Ant International to Provide a Variety of Digital Payment Solutions for Tottenham Hotspur

Hey Payments Fanatic!

It’s been one of those extra busy weeks for me, and I’m sure Ant Group can relate, as they secured a new three-year partnership this week to provide their range of digital payment solutions to Premier League club Tottenham Hotspur.

The partnership designates Ant International and its brands—Alipay+, Antom, and WorldFirst—as the exclusive official global payment solutions and digital wallet partner for Tottenham Hotspur. Additionally, Alipay+ will be the inaugural official training wear sleeve partner for both the men’s and women’s teams.

Spurs will collaborate with Ant International, utilizing its digital technology solutions brand Alipay+ and merchant payment services brand Antom, to offer a seamless payment experience for fans at Tottenham Hotspur Stadium and on e-commerce platforms.

Additionally, Ant International will assist Spurs in driving growth and engagement with its fanbase in the APAC region through its partner digital payment apps, including Alipay.

Cheers to the weekend ahead, I'll see you back on Monday!

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

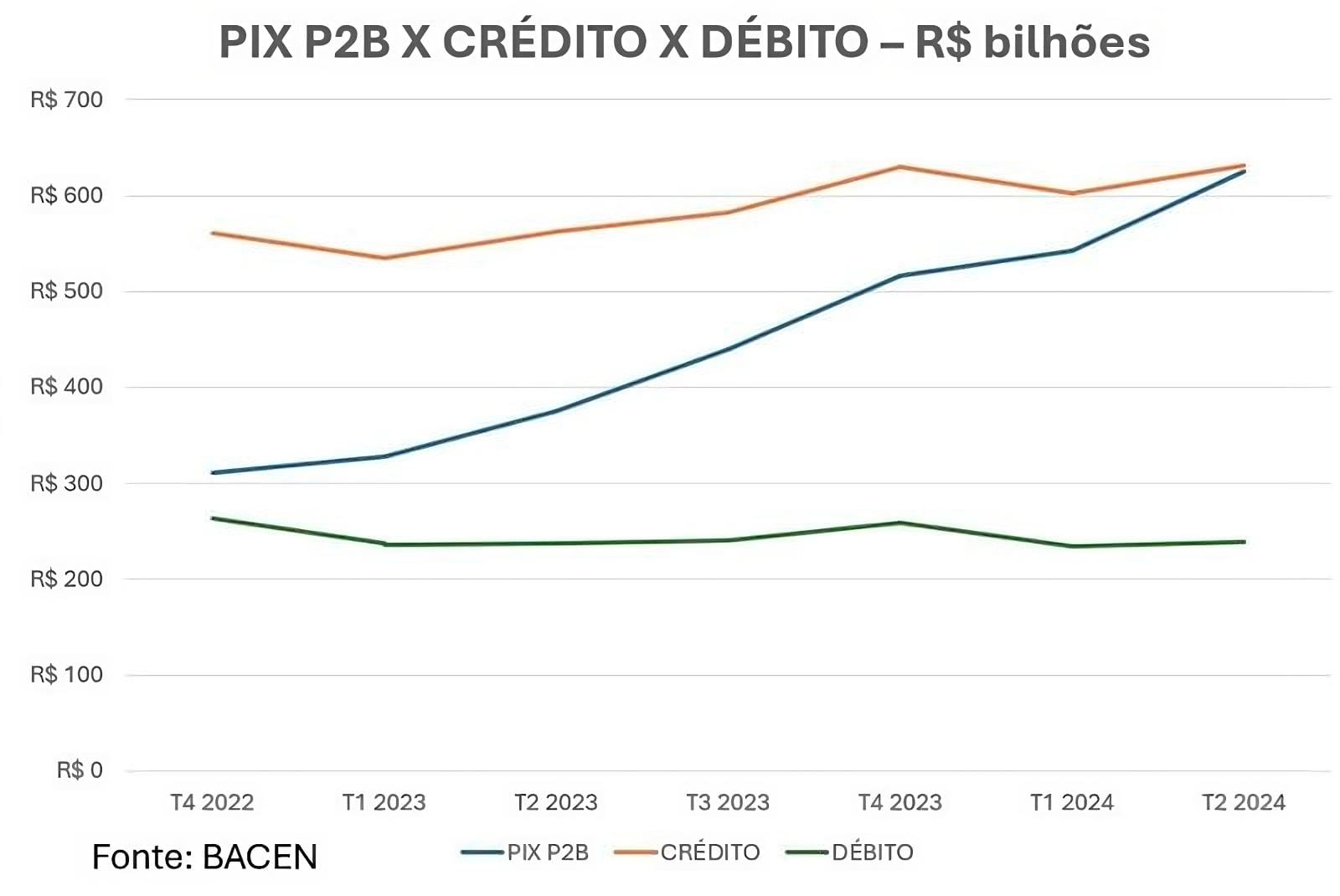

🇧🇷 Data from the Central Bank Brazil indicates that Pix P2B (person-to-business transactions) is very close to surpassing credit cards in quarterly volume (including both in-person and online purchases) 🤯

