Airwallex Expands Footprint in APAC

Hey Payments Fanatic!

Last week, Airwallex officially announced its expansion into New Zealand. Now, the company has signed a definitive agreement to acquire CTIN Pay, a licensed Intermediary Payment Service (IPS) provider in Vietnam.

This move strengthens its position in the Asia-Pacific (APAC) region, adding these new developments to its existing licenses in Australia, Singapore, Hong Kong, Malaysia, mainland China, and Japan. It reflects the company’s ongoing expansion across key APAC markets as demand for seamless cross-border payments continues to grow.

“Airwallex’s entry into Vietnam is a key step in our strategy to build a truly global financial platform,” said Arnold Chan, General Manager, APAC at Airwallex. “By addressing financial challenges in these markets, we empower local businesses to expand beyond borders. We're particularly excited about our progress and continued expansion in APAC, the region where Airwallex was born.”

To further drive its Southeast Asia expansion, Airwallex has appointed Ershad Ahamed as its new Head of Southeast Asia.

Enjoy more Payments industry updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

Time is running out! Get your ticket to the best event in FinTech.

INSIGHTS

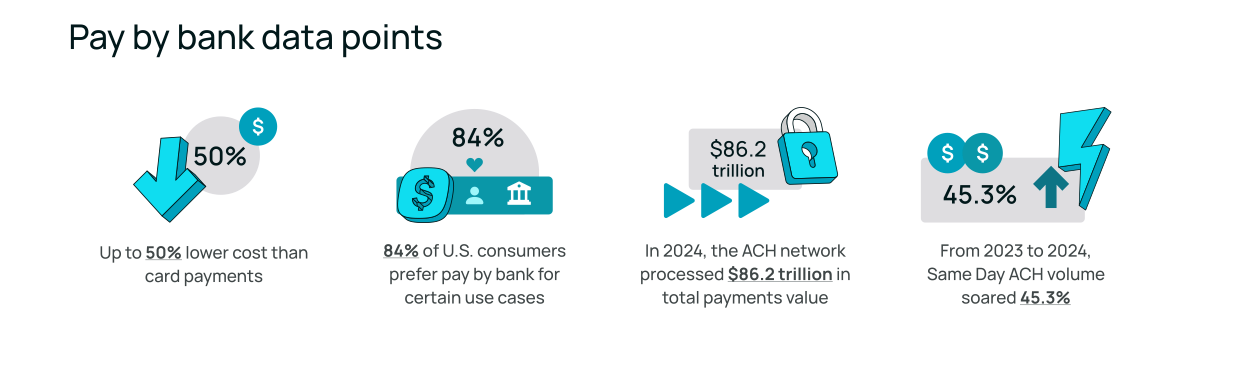

🇺🇸 The insider’s guide to pay by bank in the United States, by Aeropay. This guide compiles insights from dozens of interviews with the experts actively building pay by bank for the U.S. to provide a clear synopsis of the most important and unique details. It's packed with information to clear up confusion and misinformation about accepting pay by bank. Click here to download

PAYMENTS NEWS

🇮🇱 Papaya Global and Sumsub partner to provide clients with AI-powered fraud prevention and customer verification, while maintaining speed, accuracy, and regulatory compliance. The partnership ensures compliant payment transfers for companies and their workforce throughout the world.

🇵🇱 Mollie is now available to Polish businesses. With Mollie, Polish customers can use well-known payment methods such as BLIK and Przelewy24, as well as integrate with dozens of e-commerce platforms. This aims to provide companies with tools that will allow them to focus on what's most important - growing their businesses.

🇺🇸 Ryan Breslow is back as CEO of FinTech Bolt, after years of controversy. Bolt shared a communication that recently went out to investors in which Breslow wrote that “following a challenging few years”, he had been reinstated as Bolt’s CEO with “unanimous approval” of the board of the one-click checkout company.

🇺🇸 CFPB drops lawsuit against US banks over alleged fraud on Zelle. The agency dropped the case against JPMorgan Chase & Co., Bank of America Corp., Wells Fargo & Co. along with the parent company of the consumer payment network Zelle with prejudice, meaning it cannot be reopened.

🇺🇸 Prommt and Chargebacks911® announce new partnership. Monica Eaton, founder and CEO of Chargebacks911, stated that the partnership combines two exceptional technology solutions, enabling merchants to manage their remote payments and online transactions with confidence.

🇬🇧 BVNK launches embedded wallet that unifies fiat and stablecoin payments. The wallet brings together fiat, crypto and stablecoin payments, with direct access to leading blockchains and local and international payment schemes. Continue reading

🌍 Bespin Global and Ozone API join forces to offer cloud-based open banking solutions. The partnership will enable seamless, end-to-end compliance for financial institutions with minimal operational burden, while also providing the tools necessary to move beyond compliance when they are ready.

