Affirm Expands to the UK

Hey Payment Fanatic!

Affirm, the American FinTech giant known for its flexible buy now, pay later (BNPL) options, has officially launched its first overseas expansion in the U.K.

Max Levchin, in a conversation with CNBC, emphasized the decision behind targeting the U.K. first: “It is a huge market, it’s English-speaking… We got such an enormous amount of market pull. It kind of sealed the deal for us.”

This expansion comes as the U.K.’s FinTech sector remains fiercely competitive, housing giants like Klarna, PayPal’s BNPL service, and Zilch continue to be fiercely competitive. Yet, Affirm believes its unique long-term payment plans—some stretching up to 36 months—set it apart from rivals.

This launch arrives at a pivotal moment as the U.K. government considers new BNPL regulations aimed at greater consumer protection. Levchin welcomed this move, stating, “We welcome regulation that is thoughtful… Telling us do lots of work in the background before you lend money is great. We’re very good at automating. Pushing the onus on the consumer is dangerous.”

With authorization from the Financial Conduct Authority secured and a lineup of merchants already on board, including Alternative Airlines and Fexco, Affirm is poised to shake up the U.K. market.

What do you think about this expansion? Tell me more in the comments.

Cheers,

SPONSORED CONTENT

INSIGHTS

The integrated payments' play: Software + Payments

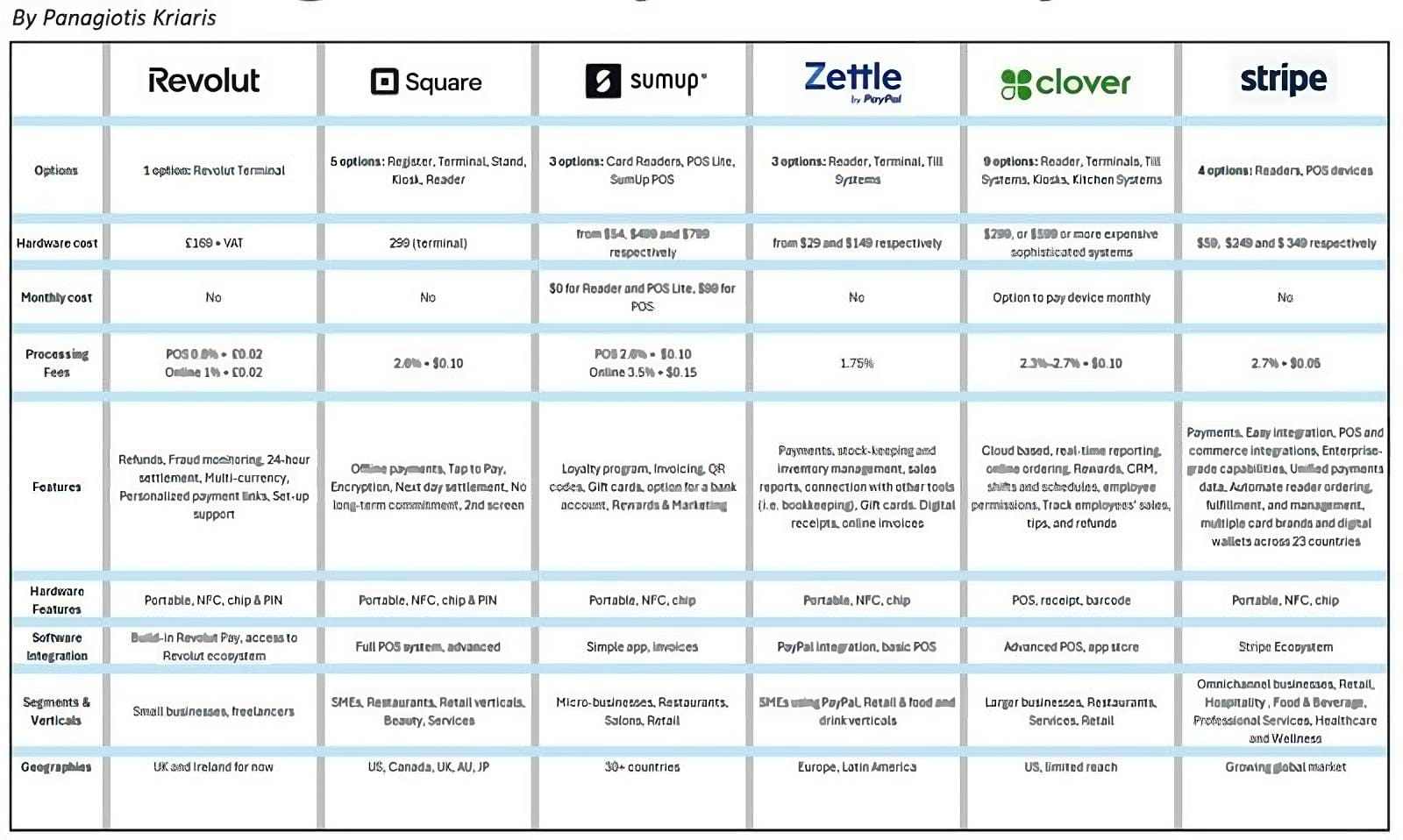

A great overview by Panagiotis Kriaris 👇

PAYMENTS NEWS

💬 How cloud modernisation is accelerating payments innovation. An interview with Scotty Perkins, Global Head of Product Management and Head of Banking and Intermediaries at ACI Worldwide, who discusses cloud modernisation's impact on payments, financial inclusion, and future trends in FinTech. Dive into the full interview here

