Adyen Expands Open Banking with Yapily Partnership

Hey Payments Fanatic!

Adyen has selected Yapily to expand its Open Banking services across Europe, focusing on streamlining merchant onboarding and account verification processes. The integration will utilize Yapily's API to enhance financial data connectivity.

Stefano Vaccino, CEO of Yapily, stated: "Merchant onboarding and account verification are just the tip of the iceberg," as Adyen plans to implement Yapily's Data products across multiple European regions. The partnership aims to enable new services including creditworthiness assessments and business account connectivity.

The collaboration will integrate Yapily's solutions into Adyen's Open Banking suite, which currently serves major platforms like eBay and Uber, to deliver enhanced financial experiences for merchants.

If you’re interested in reading more about what’s been happening in Payments, keep scrolling!

Cheers,

Level up your banking knowledge. Subscribe now for the latest in digital banking, delivered weekly.

INSIGHTS

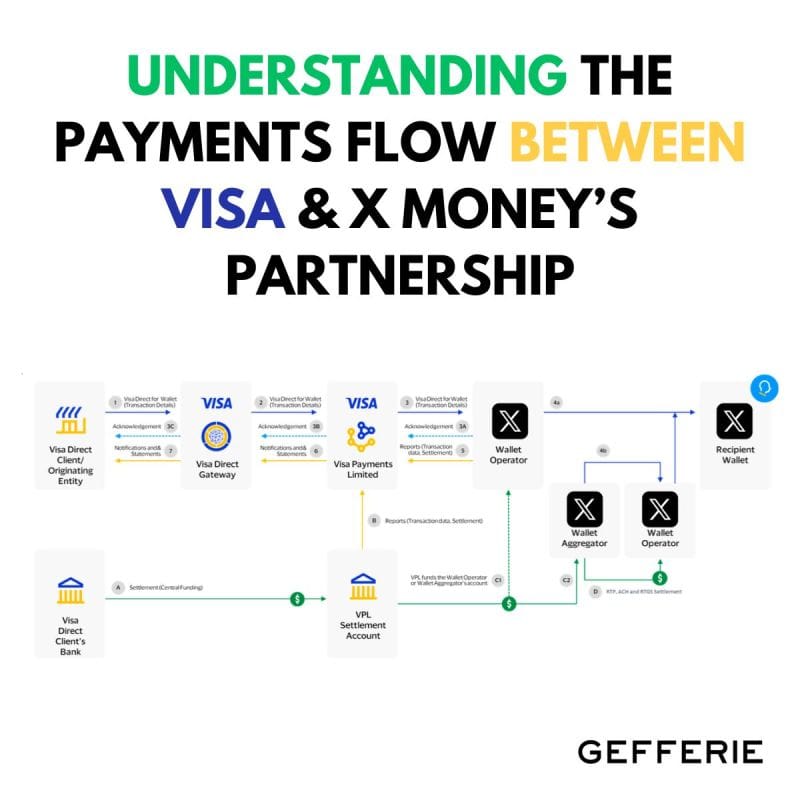

Understanding the Payments Flow between Visa and X Money partnership👇 Read more

PAYMENTS NEWS

🌍 Volt.io partners with Pay.com to enhance open banking offering. The partnership between Volt's real-time payment capabilities and Pay.com's advanced payment orchestration creates a streamlined global payments and open banking solution that simplifies payment processing for merchants and customers alike.

🇺🇸 Payroll services provider DailyPay prepares for 2025 US IPO. The New York-based company is in talks to hire investment bankers for its planned initial public offering that could value the company between $3 billion and $4 billion. Continue reading

🇬🇧 TransferGo launches multi-currency accounts. Companies often face high fees, complicated currency exchange processes, slow delivery times, and friction when moving money globally. TransferGo aims to remove these barriers by providing a trusted platform with competitive rates and a seamless international payment experience.

🇺🇸 RTP Network surpasses one billion payments. The network’s recent rapid growth underscores the expanding acceleration of instant payments adoption. This extraordinary increase reflects the growing demand for faster, more transparent, and always-available payment solutions from consumers, businesses, and the financial community.

🇨🇦 Payments Canada shares details on real-time rail development. Since their update in Q4 2024, Payments Canada and their delivery partners, CGI, IBM, and Interac, claim to have made progress on the Real-Time Rail (RTR) and are reported: “more than halfway through the technical build of the RTR”.

