American Express Fined $230M Over Deceptive Sales Practices

Hey Payments Fanatic!

American Express is shelling out $230 million to settle U.S. criminal and civil probes into misleading sales tactics targeting small businesses. The deal includes a $138.4 million payment—with $108 million in fines—and a non-prosecution agreement with the Department of Justice (DOJ). Amex is also finalizing a separate agreement with the Federal Reserve.

The DOJ claims that from 2014 to 2017, Amex misled customers about credit card rewards, fees, and unauthorized credit checks. From 2018 to 2021, the company allegedly exaggerated the tax perks of wire transfer products like Payroll Rewards and Premium Wire. Internal employee complaints even described Premium Wire as a "very questionable product."

To top it off, sales staff reportedly used fake employer ID numbers to open small business credit cards, deceiving regulators. Amex says these practices ended by 2021 and that it has since improved compliance and staff training. The company insists this settlement won’t impact its 2024 earnings forecast.

Stay tuned for more Payments updates—knowledge is your best investment!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

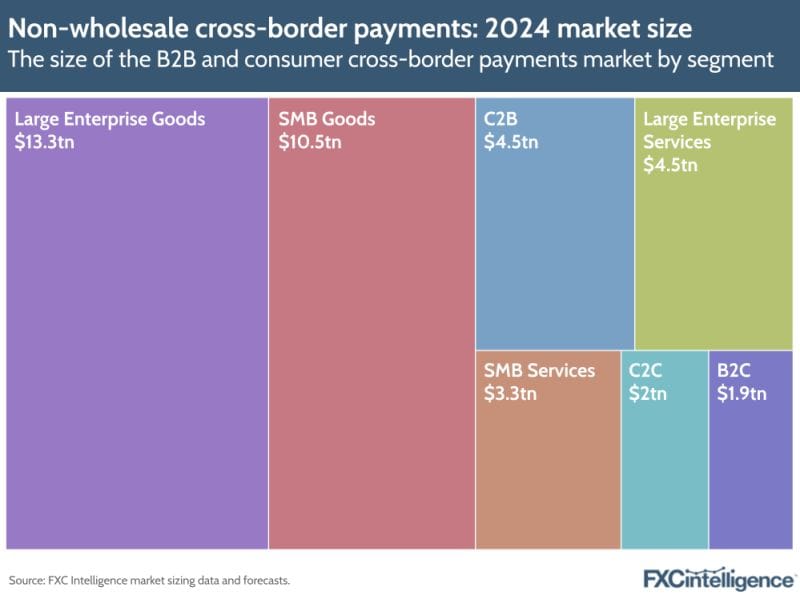

How big is the cross-border payments market?

PAYMENTS NEWS

🇲🇽 Belvo and J.P. Morgan Payments to boost recurring payments in Mexico. This strategic collaboration aims to provide businesses with an automated and efficient solution for managing recurring payments through direct debit, a core payment method among companies looking to streamline their financial processes.

🇬🇧 Paysend celebrates 10M consumer customers milestone. This achievement underscores Paysend’s remarkable growth and solidifies its position in the cross-border payments market. It has evolved into the world’s largest digital payment network, embodying its mission of delivering the simplest money transfer solutions globally.

🌍 Synchrony customers have access to Pay Later Feature of Apple Pay. Eligible holders can choose to pay with the standard terms of their credit card or use a promotional offer that includes fixed monthly payments. Read the full piece

🇬🇧 Revolut launches in-app calling feature to tackle impersonation fraud. The new feature targets impersonation scams in which criminals pretend to be a representative of a bank to gain access to sensitive details about their victim’s account, compromising their savings.

🇺🇸 Digital money transfer firm Paymints.io acquired by CertifID. With the addition of digital payments via its acquisition of Paymints.io, CertifID extends the protection it provides customers in combatting cybercrime and delivering safe closing experiences for clients.

🇺🇸 InterPayments appoints Roger Hochschild to its board of directors. This strategic appointment underscores InterPayments’ mission to empower merchants to manage their cost of acceptance directly and through partnerships with US banks, payment processors, and software platforms.

🇯🇴 Mastercard Move partners with Cairo Amman Bank. The bank will leverage Mastercard Move’s money movement capabilities to transform international money transfers for its customers in Jordan. The collaboration will advance financial inclusion and contribute to an even more accessible digital economy.

🇨🇳 PhotonPay launches Google Pay Support for Mastercard users in Hong Kong. This enables cardholders to take advantage of simple and secure contactless payments and digital card storage on both Android devices and WearOS. It also includes industry-standard tokenization.

🇺🇸 Columbia Insurance Group modernizes ayments with One Inc. By integrating PremiumPay, CIG will have the tools to power personalized branding, manage multi-channel communication preferences and deliver proactive messaging at the most critical times.

🇦🇷 Bamboo and Tiendamia partner to optimize payment solutions. This collaboration is set to address key challenges faced by Tiendamia in Argentina, allowing the company to offer more competitive pricing and a seamless shopping experience to its customers.

🇬🇧 PSR sets out updated strategy to deliver competition, innovation, and growth. These commitments set out an impactful programme of delivery as the regulator seeks to achieve world-leading payment systems where competition and innovation deliver secure, accessible, and value-for-money services that meet the needs of people and businesses.

GOLDEN NUGGET

Understanding Cards-as-a-Service 💡

The traditional card issuance process, while foundational to the modern financial ecosystem, is a complex system involving multiple stakeholders and steps. The issuer, typically a bank or financial institution, partners with a payment network such as Mastercard. This collaboration enables the issuance of cards that provide consumers access to credit, debit, or prepaid funds. These cards are linked to an account managed by the issuer, which holds the responsibility for underwriting, managing, and securing the financial relationship with the cardholder.

Key roles in the traditional card issuance process

1️⃣ Customer: The individual who applies for a card

2️⃣ Issuer: The bank or financial institution responsible for underwriting and managing the cardholder relationship

3️⃣ Issuer Processor: The entity that manages back-end processes, ensuring the card’s functionality and compliance with regulations

4️⃣ Payment Network: Entities that act as intermediaries between the issuer and the acquirer, facilitating secure transaction processing and communication within the payment ecosystem

5️⃣ Personalisation Bureau: Third-party providers that personalise physical cards with cardholder information and security features

6️⃣ Acquirer: The bank that processes payments for merchants and works with the issuer for transaction settlements

Source: Nicolas Pinto, Paymentology, audax and Mastercard

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()