Affirm & Shopify Take Shop Pay Installments to New Markets

Hey Payments Fanatic!

Affirm and Shopify are accelerating their international expansion, marking an important milestone in their ongoing partnership.

For the first time, Shopify merchants in Canada will offer Shop Pay Installments, powered by Affirm. This marks a significant step outside the U.S., with plans to expand to the U.K. and other key global markets later this year.

Shop Pay Installments, which allows shoppers to pay over time with transparent, flexible payment plans, has been a popular feature in the U.S. since its launch in 2021. Now, as it makes its way to new regions, the companies aim to bring that same simplicity and accessibility to merchants and consumers worldwide.

Max Levchin, Founder & CEO of Affirm, explained, “From day one, Affirm’s partnership with Shopify has been focused on empowering merchants to succeed by offering transparent, flexible payments that unlock purchasing power for consumers.”

This global expansion will enable merchants to activate Shop Pay Installments directly from their Shopify dashboard, without the need for complex integrations. As Affirm continues to broaden its footprint, it’s clear that seamless, flexible payment options are becoming an essential part of the global commerce landscape.

If you want to catch up on the latest in Payments, keep scrolling!

Cheers,

Network & Run - Looking for a space where networking meets fitness?🏃♂️💬 Join our weekly runs and connect with FinTech Fanatics while staying active! 📅Check out April/May schedule & Sign Up Here to be part of a vibrant community of over 19+ cities.

INSIGHTS

Check out these 'Market Monitor 2024' stats from Belgium 🇧🇪 by Becom 👇

PAYMENTS NEWS

🇸🇬 Airwallex reports triple-digit full year revenue growth in Singapore for 2024, unveils SME trends shaping business outlook in 2025. FY2024 revenue more than doubled, growing 153% year-on-year (YoY), fueled by strong transaction volumes and a standout Q4. In early 2025, it announced its launch in New Zealand and acquired Vietnam-based CTIN Pay.

🇺🇸 Stripe is not becoming a bank. Some wondered if Stripe would now be considered a bank. The short answer is: No. What is true is that this marks the first time that Stripe has applied for a banking license. This does not mean it will be accepting deposits, but will process its own payments if approved.

🇮🇳 FinTech firm Razorpay launches Turbo UPI Plugin on BHIM Vega platform. The solution enables businesses to offer seamless in-app payment experiences, allowing customers to complete transactions instantly without switching to third-party apps.

🇬🇧 FinTech Ryft raises £5.7M Series A to challenge Stripe and Ayden. It plans to use the new funding to support its international expansion and grow its team. The company's technology enables acquiring banks to split payments and process payouts at a much lower cost than alternatives.

🇦🇪 Tap Payments granted UAE retail payment licence, completes GCC regulatory approval. The new license enables the Saudi-headquartered firm to offer its payments suite, which supports over 20 different payment methods, to businesses in the UAE.

🇬🇧 Yapily and Allica Bank join forces to bring the power of open banking’s seamless, secure top-ups to UK SME current accounts. By leveraging Yapily’s open banking technology, Allica Bank is now building on its mission to give established businesses the banking they deserve by enabling them to top up their accounts even faster.

🇸🇦 Telr teams up with Saudi Awwal Bank to boost eCommerce payments. Merchants will gain access to a wide range of tools, including payment links, QR codes, digital invoicing, recurring payments, BNPL options, and other proprietary features.

🇺🇸 Los Angeles-based Rain raised a $75M Series B in another good sign for FinTech. The startup plans to use the new funds to help it add credit card and saving products to its roster. It aims to attract employers who want to help employees access earned wages between their paychecks with automation.

🇦🇺 iGoDirect appoints Hamish Moline as new CEO. Under his leadership, iGoDirect will focus on strengthening partnerships, streamlining product offerings, and delivering enhanced value to clients and customers. With a proven track record of driving growth, innovation, and strategic partnerships, Hamish is well-positioned to lead iGoDirect into its next phase of expansion.