🇺🇸 Visa has deployed hundreds of AI use cases. It’s not stopping. Visa is accelerating generative AI use, with over 500 applications, to enhance innovation and counter evolving fraud tactics. Simultaneously, it's restructuring globally, planning 1,400 layoffs by year-end, according to sources.

🇳🇿 New digital wallet and POS app Payap gears up for 2025 launch in New Zealand. The company’s app leverages open banking for a low-cost, contactless payment solution, offering consumers a digital wallet that unifies bank accounts, gift cards, and loyalty cards for instant QR payments in-store and online.

🇺🇸 Checkbook joins J.P. Morgan Payments Partner Network, Checkbook and J.P. Morgan Payments will transform digital check payments, allowing J.P. Morgan corporate clients to send digital checks directly from their accounts, enhancing B2B and B2C transactions.

🇸🇬 Anchorage Digital Singapore Pte Ltd receives Major Payment Institution licence from the Monetary Authority of Singapore (MAS). With this license, Anchorage Digital Singapore now offers a complete, integrated solution including custody, staking, trading, and settlement, including fiat on and off ramps.

🇵🇭 Wise granted access to Philippines’ InstaPay. Wise’s connection to InstaPay will enhance cross-border payments for its 13 million global customers and millions more from major banks and financial institutions. Continue reading

🇰🇪 FinMont announces strategic partnership with leading African payment processing provider, iPay. This aims to enhance FinMont’s payment ecosystem by integrating iPay’s innovative payment services, offering more flexibility and improved processing capabilities for FinMont’s global network of travel industry merchants.

🇰🇷 Korea’s SentBe goes live with Visa Direct’s card transfer service. SentBe, among Korea's first FinTechs to adopt Visa Direct, enables real-time overseas payments via Visa’s network, offering secure transfers at 90% lower costs than traditional banks for added convenience.

🇨🇭 BIS exits ‘Project mBridge’ citing maturity amid BRICS speculation. BIS General Manager Agustín Carstens shared the transition during a fireside chat at the Santander International Banking Conference 2024 in Madrid, emphasizing that the decision was due to the project’s maturity and not political reasons or failure.

🇺🇸 FinTech firm FIS' profit rises on strong demand for banking solutions. FIS reported a 37% Q3 profit increase, fueled by rising demand for its banking, payments, and capital market solutions, particularly as small and mid-sized banks adopt digital services to stay competitive.