🇨🇴 Payoneer partners with Bancolombia’s neobank Nequi. Users will be able to transfer their dollars and euros from Payoneer to Nequi and receive them in Colombian pesos in a matter of minutes. Payoneer will enable Nequi users to bring euros through the Nequi platform for the first time.

🇵🇰 Payoneer partners with Meezan Bank. Under the partnership, Meezan Bank customers can link their Payoneer accounts to the bank’s mobile banking app to make real-time withdrawals in multiple global currencies directly into their Meezan local receiving accounts.

🌎 emerchantpay expands LatAm footprint with enhanced local acquiring capabilities in Brazil and Mexico. This strategic enhancement empowers merchants with higher acceptance rates, optimised cross-border transactions and more competitive pricing, ensuring a seamless payment experience for businesses operating in the region.

🇳🇬 Flutterwave signs deal with Small and Medium Enterprises Development Agency of Nigeria. Under this partnership, both will collaborate to provide MSMEs with seamless and secure digital storefronts, payment solutions, enabling them to accept payments from customers worldwide.

🇨🇦 Mastercard tasks new leads with steering innovation and strategy. Erin Elofson will lead Mastercard's operations in Canada as Division President and Janet George has joined as Executive Vice President of AI, focusing on AI integration across Mastercard's services. These changes are aimed at enhancing Mastercard's global growth and technology-driven offerings.

🇵🇰 Mastercard signs strategic collaboration with Mashreq to support its launch as a digital bank in Pakistan. This collaboration will introduce innovative digital propositions to individuals and businesses to bolster the digital economy, accelerate digital payment adoption, and drive financial inclusion.

🇰🇼 Visa launches Tap to add card in Kuwait, enhancing the ease and security of adding cards to digital wallets. The solution eliminates the cumbersome process of manual entry, a common source of errors and a vulnerability exploited by fraudsters seeking to compromise sensitive card information.

🇦🇪 Emirates NBD to introduce the Visa Commercial Pay-Mobile Module. This initiative aligns with the UAE Government’s vision of digitalizing payments while at the same time providing a distinctive and unique proposition to Emirates NBD’s clients to enhance payment efficiencies, enabling security, automation and reconciliation through tokenized credentials.

🇵🇹 Walletto integrates MB WAY as an option for improved payments. This addition to Walletto’s acquiring services aims to allow businesses to offer faster, safer, and more efficient payment experiences to their customers. Read more

🌍 Viva.com and Extenda Retail unite to advance cloud-native all-in-one retail & hospitality solutions in Europe. This partnership aims to provide retailers with the latest cloud-native warehouse-to-payments technology. Continue reading

🇺🇸 PayPal scammers adopt Docusign API to con customers. The program allows 'customers' to send emails that come from genuine Docusign accounts, and they can use templates to impersonate reputable companies. Users are notified of an 'unauthorised' transaction and given a contact number for security and refunds.

🌍 Alipay+ expands collaboration with Whale Cloud. Businesses will have access to digital wallet solutions with marketing tools, risk management systems, and financial service technologies. The collaboration aims to offer a super app solution for an open ecosystem for digital services.

🇬🇧 Fiinu bolsters leadership team with strategic appointments as plugin Overdraft® Project Advances. The company has appointed Dr. Feyzullah Egriboyun as Group CFO, Timo Rinne as Head of Technology, and Albert Owen III as Head of Operations. These strategic appointments are aimed at supporting the development and launch of Fiinu's Plugin Overdraft® platform in the UK.

GOLDEN NUGGET

What is Payment Routing?

