"AI Can Already Do All the Jobs Humans Do," Says Sebastian Siemiatkowski

Hey Payments Fanatic!

Klarna's workforce transformation is making headlines as CEO Sebastian Siemiatkowski revealed their headcount has decreased from 4,500 to 3,500 employees over the past year. While the company hasn't completely halted hiring, they're now only backfilling essential roles, primarily in engineering.

John Craske, Klarna's global press lead clarifies the shift: "When you look at it historically, we were hiring between one to one and a half thousand people a year from 2019 to 2022. Now, we're not actively recruiting to expand the workforce but only backfilling some essential roles." Meanwhile, Sebastian Siemiatkowski states: "I am of the opinion that AI can already do all of the jobs that we as humans do."

Despite Siemiatkowski's bold claims about AI replacing workers - including his recent use of an AI deepfake to report financial results - Klarna still maintains over 50 open positions globally. The company's current employee count matches its 2021 levels, reflecting a broader tech industry trend of workforce adjustments following pandemic-era expansion.

What's your take on AI's role in reshaping FinTech workforces? Share your thoughts in the comments below!

Read more global Payments industry updates below👇 and I'll be back tomorrow!

Cheers,

SPONSORED CONTENT

INSIGHTS

PAYMENTS NEWS

🇦🇺 Airwallex APAC revenue soars 83%. Lucy Liu, President and co-founder of Australian-founded payments unicorn Airwallex, tells Forbes Australia global revenue grew by 73 per cent year-over-year, and transaction volume increased 60 per cent. Read More

🇵🇰 Mastercard partner with Bank of Punjab to transform digital ecosystem. The collaboration seeks to transform the bank’s digital ecosystem and its customers’ digital experience. Also, see the launch of Islamic credit cards to address the high demand for Islamic banking payment solutions in Pakistan.

🇸🇦 Mastercard collaborates with Jeel to drive payment modernization in Saudi Arabia. This collaboration will bring unprecedented benefits to a wide range of stakeholders. It empowers non-banking financial institutions to bring innovative products to the market swiftly and efficiently with greater ease and peace of mind.

🇦🇪 LuLu Financial Holdings partners with Circle. This collaboration, which was formalised at the Abu Dhabi Finance Week (ADFW), will leverage USDC, Circle’s fully-reserved digital dollar, to facilitate cross-border payments, reinforcing LuLuFin’s position as a leader in adopting digital innovations to transform financial services.

🇨🇦 Neo Financial launches cashback credit cards. The decision to launch comes during a period of high cost of living, with individuals actively seeking methods to maximise the value of their spending, with Neo Financial’s credit card suite being developed to meet these demands.

🇳🇱 Two and ABN AMRO partner on B2B e-Commerce payments. Together, the firms are launching a state-of-the-art “Pay on Invoice” solution, designed to bring seamless, secure, and flexible payment options to B2B e-commerce transactions. Businesses can now offer 30-day net terms, improving cash flow and financial flexibility.

🇮🇳 Worldline and Forthcode partner for In-Flight Payments in India. The collaboration aims to streamline ancillary revenue management for airlines by integrating in-flight retail, inventory, and payment systems on a single cloud platform. This solution supports cashless purchases, quick transactions, and automated reconciliation.

🇰🇪 Juicyway has processed over $1B in cross-border payments. These transactions are powered by stablecoin technology at their core. According to its founders, the FinTech racked up these numbers with no publicly available app or marketing efforts. Read More

🇬🇧 Modulr secures contract to provide CoP services to HMRC. The agreement will enhance payment validation and security for HMRC's transactions with individuals and businesses. Modulr's CEO emphasized the importance of modern payment technology in improving public sector services.

🇯🇵 JCB now supports transactions on ETA apps for UK travelers. Starting on January 8, 2025, tourists from select countries will need an ETA to enter the UK. The move aligns with new UK border regulations and aims to enhance accessibility for JCB cardholders worldwide.

