ABN Amro's Tikkie Payments Hit Record 7.4 Billion Euros in 2024

Hey Payments Fanatic!

Dutch payment app Tikkie has shattered records in 2024, processing a staggering €7.4 billion in transactions - an 8% increase from last year's €6.6 billion milestone. With 10 million users now on board, the platform handles an impressive 5.3 payments per second, with the average transaction amount increasing to €47.28.

The app's efficiency is remarkable, with 89% of consumer Tikkies paid within 24 hours and 64% settled within an hour. Business adoption is equally strong, showing 81% of payments completed within a day. The platform hit its peak on May 24th, processing 648,000 transactions in a single day - that's 7.5 Tikkies per second.

Moreno Kensmil, Tikkie's Head of Marketing, highlighted an innovative use case: "A million people have already received direct refunds on their bottle deposits via Tikkie. More and more places around the Netherlands have deposit return machines with Tikkie QR codes, including at schools and railway stations."

What's your experience with peer-to-peer payment apps? Are they becoming an essential part of daily life in your country? Share your thoughts in the comments!

Enjoy more Payments industry updates I listed for you below and I'll be back in you inbox tomorrow!👇

Cheers,

Stay Ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

6 Key Payments Issues in 2025: Waves of change keep on hitting the vibrant payments business, from new channel opportunities to an uncertain whipsawing regulatory atmosphere. Here's a review of what the industry will face this year. Click here to access the full article

PAYMENTS NEWS

🇬🇧 Merchants choose payment providers based on business commitment to ESG. A study by Ecommpay reveals that 61% of e-commerce merchants prioritize ESG commitments when selecting payment providers, with 38% considering it. Miranda McLean, Ecommpay’s CMO, emphasizes the growing importance of ESG in partnership decisions, urging providers to showcase their credentials.

🇬🇧 Zilch hits 4.5M customers, steady revenue growth. Zilch reported in September 2024 that it has generated $130 million or £100 million in revenue while turning the corner on profitability. The FinTech compares itself to other big name FinTechs like Revolut, Starling Bank, and Monzo in regard to its speed of growth. Checkout.com is Zilch’s primary acquiring partner globally.

🇺🇸 DraftKings tries subscription payments. The company is promoting the new service by offering customers boosted offers if they sign up. DraftKings said: “The subscription service was designed to offer our customers an enhanced fan experience, creating more excitement and value to our extensive parlay offering”.

🇺🇸 Elite acquires Tranch to streamline law firm payments. Elite’s acquisition of Tranch will enhance its ability to augment law firms’ financial and business management processes by delivering elevated, end-to-end visibility and management of revenue cycles to help firms accelerate growth. Click here for more information

🇪🇬 PayMint launches Meeza Card with ADIB. According to ADIB-Egypt, the launch supports its initiative to advance financial inclusion “in line with the vision of the Egyptian government and the Central Bank of Egypt” by collaborating with FinTech companies to drive the nation’s shift towards a cashless society.

🇸🇬 DBS: Digital Ang Baos gaining popularity with DBS/POSB reporting a doubling of customers using their digital gifting services in 2024 compared to the previous year. Over 70% were first-time users, transferring SGD 39 million during Lunar New Year. Read More

🇸🇬 SC Ventures launches billing FinTech for APAC SMEs. The FinTech investment and incubation arm of Standard Chartered, has launched Labamu, a platform that will offer SMEs digital billing, catalogue, stock and material management, plus customer relationship management and reporting services. Read more

