$134M Deal Completed: Fiserv Acquires Payfare

Hey Payments Fanatic!

After three months since the announcement, Fiserv has completed its acquisition of Payfare in a deal valued at $134 million. The transaction strengthens Fiserv’s presence in the gig economy and enhances its embedded financial solutions. By integrating Payfare’s card program management and digital banking capabilities, Fiserv expands its offerings in embedded banking, payments, and lending.

Fiserv, a member of the S&P 500 since 2006, delivers account processing, digital banking, card issuing, and merchant acquiring services. It operates the Clover point-of-sale platform and facilitates money movement across more than 100 countries.

Payfare, a ten-year-old company based in Canada, specializes in instant payouts and digital banking solutions for gig workers. It partners with platforms like Uber, Lyft, and DoorDash to offer financial tools such as earned wage access and loyalty rewards. Payfare went public on the Toronto Stock Exchange in 2021.

"It's an exciting day for Payfare as we join together with Fiserv," said Marco Margiotta, Payfare's CEO. "This is a transformative step that will further our mission of providing financial security and inclusion for all workers as we innovate further and faster with Fiserv. Thank you to the dedicated Payfare team, our clients, and partners who have paved a new way of pay, as we powered over $20 billion in instant access to earnings for millions of gig workers over the years."

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

SPONSORED CONTENT

Time is running out! Get your ticket to the best event in FinTech.

INSIGHTS

🇺🇸 BNPL services saw steady growth with highest usage among younger consumers. The number of consumers using pay over time or BNPL products “grew significantly year over year, especially during the holiday season.” This is according to a report from JDPower.