GOLDEN NUGGET

𝐏𝐚𝐲𝐨𝐮𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧: The Future of Seamless Global Payments, an untapped market 👇

In today's hyper-connected world, businesses are no longer bound by borders— but efficiently navigating the complexities of cross-border payments is no small feat. That's where Payout Orchestration steps in, revolutionizing how global payments are managed.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲𝐨𝐮𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧?

Payout Orchestration is a centralized approach to managing payouts across multiple payment methods, regions, and currencies. It consolidates diverse payment networks into a unified framework, allowing businesses to:

► Choose the most efficient payout option

► Ensure compliance with local regulations

► Optimize costs and transaction speed

𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐆𝐥𝐨𝐛𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

The payments landscape has evolved dramatically:

► 𝐄𝐚𝐫𝐥𝐲 𝐝𝐚𝐲𝐬: Manual processes with limited options

► 𝐆𝐫𝐨𝐰𝐭𝐡 𝐨𝐟 𝐅𝐢𝐧𝐓𝐞𝐜𝐡: Introduction of digital wallets, real-time payments, and card networks

► 𝐓𝐨𝐝𝐚𝐲: Businesses demand fast, secure, and scalable solutions to meet customer expectations globally

Globalization and technology have transformed payouts from a transactional necessity into a strategic advantage.