The use of contactless Pix could further accelerate its growth, impacting debit cards even more (Pix P2B was more than 2.5 times larger than debit card transactions in the second quarter of this year).

PAYMENTS NEWS

🇺🇸 Convera selected by Routable for its extensive Global Payments Network. This integrated partnership will enable Routable to leverage Convera’s global network and expertise in foreign exchange and compliance to provide its customers with increased global reach, reliability, and competitive rates.

🇬🇧 Huma raises $38M to hyper-scale its Payment Financing (PayFi) Network. PayFi aims to address this giant liquidity gap by bringing trillions of dollars of real world payment volume over to blockchains and stablecoins. Read on

🇨🇳 Unlimit partners with Shoplazza to boost cross-border payments for Chinese e-commerce. The collaboration will help to enhance cross-border payments for Shoplazza’s 500,000+ merchants, improve payment success rates, and support the growth of the e-commerce industry in the APAC region.

🇵🇰 Visa aims for 10-fold rise in Pakistani use of digital payments. The payments giant plans to increase the number of businesses accepting digital payments in Pakistan tenfold over the next three years, the company’s general manager for Pakistan, North Africa and Levant told Reuters.

🇬🇧 Ant International to supply range of digital payment options for Tottenham Hotspur. The partnership sees Ant International, including its brands Alipay+, Antom and WorldFirst, become the exclusive official global payment solutions and digital wallet partner of Tottenham Hotspur.

🇺🇸 Mastercard bolsters threat intelligence capabilities with $2.65 billion deal for Recorded Future. The acquisition will bring expanded threat intelligence capabilities to the payments firm, which recorded $9 trillion in gross dollar volumes last year, a metric that represents the total dollar value of all transactions processed.

🇲🇼 Flutterwave's Send App launches in Malawi. “This marks the beginning of an exciting journey of endless possibilities in Malawi, and we’ll continue innovating to make Send App available to as many people as possible who need it across the African continent." Olugbenga ‘GB’ Agboola, Founder and CEO of Flutterwave said.

Swift to develop concrete plans for CBDC and tokenised asset exchange. Swift is moving forward with plans to offer member banks access to emerging digital asset classes and currencies over its network, covering a range of use cases in payments, securities, FX, trade and beyond.

🇭🇺 B2B BNPL player PastPay secures €12 million Series A. The financing will be spent on investment in product development and the expansion of its digital services and infrastructure for both online and offline transactions.

🇧🇷 B3 and Rendimento join over 30 payment initiators. The list of institutions authorized to operate as a payment transaction initiator (ITP) via Pix in Open Finance in Brazil continues to grow. Last Friday (09/06), B3 and Banco Rendimento joined the group, which now consists of 35 institutions.