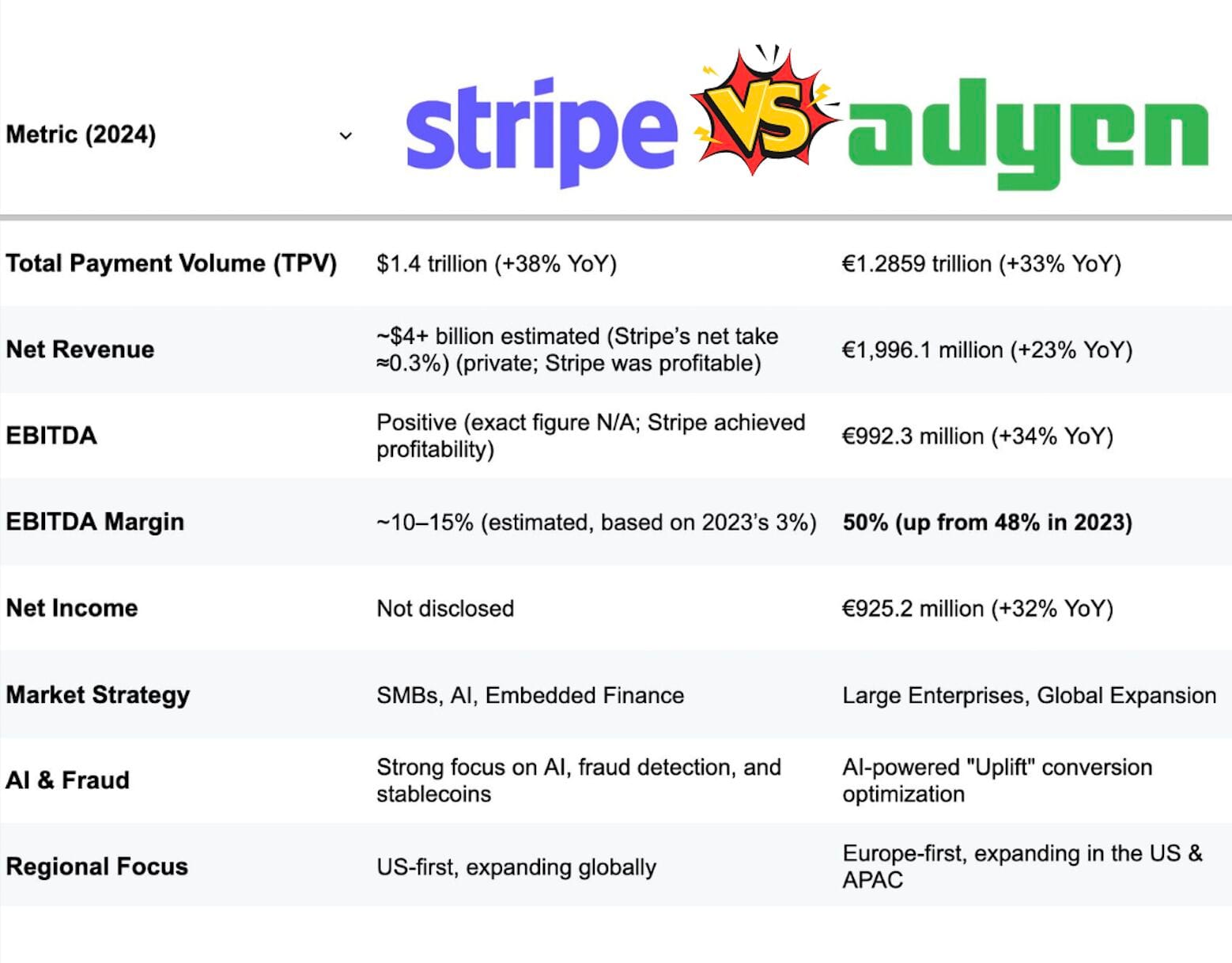

➡️ Stripe 🆚 Adyen

Here is a comparison of the latest Financial Reports:

PAYMENTS NEWS

🇲🇽 Pomelo's CEO takes the stage at FinTech Mexico Festival. CEO and cofounder Gaston Irigoyen participated in the panel “Mexico: The Next Big Opportunity for Digital Banking in Latin America,” where he and other experts discussed the future of digital banking in Latin America and highlighted Mexico’s strong potential as one of the most promising markets for financial services worldwide. Discover more

🇺🇸 Ramp nearly doubles valuation to $13bn. Ramp’s annualised revenue, a metric often used by fast-growing start-ups which multiplies the current month’s revenue by 12, is $700mn. That figure is up from $300mn in August 2023. It follows rapid growth powered by an uptick in card transactions and bill payments spending.

🇮🇳 Paytm expands digital payment solutions through RBL Bank partnership. RBL Bank merchants will gain access to Paytm’s technology infrastructure including real-time transaction monitoring and instant settlement through the Paytm for Business dashboard.

🇧🇷 Brazil’s OneKey Payments adopts Belvo’s Biometric Pix. With this technology, users can “authorize transactions quickly and securely using only their mobile device’s biometrics—eliminating the need for passwords or access to their banking app.

🇺🇸 Why employees of FinTech Stripe "lurk in the internet’s sketchier chat groups." In Stripe's 2025 annual letter, the company’s founders describe one of its unusual methods for combatting fraud. They say fraud is an "adversarial business" where fraudsters refine their methods. This can be a problem when working with LLMs, which "mostly deal with knowledge that changes slowly."

🇺🇸 Google Pay’s new feature: will you be able to send payments using voice? This new technology aims to let users send money simply by using voice commands. With Google Assistant integration, making transactions could become as easy as saying, “Hey Google, send $20 to John on Google Pay.”

🇬🇧 PayAlly announces global expansion, advancing to meet client expectations as transfers exceed £6Bn. With this increase, PAYALLY ensures every client can confidently receive the best personalised service, with their dedicated consultant providing advice and guidance on any specific challenges they may face.

🎤 Southeast Asia and India are defining FinTech around the world: Pine Labs CEO. Amrish Rau says the technology and take-up of FinTech in Southeast Asia and India are setting the pace for other markets, including the U.S. and Europe. He also discusses the group’s IPO plans down the road. Watch the full video

🇬🇧 Businesses are ditching card terminals for smartphones. Tap-to-phone adoption has exploded by 320% in the last 12 months, compared to the global average growth rate of 200%. Smartphones as a form of near-field communication (NFC) technology has expanded the ability to take contactless payments for small businesses and micro sellers, who originally may have been cash only.

🇦🇷 Galicia launches a new feature for international transfers from the Galicia App with "Envíos de Dinero al Exterior". This allows customers to send money abroad quickly, securely, and efficiently. This innovation is the result of a strategic partnership with Remitee.

🇺🇸 Zip announces partnership with GameStop. Zip will be GameStop’s primary pay-in-installments service for online and in-store customers in the U.S. GameStop is a specialty retailer offering games and entertainment products through its thousands of stores and ecommerce platforms.

🇷🇼 FinTech Nsano enters Rwanda with two licenses. Priscilla Hazel, the group CEO of Nsano, commended the National Bank of Rwanda for a seamless and transparent process in acquiring their license, highlighting Rwanda as a rapidly growing technology hub, which aligns well with Nsano's mission to establish itself as a leading digital payment processor in Africa.

🇬🇧 The Payments Association calls on UK Government to push for growth through payments innovation. The Manifesto describes the 66 policies recommended by the 216 payments professionals working across financial crime, regulation, open banking, ESG, cross-border payments, digital currencies and financial inclusion.