GOLDEN NUGGET

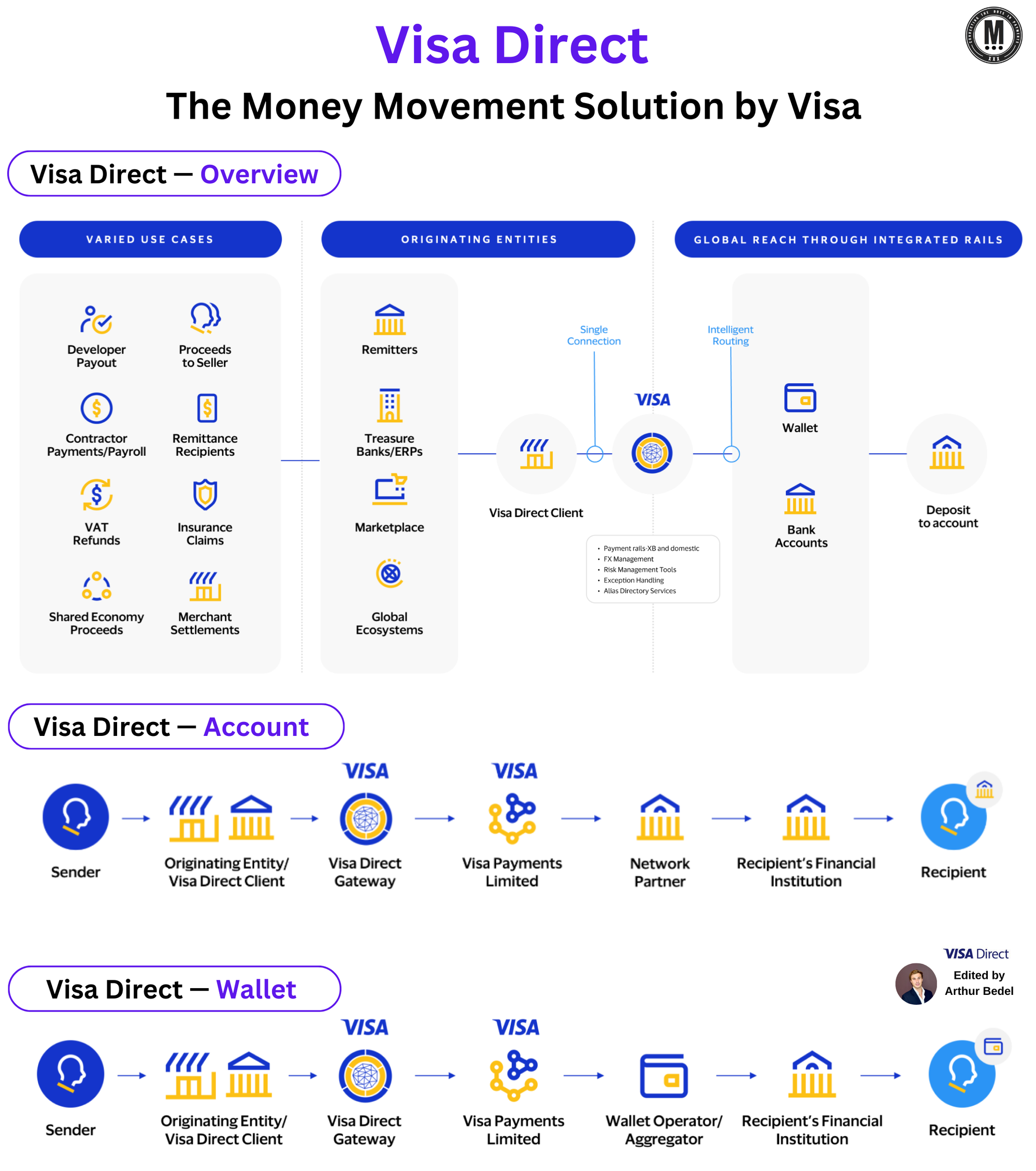

Visa Direct — Account & Wallet, the global money movement solution by Visa, disrupting how businesses deliver funds to billions of endpoints👇

Visa Direct (Account & Wallet) is built to help businesses payout worldwide through ACH, and faster payment networks via a single integration, helping companies meet their operational, commercial, and regulatory needs.

You won't believe me but today, #checks account for 50% of B2B payments. Crazy...

Visa built a solution that allows Financial Institutions to send funds (payouts) to accounts, wallets and cards in all major global markets.

► 𝐀𝐜𝐜𝐨𝐮𝐧𝐭

Send a payout to bank accounts via the Visa network using its Automated Clearing House (#ACH) / Real Time Payments (#RTP) fulfillment method. The push-to-account service is available cross border.

𝐇𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬:

1️⃣ - Sender initiates a payment using a visa direct client.

2️⃣ - Visa Direct Client processes the payment through the Visa Direct Gateway.

3️⃣ - Visa Direct Gateway connects to the Visa Payments Limited (VPL) banking network.

4️⃣ - Local funds transfer scheme/network is utilized to identify appropriate network partners.

5️⃣ - After a network partner has been identified, the payment is transferred to the recipients FI.

► 𝐖𝐚𝐥𝐥𝐞𝐭

Send a payout to wallets via the Visa network, available cross-border. Visa offers the service through Visa Payments Limited (VPL) who can use their network of Wallet Aggregators and Wallet Operators to deliver the payout to the Recipient's wallet.

𝐇𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬:

1️⃣ - Sender initiates a payment using a visa direct client.

2️⃣ - Visa Direct Client processes the payment through the Visa Direct Gateway.

3️⃣ - Visa Direct Gateway connects to the Visa Payments Limited (VPL) network.

4️⃣ - A network of waller aggregators and operators on the VPL is utilized facilitate the transaction.

5️⃣ - The payment is transferred to the recipients FI.

► 𝐂𝐚𝐫𝐝:

A real-time payout to cards, using Visa's global payment system. Originating Entities can use the Visa network to send money to over three billion eligible Visa card accounts!

The new innovative payment solution surged 36% in the last year surpassing 5.9 billion transactions (excluding Russia) across 60+ uses, 550+ enablers, 170+ countries and 2000+ programs.

But why Visa Direct? There are 2 main uses:

► 𝐏𝐞𝐞𝐫-𝐭𝐨-𝐏𝐞𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 (#P2P):

🔸Paying friends and family

🔸Splitting bills

🔸Sending remittances

🔸Account transfers

► 𝐅𝐮𝐧𝐝𝐬 𝐃𝐢𝐬𝐛𝐮𝐫𝐬𝐞𝐦𝐞𝐧𝐭:

🔸Reimbursements

🔸Refunds

🔸Rebates

🔸Payouts

🔸Loan distributions

🔸Government disbursements

It simplifies a complex process providing a fast & convenient experience to reach payees worldwide securely and reliably on the Visa Network 🚀

Source: Visa Direct

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()