Apple Finally Opens iPhone NFC to Third-Party Developers – But There's a Catch

Hey Payments Fanatic!

Apple has announced plans to open up its iPhone tap-to-pay NFC (Near Field Communication) capabilities to third-party developers, signaling a significant shift in the company's approach to mobile payments. This move comes amid increasing regulatory scrutiny, particularly in Europe, where Apple has faced pressure to loosen its exclusive control over NFC technology on its devices.

NFC, the wireless technology behind Apple Pay and Wallet, has long been under Apple's tight control, limiting its use to the company's own payment systems. However, this exclusivity has been under investigation by the European Commission for potential anti-competitive practices, especially concerning its impact on competition within the mobile payments market.

In response to these pressures, Apple has started to grant third-party developers access to its NFC technology in Europe and is now expanding this openness to other global markets. The company has outlined plans to roll out NFC and Secure Element (SE) API access to several countries, including Australia, Brazil, Canada, Japan, New Zealand, the U.K., and the U.S., with the release of the iOS 18.1 update.

Additional regions are expected to gain access in the near future.

Previously, Apple allowed limited third-party use of NFC for functions such as reading NFC tags. However, the ongoing antitrust investigation by the EU has compelled Apple to go further, providing competitors with access to the iPhone's Secure Element for mobile payments.

This decision helped Apple avoid a potential antitrust fine that could have amounted to 10% of its global revenue, estimated at around $40 billion.

As regulatory landscapes in other parts of the world begin to align with the EU's stance, Apple appears to be taking proactive measures by expanding NFC access to developers globally, likely aiming to stave off further regulatory challenges.

It’s important to note, however, that developers will be required to enter into a "commercial agreement with Apple" to access these new capabilities. The specifics of this agreement, including the associated fees, have not yet been fully disclosed, indicating that this service will not be entirely free.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 In FinTech, a paradigm shift is emerging that transforms the traditional Buy Now Pay Later (BNPL) model into a more sustainable and financially empowering approach known as Save Now Buy Later (SNBL). Read all about it in this #FinTechreport by AGPAYTECH LTD.

PAYMENTS NEWS

🇧🇷 Nathan Marion, formerly with Yuno, joins Nubank to strengthen B2B business. The goal is to enhance Nubank's presence in the B2B market, particularly in payment and e-commerce products, according to the executive. Continue reading

🇺🇸 Tekmetric and Affirm enable auto repair payments in installments. Auto repair shops that use Tekmetric’s platform can add Affirm as a payment option with a few clicks, according to a press release. Read the full piece

🇺🇸 Corrie DeCamp joins Billtrust as chief product officer. DeCamp has over 30 years of experience managing enterprise solutions and will lead Billtrust’s product strategy and vision. She will report to Chief Technology Officer Joe Eng.

🇸🇬 New NETS Solution turns Android Phones into payment terminals, offering a more cost-effective and flexible payment option. With the NETS SoftPOS app, available on the Google Play Store, merchants can accept payments via cards, QR codes, and mobile payment methods.

🇳🇴 IDEX Biometrics and TaluCard bring inclusive biometric payment solutions to market in Europe. This initiative is set to transform payment solutions with a strong focus on accessibility and security for all users, including those with visual impairments and members of the aging community.

🇬🇧 Cardstream partners with PayPoint. The partnership sees PayPoint integrating Cardstream’s Gateway Connectivity into their MultiPay digital payments platform, which will allow it to continue to build a robust and scalable solution for clients.

🇮🇪 PTSB, a full-service bank headquartered in Dublin, Ireland, has expanded its relationship with merchant acquirer Worldpay to extend a suite of additional merchant services to its commercial customers. The expanded partnership will provide PTSB with access to additional Worldpay solutions.

🇬🇧 Sling Money raises $15 million series A to transform global payments. With Sling Money, users can easily send money instantly across 50+ countries across Europe and Africa to other users, between their own accounts, or even to non-Sling users with a Sling Link.

