Adyen Exceeds Profit Expectations with Strategic Expansion

Hey Payments Fanatic!

Payments giant Adyen has outperformed expectations with a 32% rise in core profit to €423.1 million for the first half of 2024, surpassing analysts' forecasts of €413.39 million.

This strong performance, driven by market share gains and slower hiring, boosted Adyen's shares by 12%, adding €4.3 billion to its market value, now totaling €39.6 billion.

Adyen’s growth is primarily fueled by expanding services to existing clients, including major partnerships with Cash App and Shopify. Despite the broader digital payments sector facing post-pandemic challenges, Adyen’s strategic moves in the Europe, Middle East, Africa (EMEA) region, and North America, where it has single-digit market shares, offer significant room for growth.

Revenue increased by 24% to €913.4 million, with the EBITDA margin rising to 46% from 43%. Adyen confirmed its 2024 and 2026 guidance and highlighted its expansion into India, where it has been authorized to operate as an Online Payment Aggregator.

The company is also launching a technology hub in Bengaluru, aimed at enhancing local payment processing capabilities. This hub will enable Adyen to optimize transactions for merchants in India and tap into the country's burgeoning e-commerce market, which is rapidly moving towards digital payments.

By building out its infrastructure and tapping into local talent, Adyen is positioning itself to become a key player in India’s evolving digital landscape.

Have a great weekend and I'll be back on Monday!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🌐 PayQuicker, a leader in global payouts orchestration, announced a collab with Thunes, a global money movement innovator, to expand its e-Wallet payout capabilities worldwide. The collaboration aims to address the increasing demand for more diverse, and flexible payout methods, especially in emerging markets where e-Wallets serve as essential financial tools.

📰 Yuno recently secured a $25 million Series A round to support launches in key Asian markets like Singapore, Hong Kong, and Thailand. Jonathan Hall, Head of Asia at Yuno, elaborates on Yuno’s strategic goals for these markets and how the funding will be utilized: Click here to learn more

🇸🇪 Klarna takes on banking with new savings, cash-back offerings. Klarna’s marketing slogan for this is “Save Now, Pay Later.” The firm is set to launch two innovative products designed to enhance the appeal of its "buy now, pay later" (BNPL) offerings.

🇺🇸 Zip announces strategic partnership with Stripe in the U.S. to accelerate market growth. With the new integration, eligible merchants can easily enable Zip as a payment method with a single click, which can help attract new customers and increase both conversion rates and basket sizes.

🇺🇸 FIS® announced that it is unlocking the Neural Payments solution to its clients, expanding the availability of peer-to-peer (P2P) payments by leveraging the company’s global scale and NYCE debit rails to bring this capability to a wider range of institutions.

🇺🇸 Gun-focused BNPL FinTech faces potential CFPB suit. Credova, a “buy now, pay later” provider focused on gun financing, is facing a potential enforcement action from the Consumer Financial Protection Bureau, according to a securities filing.

🇬🇧 Paddle, a payments infrastructure provider, has opened applications for its third AI Launchpad, offering 75 ambitious AI founders the chance to participate in a 6-week program to help them build, launch and scale their AI-powered business ideas.

🇺🇸 Modern Treasury expands Instant Payments Support to mutual customers at 6 big banks. The expansion applies to customers of Bank of America, Cross River, JPMorgan Chase, PNC Financial Services, U.S. Bank and Wells Fargo. “By making instant payments easier to access for our customers, we’re helping them deliver better customer experiences while enabling real-time insight into cash flow,” said the firm's co-founder and CTO.

🇺🇸 Mesh, the modern connectivity layer for crypto that makes payments and deposits seamless, announced a new investment by QuantumLight, the innovative venture capital firm founded by Nik Storonsky, the CEO and founder of global financial superapp Revolut.

🇺🇸 Mastercard collaborates with FinTech start-up, Scale. The collaboration will alleviate key technical and commercial barriers to entry that FinTech companies, aggregators, enablers, payment service providers (PSPs) and telcos face when launching payment programs..

🇬🇧 SeerBit and Kuda join forces to enhance seamless online payments. The partnership enables millions of Kuda retail customers to make seamless payments on SeerBit’s checkout platform without inputting their card details, further assuring the security of their transactions.

