Affirm and Sixth Street Strike $4B Loan Partnership

Hey Payments Fanatic!

Buy Now, Pay Later (BNPL) company Affirm has partnered with private credit giant Sixth Street on a $4 billion, three-year loan deal—the largest in Affirm's history. Sixth Street will provide upfront capital for Affirm to issue short-term installment loans, with repayments reinvested to extend up to $20 billion in loans over the partnership.

This deal highlights the growing synergy between fintech and private credit, with asset managers increasingly funding nonbank lenders like Affirm. Unlike banks, which rely on deposits, fintechs use diversified funding models like this forward flow agreement. Sixth Street will purchase Affirm-originated loans used for purchases on platforms such as Amazon and Apple.

While private credit is the main driver, traditional banks still play a role, indirectly financing loans through private-credit funds. Affirm's funding capacity has soared to $16.8 billion, growing 130% in three years, while its gross merchandise volume rose 34% in the first nine months of 2024.

Affirm offers APRs between 0%-36%, with no late fees for missed payments. As of September, its delinquency rate was just 2.8%.

Wishing you a fantastic week ahead, I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

INSIGHTS

PAYMENTS NEWS

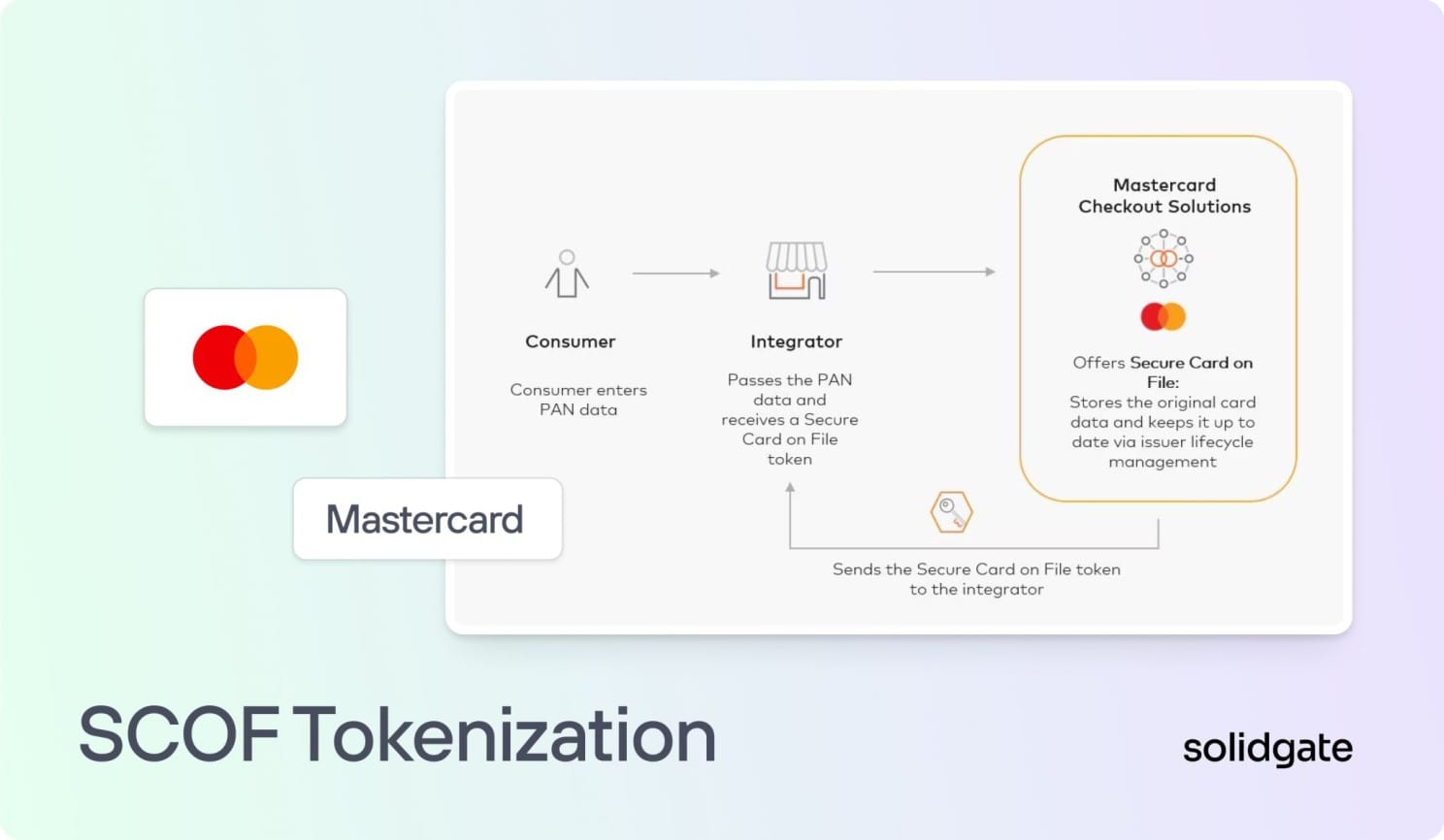

🇬🇧 Solidgate upgrades to Mastercard's Secure Card-on-File (SCOF) tokenization. This milestone is pivotal in the company's journey to redefine payment security and efficiency. Through SCOF, they’ve adopted Mastercard’s robust tokenization technology to enhance payment security, reduce fraud, and optimize the payment experience for merchants and cardholders around the world.