GOLDEN NUGGET

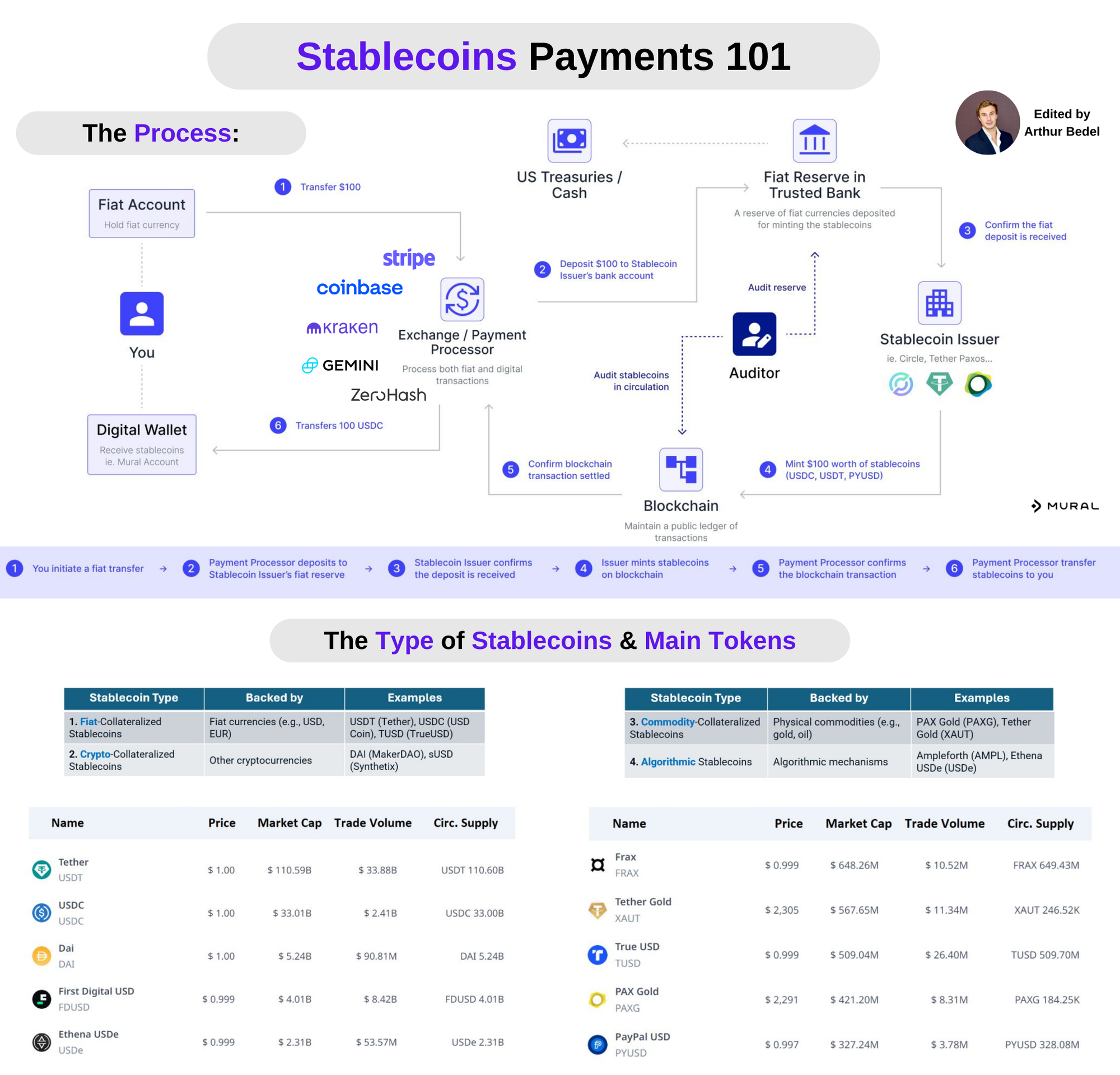

Stablecoins 101 — what are they, how do you pay with them, why stablecoins and who are the main players 👇

What are Stablecoins:

Stablecoins are a type of cryptocurrency designed to maintain a stable value relative to a specific asset, usually a fiat currency like the USdollar or a commodity like gold.

Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which can experience significant price volatility, stablecoins aim to offer the best of both worlds:

👉 the instant processing and security of payments of cryptocurrencies

👉 the stable valuations of fiat currencies.

There are primarily 3 types of stablecoins:

🔸Fiat-collateralized stablecoins — Backed by fiat currency at a 1:1 ratio. For every stablecoin issued, a certain amount of fiat currency is held in reserve. I.e. USDC (U.S. Dollar Coin) and Tether (USDT).

🔸 Crypto-collateralized stablecoins — Backed by other cryptocurrencies as collateral. I.e. DAI, which is pegged against the U.S. dollar but backed by Ethereum.

🔸 Algorithmic stablecoins: Unlike the other types, these are not backed by any collateral but instead use algorithms to control the supply of the issued tokens. This type can be more volatile and has been subject to failures.

Stablecoins are popular for transactions, savings, trading in the cryptocurrency market & decentralized finance (DeFi) applications.

Main providers are both Blockchain Infrastructure Players & Exchanges:

🔸 Zero Hash, Circle, Coinbase, Kraken Digital Asset Exchange, Paxos etc...

The History & Benefits of Stablecoins:

Created in 2014, Tether (USDT) was the first widely recognized stablecoin bridging the gap between fiat and crypto currencies. In payments, they offer:

🔸Stability — Pegged to stable assets like fiat currencies, they don't suffer from the same volatility as other cryptocurrencies, making them more suitable for everyday transactions.

🔸Speed and Efficiency — Faster than traditional bank transfers, especially cross borders, significantly reducing transaction times from days to minutes or even seconds.

🔸Lower Transaction Fees: Traditional cross-border transactions involve multiple intermediaries, each of which can add costs and delays. Stablecoins simplify the process, potentially lowering costs.

🔸Accessibility — Stablecoins can be accessed by anyone with an internet connection, bypassing the need for traditional banking infrastructure.

Many more benefits available...

Stablecoins are bridging the gap between traditional payments and cryptocurrencies. They can't be ignored, no matter which side you are on. Slowly but surely they are gaining adoption globally 🚀

👉 The newsletter "The Payments Brews", will dive deeper into Stablecoins outlying the HOW to leverage them!

Source: Mural, Global X ETFs, CBpay, KuCoin Exchange

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()