Adyen Unveils 'Adyen Uplift': AI-Powered Payments Optimization

Hey Payments Fanatic!

Adyen has launched Adyen Uplift, an AI-powered payment optimization suite trained on over $1 trillion in global payments data. The solution aims to help businesses boost payment conversion while simplifying fraud management and reducing costs, with pilot customers reporting up to 6% increase in conversion rates.

Adyen’s customers can utilize data-driven, tailored performance recommendations and opportunities to test different payment configurations to maximize performance.

Carlo Bruno, VP of Product at Adyen explains: "Balancing risk management, driving conversion, and minimizing cost has always required ineffective compromises – until now. Adyen Uplift changes the game by unleashing the depth and power of AI to solve for real-time payment optimization. This will transform cost savings and performance, redefining business efficiency in 2025 and beyond."

Kes Saulis, Head of Payments at Nord Security confirms the impact: "We've increased our conversion rate on customer initiated transactions by 10% by leveraging Adyen's AI technology, which optimizes the entire payment funnel while maintaining control over fraud and costs."

Read more global Payments industry updates below 👇 and I'll be back on Monday!

Cheers,

Stay Ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

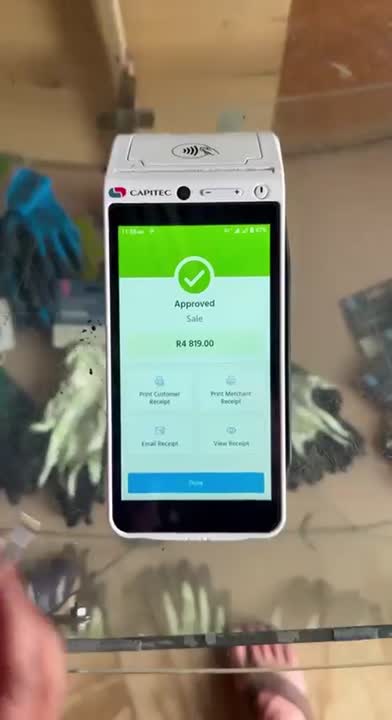

UX on another level 🤯 What do you think? And which South African bank is this? ➡️ Watch video

PAYMENTS NEWS

🇬🇧 Ecommpay Chief Marketing Officer shortlisted in Women in Payments EMEA 2025 Awards. Miranda McLean, CMO has advocated for women and other minority groups in the tech community for a number of years and firmly believes that the FinTech sector must be as open and diverse as possible. Winners will be announced at an Awards dinner in London on 9th April.

🌍 Can Wero shape the future of European payments? Martina Weimert, CEO of European Payments Initiative (EPI), explains the motivation behind Wero. Wero digital wallet aims to offer a European sovereign unified payment solution to address the needs of consumers, professionals and merchants in all European markets.

🇹🇭 Thailand tests crypto payments with Phuket for tourists. The initiative, announced by Deputy Prime Minister and Finance Minister, aims to allow foreign visitors to make payments using Bitcoin and other digital currencies, offering a seamless alternative to cash transactions. Continue reading

🇺🇸 Boost Payment Solutions names Rinku Sharma as CTO. Sharma will drive growth and scalability by continuing to modernize and automate payment processes while strengthening data governance, quality, and security measures. He will utilize advanced solutions and incorporate innovations, including AI.

🇸🇬 Nium launches Diners Club International Card. The introduction provides Nium travel customers with even greater payment flexibility, acceptance and choice, reinforcing Nium’s position as a scheme-agnostic innovator in the travel payments industry.

🇺🇸 OnPay raises over USD 100 million in Series B funding. The funds secured will enable the company to scale its capabilities, invest in product development, expand partnerships and integrations, and accelerate go-to-market strategy. This latest investment marks the increasing market demand for turnkey payroll software.

🇵🇪 Kuady launches physical prepaid Mastercard in Peru. The physical Kuady card allows users to make secure in-store purchases with any merchant accepting Mastercard using their Kuady wallet balance. Online payments can continue via the virtual card, providing a flexible mix of both digital and physical payment options.

🇦🇪 Arf and LuLu Financial Holdings announce strategic partnership to revolutionize settlement times in global and cross-border payments. This collaboration will allow LuLuFin to leverage Arf's advanced settlement infrastructure, offering T-0 settlement times.