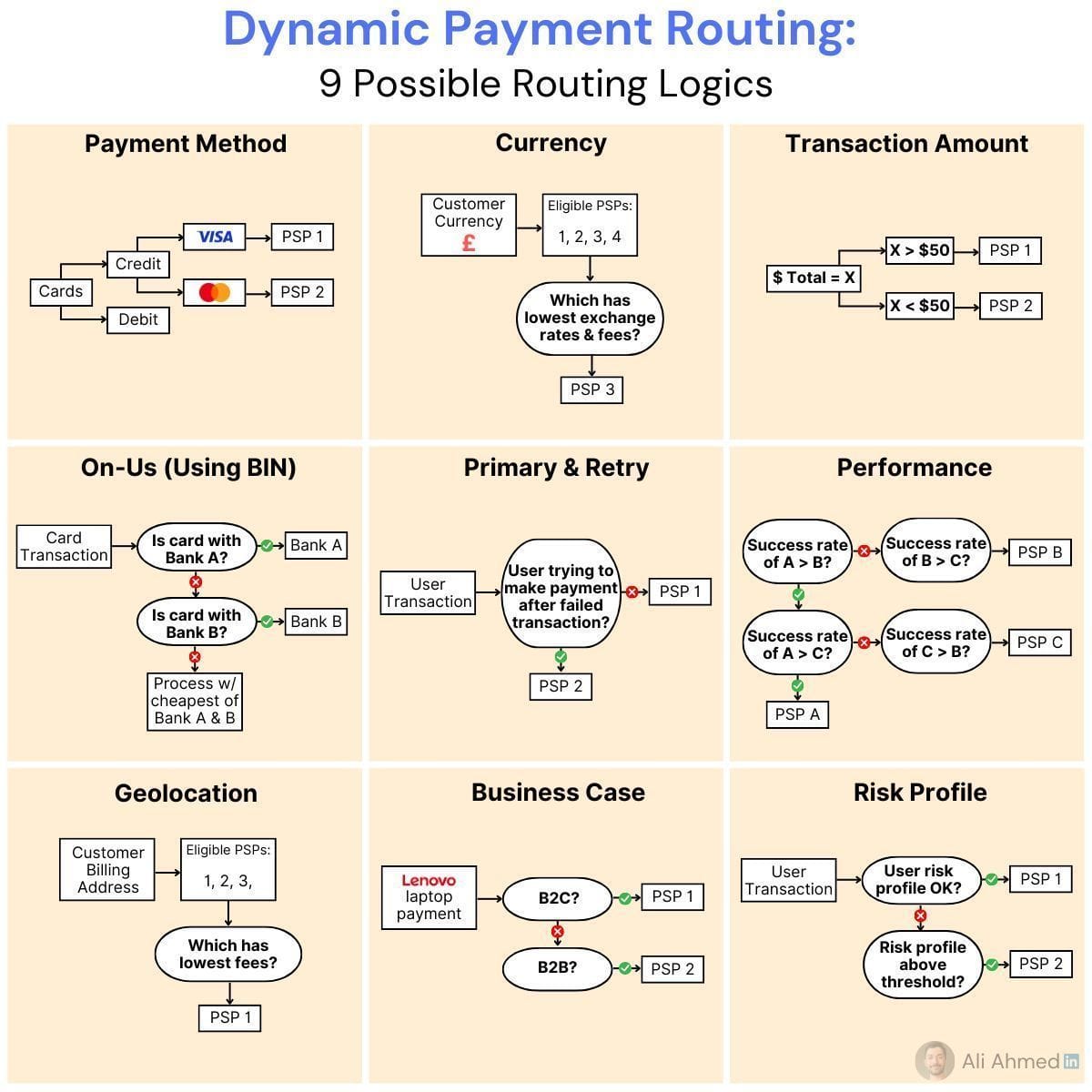

Below is a diagram made by Ali Ahmed of 9️⃣ potential routing logics you might encounter. 👇

Let’s break it down:

Payment routing is apart of the Payment process for merchants working with multiple PSPs.

The idea is that, based on a set of rules decided by the merchant, transactions will take the most efficient path to the right PSP.

There are 2 types of routing, static & dynamic.

1️⃣ Static Routing: Static routing is when a merchant delivers transactions to a PSP through a route they manually configured. The path of the transaction is set in stone & can't "intelligently" make the right decision.

2️⃣ Dynamic Routing: Dynamic payment routing is able to adjust the path of the transaction in real-time, based on current conditions. It's sometimes called "smart" or "intelligent" routing since it can make decisions based on logical rules, rather than a set path.

What are the benefits of dynamic routing?

► Resilience - Transactions can be rerouted if a path or node in the network goes down.

► Scalability - As payments become more complex, dynamic routing allows merchants to remove the burden of taking on more transactions than normal. Companies that are growing internationally (like Dollar Shave Club) benefit.

► Cost Effectiveness - Dynamic routing ensures that the lowest costly route is picked, meaning transaction fees are always lower on average.

► Load Balancing - To prevent congestion, or simply to fulfill volume metrics, dynamic routing can more evenly distribute transaction traffic across its existing network. Some high-risk merchant providers (like PaymentCloud) benefit here.

► User Experience - Faster transaction times, lower fees on average, & reduced likelihood of failed transactions mean that consumers don't experience friction, while merchants optimize revenue.

Should merchants build a dynamic payment routing system in-house, or use a provider? This question comes up a lot.

Long-term, an in-house dynamic routing system makes it hard to remain efficient & scalable.

Each new alternative payment method can take 2-4 weeks to integrate, each payment method or rail can have different fees, & issue handling takes longer.

By using a provider, like ACI Worldwide for example, adding new payment methods to routing is like turning on a light switch, there's only one fee for all payment methods & provider rails, and issue handling can be taken care of in minutes.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()