Affirm Tops Expectations in Q1 Earnings

Hey Payments Fanatic!

Affirm, the buy-now-pay-later giant, reported stronger-than-expected results for Q1, surpassing forecasts on both revenue and earnings.

- Loss per share: 31 cents vs. 35 cents expected

- Revenue: $698 million vs. $664 million forecast

- GMV: $7.6 billion, up 35% year-over-year

Affirm’s revenue rose 41% to $698 million, while key metric RLTC reached $285 million, beating guidance. With partnerships like Apple, Amazon, and Shopify, Affirm continues to expand its reach and remains focused on GAAP profitability by Q4 2025.

The company expects Q2 revenue between $770 million and $810 million, with GMV projected at $9.35 billion to $9.75 billion, further solidifying its growth momentum.

Catch more updates below👇 and see you tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 Check out Global Payment Trends report by HSBC. This edition focuses on how the payments landscape continues to transform, driven by technological advancements, the adoption of new digital business models and the emergence of new payments infrastructure. Link here

PAYMENTS NEWS

🇬🇧 Solidgate Introduces No-Code Payment Links—Now Live in Solidgate HUB. Solidgate Payment Link is a reusable URL that lets businesses instantly create and share payment links with clients. It allows merchants to generate unique links for products or services, sharing them across social media, email, or chat for convenient customer payments.

🇺🇸 ACI Worldwide, Inc. reports financial results for the Quarter ended September 30, 2024. “We are very pleased with our third quarter results and the continued positive momentum in the business. We saw particular strength within our Bank and Merchant segments and are once again raising our full-year outlook,” said Thomas Warsop, president and CEO of ACI Worldwide.

🇸🇬 FOMO Pay teams up with Mastercard to enable contactless card acceptance through FOMO SoftPOS. The solution provides customers with more payment options while giving merchants greater flexibility and mobility as multiple smartphones can be activated for use as needed.

🇹🇬 Ecobank partners with Nium to unlock real-time cross-border payments across 35 African markets. This partnership is set to revolutionise the region's payments landscape by enabling faster, more efficient international payments for businesses and consumers alike.

🇨🇦 TD integrates with TouchBistro to provide payment solution to Canadian restaurant owners. This will enable Canadian restaurant and food service entrepreneurs to consolidate all management and payment services into one, easy to use POS and restaurant management system.

💰 Visa backs four new African FinTech start-ups as part of $1bn continental commitment. Investment recipients include Nigeria’s AI-powered address verification platform OkHi, Kenya’s HR and payroll platform Workpay, Ghana’s business lending and payments app Oze, and restaurant software vendor Orda. Africa, which operates between Nigeria and Kenya.

🇨🇳 XTransfer showcases cross-border payment solutions at SFF 2024. The company aims to expand its presence in Southeast Asia, offering secure and efficient payment solutions to SMEs in the region. Continue reading

🇮🇹 Satispay raises €60M, reaching Unicorn status after previous €90M and €320M rounds. According to Corriere, the new capital injection comes again from the three funds involved in the last major funding round: Addition, Greyhound Capital, and Lightrock. More info here

🇩🇪 Lunu Pay and Ingenico bring crypto payments to physical retail stores. The collaboration is a key step in making digital currencies more accessible for consumers and enabling merchants to embrace the crypto market confidently, without technical barriers.

🇳🇵 NCHL and Ant International launch NEPALPAY QR for cross-border payments. The feature enables travelers from ten regions, including China, Hong Kong, Singapore, and South Korea, to use their native e-wallets and banking apps at over 875,000 NEPALPAY QR-compatible merchants in Nepal.

🇺🇸 This year, U.S. consumers are expected to spend about $𝟭𝟴 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 on bargain shopping site Temu. Behind the scenes, though, Temu has encountered trouble with the bank that was handling those payments. Find out more

🇳🇱 Netherlands-based Intersolve names Five Degrees co-founder Martijn Hohmann as provisional CEO. Hohmann takes the reins of the payment processor from managing director André Moen. Intersolve said in a Linkedin post that Hohmann will focus on “product innovation and other business development”.

