Airwallex Expands into Latin America with Strategic Moves in Brazil and Mexico

Hey Payments Fanatic!

Airwallex has secured major regulatory approvals in Latin America, obtaining a payment institution license from Brazil's Central Bank and finalizing the acquisition of Mexico-based MexPago, along with its IFPE license. These moves enable Airwallex to connect its global financial infrastructure with Latin America's two largest economies.

Ravi Adusumilli, President, Americas at Airwallex states: "Our infrastructure strategy is to connect diverse and strategically significant markets around the world. With licenses in Brazil and Mexico, we can help companies in Latin America to expand and thrive across borders."

Meanwhile, Luis Castillejos Ordaz, CEO and founder of MexPago, who will become Airwallex's Country Manager for Mexico, adds: "Mexico plays a pivotal role in the global economy, serving as a key link between North and South America and a critical hub for cross-border payments."

The expansion targets significant market opportunities, with Brazil's PIX expected to handle 40% of online payments by 2026, while Mexico shows the region's fastest cross-border transaction growth at 44% CAGR, recently becoming the top exporter to the U.S.

Read more global Payments industry updates below 👇 and I'll be back tomorrow!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

📊 Cross Border Payment Expectations vs Reality. Real-time payments have raised consumers’ expectations for fast and easy cross-border payment experiences. But unfortunately, the complexity of cross-border payments often causes these expectations to not be met. Download Visa’s full report to learn more

PAYMENTS NEWS

🇺🇸 ACI Worldwide announces the appointment of Philip Bruno as Chief Strategy and Growth Officer. “The addition of Phil to our already strong executive leadership team is critical to further enhancing our corporate strategy and increasing our growth opportunities. He brings the strong vision and business expertise.” said Thomas Warsop, president and CEO of ACI Worldwide.

🇺🇸 FinTech Klarna’s loan sales suggest it is more Fin than Tech. Klarna is seeking buyers for a pipeline of its future buy-now-pay-later loans is a reminder that for now at least, its underlying business looks more like a financial firm than a tech group.

🇺🇾 Payment services provider dLocal is analyzing whether to buy a smaller FinTech rival this year after the company itself was the target of takeover proposals, and claims it's NOT FOR SALE 🤯 This is what Chief Executive Officer Pedro Arnt said in an interview.

🇯🇵 SoftBank veteran hunts for profits in payments infrastructure plumbing. Akshay Naheta, an executive whose career has been marked by bold wagers on disruption, is making perhaps his most ambitious bet yet: That the world’s payment infrastructure is ripe for reinvention. Read the full piece

🇻🇳 Cross-border QR payments now live between Vietnam and Laos. This allows businesses and individuals to conduct transactions in Vietnamese Dong or Lao Kip, reducing reliance on foreign currencies and lowering transaction costs. The initiative aims to boost bilateral trade, investment, and tourism.

🇬🇧 Lyca Mobile and Revolut Pay launch first MVNO. The partnership aims to revolutionise payment experiences for customers by simplifying and enhancing payment processes. By integrating Revolut Pay, customers gain access to automated subscription and bill payments, real-time payment notifications, and one-click top-ups.

🇬🇧 Ebury to acquire Lithuanian international payments provider ArcaPay amid strong growth and continued profitability momentum. The acquisition will enable Ebury to expand in the Baltics, help existing clients grow in the region and further strengthen and complement its core capabilities in international payments.

🌍 Adyen powers wamo's latest payment service. The solution allows business owners to accept payments in-store or on the go, simplify cash flow management, consolidate payment and financial tasks and focus on growing their businesses. Continue reading

🇬🇧 Klearly snatches €6 million for in-person payments and to support SMBs across Europe. With this fresh injection of capital, Klearly looks to lead a transformation in the €7.9 trillion European point-of-sale market, reshaping how payments are processed and integrated into merchant operations.

🇫🇷 Lemonway unveils online onboarding solution for marketplaces, powered by Entrust identity verification solution. This solution eliminates the need for marketplaces to manage new customer onboarding themselves, allowing them to focus on strategy and business growth while staying competitive in the eyes of their partners.