GOLDEN NUGGET

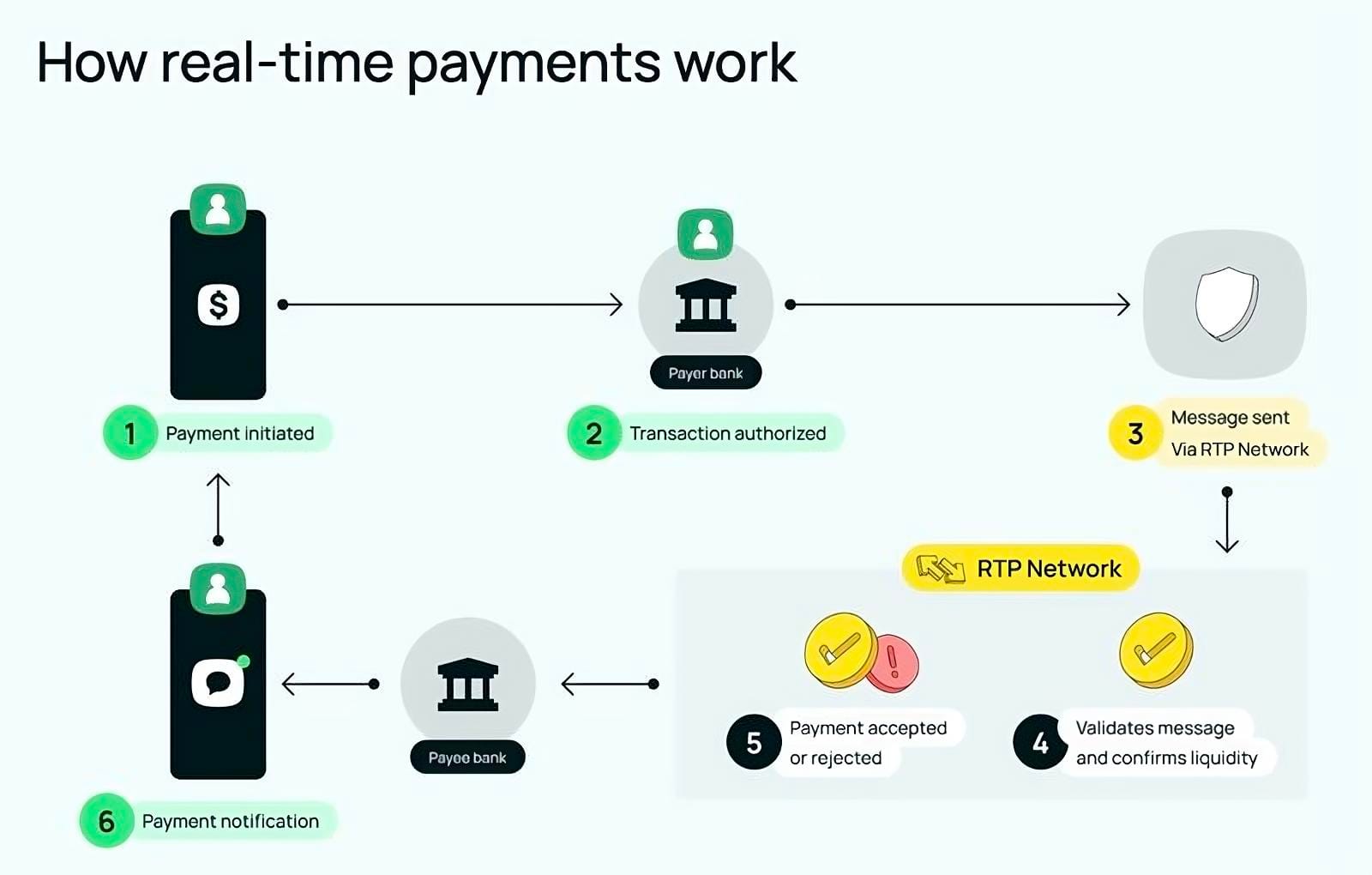

What is pay-by-bank? And What are real-time payments?

Aeropay explains it best:

𝗣𝗮𝘆-𝗯𝘆-𝗯𝗮𝗻𝗸 (also called A2A payments) is a direct form of payment that enables an electronic transfer of funds between two bank accounts.

The value of pay-by-bank is its simplicity. By linking two bank accounts using a bank aggregator, one party can either request or send money directly via ACH, RTP, or FedNow rails, without cash or cards.

𝗥𝗲𝗮𝗹-𝘁𝗶𝗺𝗲 𝗽𝗮𝘆𝗺𝗲𝗻𝘁𝘀, also called instant payments, are electronic transfers of funds between bank accounts that’s instant and available 24/7.

Real-time payments are significantly faster than traditional payment methods, which can take one to three business days to complete.

Real-time payments are a pay-by-bank offering. They facilitate an immediate transfer of funds for virtually any money movement use case, including:

► From person to person (splitting bills, personal loans, gifting money)

► From person to business (automated bill payments, ACH rent payments)

► From business to business (supplier payments, invoice settlements, bulk orders)

► From business to person (payroll disbursements, expense reimbursements, refunds)

► From government to person (social welfare payments, tax refunds, pension disbursements)

► From person to government (tax payments, license fees, fines)

► And more

𝗡𝗢𝗧𝗘: The United States offers real-time payments through RTP from The Clearing House and FedNow from the Federal Reserve.

Currently, these services only offer instant payouts, meaning only instant withdrawals (pull payments) are supported.

However, there are anticipated plans for FedNow to expand its services to support a full range of payment scenarios.

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: Aeropay

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()