Airwallex Plans US & UK Banking Licences Ahead of IPO

Hey Payments Fanatic!

Airwallex is preparing to apply for a UK banking licence — with plans to pursue a US licence next, likely through the acquisition of a local bank. This signals an expansion beyond its core in payments, as the company looks to enter the lending space and operate on the same playing field as global banks.

Until now, Airwallex has built its business through payment licences, helping companies move money across borders and manage international operations. Securing banking licences would unlock new products — including credit — and take Airwallex a step closer to offering a full suite of financial services to its global clients.

Founded in 2015, the $5.6 billion FinTech offers banking and multicurrency payment services to businesses around the world, including high-profile clients like McLaren. Its platform helps companies manage staff payroll, supplier payments, and foreign exchange in multiple currencies.

“We are planning to apply for a UK banking licence, the UK is one of the most friendly markets for FinTechs ... the [FCA] is still one of the best regulators,” Co-Founder & CEO Jack Zhang told the Financial Times.

Looking further ahead, Airwallex has its sights set on a US banking licence — but expects the route there to be different. “Ultimately in a decade I think we’re going to displace some of the global banks,” said Zhang.

As for the next step on its corporate journey, the FinTech is steering firmly towards a US listing, where Zhang sees unmatched market conditions: “The US market is still the most liquid capital market and most accessible capital market in the world.”

If you want to catch up on the latest in Payments, keep scrolling!

Cheers,

PAYMENTS NEWS

🇮🇱 Airwallex enables businesses to collect and hold funds in Israeli Shekels. The new offering enables Israeli and global Airwallex customers to open accounts, facilitating seamless transactions in ILS via the Israeli payment network. Businesses can now benefit from local collection capabilities, real-time settlement for faster payments, and streamlined treasury management.

🇬🇧 Ecommpay shortlisted in ICA Compliance Awards Europe 2025. The payments platform has been recognised for customisable financial crime prevention. In partnership with Cable, Ecommpay has designed and implemented a groundbreaking solution, redefining financial crime compliance.

🇪🇬 Mastercard and PayTabs collaborate to empower Egypt’s small and medium enterprises. Through this collaboration, PayTabs will leverage Mastercard’s global network and digital payments capabilities to provide merchants with a white-labelled digital payments platform.

🇬🇧 Viva.com expands near-instant payment footprint across Europe, with UK launch of Mastercard Move. This step enables businesses across 24 European countries to send and receive near-instant payments regardless of currency and geography, enhancing operational efficiency and customer satisfaction.

🇮🇳 Revolut gets RBI nod for PPIs, wallets. With the PPI license in place, Revolut can now offer both international and domestic payment solutions under one platform in India. Through its mobile wallet product, Revolut will also be able to offer UPI payment services to its Indian customers.

🇻🇳 FOMO pay adds Vietnam to cross-border network with launch of VND accounts. The service enables merchants, corporations, and institutions to send and receive VND within Vietnam using locally issued virtual accounts under their own names via the country’s local payment infrastructure.

🇺🇸 Stripe applies for US Banking License to expand merchant acquiring capabilities. Stripe’s application for a Merchant Acquirer Limited Purpose Bank (MALPB) charter has been accepted by the state of Georgia’s Department of Banking and Finance, bringing the financial infrastructure giant one step closer.

🇦🇺 Aussie paytech Fat Zebra continues expansion with SecurePay acquisition. The acquisition will see the company add thousands of active merchants to its customer base, help bolster its local position, and enhance the company's ability to provide a comprehensive suite of payment solutions, spanning enterprise, platform, and SMB segments.

🇮🇳 Juspay secures $60 Mn to boost payments infra with AI. The startup plans to deploy the fresh capital to fuel its AI capabilities and drive innovations to boost workforce productivity and merchant experience. Read more

🌍 Verve expands payment frontiers with global partnerships and contactless innovation. The company has partnered with leading international and regional payment platforms, including Temu, AliExpress, PalmPay, and FortisPay. These integrations enhance Verve cardholders’ access to global e-commerce marketplaces and digital payment solutions.

🌎 SumUp unveils new products and features to its global customer base of small businesses at the annual Beacon Event. The following products and features are designed to address merchant pain points, expanding SumUp’s existing industry-leading product ecosystem.