🇺🇸 Amex-backed Blackbird wants restaurants to cut payments middlemen. The Blackbird app allows customers to pay for meals and accumulate points in a blockchain-based program called $FLY, which can be used to pay for meals at other restaurants in the network.

🇲🇦 Moroccan FinTech PayTic secures $4M to expand payment automation across Africa. The recent funding is expected to bolster PayTic’s efforts to address the increasing demand for efficient payment processing solutions in Africa. Continue reading

🇺🇸 PayPal’s Xoom partners with Tenpay Global to offer cross-border remittances to Weixin. This new partnership allows Weixin Pay users to receive money directly into their Weixin Pay Wallet Balance or bank accounts linked to Weixin Pay through Xoom or PayPal's mobile app and website.

🌎 Spreedly and EBANX team to promote local payments in LatAm. The partnership is designed to help international companies access local payment options in the Latin American (LatAm) region. It provides a unified framework for businesses to offer payment methods.

🇿🇦 BNPL in South Africa gets boost with Happy Pay and Peach Payments partnership. The collaboration will allow thousands of online merchants using Peach Payments to offer customers interest-free, deposit-free payment options through Happy Pay.

GOLDEN NUGGET

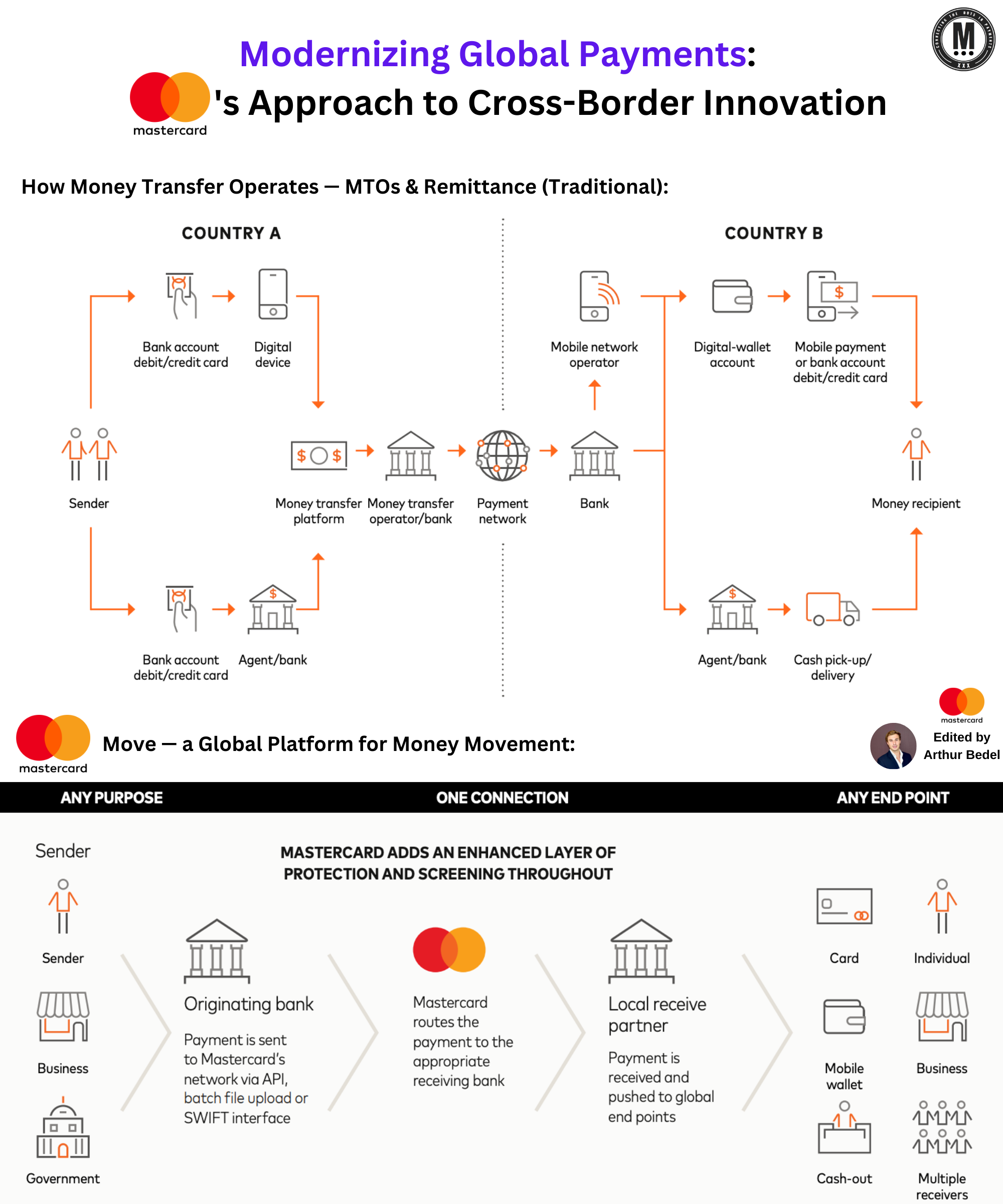

Mastercard 𝐌𝐨𝐯𝐞 — 𝐚 𝐧𝐞𝐰 𝐚𝐩𝐩𝐫𝐨𝐚𝐜𝐡 𝐭𝐨 𝐦𝐨𝐝𝐞𝐫𝐧𝐢𝐳𝐢𝐧𝐠 𝐜𝐫𝐨𝐬𝐬-𝐛𝐨𝐫𝐝𝐞𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬👇

Traditional cross-border payments are often slow, costly, and lack transparency— issues that can hold back global e-commerce, marketplaces and revenue in general. Mastercard Move is stepping up to address these challenges with real-time speed, lower costs, and clear, upfront fees.

𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬:

► 𝐁𝐚𝐧𝐤/𝐖𝐢𝐫𝐞 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫𝐬: Secure and widely used, but often costly, slow, and lacking fee transparency.