🇺🇸 Musk team given access to sensitive federal payment system. The Trump administration has given Elon Musk's deputies access to the federal payments system that controls the flow of trillions of dollars in government funds every year. Read more

🇬🇧 Payments FinTech GoCardless shrinks losses after cutting jobs. The London-headquartered FinTech posted a pretax loss of £35 million ($43.8 million) for the 12 months through June 2024, compared to a £78 million loss a year earlier. Revenue grew 41% year-on-year to £132 million.

🌍 PRECISION and FinMont partner to Drive Innovation and Solve Fraud Challenges. This collaboration addresses these challenges by integrating PRECISION’s proven fraud prevention technology into FinMont’s platform, creating a next-generation payment ecosystem tailored to address the unique complexities of travel payments.

🌍 Binance Pay partners xMoney to enhance payment convenience. The collaboration allows direct payments from Binance accounts to merchants, reducing processing times and streamlining checkout procedures across industries.

🇺🇸 Yaspa and Playbook Engineering join forces to transform iGaming payments. This collaboration will enable players to enjoy seamless, fast, and secure payment journeys using Pay by Bank for deposits and withdrawals. Playbook strategically selected Yaspa as their exclusive real-time payment provider.

GOLDEN NUGGET

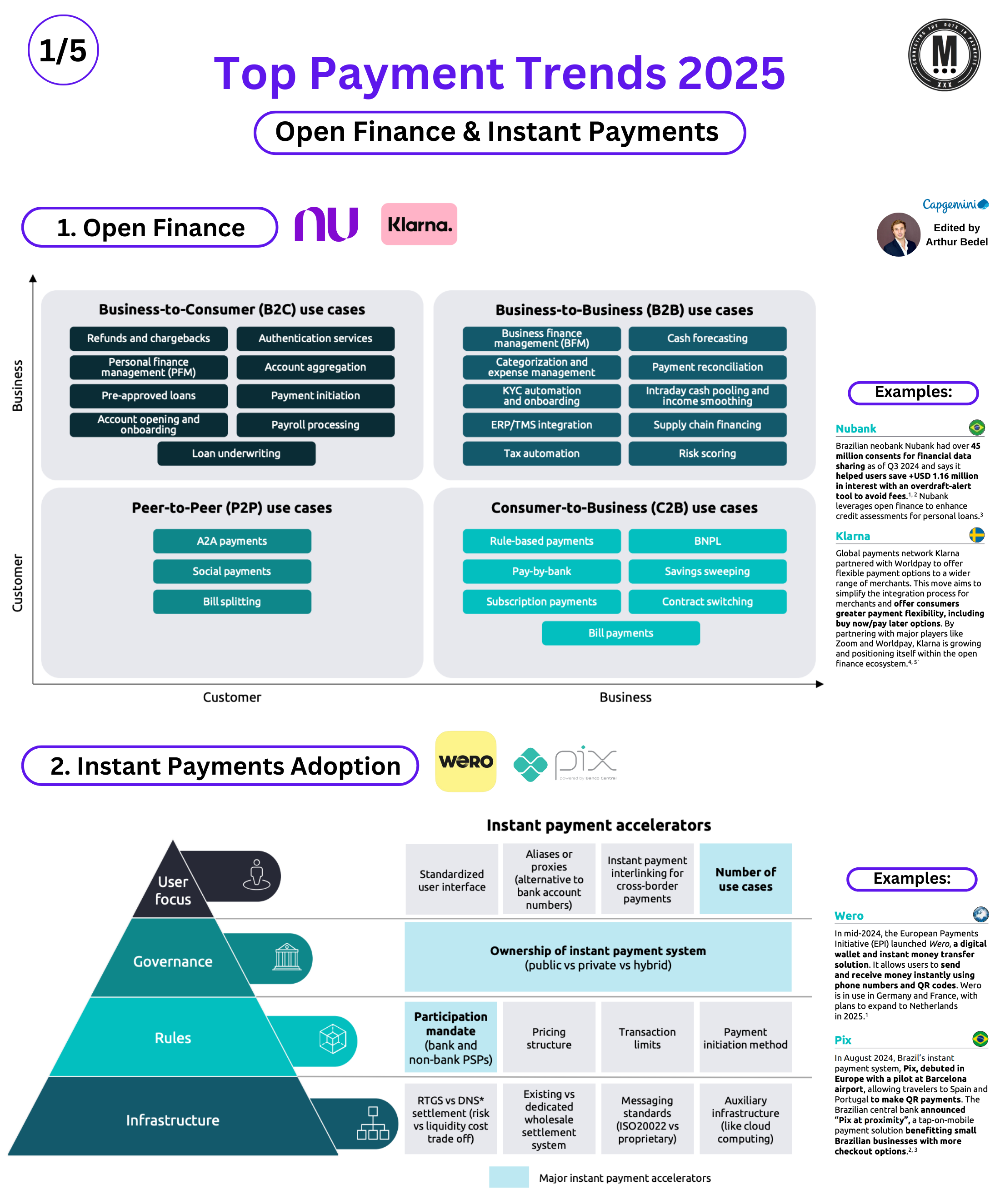

𝐓𝐨𝐩 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 2025 by Capgemini — Open Finance & Instant Payments Adoption.

The forever-evolving payments landscape is taking on 2025 with new initiatives, innovations, and trends.

🔟 𝐓𝐡𝐞 𝐓𝐨𝐩 10 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐨𝐟 2025:

1. 𝐎𝐩𝐞𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

2. 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧

3. 𝐏𝐎𝐒 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬

4. 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

5. 𝐂𝐨𝐦𝐩𝐨𝐬𝐚𝐛𝐥𝐞 𝐂𝐥𝐨𝐮𝐝-𝐁𝐚𝐬𝐞𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐇𝐮𝐛𝐬

6. 𝐌𝐮𝐥𝐭𝐢-𝐑𝐚𝐢𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐞𝐬

7. 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞

8. 𝐃𝐞𝐜𝐞𝐧𝐭𝐫𝐚𝐥𝐢𝐳𝐞𝐝 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲

9. 𝐑𝐞𝐦𝐢𝐭𝐭𝐚𝐧𝐜𝐞 𝐓𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧

10. 𝐃𝐚𝐭𝐚 𝐌𝐨𝐧𝐞𝐭𝐢𝐳𝐚𝐭𝐢𝐨𝐧

#1: 𝐎𝐩𝐞𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐁𝐚𝐜𝐤𝐠𝐫𝐨𝐮𝐧𝐝: Open Finance expands the scope of Open Banking by incorporating not just banking data but also insights from investments, insurance, and pensions.

𝐊𝐞𝐲 𝐈𝐦𝐩𝐚𝐜𝐭𝐬:

► Enables hyper-personalized products and services.

► Greater access to financial services, particularly for underserved markets.

► Banks and FinTechs benefit from streamlined processes and enhanced data insights.

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬:

► Businesses — Cash forecasting, risk scoring, and KYC automation.

► Consumers — Loan underwriting, payroll processing, and account aggregation

► Peer-to-Peer — Social payments, bill splitting, and A2A transfers.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬:

🔸 Nubank: Leveraging Open Finance for better credit assessments and financial planning tools.

🔸 Klarna: Driving flexible payment solutions in partnership with global merchants.

#2: 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐁𝐚𝐜𝐤𝐠𝐫𝐨𝐮𝐧𝐝: Instant Payments involve real-time money transfers between bank accounts, bypassing traditional intermediaries. They're already transforming economies by shortening settlement cycles and reducing costs.

𝐊𝐞𝐲 𝐈𝐦𝐩𝐚𝐜𝐭𝐬:

► Banks — Lower transaction costs and strengthened corporate relationships.

► Businesses — Faster cash flows and real-time treasury management.

► Consumers — Seamless, low-cost transactions.

𝐊𝐞𝐲 𝐀𝐜𝐜𝐞𝐥𝐞𝐫𝐚𝐭𝐨𝐫𝐬:

1. Standardized user interfaces.

2. Cross-border payment linkages.

3. Governance frameworks (e.g., public vs. private ownership models).

4. Advanced infrastructure such as ISO 20022 messaging standards.

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬:

► A2A Payments, just-in-time supplier payments, and QR-code-based cross-border transactions.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬:

► #Wero : A European wallet simplifying instant cross-border money transfers.

► #Pix: Brazil's instant payment system, now piloted in Europe.

🚨 This is a series of 5 posts — next up 🚨

3️⃣ — 𝐏𝐎𝐒 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬

4️⃣ — 𝐂𝐫𝐨𝐬𝐬 𝐁𝐨𝐫𝐝𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Get ready, it is just the beginning!

Source: Capgemini

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()