GOLDEN NUGGET

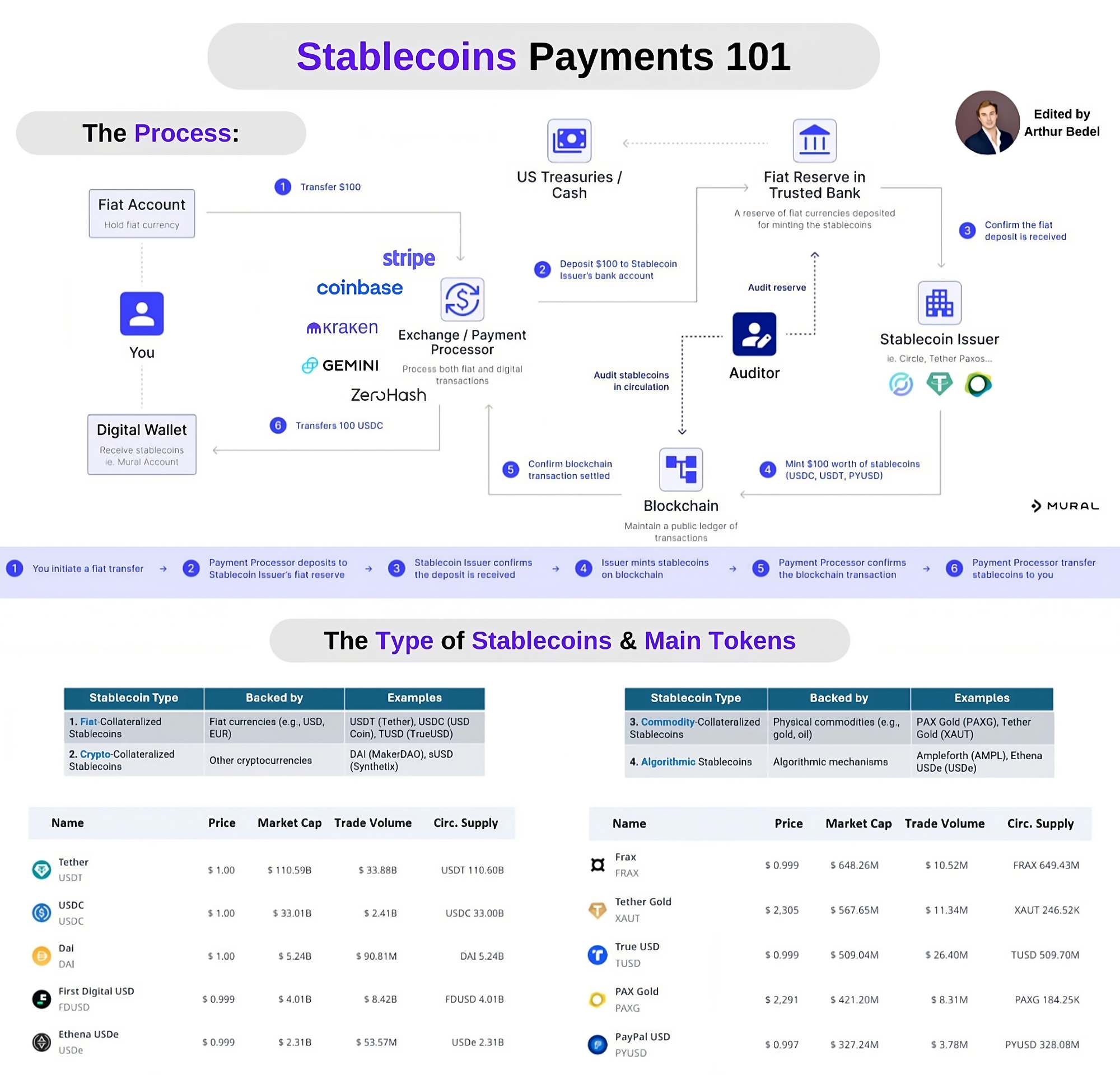

Blockchain-enabled Payments can revolutionize the global payments industry with faster and cheaper payments👇

The next wave of disruption in payments is tied to technology and the #blockchain is a pretty fascinating one. Most people only associate it with crypto. The blockchain is the underlying technology of cryptocurrencies, the actual gem.

Until recently, payments have been enabled through the traditional model by those 6 main players:

👉 Issuers - Wells Fargo, Citi

👉 Acquirers - Nuvei, Adyen, Checkout.com

👉 Card Schemes - Visa, Mastercard

👉 Payment Orchestration - Spreedly, Gr4vy, Inc 👉 Payment Methods (#APMs) - Klarna, Alipay, Accrue Savings, Trustly

👉 Token Vaults - VGS, Basis Theory

This complex model creates various points of failure, an expensive process, friction and less transparency, especially in cross-border transactions.

Digital currencies and #CBDCs are gaining momentum and rising to the top of the agenda for innovative PSPs that are looking for #regulated, fast and global alternatives.

As a result, more payments and cryptocurrency ecosystem providers are entering the market:

👉 Global Cryptocurrency Market Cap: $2.56

👉 Bitcoin Market Cap: $1.26T.

What to know:

🔸Major blockchain and #cryptocurrency infrastructure providers are expanding into payments. Binance launched a payments technology company, Bifinity to enable fiat-crypto payments.

🔸Traditional payments companies have also entered the crypto market. Consumers can now make payments with cryptocurrencies linked to Visa and Mastercard cards. PSPs - Nuvei, Stripe, PayPal - can transfer, receive and send cryptocurrencies - Pay With Crypto, powered by organizations like Zero Hash.

Here are the major benefits to use the blockchain for Global Payments:

✅ Immediate

✅ Cheap

✅ Global reach

✅ Settled in a secure settlement medium

✅ Data Enrichment

✅ Lower Risk (Higher Acceptance)

✅ Interoperability (Open Loop)

There is also a need to address to concerns to keep increasing adoption:

❌ Regulations

❌ Liability

❌ Trust

Overall, stablecoins and crypto payments powered by Zero Hash, Mural and others have the potential to disrupt the industry, starting with those uses cases:

🔸Global Remittances

🔸eCommerce Transactions

🔸Subscription-based Payments 🔸MicroPayments

🔸Hedging against currency devaluation

🔸Capital efficiency in Trading

👉 Financial Inclusion

Other forces are also reshaping the payments industry:

🔸Real Time Payments Rails

🔸Open Banking

🔸Buy Now Pay Later

🔸Digital Wallets & Super Apps

🔸Embedded Payments

🔸Digital Currencies and CBDCs

Technology is driving & disrupting payments! The rise of digital currencies, Bitcoin Halving & the AI boom are making it happen.

Source: EY's report - How the rise of PayTech is reshaping the payment landscape

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()