GOLDEN NUGGET

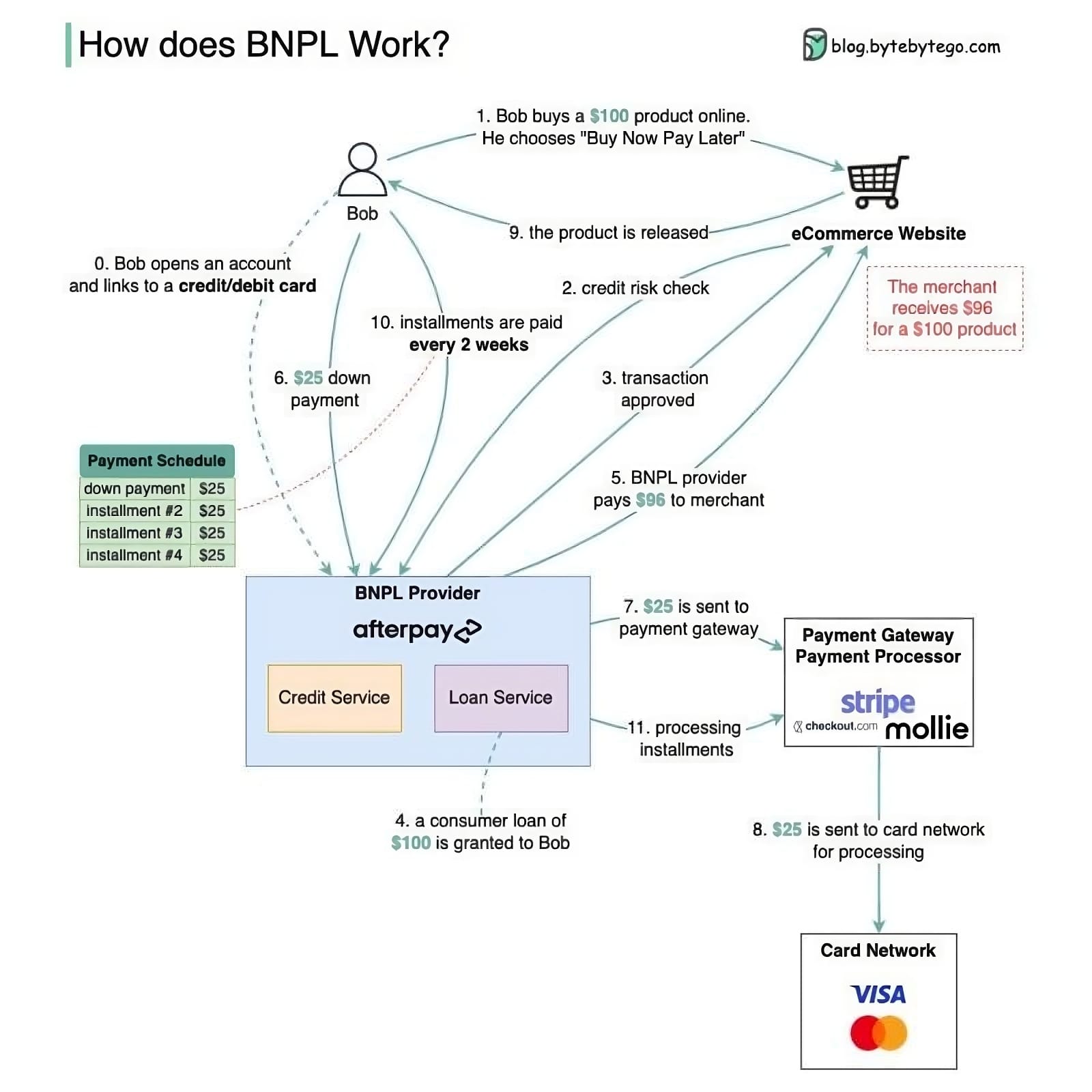

🤔What is 𝗕𝘂𝘆 𝗡𝗼𝘄, 𝗣𝗮𝘆 𝗟𝗮𝘁𝗲𝗿 (BNPL), and how does it work?

Here is a step-by-step guide:

Todays “Weekend FinTech Education” update is all about one of the most discussed subjects in FinTech in recent years: 𝘽𝙪𝙮 𝙉𝙤𝙬 𝙋𝙖𝙮 𝙇𝙖𝙩𝙚𝙧.

The growth of BNPL has been dramatic in recent years. The BNPL provider represents the primary interface between the merchants and the customers for both eCommerce and POS (Point of Sale).

The diagram above shows how the process works:

‣ Step 0. Bob registers with AfterPay. An approved credit/debit card is linked to this account.

‣ Step 1. The "Buy Now, Pay Later" payment option is chosen by Bob when he wants to purchase a $100 product.

‣ Steps 2-3. Bob's credit score is checked by the BNPL provider, and the transaction is approved.

‣ Steps 4-5. A BNPL provider grants Bob a $100 consumer loan, which is usually financed by a bank. A total of $96 out of $100 is paid to the merchant immediately (yes, the merchant receives less with BNPL than with credit cards!) Bob must now pay the BNPL provider according to the payment schedule.

‣ Step 6-8. Bob now pays the $25 down payment to BNPL. Stripe processes the payment transaction. It is then forwarded to the card network by Stripe. The card network must be paid an interchange fee since this goes through them as well.

‣ Step 9. Bob can now receive the product since it has been released.

‣ Steps 10-11. The BNPL provider receives installment payments from Bob every two weeks. Payment gateways process installments by deducting them from credit/debit cards.

I highly recommend the complete deep dive article by ByteByteGo for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()