► 𝐌𝐨𝐧𝐞𝐲 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫 𝐎𝐩𝐞𝐫𝐚𝐭𝐨𝐫𝐬 (MTOs): Fast and accessible but with high fees and increased fraud risk, especially in cash-based transfers.

► 𝐂𝐚𝐬𝐡-𝐁𝐚𝐬𝐞𝐝 𝐑𝐞𝐦𝐢𝐭𝐭𝐚𝐧𝐜𝐞𝐬: Essential for areas with limited banking infrastructure, but prone to fraud and higher costs.

These legacy systems have long created delays and additional costs for businesses and individuals alike. Now, Mastercard Move offers a fresh approach, designed to empower global marketplaces and improve cross-border payments.

𝐖𝐡𝐲 Mastercard 𝐌𝐨𝐯𝐞 𝐢𝐬 𝐚 𝐆𝐚𝐦𝐞-𝐂𝐡𝐚𝐧𝐠𝐞𝐫:

► 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬: Enables same-day to real-time transfers across 10 billion+ endpoints like bank accounts, wallets, and cash-out locations.

► 𝐓𝐫𝐚𝐧𝐬𝐩𝐚𝐫𝐞𝐧𝐜𝐲 & 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲: Provides clear FX rates, upfront fees, and fast delivery with real-time status updates.

► 𝐆𝐥𝐨𝐛𝐚𝐥 𝐑𝐞𝐚𝐜𝐡: Operates in 180+ countries and 150+ currencies, making it accessible to millions.

► 𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐝 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: Mastercard’s trusted network offers advanced fraud protection, ensuring safer transactions.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞:

Imagine a global marketplace enabling vendors in one country to receive payments from international buyers instantly, with lower fees and greater transparency. This improved payment experience means vendors get their funds faster, which strengthens trust and supports growth.

eBay / Etsy / StockX / Wayfair / Instacart / DoorDash / Uber

As the demand for digital payments soars, Mastercard Move is setting a new standard for seamless, secure, and fast cross-border payments, positioning global businesses for success!

Source: Mastercard

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()