GOLDEN NUGGET

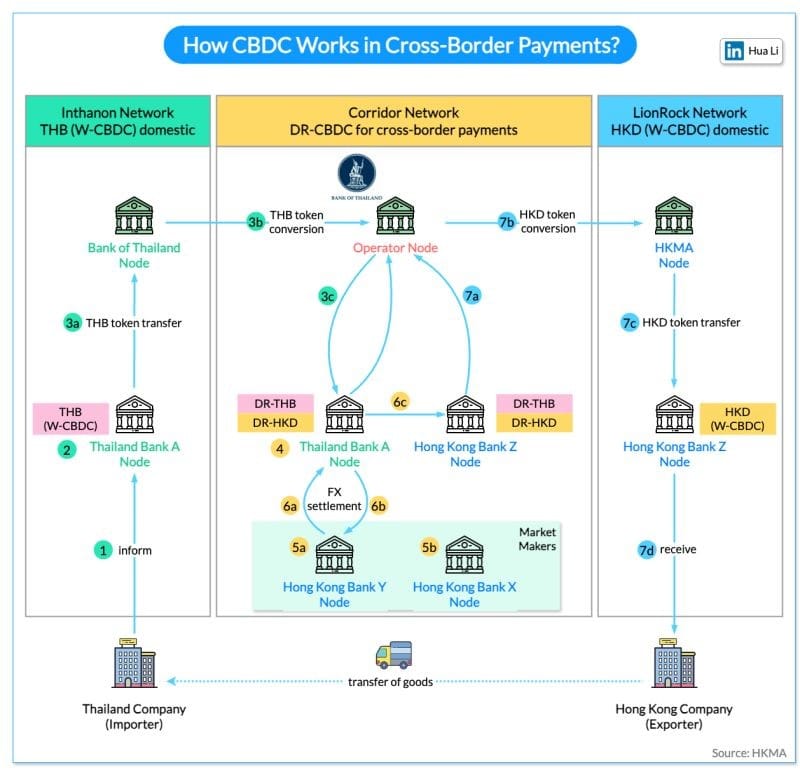

How does CBDC (Central Bank Digital Currency) work in 𝐜𝐫𝐨𝐬𝐬-𝐛𝐨𝐫𝐝𝐞𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

The diagram above shows an example between BOT (Bank of Thailand) and HKMA (Hong Kong Monetary Authority). The whole process can finish 𝐰𝐢𝐭𝐡𝐢𝐧 10 𝐬𝐞𝐜𝐨𝐧𝐝𝐬!

▶️ There are 𝐭𝐡𝐫𝐞𝐞 𝐧𝐞𝐭𝐰𝐨𝐫𝐤𝐬:

1. Inthanon network - initiated by BOT in 2018, focusing on Wholesale-CBDC (W-CBDC). The domestic transactions run in this network.

2. LionRock network - initiated by HKMA in 2017, also focusing on W-CBDC. The domestic transactions run in this network.

3. Corridor network - initiated by both BOT and HKMA in 2019, focusing on cross-border payments. To enter the corridor network, the currency must be 𝐜𝐨𝐧𝐯𝐞𝐫𝐭𝐞𝐝 into DR (Depository Receipt) for interbank exchanges.

▶️ Let’s 𝐰𝐚𝐥𝐤 𝐭𝐡𝐫𝐨𝐮𝐠𝐡 𝐚𝐧 𝐞𝐱𝐚𝐦𝐩𝐥𝐞.

Suppose a Thai company needs to pay 1 million HKD to an HK company.

🔹 Step 1: The Thai company informs bank A to transfer 1 million HKD to the HK company’s account at bank Z.

🔹 Step 2: Bank A checks if bank Z is a member of the corridor network.

🔹 Steps 3a - 3c: If the check is positive, bank A converts 4 million THB into DR-THB. 𝐁𝐎𝐓 𝐧𝐨𝐝𝐞 is responsible for destroying W-CBDC and issuing DR-THB. The 𝐨𝐩𝐞𝐫𝐚𝐭𝐨𝐫 𝐧𝐨𝐝𝐞 in the corridor network, which is run by both BOT and HKMA, is responsible for managing DR and monitoring transactions.

🔹 Steps 4 and 5: Bank A needs to convert DR-THB to DR-HKD. It searches among the 𝐦𝐚𝐫𝐤𝐞𝐭 𝐦𝐚𝐤𝐞𝐫𝐬 and finds bank Y offers the best FX rate.

🔹 Steps 6a - 6c: Now the banks settle the currency conversion: bank A receives 1 million DR-HKD from bank Y, bank Y receives 4 million DR-THB from bank A, and bank Z receives 1 million DR-HKD from bank A.

🔹 Steps 7a - 7d: Bank Z converts 1 million DR-HKD to W-CBDC, and confirms that it has received 1 million HKD. 𝐇𝐊𝐌𝐀 𝐧𝐨𝐝𝐞 is responsible for destroying DR-HKD and issuing W-CBDC.

👉 Over to you: Do you think this model with CBDC is the 𝐟𝐮𝐭𝐮𝐫𝐞 of cross-border payments?

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()