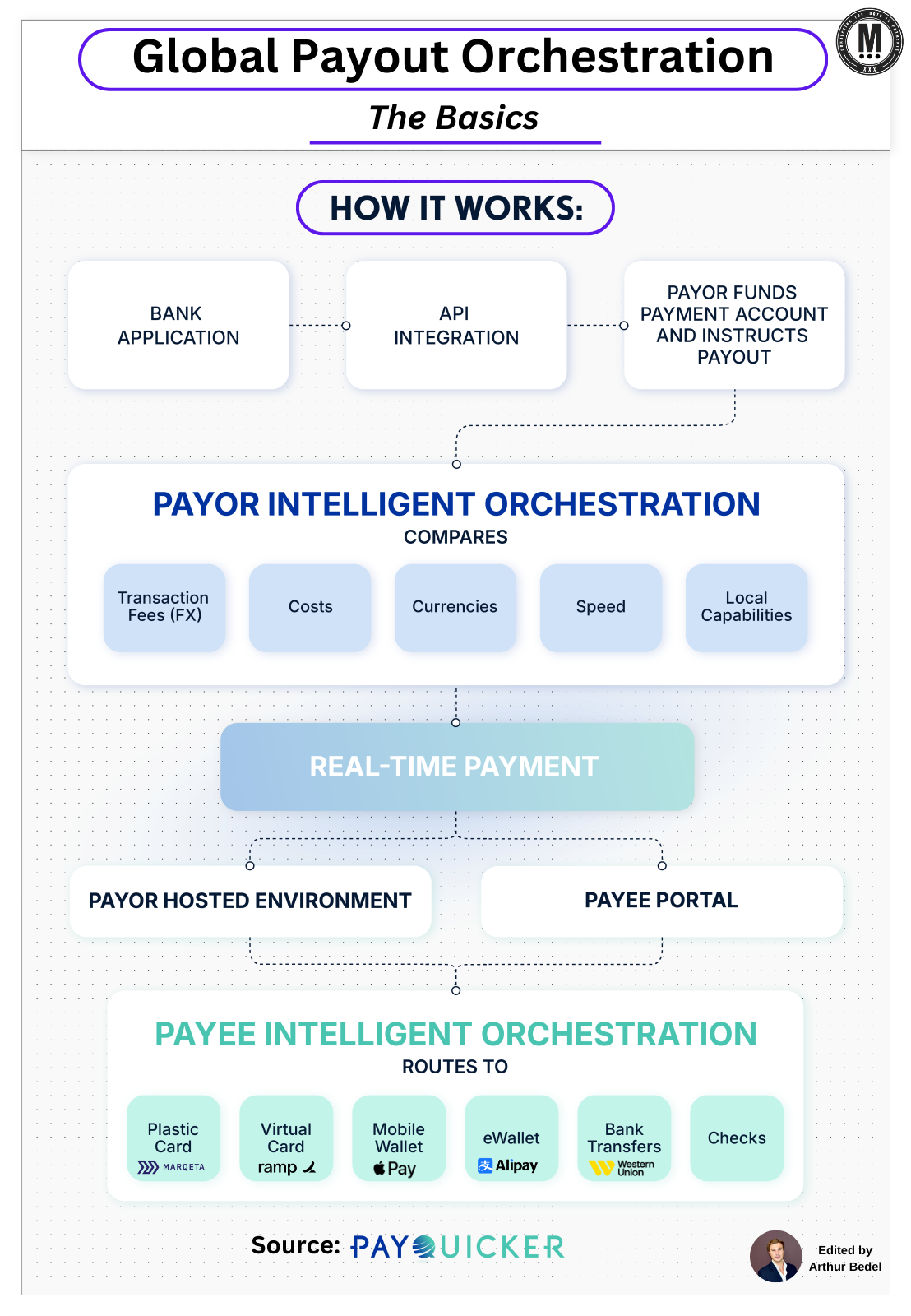

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐏𝐚𝐲𝐨𝐮𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐖𝐨𝐫𝐤?

1️⃣ 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧: Connects with multiple banks, payment processors, and payout methods through a single API.

2️⃣ 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧: Dynamically selects the most efficient route for each transaction based on factors like cost, speed, and compliance.

3️⃣ 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭: Automatically ensures every transaction aligns with regional regulations, avoiding delays and penalties.

4️⃣ 𝐒𝐜𝐚𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲: Provides businesses with the agility to expand into new markets without overhauling their payment infrastructure.

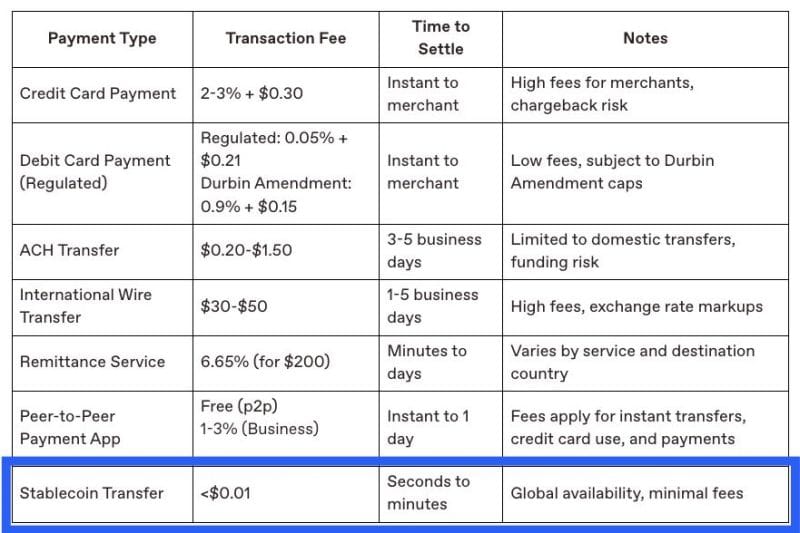

𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐏𝐚𝐲𝐨𝐮𝐭 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 & 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬

► Bank Transfers:

Direct payments to bank accounts worldwide — SWIFT, SEPA, ACH

► Digital Wallets:

Payments to platforms providing mobile or online payment storage — PayPal, Skrill, Alipay

► Real-Time Payments:

Instantaneous transfers in supported regions — Zelle, Faster Payments (UK), RTP Network (US)

► Prepaid Cards:

Reloadable cards for immediate access to funds — Payoneer, Netspend, Revolut

► Cash Pickup:

Payments available for collection at physical locations — Western Union, MoneyGram International, Ria Money Transfer

The power of Payout Orchestration lies in its ability to bridge the gap between businesses and their global workforce, customers, and partners. By simplifying the complex and optimizing the payment journey, businesses can focus on growth — not logistical headaches.

Source: PayQuicker

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()