Adyen Sees 22% Growth in Processed Volumes as Digital Payments Expand

Hey Payments Fanatic!

Before the news, a quick favor—my friend Chiara Liqui Lung is launching her own project, and I’m thrilled for her! She’s spent years helping FinTech startups grow and scale, and now she’s sharing her expertise with founders.

If you’re tackling the challenges of launching or scaling, she’s a great person to talk to. No pressure, just a conversation—feel free to reach out!

Speaking of scaling… Adyen has reported a 22% increase in processed volumes for the second half of 2024, reaching €666.4 billion, as demand for omnichannel payment solutions continues to rise.

The company saw strong momentum across digital, in-store, and enterprise payments, with Unified Commerce volumes growing 35% and the number of large-scale merchants processing payments through both POS and eCommerce increasing by 97 new additions.

The EMEA region remained a key revenue driver, posting 27% year-over-year growth, while North America revenues climbed 21%. Adyen's Platforms Business, its fastest-growing segment, saw a 44% increase in volume, reaching €88.5 billion in the latest period. Meanwhile, Adyen’s digital payments segment grew 13% to €383.5 billion, with 91% of digital customers using localized payment methods.

The company also highlighted its investment in U.S. debit transaction capabilities, with its Intelligent Payment Routing solution delivering an average 26% cost savings and a 0.22% increase in authorization rates for pilot customers.

Plenty more Payments industry updates await below—let’s dive in! 👇

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

INSIGHTS

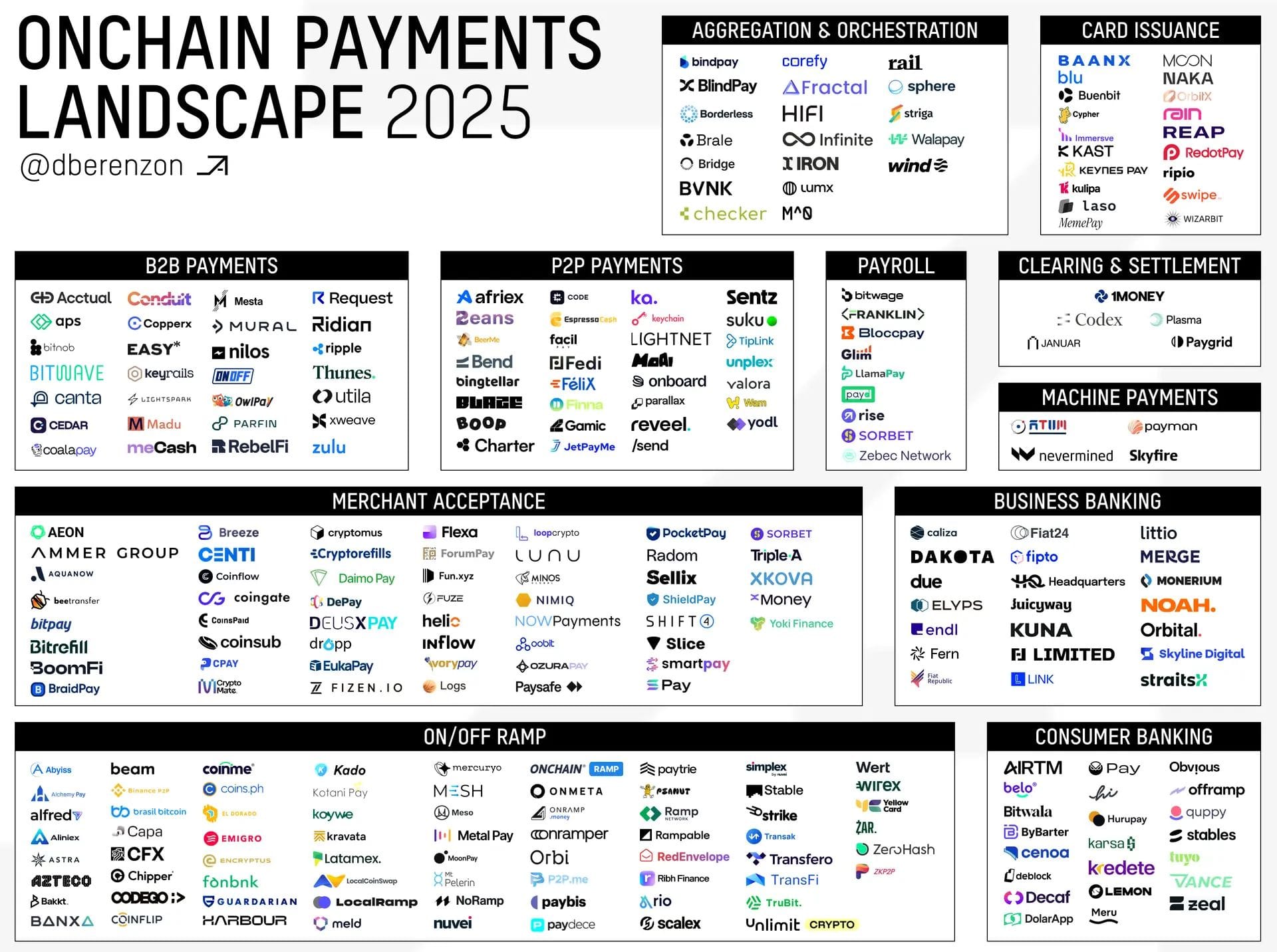

There are currently ~280 payment companies building on cryptorails 👇

Which company is missing from this map?

PAYMENTS NEWS

🇱🇹 Checkout.com announces its partnership with Vinted. With AI-driven optimizations, Checkout.com’s Intelligent Acceptance has boosted Vinted’s acceptance rates by 4.15% in 2024, reducing failed transactions and increasing engagement. As a result, Vinted significantly grew its transaction volume with Checkout.com, reinforcing their strong partnership.

🇪🇪 Why online payments fail, and how to recover lost sales, by Solidgate. This blog draws on years of experience optimizing payment performance for online businesses to explain the nature of failed payments and provide effective solutions. Learn more

🇺🇸 Regions Bank announces latest innovation to help companies streamline cash flow. The name of the solution is Regions Embedded ERP Finance. The result is Regions’ clients now have the option of using this tool, powered by Koxa, to seamlessly connect financial data to their own enterprise resource planning (ERP) systems.

🇺🇸 MoonPay Balance is now live in the U.S. The feature, first unveiled to European users in November, lets users deposit funds to their account for zero-fee purchases. Users can also sell crypto back into their MoonPay Balance, making it easy to make later purchases or withdraw when it suits them.

🇨🇳 Payoneer receives regulatory approval for its acquisition of a licensed China-based payment service provider. The transaction is expected to close in the first half of 2025, subject to customary closing conditions. Click here for more

🌏 Mastercard launches anti-money laundering service “TRACE” to combat financial crime in Asia Pacific. Powered by timely and large-scale payments data from multiple financial institutions, TRACE provides holistic intelligence, enabling tracing of financial crime across a payments network.

🇬🇧 ShopMate announces partnership With DNA Payments to transform payment solutions for convenience stores. Through this strategic partnership, ShopMate is enhancing its support for retailers by integrating a seamless and efficient payment solution into its EPOS system, ShopMate Pay.

🇦🇺 NSW inks deals with big four banks and Citi to fix payments. Commonwealth Bank and National Australia Bank will join the existing three banking partners for the NSW government, a move it claims will improve liquidity and protect against market shocks.

🇳🇬 AZA Finance and dLocal partner. The partnership will see dLocal’s cross-border payment infrastructure combined with the FinTech company specializing in payments and foreign exchange in Africa’s foreign exchange capabilities and network of regional licenses.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()