GOLDEN NUGGET

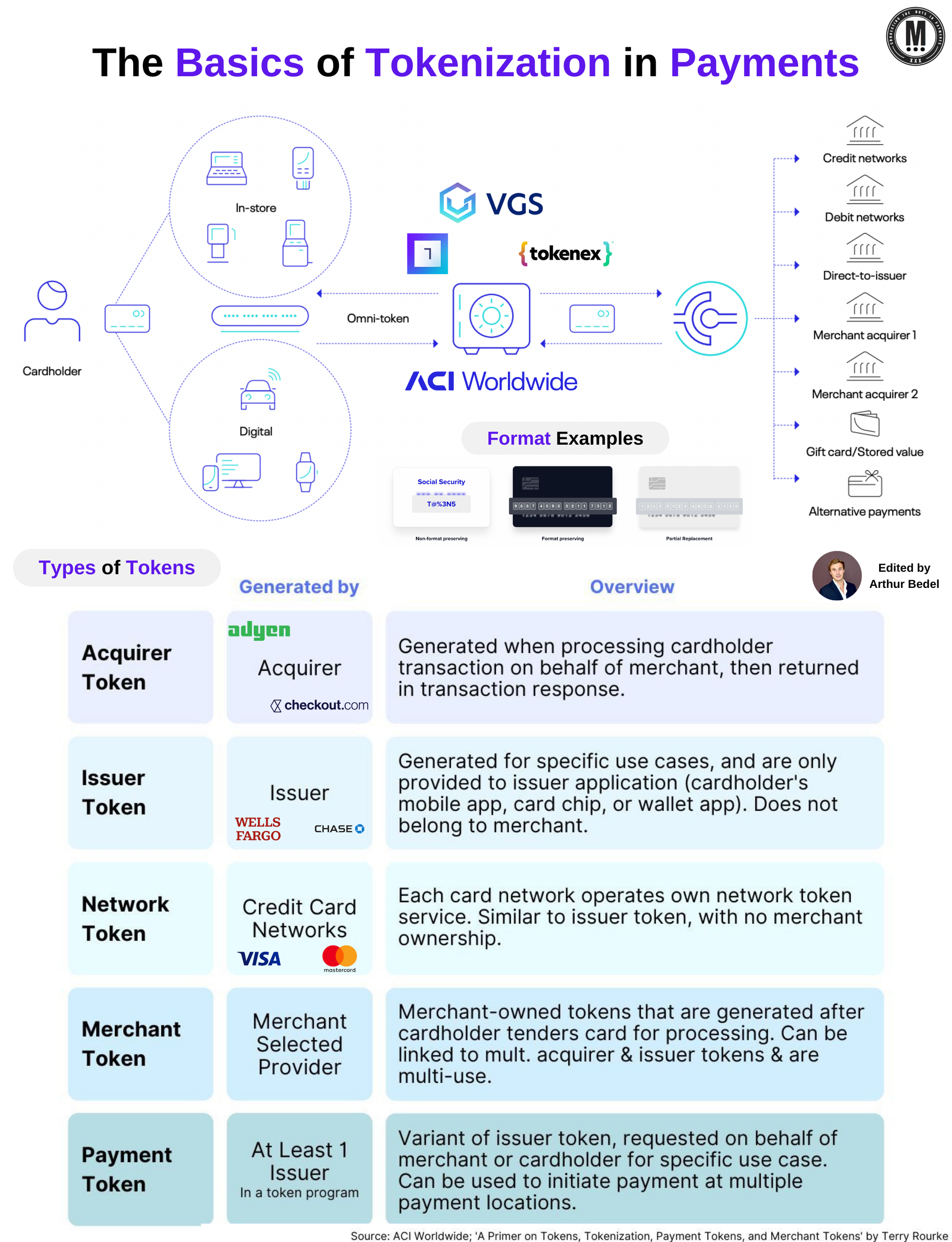

The basics of Tokenization. A crucial process in Payments👇

What are Tokens:

Tokens are unique, randomly generated strings of characters or symbols used to represent sensitive data, such as primary account numbers (PANs). Since tokens are nonconvertible — that is, they can't be reverse-engineered to reveal a customer's original PAN — they're an effective tool to protect sensitive data during storage, transmission and retrieval.

What is Payment Tokenization:

Payment tokenization is the process of replacing sensitive personal information with a surrogate value — a token — stored in a PCI-compliant token vault owned by the token creator, which can be an entity such as an acquirer, issuer, 3rd party token vault & network or payment processor.

To discover the PAN a token represents, a merchant would need to present that token to its creator; the creator would then look up the PAN within their highly secure token vault. When using payment tokens, the creator does not return the PAN to the merchant, but instead uses it to authorize a transaction. This way, the merchant is able to keep sensitive data out of their systems, so that hackers cannot gain access to it.