🇺🇸 Visa unveils slate of new services to power client growth. The new products make accepting payments easier and more secure in an increasingly complex commercial landscape. These services help businesses achieve their full potential by freeing up resources to focus on other business priorities.

🇮🇳 Easebuzz secures $30 million in funding led by Bessemer Ventures. The funding will help accelerate the FinTech company’s product portfolio in online payments, expand its vertical Software-as-a-Service offerings, and venture into offline payment solutions, including point-of-sale and UPI QR-based Soundbox solutions.

🇪🇬 e& Egypt launches instant international money transfer via digital wallet. This new feature allows customers to receive money from UAE and Saudi Arabia instantly and securely without visiting branches or intermediaries. This comes as part of a strategy aligned with the Central Bank of Egypt’s efforts to promote financial inclusion and reduce the nation’s reliance on cash-based transactions.

🌎 Virgo and Vaulta launch cross-border remittance network VirgoPay. The VirgoPay service will allow users to add funds using traditional local payment rails, such as bank transfers, e-transfers, and card processing, or directly from a crypto wallet, and enables users to select from a range of fiat currencies.

🇺🇸 FinTech FIS to help power real-time rewards for payments and commerce network Bilt. The Premium Payback solution seeks to drive more engaged cardholder behavior for its clients by connecting participating issuers with participating merchants to allow customers to redeem their points directly at the point of purchase, which can provide immediate savings.