🇺🇸 Global Payouts Orchestration: Driving Payments 3.0. As businesses expand globally and workers seek faster, more flexible access to earnings, Global Payouts Orchestration is reshaping the industry. Discover how it’s driving speed, flexibility, and seamless cross-border transactions in the evolving global payments landscape. Explore PayQuicker’s insights to learn more

🇮🇱 Mesh Payments partners with SoFi Bank and Galileo to revolutionize travel and expense management. This partnership integrates Mesh Payments’ next-generation expense and card infrastructure with SoFi Bank’s scalable financial framework and Galileo’s modern, and customizable API-based payments processing platform. Read More

🇨🇦 Nuvei has expanded its partnership with Google, to integrate Google Pay into its cashier solution for merchants across Latin America. The integration helps businesses access new customer segments and supports growth in the region. The shift to mobile and digital payments is driven by consumer demand for convenience and speed.

🇺🇸 FlexPoint’s AI System enables same-day ACH Payments. The system connects to the Federal Reserve’s FedNow® Service, enabling faster transfers for businesses of all sizes. FlexPoint aims to bring faster payment capabilities to a broader market, helping to address cash flow challenges.

🇬🇧 Wirex launches Visa Platinum Card in the UK, giving exclusive benefits in addition to standard Visa perks. The card has no annual fees and flexible spending limits. It also offers secure, contactless payments and advanced fraud protection. Explore more

🇻🇳 Vietnam and Cambodia launch cross-border QR payment linkage. The initiative allows Vietnamese and Cambodian visitors to use their domestic currencies, VND and KHR, for payments at various merchants in each other’s country. This new payment system is expected to boost tourism and economic ties between the two nations.

🇪🇬 Visa introduces Apple Pay to customers in Egypt, offering a secure, seamless way to pay in-store, in-app, and online. It also enables faster purchases on apps and websites without requiring repeated input of contact or billing details. Visa aims to align with Egypt’s growing demand for secure, digital-first payment solutions. Read More

🇪🇬 Meeza National Payment Scheme introduces Apple Pay for customers in Egypt. The move is in line with Meeza’s commitment towards bringing its customers more secure and convenient payment methods. Continue reading

🇪🇬 Mastercard partners with Central Bank of Egypt to launch Apple Pay. Users can pay in-store with an iPhone or Apple Watch or make online purchases on iPhone, iPad, and Mac without typing card details repeatedly. Transactions are secured with Face ID, Touch ID, or passcode and a unique dynamic security code.

🇺🇸 Paidly, Inc. closes series A funding to tackle student loan debt for employers and employees. The funding will enable Paidly to enhance its platform and expand its reach. The partnership with S30Build, LLC underscores Paidly’s ability to make a meaningful impact when addressing the challenges posed by student loan debt.

🇺🇸 GoAuto Insurance adopts One Inc's ClaimsPay® and PremiumPay® to streamline operations. This move consolidates inbound and outbound payment activities into one platform, improving efficiency. The Baton Rouge-based insurer aims to expand payment options beyond checks.

⬆️ 10 Top payments trends for 2025. In an effort to make online checkout as efficient as physical, Mastercard announced that by 2030, shoppers won’t even need a physical card number or have to punch in a password or one-time code to make a transaction online, by combinating tokenization, biometric authentication and the Click to Pay digital wallet.

🇬🇧 The UK payments regulator is consulting on a cross-border card fees cap, which is costing UK businesses £150-200 million annually due to reduced competition. These fees apply to online purchases made with EU-issued cards. Mastercard and Visa dominate 99% of UK card payments. Read More

🇧🇷 Central Bank approves payment of bills via Pix, effective on February 3, with experimental use of QR codes for instant Pix transactions. This eliminates delays associated with traditional slips. Additionally, the BC introduced a dynamic collection slip for greater security in payments tied to negotiable securities, ensuring funds go to legitimate holders.