Tokens can vary in format but generally they fall into 3 categories:

► 𝐍𝐨𝐧-𝐅𝐨𝐫𝐦𝐚𝐭 𝐏𝐫𝐞𝐬𝐞𝐫𝐯𝐢𝐧𝐠:

The token doesn't look like the original data. For instance, a social security number could be represented as "T@%3N5."

► 𝐅𝐨𝐫𝐦𝐚𝐭 𝐏𝐫𝐞𝐬𝐞𝐫𝐯𝐢𝐧𝐠:

The token retains the format of the original data but scrambles the numbers.

► 𝐒𝐞𝐥𝐞𝐜𝐭𝐢𝐯𝐞 𝐌𝐚𝐬𝐤𝐢𝐧𝐠:

A hybrid approach, some original numbers are left unchanged for verification purposes, such as the last four digits of a credit card.

𝗦𝗶𝗻𝗴𝗹𝗲-𝘂𝘀𝗲 𝘃𝘀. 𝗠𝘂𝗹𝘁𝗶-𝘂𝘀𝗲 𝗧𝗼𝗸𝗲𝗻𝘀

Tokens can be transient or enduring. Single-use tokens expire after a single transaction, whereas multi-use tokens can be used for multiple transactions over an extended period.

𝗦𝗮𝗳𝗲𝘁𝘆 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 𝗼𝗳 𝗧𝗼𝗸𝗲𝗻𝘀

Tokens are secure because they're infeasible to reverse-engineer.

Even if a data breach occurs, what is stolen are merely tokens, which are useless without access to the token vault. Industry standards like point-to-point encryption (P2PE) and PCI DSS guidelines add an extra layer of security.

𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝘃𝘀. 𝗘𝗻𝗰𝗿𝘆𝗽𝘁𝗶𝗼𝗻

While both methods aim to protect data, tokenization offers an edge in compliance and security. If sensitive information is encrypted rather than tokenized, the data could potentially be decrypted, bringing it back into the PCI DSS scope and increasing risks.

𝗧𝘆𝗽𝗲𝘀 𝗼𝗳 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀:

‣ 𝗔𝗰𝗾𝘂𝗶𝗿𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Generated by transaction processors, usually restricted to specific merchants.

‣ 𝗜𝘀𝘀𝘂𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Created by card issuers, like Visa or Mastercard, often for digital wallets such as Apple Pay or Google Pay.

‣ 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗧𝗼𝗸𝗲𝗻𝘀: Produced by credit card networks themselves, not bound to specific issuers.

‣ 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: A newer category generated on behalf of issuers and merchants, usable across multiple locations.

‣ 𝗠𝗲𝗿𝗰𝗵𝗮𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: Tailored for individual merchants, these can be integrated into a merchant's specific customer journey and can link to multiple other types of tokens.

3rd-party providers — VGS, Basis Theory, TokenEx, and others — are able to generate agnostic tokens extremely valuable for interoperability across channels and providers.

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

► 𝐄𝐧𝐬𝐮𝐫𝐞 𝐏𝐂𝐈 𝐃𝐒𝐒 𝐜𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞. By replacing PANs with randomly generated characters and symbols, tokenization dramatically reduces merchants' exposure to risk, enabling them to secure payments and meet PCI DSS compliance obligations.

► 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 𝐜𝐨𝐬𝐭𝐬. Tokenization simplifies payments security, which means merchants spend less trying to meet PCI DSS's compliance requirements. Additionally, by securing payments, tokenization reduces the risk of data breaches and their associated costs, such as fines, legal fees, damage to their reputation and loss of business.

► 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐞𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲. Tokenization enables merchants to keep customers' tokens, rather than their PANs, on file, which streamlines the payments process. Rather than manually enter their information every time they initiate a transaction, customers can easily and securely set up recurring or one-click payments.

► 𝐑𝐞𝐝𝐮𝐜𝐞 𝐭𝐡𝐞 𝐫𝐢𝐬𝐤 𝐨𝐟 𝐝𝐚𝐭𝐚 𝐛𝐫𝐞𝐚𝐜𝐡𝐞𝐬. With tokenization, merchants can only store tokens, not customers' PANs. This way, should a bad actor hack into a merchant's systems, they'll only be able to access tokens, which are useless to them, rather than actual cardholder data.

► 𝐈𝐦𝐩𝐫𝐨𝐯𝐞 𝐭𝐡𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐞𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞. From a faster, more seamless checkout process to the peace of mind of knowing that their payments information is kept safe, tokenization enhances the customer experience and improves long-term satisfaction and loyalty.

𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 is one of the most crucial processes in payments, from acceptance, to security, compliance, cost, user experience and more.

Source: ACI Worldwide & Terry Rourke & his amazing report

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()