GOLDEN NUGGET

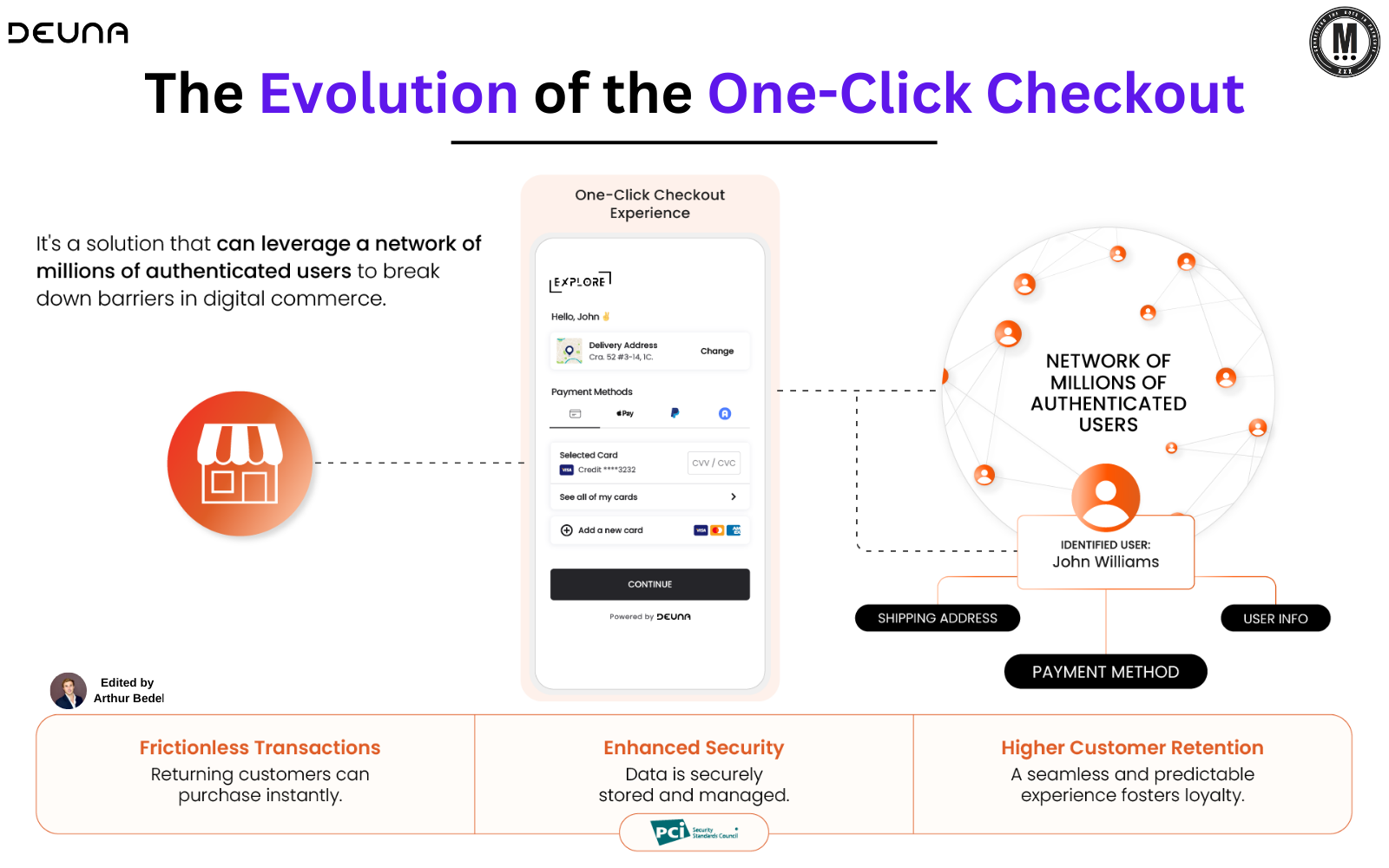

𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐭𝐡𝐞 𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 — it's all about the 𝐔𝐬𝐞𝐫 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 by DEUNA👇

𝐓𝐡𝐞 𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐚 𝐔𝐬𝐞𝐫 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐭𝐨 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐞 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭

► One-Click Checkout has evolved beyond a UX feature — it's now a networked infrastructure that recognizes users across different merchants, enabling them to complete purchases in seconds.

► When millions of users are already verified, and their credentials securely stored, checkout becomes nearly invisible. The value of this shared network is exponential: each new user improves conversion for every merchant connected to the ecosystem.

𝐓𝐡𝐞 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 & 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫𝐬

✅ 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬 replaces sensitive card numbers with tokens issued by the card networks (e.g. Visa, Mastercard). These tokens are merchant-specific, device-aware, and more secure than raw PAN data.

► As a result, transactions are less likely to be declined and more resilient to fraud.

✅ 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫 services automatically refresh expired or reissued cards without user intervention via network services directly corresponding with the Issuing Banks.

► This keeps the One-Click experience smooth and uninterrupted — even when card credentials change in the background.

Together, these tools increase approval rates, reduce friction, and maintain continuity.

𝐑𝐞𝐠𝐮𝐥𝐚𝐫 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐯𝐬. 𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭

𝐑𝐞𝐠𝐮𝐥𝐚𝐫 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭:

❌ Manual entry of shipping and payment info

❌ Authentication for every purchase

❌ Prone to errors and drop-offs

❌ Cards expire → Transactions fail

𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭:

✅ User credentials already tokenized and authenticated

✅ Seamless checkout across merchants using the same network

✅ Higher card approval rates with network tokens

✅ Cards are auto-updated in the background

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐝 𝐛𝐲 𝐓𝐨𝐤𝐞𝐧𝐬 & 𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐔𝐬𝐞𝐫 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 👇

✔️ 𝐒𝐭𝐫𝐨𝐧𝐠𝐞𝐫 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 – Tokenized data is useless if intercepted, reducing fraud risks.

✔️ 𝐇𝐢𝐠𝐡𝐞𝐫 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐑𝐚𝐭𝐞𝐬 – Network tokens are more trusted by issuers than static card numbers.

✔️ 𝐏𝐞𝐫𝐬𝐢𝐬𝐭𝐞𝐧𝐭 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞 – Account updater ensures no friction.

✔️ 𝐆𝐥𝐨𝐛𝐚𝐥 𝐒𝐜𝐚𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲 – Shared networks reduce onboarding friction for new merchants and users alike.

𝐓𝐡𝐞 𝐄𝐧𝐝 𝐨𝐟 𝐭𝐡𝐞 𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐒𝐞𝐫𝐢𝐞𝐬 (3/3)

One-Click Checkout is no longer a standalone tool — it’s an integrated layer across identity, security, and payments.

With advancements in tokenization and networked authentication the checkout process can now be instant, trusted, and invisible.

Source: DEUNA

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()