GOLDEN NUGGET

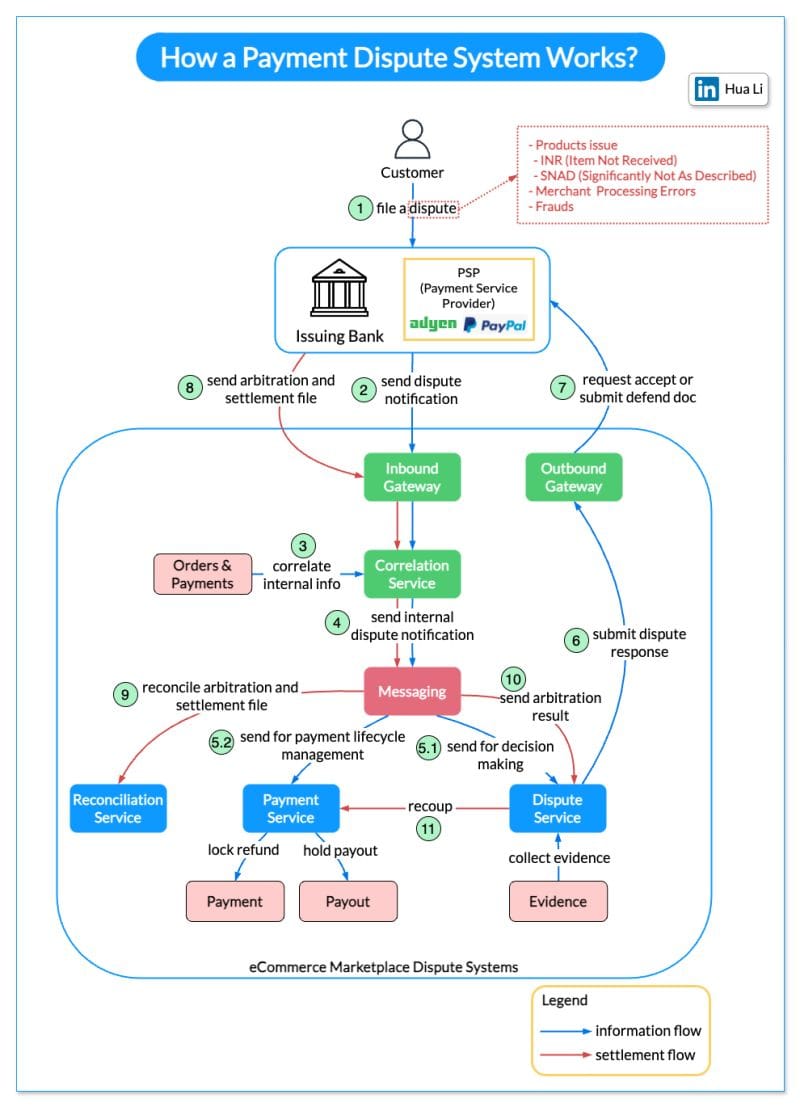

How is a credit card 𝐝𝐢𝐬𝐩𝐮𝐭𝐞 processed in the system? 👇

Dispute happens when a cardholder disagrees with a merchant’s charge.

A dispute is 𝐞𝐱𝐩𝐞𝐧𝐬𝐢𝐯𝐞: for every dollar in disputed transactions, an additional $1.50 is spent on fees and expenses [1]. The process/system complexity leads to the cost.

The diagram below shows how a dispute is processed in an eCommerce marketplace.

🔸 Steps 1-2: A customer files a dispute with the issuer or PSP (Payment Service Provider). The issuer or PSP sends the 𝐝𝐢𝐬𝐩𝐮𝐭𝐞 𝐧𝐨𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 to the eCommerce marketplace’s inbound gateway.

🔸 Steps 3-4: The inbound gateway sends the dispute notification to the correlation service, which correlates internal orders and payments with external bank information. Then the enriched notification gets sent to a messaging component.

🔸 Steps 5.1-5.2: The dispute notification is sent to the dispute service for the 𝐝𝐞𝐜𝐢𝐬𝐢𝐨𝐧-𝐦𝐚𝐤𝐢𝐧𝐠 process. It collects evidence from various internal systems to help make the decision. Meanwhile, the dispute notification is sent to the payment service to lock the refund and hold payment.

🔸 Steps 6-7: The decision (accept or defend) is sent to the outbound gateway, then sent to the issuer or PSP for 𝐚𝐫𝐛𝐢𝐭𝐫𝐚𝐭𝐢𝐨𝐧.

🔸 Steps 8-11: After arbitration, the bank or PSP sends the arbitration notification (win or lose) back, together with the settlement files. The reconciliation service reconciles arbitration result and settlement files. The arbitration result is sent to the dispute service. If there is a cost due to merchandise reasons for arbitration loss, the dispute service calls the payment service to 𝐫𝐞𝐜𝐨𝐮𝐩 the cost from the seller.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()