GOLDEN NUGGET

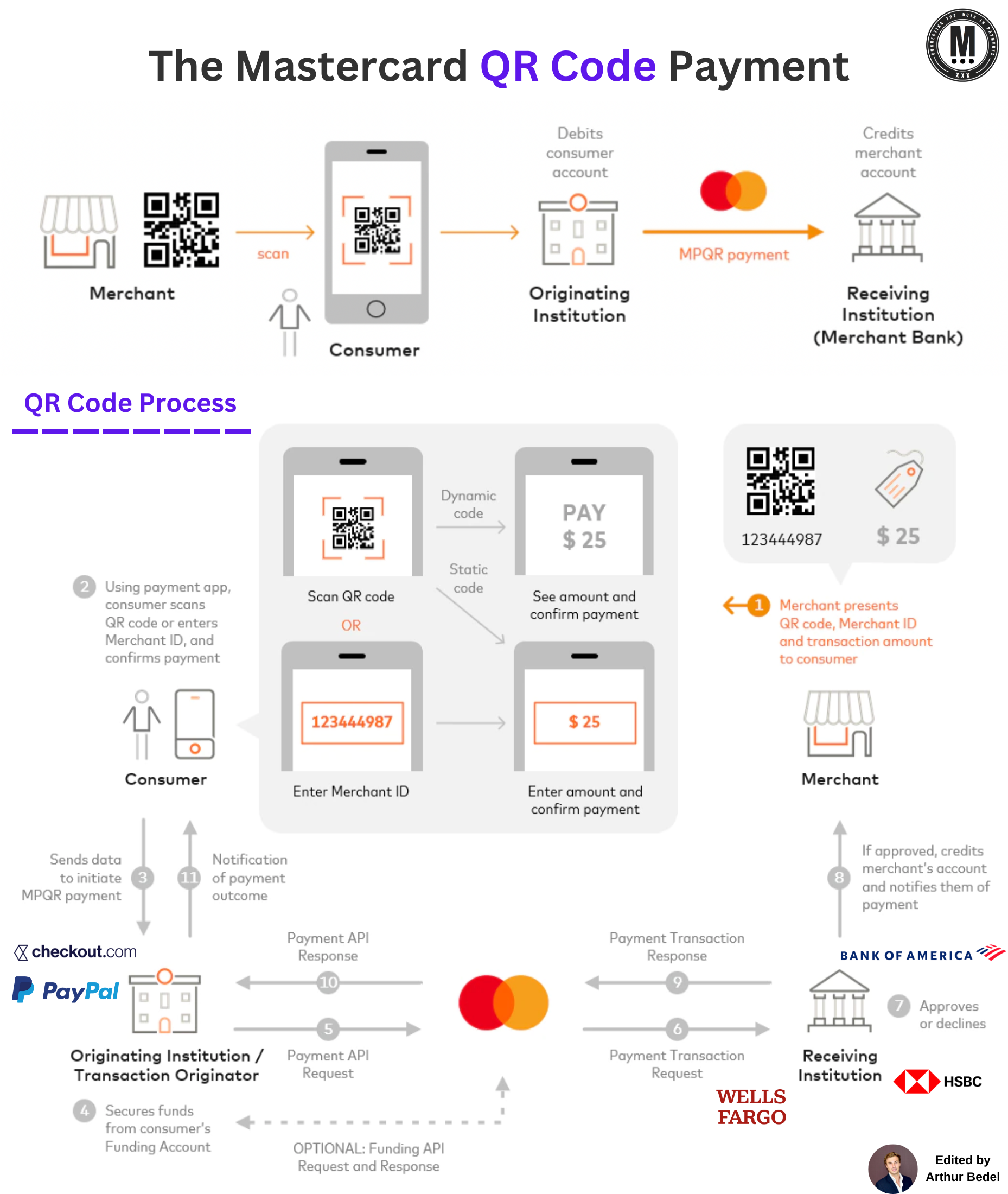

By simply scanning 𝐌𝐚𝐬𝐭𝐞𝐫𝐜𝐚𝐫𝐝'𝐬 - 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐏𝐫𝐞𝐬𝐞𝐧𝐭𝐞𝐝 𝐐𝐑 𝐂𝐨𝐝𝐞 (𝐌𝐏𝐐𝐑) consumers can make cashless payments but how exactly?👇

MPQR enables consumers to make digital payments for goods and services from their mobile phones by simply scanning a Mastercard QR Code or manually inputting an alias provided by any Mastercard QR accepting merchant.

This push-payment method has the convenience of cash and the security of a card payment, without needing a card payment terminal - or called Point Of Sale (POS).

𝐇𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬 👇

MPQR and Mastercard QR codes facilitate many different fast-payment use cases. Merchants can present QR codes on their:

🔸websites

🔸mobile devices

🔸in-store signage

🔸invoices

🔸ticket machines

🔸others...

𝐌𝐚𝐬𝐭𝐞𝐫𝐜𝐚𝐫𝐝 𝐐𝐑 𝐜𝐨𝐝𝐞𝐬 𝐜𝐚𝐧 𝐛𝐞:

► 𝐃𝐲𝐧𝐚𝐦𝐢𝐜: The code includes the transaction amount and is generated for each transaction (often the best option***)

► 𝐒𝐭𝐚𝐭𝐢𝐜: The code excludes the transaction amount and is used for all transactions. The consumer enters the transaction amount in their payment app after scanning the code.

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐡𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬 👇

1️⃣ Merchant presents QR code, Merchant ID and transaction amount to consumer

2️⃣ Using Payments App, consumer scans QR code or enters Merchant ID and confirms payments

3️⃣ Data is sent to the Acquirer (Nuvei) or Wallet (PayPal or Alipay) - called Originating Institution - to initiate MPQR Payment

4️⃣ & 5️⃣ Acquirer or Wallet secures the funds and does a Payment API request to Mastercard

6️⃣ & 7️⃣ Mastercard passes the transaction request to Receiving institution, Issuers (Wells Fargo or Citi) who approves or declines it.

8️⃣ If approved, the merchant's account is credited and a notification of payment is sent to them

9️⃣ - 1️⃣1️⃣ Payment Transaction Response is sent back from the Issuer through Mastercard to the Acquirer and finally the consumer with a notification of payment outcome

𝐍𝐎𝐓𝐄 -- Mastercard does not transmit funds. All Mastercard QR and Mastercard Network funds are transmitted by a licensed Financial Institution for which Mastercard provides data processing services.

During the pandemic,QR codes exploded as an Alternative Payment Method (APM). By 2025, 100M U.S. Consumers will be scanning QR codes to make digital payments both in-store and online. It's easy, efficient and secured.

Check it out & don't forget about Mastercard Send, Ethoca and other amazing solutions proposed by the Payments Giant

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()