing in multiple currencies across Visa and other card networks. Read More

🇬🇧 JCB announced a strategic partnership with DOJO to expand JCB card acceptance in the UK. About 6,000 to 7,000 merchants will now be able to accept payments using JCB’s “front of wallet” card. At the same time, DOJO merchants will be exposed to a market of 164 million cardmembers across the globe.

🇺🇸 Prepaid payments platform Recharge raises €45M to go on M&A spree. “We see an opportunity to grow faster through M&A and there’s a number of opportunities in other markets and segments that we can consolidate, especially as this industry is still so young,” Recharge’s CEO said.

🇪🇺 PayRetailers appoints Natalie McGowan as VP of Acquiring & EU Payment Partners. With over two decades of experience in the payments industry, Natalie brings a wealth of expertise in payment networks and international growth strategies. Read more

🇺🇸 FreedomPay partners with Mastercard on payment solutions. By combining the capabilities of both companies, the collaboration is intended to simplify the process of connecting merchants with acquirers and broaden the range of accepted payment methods across various regions.

🇪🇸 Nuvei partners with Outpayce from Amadeus. This partnership positions Nuvei as a global leader in advancing Outpayce's innovative payment ecosystem. Travel businesses can access Nuvei's expansive suite of payment capabilities, enhancing their ability to process transactions efficiently and securely across geographies.

🇺🇸 Mastercard agrees to settle pay discrimination suit for $26M. The complaint accuses the company of underpaying female, Black, and Hispanic employees compared with their male and white counterparts, also agreed to conduct annual pay equity audits for three years and hire a psychologist to assess bias in its workplace.

GOLDEN NUGGET

How do we find opportunities among so many payment companies?

What do they do exactly? 👇

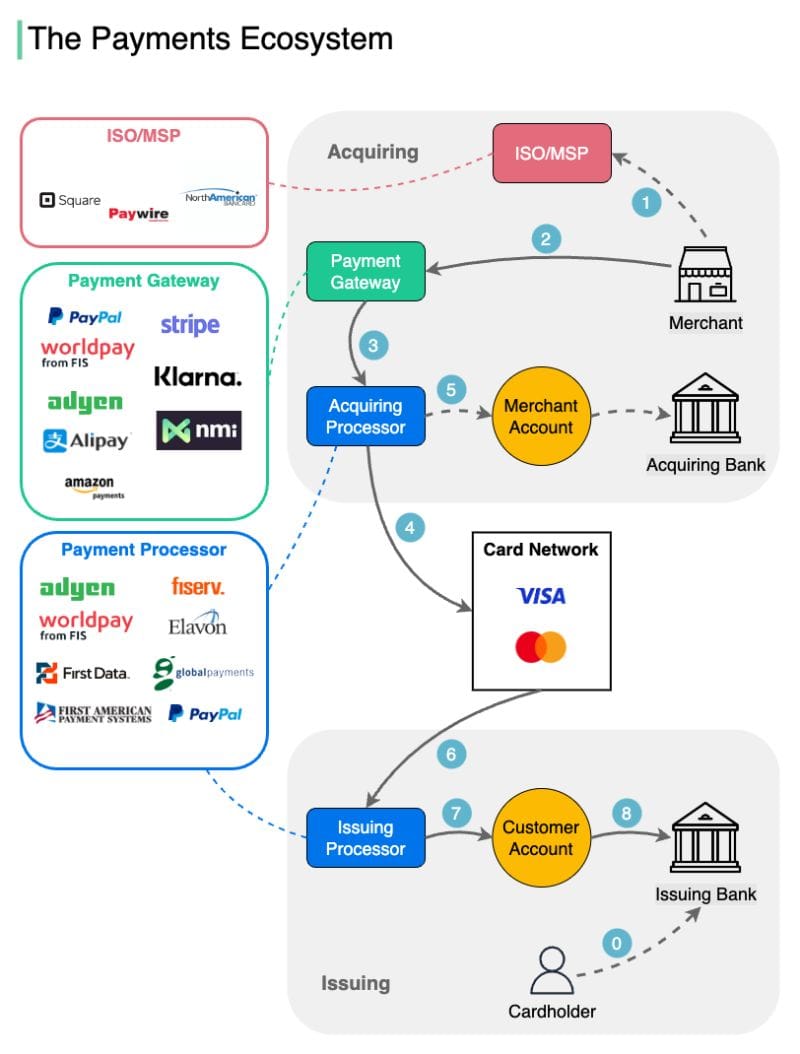

The diagram above shows the payments ecosystem.

🔸 Steps 0-1: The cardholder opens an account in the issuing bank and gets the debit/credit card. The merchant registers with ISO (Independent Sales Organization) or MSP (Member Service Provider) for in-store sales. ISO/MSP partners with payment processors to open merchant accounts.

🔸 Steps 2-5: The acquiring process.

The payment gateway accepts the purchase transaction and collects payment information. It is then sent to a payment processor, which uses customer information to collect payments. The acquiring processor sends the transaction to the card network. It also owns and operates the merchant’s account during settlement, which doesn’t happen in real time.

🔸 Steps 6-8: The issuing process.

The issuing processor talks to the card network on the issuing bank’s behalf. It validates and operates the customer’s account.

👉 Quite a few companies offer digital wallets. Can you find a place for wallets in the ecosystem?

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()