GOLDEN NUGGET

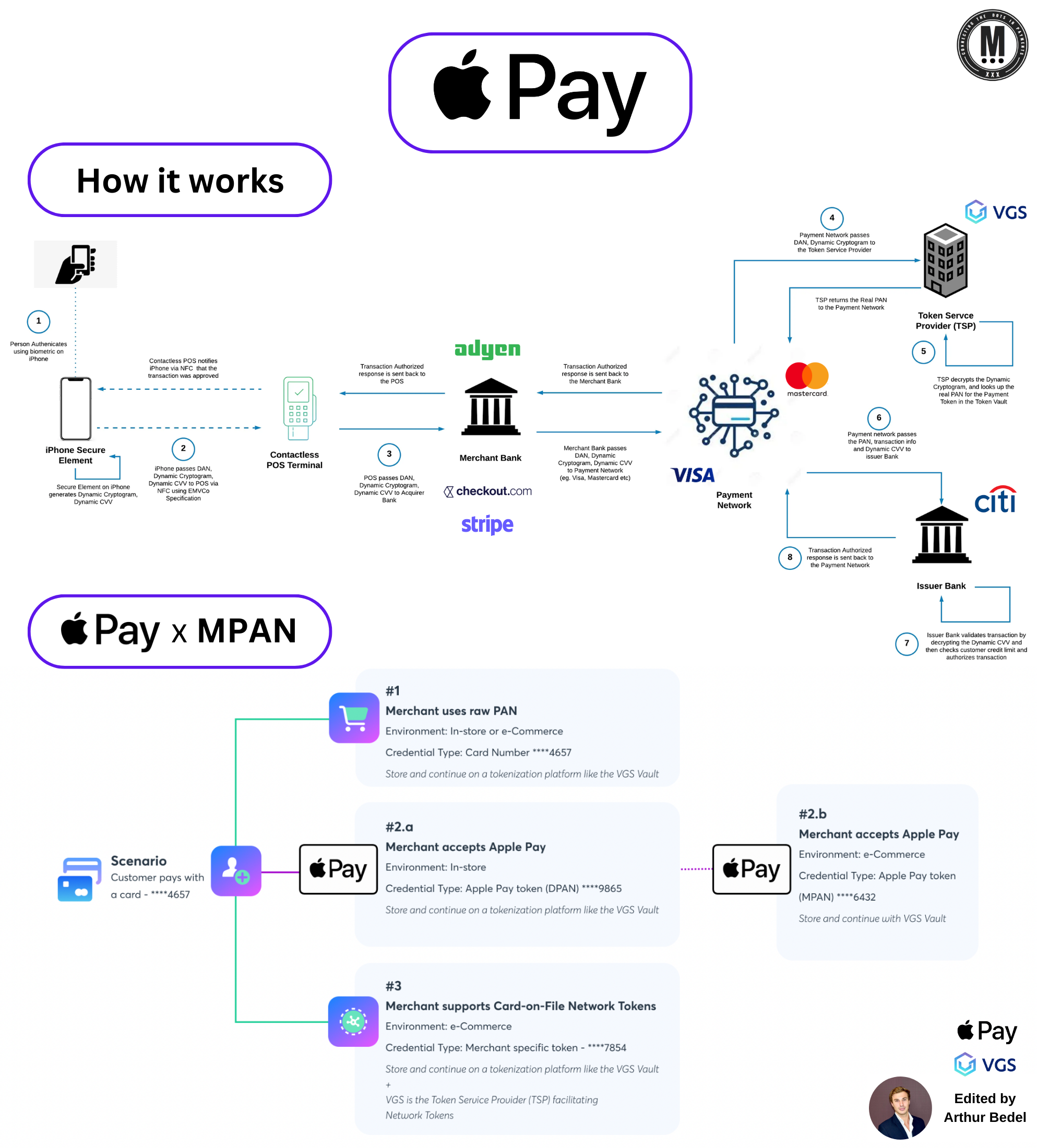

Apple𝐏𝐚𝐲 x 𝐌𝐏𝐀𝐍.

ApplePay is advancing payments with #MPANs, providing direct merchant account connections that enhance speed, security, and transaction data, surpassing the limitations of #DPANs tied to devices.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐩𝐩𝐥𝐞 𝐏𝐚𝐲?

ApplePay is a mobile payment and digital wallet service by Apple that allows users to make payments using an iPhone, Apple Watch, iPad, or Mac. It digitizes & replaces the traditional credit card and debit card chip and PIN or magnetic stripe transaction at point-of-sale terminals.

𝐇𝐨𝐰 𝐀𝐩𝐩𝐥𝐞 𝐏𝐚𝐲 𝐖𝐨𝐫𝐤𝐬:

1️⃣ 𝐒𝐞𝐭𝐭𝐢𝐧𝐠 𝐔𝐩: Users add their credit or debit cards to the Apple Wallet app on their iOS devices. The card information is not stored on the device or on Apple servers. Instead, a unique Device Account Number is assigned, encrypted, and securely stored in the Secure Element on your device.

2️⃣ 𝐌𝐚𝐤𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Users can make payments both in-store and online, by respectively using Tap to Pay or Face ID, Touch ID or their passcode to pay.

3️⃣ 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: ApplePay uses a Network Token (DPAN today). When a user makes a purchase, the token, along with a cryptogram (a one-time use, dynamic security code), is sent to the retailer for payment.

4️⃣ 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬:

► The token is sent to the card issuer (bank).

► The bank verifies the token and cryptogram.

► The bank authorizes the transaction.

𝐇𝐨𝐰 𝐭𝐨 𝐔𝐬𝐞 𝐀𝐩𝐩𝐥𝐞𝐏𝐚𝐲:

1️⃣ 𝐀𝐝𝐝 𝐚 𝐂𝐚𝐫𝐝: Open the Wallet app, tap the "+" button, and follow the steps to add a new card. Your bank or card issuer will verify your information, and you might need to provide additional verification.

2️⃣ 𝐈𝐧-𝐒𝐭𝐨𝐫𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭:

► Hold your iPhone near the contactless reader.

► Authenticate with Face ID, Touch ID, or your passcode.

► A checkmark and "Done" will appear on the display, indicating the payment was successful.

3️⃣ 𝐈𝐧-𝐀𝐩𝐩 𝐚𝐧𝐝 𝐎𝐧𝐥𝐢𝐧𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭:

► Choose ApplePay at checkout.

► Confirm the payment using Face ID, Touch ID, or your passcode.

Apple𝐏𝐚𝐲 𝐱 𝐌𝐏𝐀𝐍𝐬:

Traditionally, after cardholder verification, a device-specific network token (DPAN) replaces the customer's Primary Account Number (#PAN) in Apple Wallet. DPAN's make transactions secure, however, drawbacks include the need for a new DPAN when changing devices and the issuance of multiple DPANs across different devices.

𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭-𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐍𝐮𝐦𝐛𝐞𝐫 (𝗠𝗣𝗔𝗡) are not device-bound but linked to the user's iCloud, facilitating device changes without affecting the token.

🚨 Visa announced a mandate for merchants to use #MPAN instead of #DPAN for Standing Instruction transactions 𝐬𝐭𝐚𝐫𝐭𝐢𝐧𝐠 𝐉𝐮𝐥𝐲 30 2025.

Source: VGS & ApplePay

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()